Accounting > QUESTIONS & ANSWERS > Cost Accounting MGA 314 _ch11__problems with verified solutions (All)

Cost Accounting MGA 314 _ch11__problems with verified solutions

Document Content and Description Below

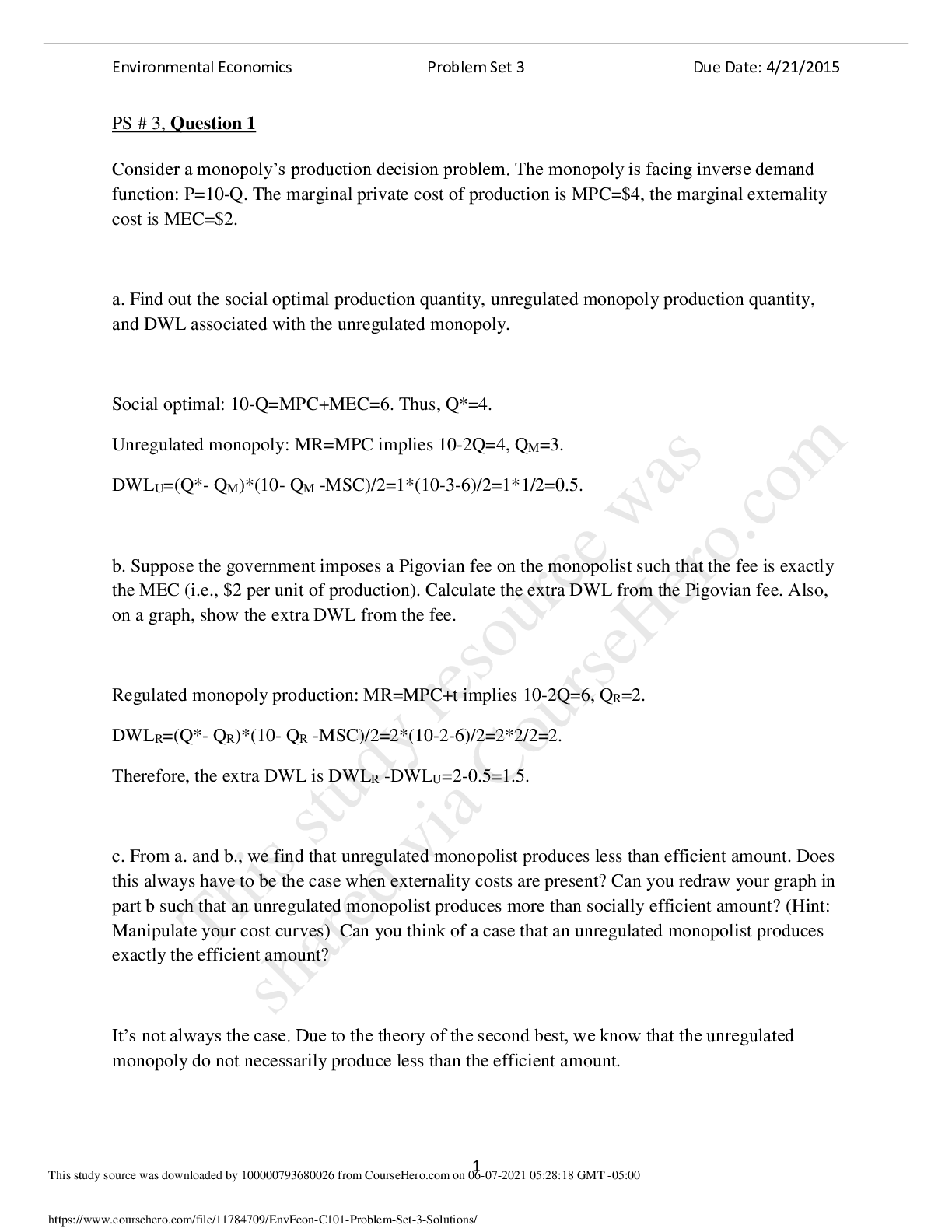

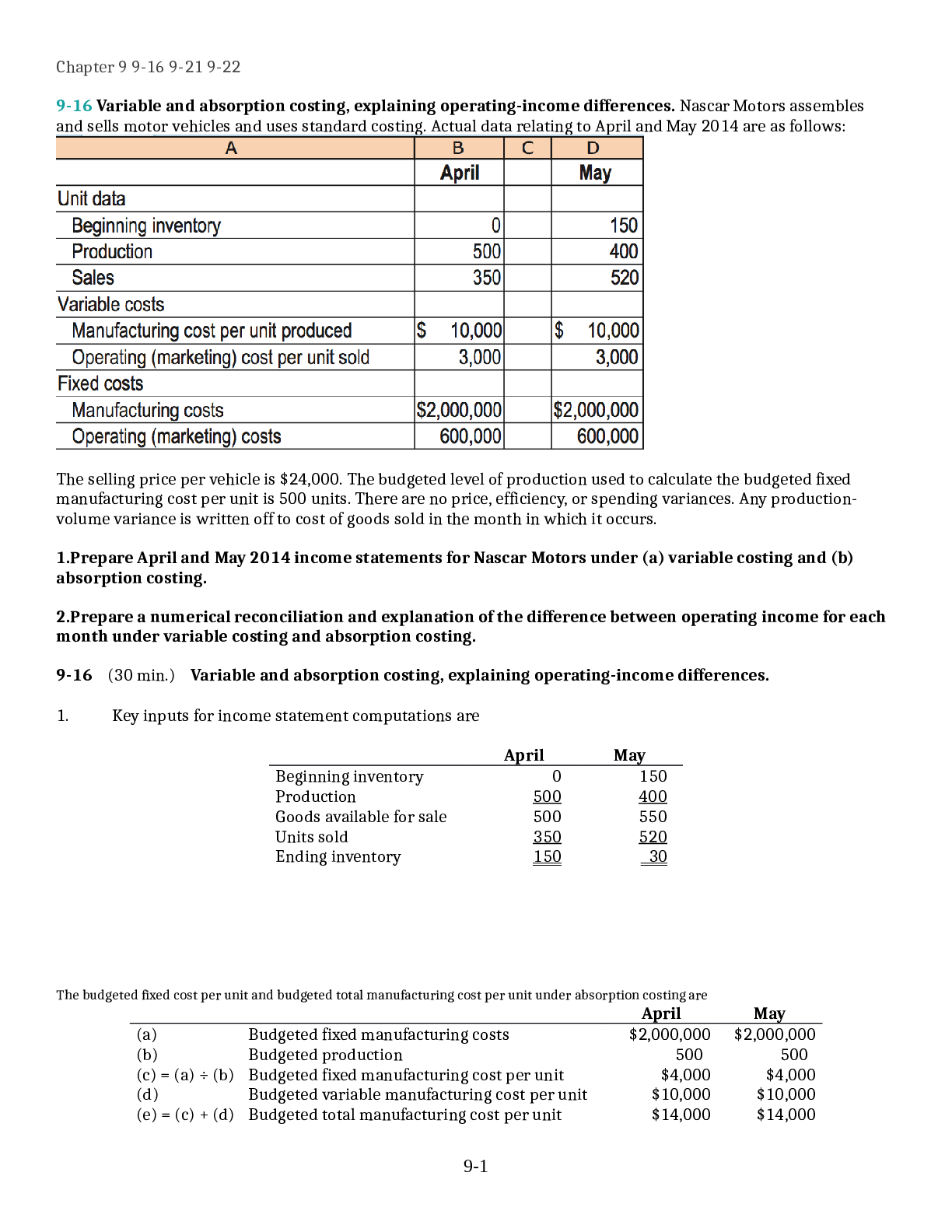

CHAPTER 11 DECISION MAKING AND RELEVANT INFORMATION 11-1 The five steps in the decision process outlined in Exhibit 11-1 of the text are 1. Identify the problem and uncertainties. 2. Obtain inform... ation. 3. Make predictions about the future. 4. Make decisions by choosing among alternatives. 5. Implement the decision, evaluate performance, and learn. 11-2 Relevant costs are expected future costs that differ among the alternative courses of action being considered. Historical costs are irrelevant because they are past costs and, therefore, cannot differ among alternative future courses of action. 11-3 No. Relevant costs are defined as those expected future costs that differ among alternative courses of action being considered. Thus, future costs that do not differ among the alternatives are irrelevant to deciding which alternative to choose. 11-4 Quantitative factors are outcomes that are measured in numerical terms. Some quantitative factors are financial––that is, they can be easily expressed in monetary terms. Direct materials are an example of a quantitative financial factor. Other quantitative nonfinancial factors, such as on-time flight arrivals, cannot be easily expressed in monetary terms. Qualitative factors are outcomes that are difficult to measure accurately in numerical terms. An example is employee morale. 11-5 Two potential problems that should be avoided in relevant cost analysis are (i) Do not assume all variable costs are relevant and all fixed costs are irrelevant. (ii) Do not use unit-cost data directly. It can mislead decision makers because a. it may include irrelevant costs, and b. comparisons of unit costs computed at different output levels lead to erroneous conclusions. 11-6 No. Some variable costs may not differ among the alternatives under consideration and, hence, will be irrelevant. Some fixed costs may differ among the alternatives and, hence, will be relevant. 11-7 No. Some of the total manufacturing cost per unit of a product may be fixed and, hence, will not differ between the make and buy alternatives. These fixed costs are irrelevant to the make-or-buy decision. The key comparison is between purchase costs and the costs that will be saved if the company purchases the component parts from outside plus the additional benefits of using the resources freed up in the next best alternative use (opportunity cost). Furthermore, managers should consider nonfinancial factors such as quality and timely delivery when making outsourcing decisions. 