Accounting > QUESTIONS & ANSWERS > Western Leyte College of Ormoc city, Inc .FAR 10128. Bonds Payable.-VERIFIED BY EXPERTS-GRADED A+ (All)

Western Leyte College of Ormoc city, Inc .FAR 10128. Bonds Payable.-VERIFIED BY EXPERTS-GRADED A+

Document Content and Description Below

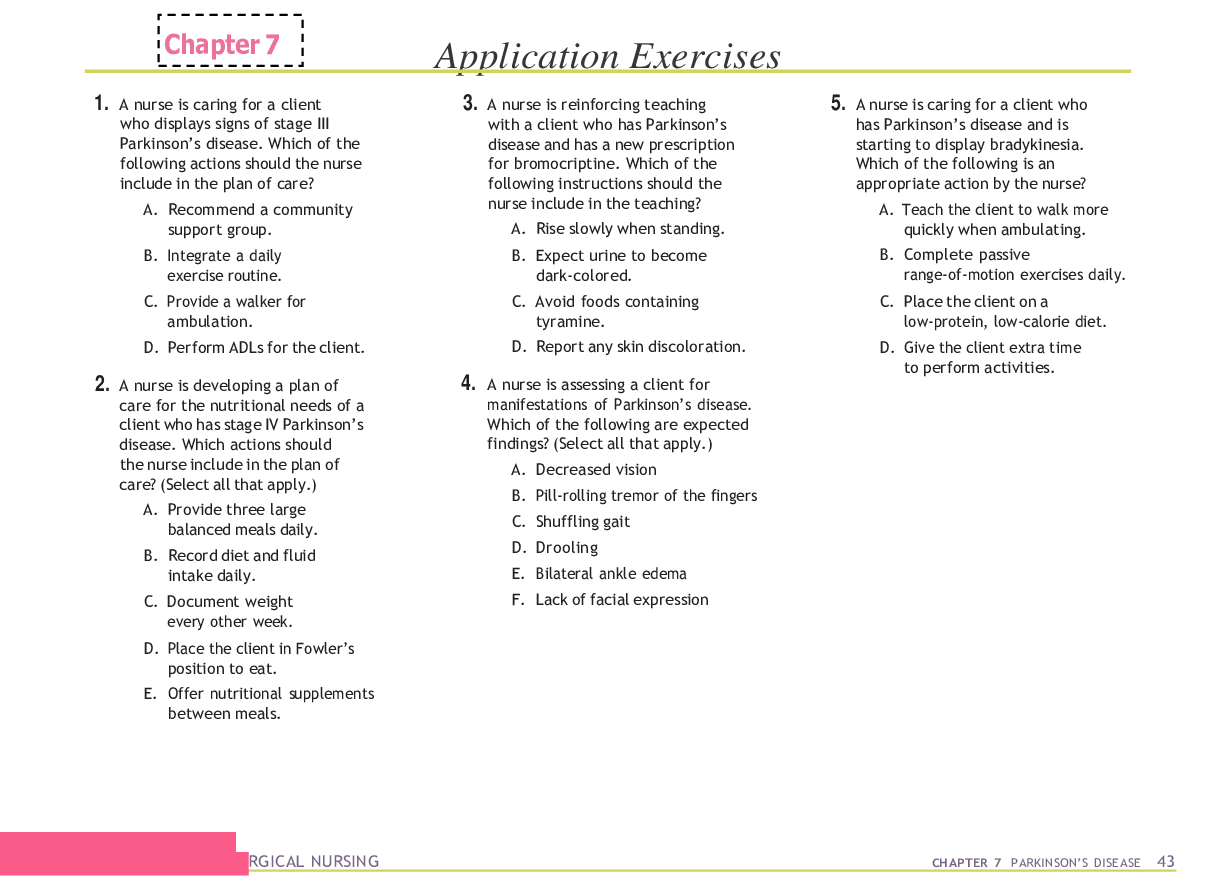

BONDS PAYABLE Easy: 1. A bond indenture is a. a contract between the corporation issuing the bonds and the underwriters selling the bonds b. a contract between the corporation issuing the bonds a... nd the bond trustee, who is acting on behalf of the bondholders. c. the amount due at the maturity date of the bonds d. the amount for which the corporation can buy back the bonds prior to the maturity date 2. An unsecured bond is the same as a a. term bond. b. zero coupon bond. c. debenture bond. d. bond indenture. 3. Bonds that are subject to retirement at a stated peso amount prior to maturity at the option of the issuer are called a. options. b. early retirement bonds. c. Debentures d. callable bonds. 4. When the effective-interest method is used, the amortization of the bond premium a. has no effect on the interest expense in any period b. increases interest expense each period c. increases interest expense in some periods and decreases interest expense in other periods d. decreases interest expense each period 5. The Torrez Corporation issues 1,000, 10-year bonds, 8%, P1,000 bonds dated January 1, 2017, at 97. The journal entry to record the issuance will show a a. debit to Cash of P1,000,000. b. credit to Cash for P970,000. c. credit to Bonds Payable for P1,000,000. d. credit to Discount on Bonds Payable for P30,000. 6. If the market rate of interest is greater than the contractual rate of interest, bonds will sell a. at a discount.b. at face value. c. at a premium. d. only after the stated rate of interest is increased. 7. On January 1, 2017, P1,000,000, 5-year, 10% bonds, were issued for P970,000. Interest is paid semiannually on January 1 and July 1. If the issuing corporation uses the straight-line method to amortize discount on bonds payable, the semiannual amortization amount is a. P6,000 b. P3,000 c. P5,000 d. P5,808 8. Sinking Fund Income is reported in the income statement as a. gain on sinking fund transactions b. other income c. income from operations d. extraordinary 9. On June 1, P400,000 of bonds were purchased as a long-term investment at 101 and P500 was paid as the brokerage commission. If the bonds bear interest at 12%, which is paid semiannually on January 1 and July 1, what is the total cost to be debited to the investment account? a. 401,500 b. 400,000 c. 403,500 d. 404,500 [Show More]

Last updated: 1 year ago

Preview 1 out of 43 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$13.00

Document information

Connected school, study & course

About the document

Uploaded On

May 28, 2021

Number of pages

43

Written in

Additional information

This document has been written for:

Uploaded

May 28, 2021

Downloads

0

Views

35

.png)

.png)