Accounting > EXAM > University of Phoenix ACC 422 30 Comprehensive Questions and Answers. Graded A+ (All)

University of Phoenix ACC 422 30 Comprehensive Questions and Answers. Graded A+

Document Content and Description Below

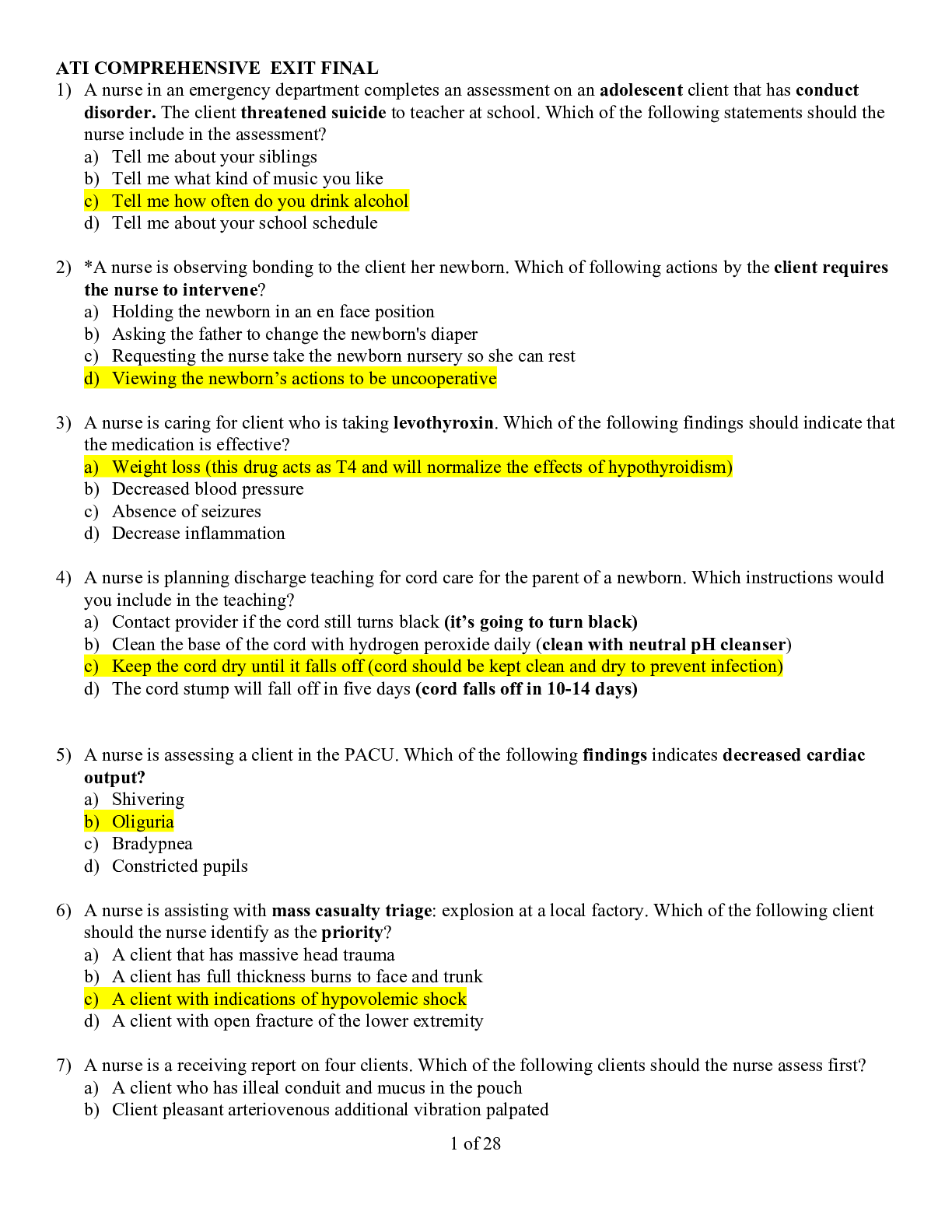

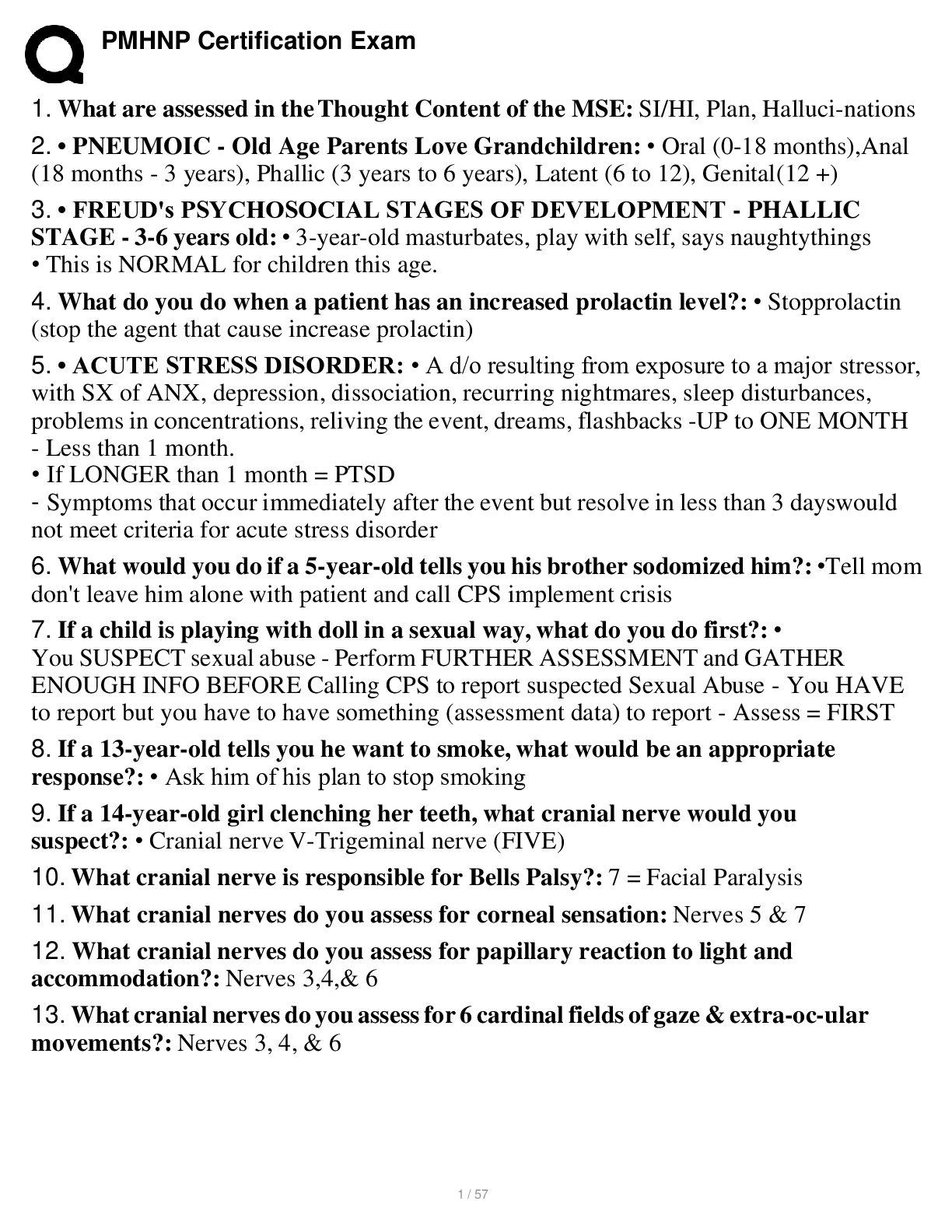

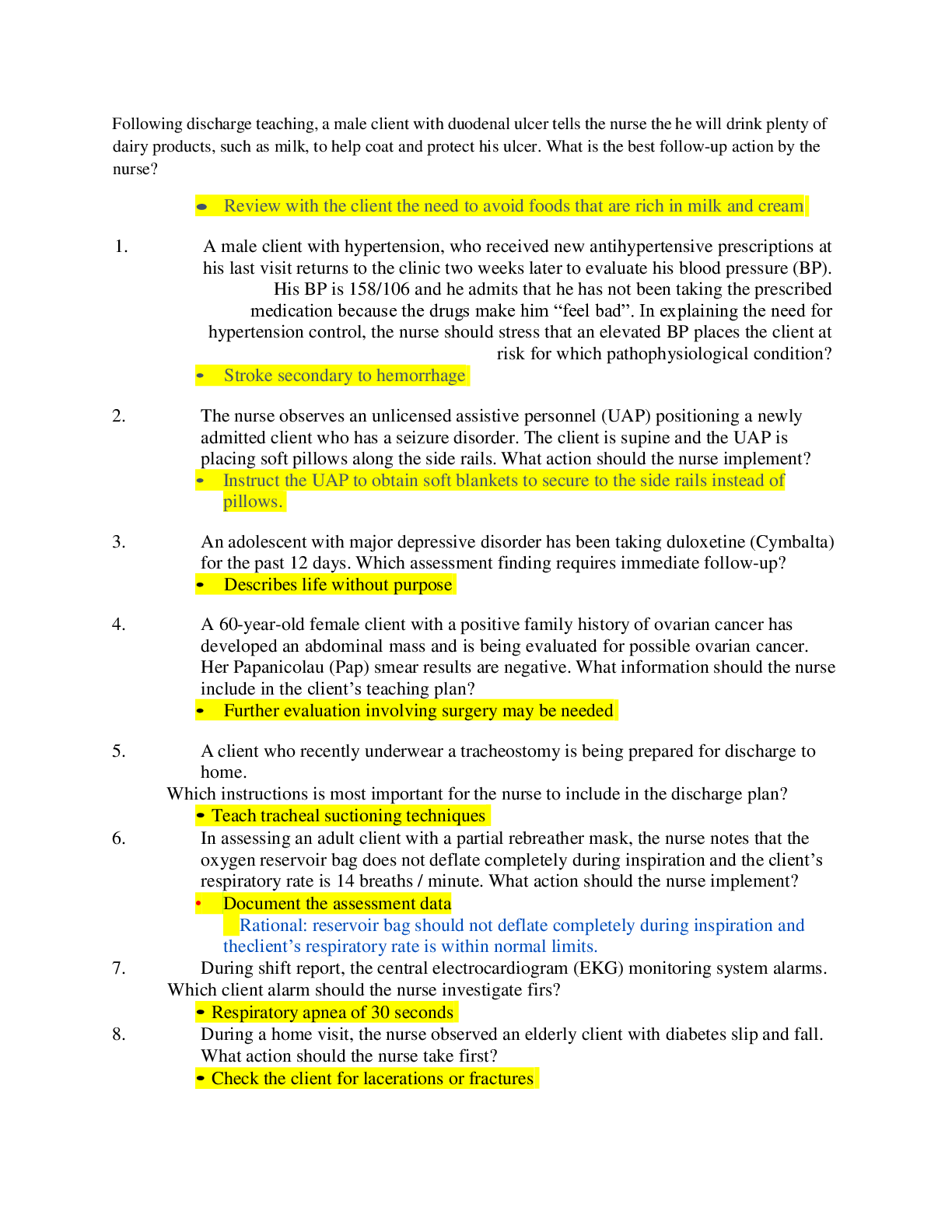

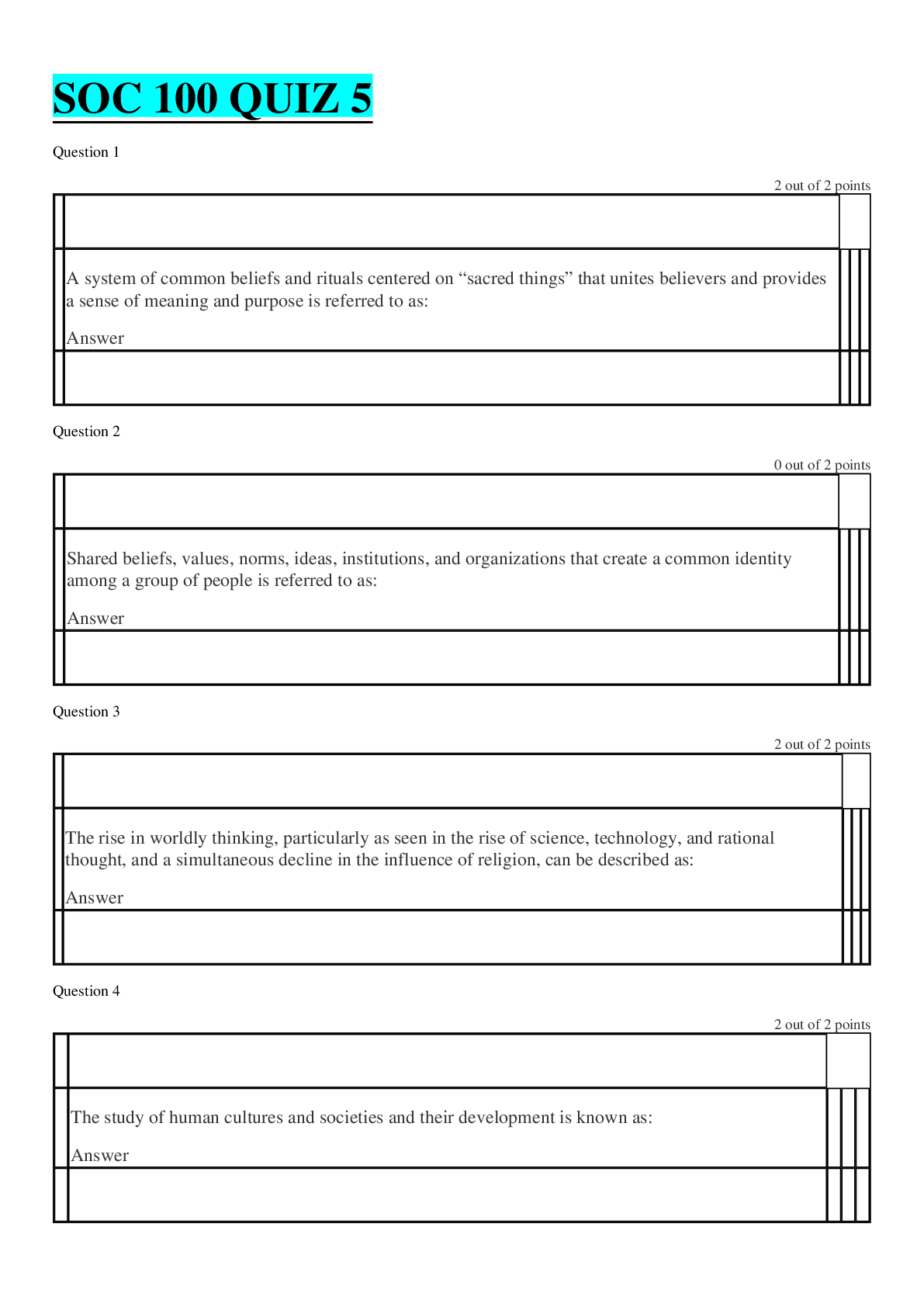

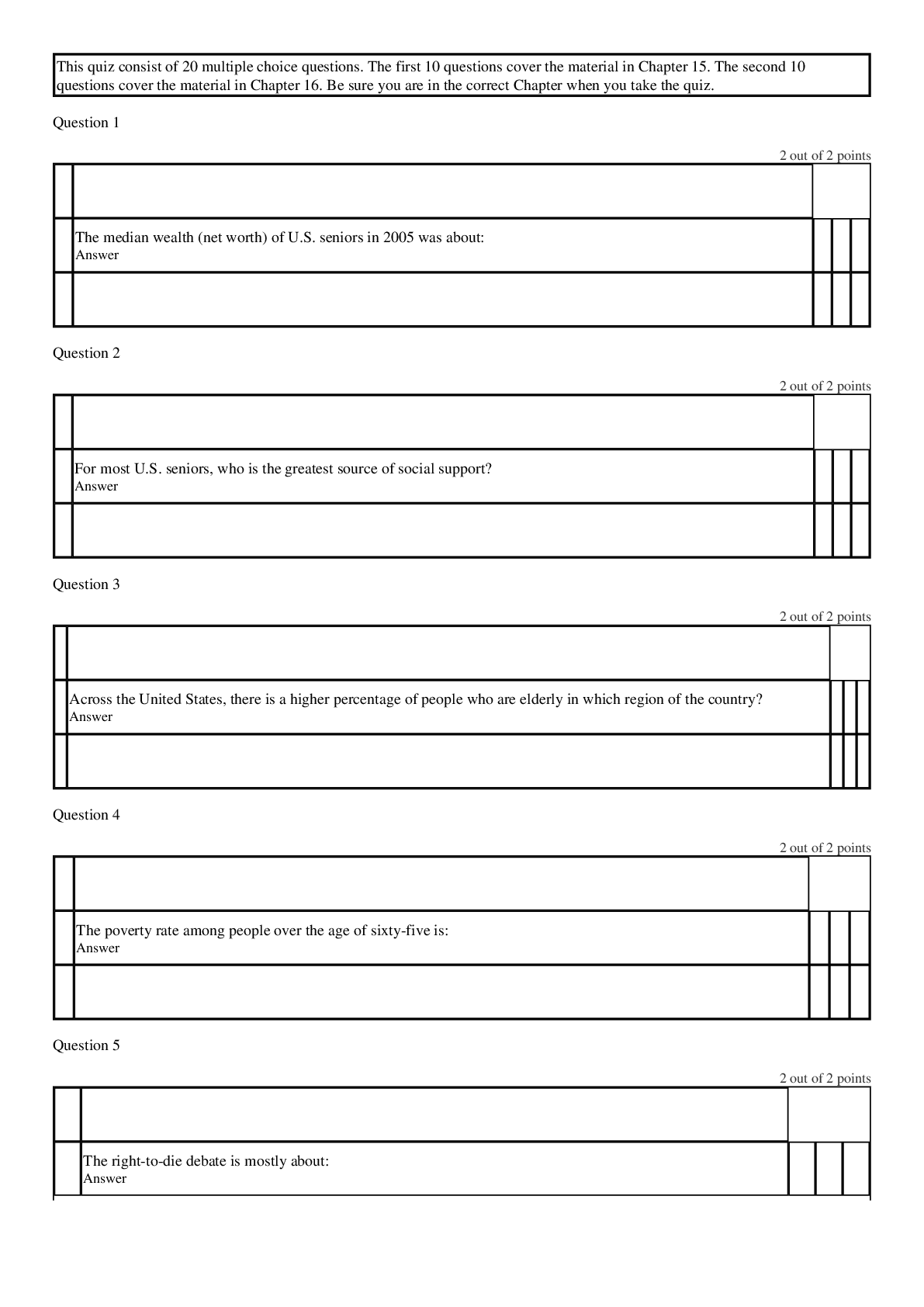

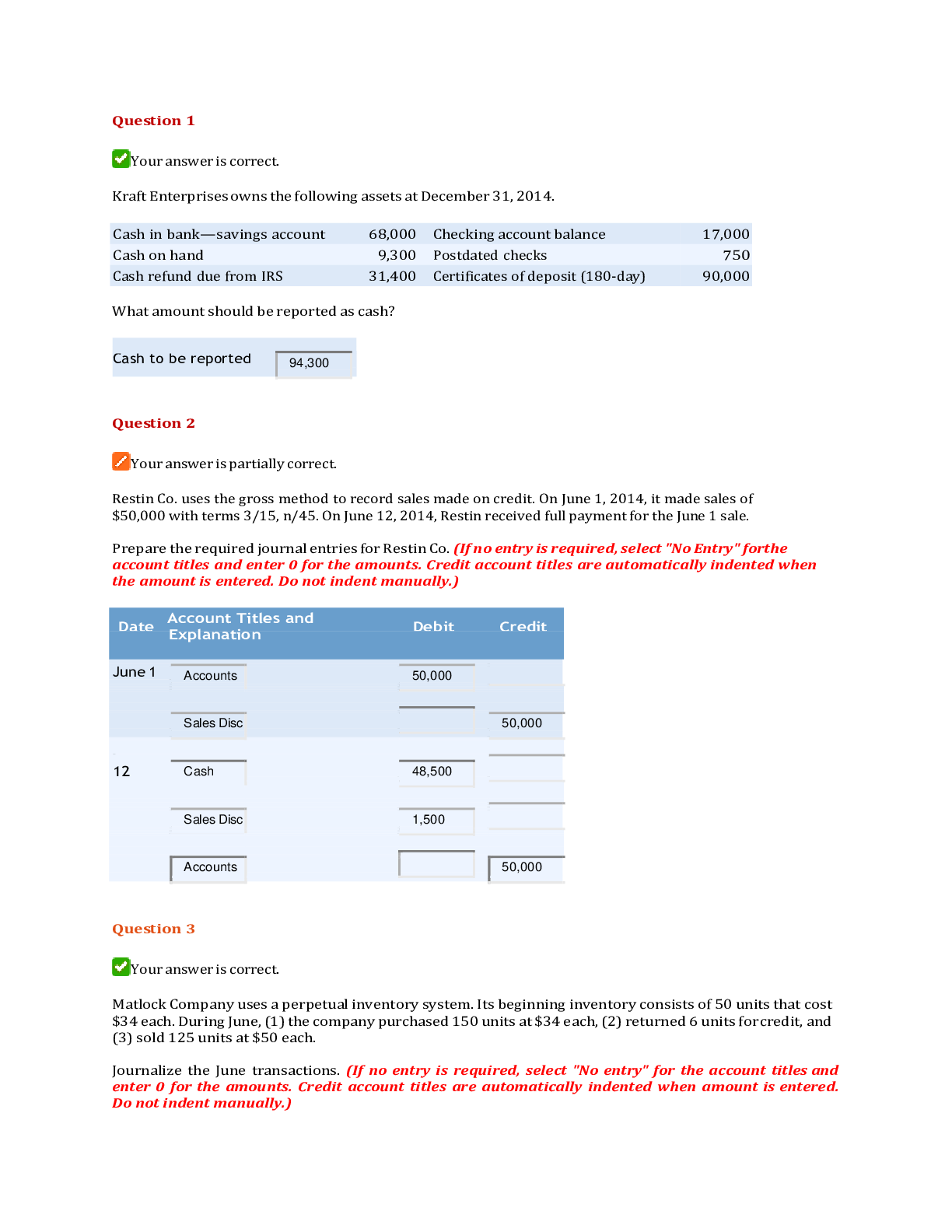

Question 1 Your answer is correct. Kraft Enterprises owns the following assets at December 31, 2014. Cash in bank—savings account 68,000 Checking account balance 17,000 Cash on hand 9,300... Postdated checks 750 Cash refund due from IRS 31,400 Certificates of deposit (180-day) 90,000 What amount should be reported as cash? $ Question 2 Your answer is partially correct. Restin Co. uses the gross method to record sales made on credit. On June 1, 2014, it made sales of $50,000 with terms 3/15, n/45. On June 12, 2014, Restin received full payment for the June 1 sale. Prepare the required journal entries for Restin Co. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) June Question 3 Your answer is correct. Matlock Company uses a perpetual inventory system. Its beginning inventory consists of 50 units that cost $34 each. During June, (1) the company purchased 150 units at $34 each, (2) returned 6 units for credit, and (3) sold 125 units at $50 each. Journalize the June transactions. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) No Account Titles and . Explanation Debit Credit (1) Inventory 5,100 Accounts P 5,100 (2) Accounts P 204 Inventory 204 (3) Accounts R 6,250 Sales Reve 6,250 (To record sales) Cost of Go 4,250 Inventory 4,250 Show Solution