11-8 Opportunity cost is the contribution to income that is forgone (rejected) by not using a limited resource in its next-best alternative use. 11-111-9 No. When deciding on the quantity of inventory to buy, managers must consider both the purchase cost per unit and the opportunity cost of funds invested in the inventory. For example, the purchase cost per unit may be low when the quantity of inventory purchased is large, but the benefit of the lower cost may be more than offset by the high opportunity cost of the funds invested in acquiring and holding inventory. 11-10 No. Managers should aim to get the highest contribution margin per unit of the constraining (that is, scarce, limiting, or critical) factor. The constraining factor is what restricts or limits the production or sale of a given product (for example, availability of machine-hours). 11-11 No. For example, if the revenues that will be lost exceed the costs that will be saved, the branch or business segment should not be shut down. Shutting down will only increase the loss. Allocated costs and fixed costs that will not be saved are irrelevant to the shut-down decision. 11-12 Cost written off as depreciation is irrelevant when it pertains to a past cost such as equipment already purchased. But the purchase cost of new equipment to be acquired in the future that will then be written off as depreciation is often relevant. 11-13 No. Managers often favor the alternative that makes their performance look best so they focus on the measures used in the performance-evaluation model. If the performance-evaluation model does not emphasize maximizing operating income or minimizing costs, managers will most likely not choose the alternative that maximizes operating income or minimizes costs. 11-14 The three steps in solving a linear programming problem are (i) Determine the objective function. (ii) Specify the constraints. (iii) Compute the optimal solution. 11-15 The text outlines two methods of determining the optimal solution to an LP problem: (i) Trial-and-error approach (ii) Graphic approach Most LP applications in practice use standard software packages that rely on the simplex method to compute the optimal solution. 11-211-16 (20 min.) Disposal of assets. Answer the following questions. 1. A company has an inventory of 1,250 assorted parts for a line of missiles that has been discontinued. The inventory cost is $76,000. The parts can be either (a) remachined at total additional costs of $26,500 and then sold for $33,500 or (b) sold as scrap for $2,500. Which action is more profitable? Show your calculations. 