Business > QUESTIONS & ANSWERS > San Jose State UniversityBUS 170Quiz_Ch_10_Solution. (All)

San Jose State UniversityBUS 170Quiz_Ch_10_Solution.

Document Content and Description Below

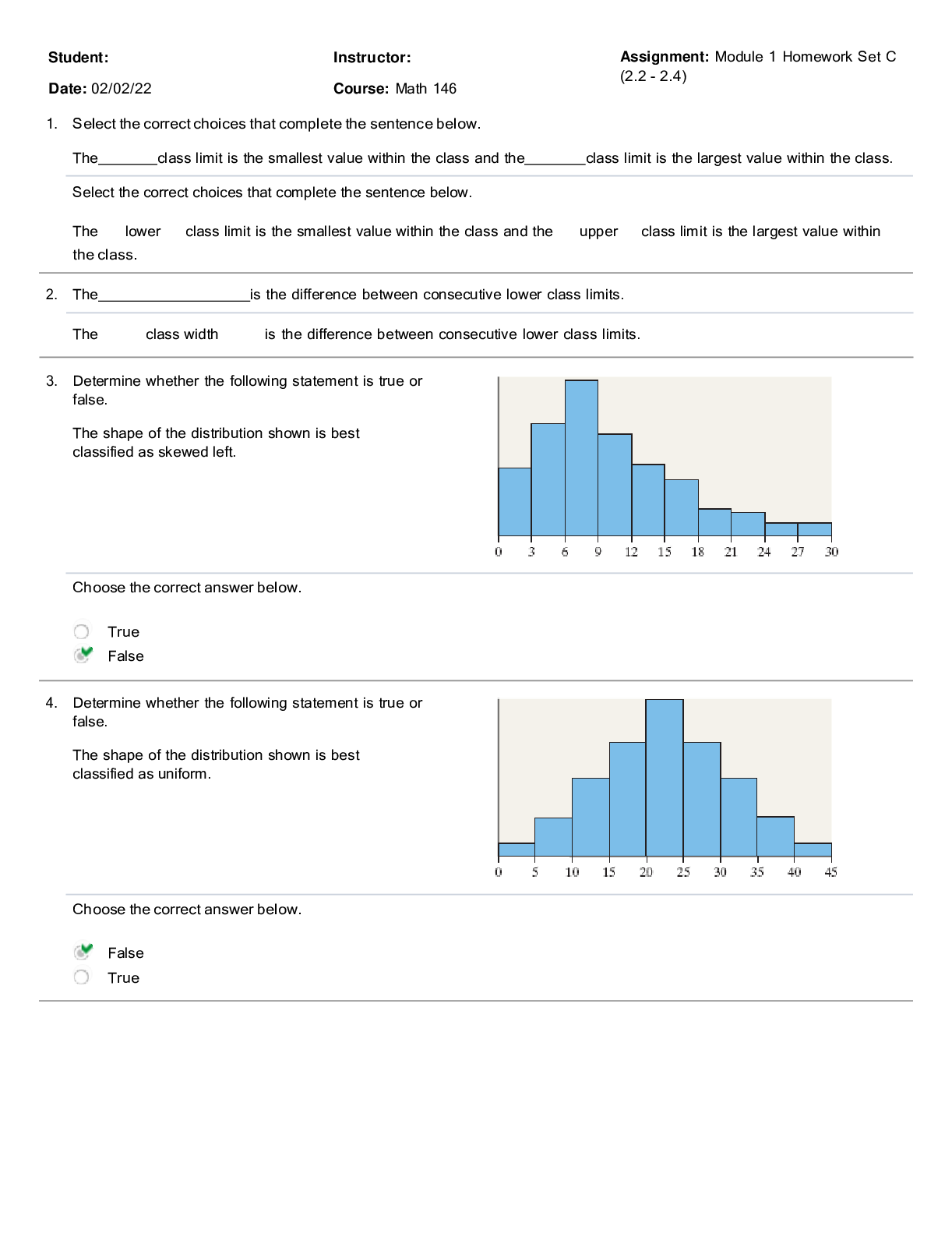

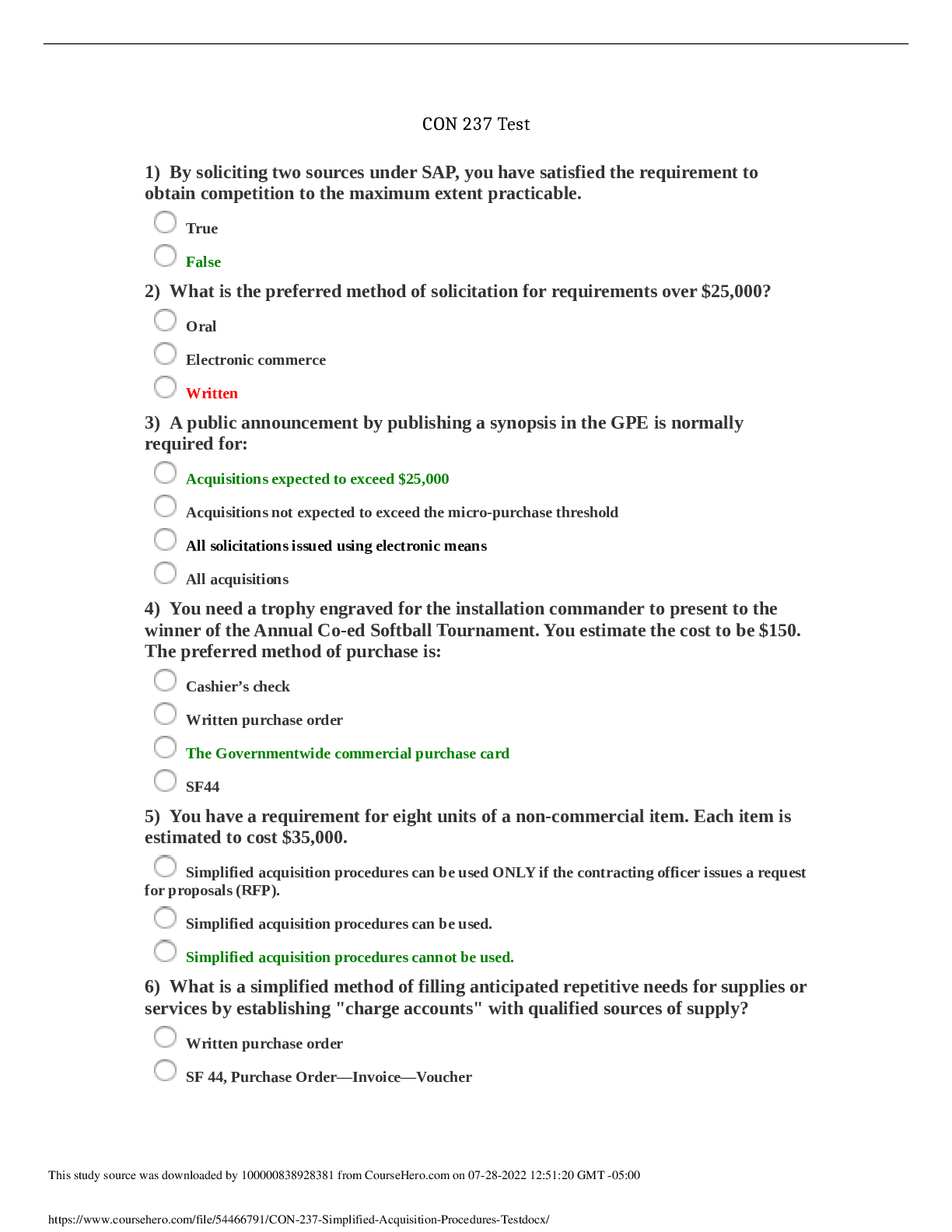

Quiz Ch 10 Solution (3 points) 1. WACC and Optimal Capital Budget (2 points) Adams Corporation is considering four average-risk projects with the following rates of return: Project Cost Expected R... ate of Return 1 $2,000 14.00% 2 3,000 13.00% 3 5,000 12.75% 4 2,000 11.50% Adams Corporation just issued 10-year bonds that pay a 9.8% semiannual coupon. The bonds have a price of $987.54 and a par value of $1,000 It can issue preferred stock with dividend of $5 per year at $50/share The current common stock price is $36/share and the last dividend paid was $2.40. Dividends are expected to grow at a constant rate of 6.0% per year The risk premium, RP, of the stock over its cost of debt is 3.5% The company has a beta of 1.7, the yield on treasury bills is 3% and the return on the market is 9% Target capital structure is 75% common stock, 15% debt and 10% preferred stock. The company’s tax rate is 30% a. rd = YTM on bond = I *2 (since it is semiannual) N = 10*2 = 20 I = ? PV = - 987.54 [Show More]

Last updated: 1 year ago

Preview 1 out of 2 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$6.00

Document information

Connected school, study & course

About the document

Uploaded On

May 04, 2021

Number of pages

2

Written in

Additional information

This document has been written for:

Uploaded

May 04, 2021

Downloads

0

Views

29

.png)

.png)