Show Answer Link to Text Ending inventory 4,740 $ Cost of goods sold 7,110 Question 5 Your answer is correct. Amsterdam Company uses a periodic inventory system. For April, when the company sold 600 units, the following information is available. Unit s Unit Cost Total Cost April 1 inventory 250 $10 $ 2,500 April 15 purchase 400 12 4,800 April 23 purchase 350 13 4,550 1,000 $11,850 Compute the April 30 inventory and the April cost of goods sold using the FIFO method. $ Link to Text Your answer is correct. Prepare schedules to compute the ending inventory at March 31, 2014, under LIFO inventory methods. (Round answer to 0 decimal places, e.g. 2,760.) LIFO $ Ending Inventory at March 31, 2014 13,800 Don't show me this message again for the assignment Show Solution Show Answer Link to Text Your answer is correct. Calculate average-cost per unit. (Round answer to 2 decimal places, e.g. 2.76.) $ Don't show me this message again for the assignment Link to Text Weighted-Average $ Ending Inventory at March 31, 2014 15,858 Question 7 Your answer is partially correct. Presented below is information related to Rembrandt Inc.’s inventory. (per unit) Skis Boots Parkas Historical cost $190.00 $106.00 $53.00 Selling price 212.00 145.00 73.75 Cost to distribute 19.00 8.00 2.50 Current replacement cost 203.00 105.00 51.00 Normal profit margin 32.00 29.00 21.25 Determine the following: (a) the two limits to market value (i.e., the ceiling and the floor) that should be used in the lower-of- cost-or-market computation for skis. Ceiling $ Limit 193 $ (b) the cost amount that should be used in the lower-of-cost-or-market comparison of boots. $ (c) the market amount that should be used to value parkas on the basis of the lower-of-cost-or-market. $ Question 8 Your answer is incorrect. Floyd Corporation has the following four items in its ending inventory. Item Cost Replacement Cost Net Realizable Value (NRV) NRV less Normal Profit Margin Jokers $2,000 $2,050 $2,100 $1,600 Penguins 5,000 5,100 4,950 4,100 Riddlers 4,400 4,550 4,625 3,700 Scarecrows 3,200 2,990 3,830 3,070 Determine the final lower-of-cost-or-market inventory value for each item. $ Question 9 Your answer is correct. Kumar Inc. uses a perpetual inventory system. At January 1, 2014, inventory was $214,000 at both cost and market value. At December 31, 2014, the inventory was $286,000 at cost and $265,000 at market value. Prepare the necessary December 31 entry under (a) the cost-of-goods-sold method (b) Loss method. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No Account Titles and Debit Credit . Explanation (a) Cost of Go 21,000 Inventory 21,000 (b) Loss Due t 21,000 Allow ance 21,000 Question 10 Your answer is correct. Boyne Inc. had beginning inventory of $12,000 at cost and $20,000 at retail. Net purchases were $120,000 at cost and $170,000 at retail. Net markups were $10,000; net markdowns were $7,000; and sales revenue was $147,000. Compute ending inventory at cost using the conventional retail method. (Round ratios for computational purposes to 0 decimal places, e.g. 78% and final answer to 0 decimal places, e.g. 28,987.) Ending inventory using the conventional retail $ method 30,360 Don't show me this message again for the assignment Question 11 Your answer is partially correct. Mark Price Company uses the gross profit method to estimate inventory for monthly reporting purposes. Presented below is information for the month of May. Inventory, May 1 $ 160,000 Purchases (gross) 640,000 Freight-in 