Business > QUESTIONS & ANSWERS > CHAPTER 24 Multistate Corporate Taxation QUESTIONS AND ANSWERS-ALL CORRECT (All)

CHAPTER 24 Multistate Corporate Taxation QUESTIONS AND ANSWERS-ALL CORRECT

Document Content and Description Below

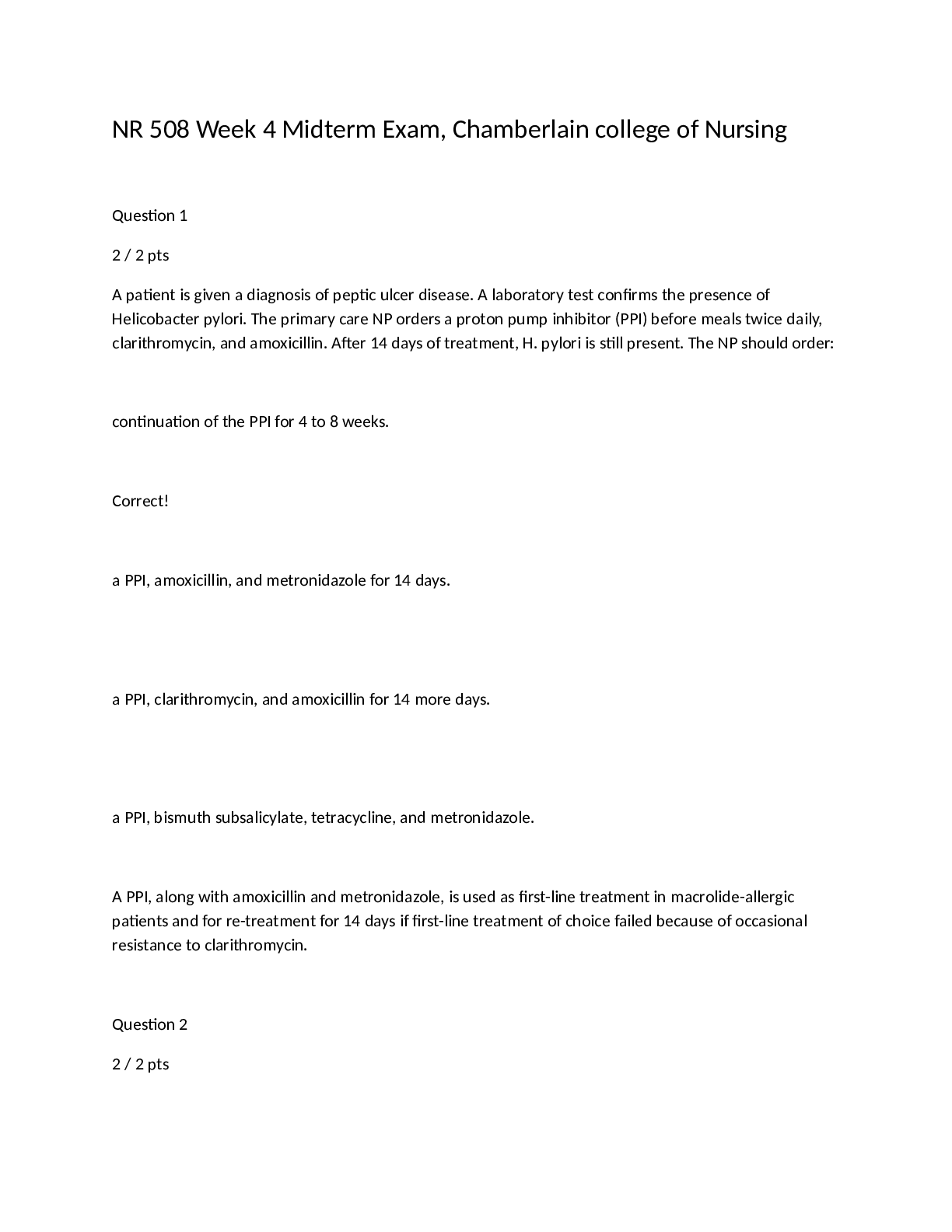

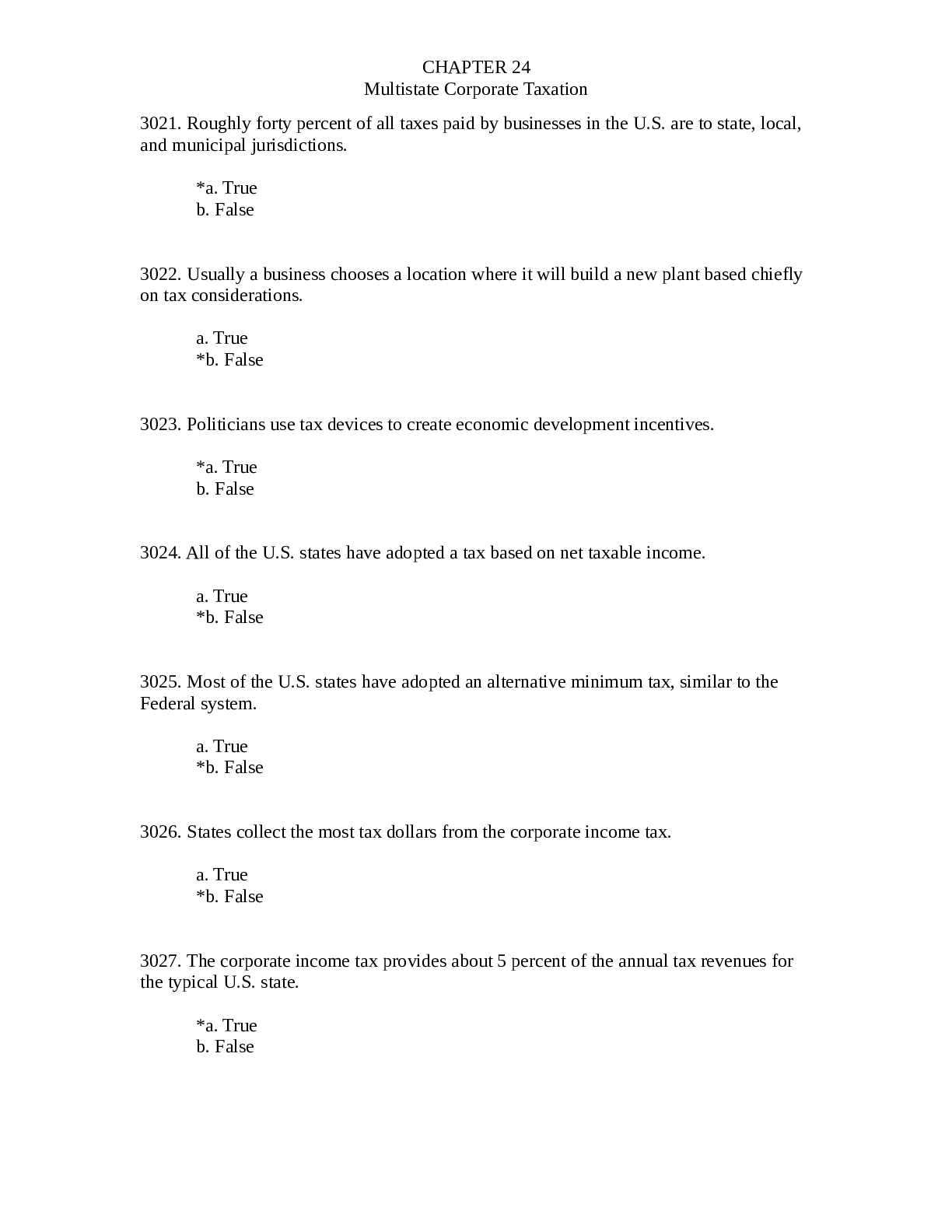

CHAPTER 24 Multistate Corporate Taxation 3021. Roughly forty percent of all taxes paid by businesses in the U.S. are to state, local, and municipal jurisdictions. *a. True b. False 3022. Usually... a business chooses a location where it will build a new plant based chiefly on tax considerations. a. True *b. False 3023. Politicians use tax devices to create economic development incentives. *a. True b. False 3024. All of the U.S. states have adopted a tax based on net taxable income. a. True *b. False 3025. Most of the U.S. states have adopted an alternative minimum tax, similar to the Federal system. a. True *b. False 3026. States collect the most tax dollars from the corporate income tax. a. True *b. False 3027. The corporate income tax provides about 5 percent of the annual tax revenues for the typical U.S. state. *a. True b. False3028. State and local politicians tend to apply new and increased taxes to taxpayers who are visitors to the jurisdiction and cannot vote to reelect the lawmaker. *a. True b. False 3029. A state or local tax on a corporation’s income might be called a franchise tax or a business privilege