2. A truck, costing $100,500 and uninsured, is wrecked its first day in use. It can be either (a) disposed of for $18,000 cash and replaced with a similar truck costing $103,000 or (b) rebuilt for $88,500 and thus be brand-new as far as operating characteristics and looks are concerned. Which action is less costly? Show your calculations. SOLUTION 1. This is an unfortunate situation, yet the $76,000 costs are irrelevant regarding the decision to remachine or scrap. The only relevant factors are the future revenues and future costs. By ignoring the accumulated costs and deciding on the basis of expected future costs, operating income will be maximized (or losses minimized). The difference in favor of remachining is $4,500: (a) (b) Remachine Scrap Future revenues $33,500 $2,500 Deduct future costs 26,500 – Operating income $ 7,000 $2,500 Difference in favor of remachining $4,500 2. This, too, is an unfortunate situation. But the $101,500 original cost is irrelevant to this decision. The difference in relevant costs in favor of replacing is $3,500 as follows: (a) (b) Replace Rebuild New truck $103,000 – Deduct current disposal price of existing truck 18,000 – Rebuild existing truck – $88,500 $ 85,000 $88,500 Difference in favor of replacing $3,500 Note, here, that the current disposal price of $18,000 is relevant, but the original cost (or book value, if the truck were not brand new) is irrelevant. 11-311-17 (20 min.) Relevant and irrelevant costs. Answer the following questions. 1. DeCesare Computers makes 5,200 units of a circuit board, CB76, at a cost of $280 each. Variable cost per unit is $190 and fixed cost per unit is $90. Peach Electronics offers to supply 5,200 units of CB76 for $260. If DeCesare buys from Peach it will be able to save $10 per unit in fixed costs but continue to incur the remaining $80 per unit. Should DeCesare accept Peach’s offer? Explain. 2. LN Manufacturing is deciding whether to keep or replace an old machine. It obtains the following information: LN Manufacturing uses straight-line depreciation. Ignore the time value of money and income taxes. Should LN Manufacturing replace the old machine? Explain. SOLUTION 1. Make Buy Relevant costs Variable costs $190 Avoidable fixed costs 10 Purchase price ____ $260 Unit relevant cost $200 $260 DeCesare Computers should reject Peach’s offer. The $80 of fixed costs is irrelevant because it will be incurred regardless of this decision. When comparing relevant costs between the choices, Peach’s offer price is higher than the cost to continue to produce. 2. Keep Replace Difference Cash operating costs (3 years) $52,500 $46,500 $6,000 Current disposal value of old machine (2,200) 2,200 Cost of new machine _ _____ 9,000 (9,000) Total relevant costs $52,500 $53,300 $ (800) 11-4 [Show More]

Last updated: 1 year ago

Preview 1 out of 43 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jun 21, 2021

Number of pages

43

Written in

Additional information

This document has been written for:

Uploaded

Jun 21, 2021

Downloads

0

Views

30

.png)

.png)

.png)

.png)

.png)