30,000 Sales revenue 1,000,000 Sales returns 70,000 Purchase discounts 12,000 (a) Compute the estimated inventory at May 31, assuming that the gross profit is 30% of sales. $ (b) Compute the estimated inventory at May 31, assuming that the gross profit is 30% of cost. (Round percentage of sales to 2 decimal places, e.g. 78.74% and final answer to 0 decimal places, e.g. 6,225.) $ Question 12 Your answer is correct. Previn Brothers Inc. purchased land at a price of $27,000. Closing costs were $1,400. An old building was removed at a cost of $10,200. What amount should be recorded as the cost of the land? $ Question 13 Your answer is correct. Garcia Corporation purchased a truck by issuing an $80,000, 4-year, zero-interest-bearing note to Equinox Inc. The market rate of interest for obligations of this nature is 10%. Prepare the journal entry to record the purchase of this truck. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Trucks 54,641 Discount o 25,359 Notes Paya 80,000 Question 14 Your answer is correct. Mohave Inc. purchased land, building, and equipment from Laguna Corporation for a cash payment of $315,000. The estimated fair values of the assets are land $60,000, building $220,000, and equipment $80,000. At what amounts should each of the three assets be recorded? (Round final answers to 0 decimal places, e.g. 5,275.) Recorded Amount $ Land 52,500 $ Building 192,500 Equipmen $ t 70,000 Question 15 Your answer is correct. Fielder Company obtained land by issuing 2,000 shares of its $10 par value common stock. The land was recently appraised at $85,000. The common stock is actively traded at $40 per share. Prepare the journal entry to record the acquisition of the land. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Land 80,000 Paid-in Cap 60,000 Common St 20,000 Question 16 Your answer is partially correct. Navajo Corporation traded a used truck (cost $20,000, accumulated depreciation $18,000) for a small computer worth $3,300. Navajo also paid $500 in the transaction. Prepare the journal entry to record the exchange. (The exchange has commercial substance.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Debit Credit Explanation Equipment 3300 Accumulat 18000 Cash 500 Trucks 20000 Gain on Dis Question 17 Your answer is partially correct. Mehta Company traded a used welding machine (cost $9,000, accumulated depreciation $3,000) for office equipment with an estimated fair value of $5,000. Mehta also paid $3,000 cash in the transaction. Prepare the journal entry to record the exchange. (The exchange has commercial substance.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Question 18 Correct. Which of the following is the recommended approach to handling interest incurred in financing the construction of property, plant and equipment? Capitalize no interest during construction. Capitalize interest costs equal to the prime interest rate times the estimated cost of the asset being constructed. Capitalize only the actual interest costs incurred during construction. Charge construction with all costs of funds employed, whether identifiable or not. Question 19 Your answer is correct. Fernandez Corporation purchased a truck at the beginning of 2014 for $50,000. The truck is estimated to have a salvage value of $2,000 and a useful life of 160,000 miles. It was driven 23,000 miles in 2014 and 31,000 miles in 2015. Compute depreciation expense for 2014 and 2015. Depreciation expense for $ 2014 6900 Depreciation expense for $ 2015 9300 