tax. *a. True b. False 3030. Most states begin the computation of taxable income with an amount from the Federal income tax return. *a. True b. False 3031. If a state follows Federal income tax rules, the state’s tax compliance and enforcement become easier to accomplish. *a. True b. False 3032. A typical state taxable income addition modification is the interest income from U.S. Treasury bonds. a. True *b. False 3033. COMPREHENSIVE VOLUME CHAPTER 24MULTISTATE CORPORATE TAXATION 13 A typical state taxable income addition modification is the Federal net operating loss (NOL) deduction. *a. True b. FalseCHAPTER 24 Multistate Corporate Taxation 3034. A state cannot levy a tax on a business unless the business was incorporated in the state. a. True *b. False 3035. Typical indicators of nexus include the presence of employees based in the state, and the ownership or lease of realty there. *a. True b. False 3036. Under P.L. 86-272, the taxpayer is exempt from state taxes on income resulting from the mere solicitation of orders for the sale of in-state realty [Show More]

Last updated: 1 year ago

Preview 1 out of 50 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$13.00

Document information

Connected school, study & course

About the document

Uploaded On

Jul 22, 2021

Number of pages

50

Written in

Additional information

This document has been written for:

Uploaded

Jul 22, 2021

Downloads

0

Views

45

.png)

.png)