Show Solution Show Answer Link to Text Depreciation $ expense 4500 Question 21 Your answer is correct. Jurassic Company owns machinery that cost $900,000 and has accumulated depreciation of $380,000. The expected future net cash flows from the use of the asset are expected to be $500,000. The fair value of the machinery is $400,000. Prepare the journal entry, if any, to record the impairment loss. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Loss on Im 120000 Accumulat 120000 Question 22 Your answer is partially correct. Everly Corporation acquires a coal mine at a cost of $400,000. Intangible development costs total $100,000. After extraction has occurred, Everly must restore the property (estimated fair value of the obligation is $80,000), after which it can be sold for $160,000. Everly estimates that 4,000 tons of coal can be extracted. If 700 tons are extracted the first year, prepare the journal entry to record depletion. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Depreciatio 73500 Coal Mine 73500 Don't show me this message again for the assignment Question 23 Francis Corporation purchased an asset at a cost of $50,000 on March 1, 2014. The asset has a useful life of 8 years and a salvage value of $4,000. For tax purposes, the MACRS class life is 5 years. Compute tax depreciation for each year 2014–2019. (Round answers to 0 decimal places, e.g. 45,892.) $ Tax depreciation for 2014 $ Tax depreciation for 2015 $ Tax depreciation for 2016 Tax depreciation for 2017 $ $ Tax depreciation for 2018 $ Tax depreciation for 2019 Question 24 Correct. Grover Corporation purchased a truck at the beginning of 2014 for $93,600. The truck is estimated to have a salvage value of $3,600 and a useful life of 120,000 miles. It was driven 21,000 miles in 2014 and 29,000 miles in 2015. What is the depreciation expense for 2015? $6,000 $37,500 $21,750 $23,490 Question 25 Your answer is partially correct. Celine Dion Corporation purchases a patent from Salmon Company on January 1, 2014, for $54,000. The patent has a remaining legal life of 16 years. Celine Dion feels the patent will be useful for 10 years. Prepare Celine Dion’s journal entries to record the purchase of the patent and 2014 amortization. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Question 26 Your answer is partially correct. Gershwin Corporation obtained a franchise from Sonic Hedgehog Inc. for a cash payment of $120,000 on April 1, 2014. The franchise grants Gershwin the right to sell certain products and services for a period of 8 years. Prepare Gershwin’s April 1 journal entry and December 31 adjusting entry. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Apr. 1 Franchises 120000 Cash 120000 Question 27 Your answer is correct. Roley Corporation uses a periodic inventory system and the gross method of accounting for purchase discounts. Prepare all necessary journal entries for Roley. (Round answers to 0 decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Credit (a) (1) July 1 Purchases 60000 Accounts P 60000 (a) (2) Freight-In 1200 Cash 1200 (b) July 3 Accounts P 6000 Purchase R 6000 (c) July 10 Accounts P 54000 Purchase D 1080 Cash 52920 Question 28 Your answer is correct. Takemoto Corporation borrowed $60,000 on November 1, 2014, by signing a $61,350, 3-month, zero- interest-bearing note. Prepare Takemoto’s November 1, 2014, entry; the December 31, 2014, annual adjusting entry; and the February 1, 2015, entry. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit 11/1/14 Cash 60000 Discount o 1350 Notes Paya 61350 12/31/14 Interest Ex 900 Discount o 900 2/1/15 Interest Ex 450 Discount o 450 (To record interest) Notes Paya 61350 Cash 61350 Question 29 Your answer is incorrect. Whiteside Corporation issues $500,000 of 9% bonds, due in 10 years, with interest payable semiannually. At the time of issue, the market rate for such bonds is 10%. Compute the issue price of the bonds. (Round answer to 0 decimal places, e.g. 38,548.) $ Question 30 Your answer is partially correct. On January 1, 2014, Irwin Animation sold a truck to Peete Finance for $33,000 and immediately leased it back. The truck was carried on Irwin’s books at $28,000. The term of the lease is 5 years, and title transfers to Irwin at lease-end. The lease requires 5 equal rental payments of $8,705 at the end of each year. The appropriate rate of interest is 10%, and the truck has a useful life of 5 years with no salvage value. Prepare Irwin’s 2014 journal entries. To record amortization of profit on sale use Depreciation Expense account and not Sales Revenue account. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58,971.) Account Titles and Explanation Debit Credit Cash 33000 Trucks 28000 Unearned P 5000 (To record the sale.) Leased Eq 33000 Lease Liab 33000 (To record the leaseback.) Depreciatio 6600 Accumulat 6600 (To record depreciation.) Unearned P 5000 Depreciatio 5000 (To record amortization of profit on sale.) Lease Liab 6600 Interest Ex 2105 Cash 8705 [Show More]

Last updated: 1 year ago

Preview 1 out of 20 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 21, 2021

Number of pages

20

Written in

Additional information

This document has been written for:

Uploaded

Apr 21, 2021

Downloads

0

Views

48