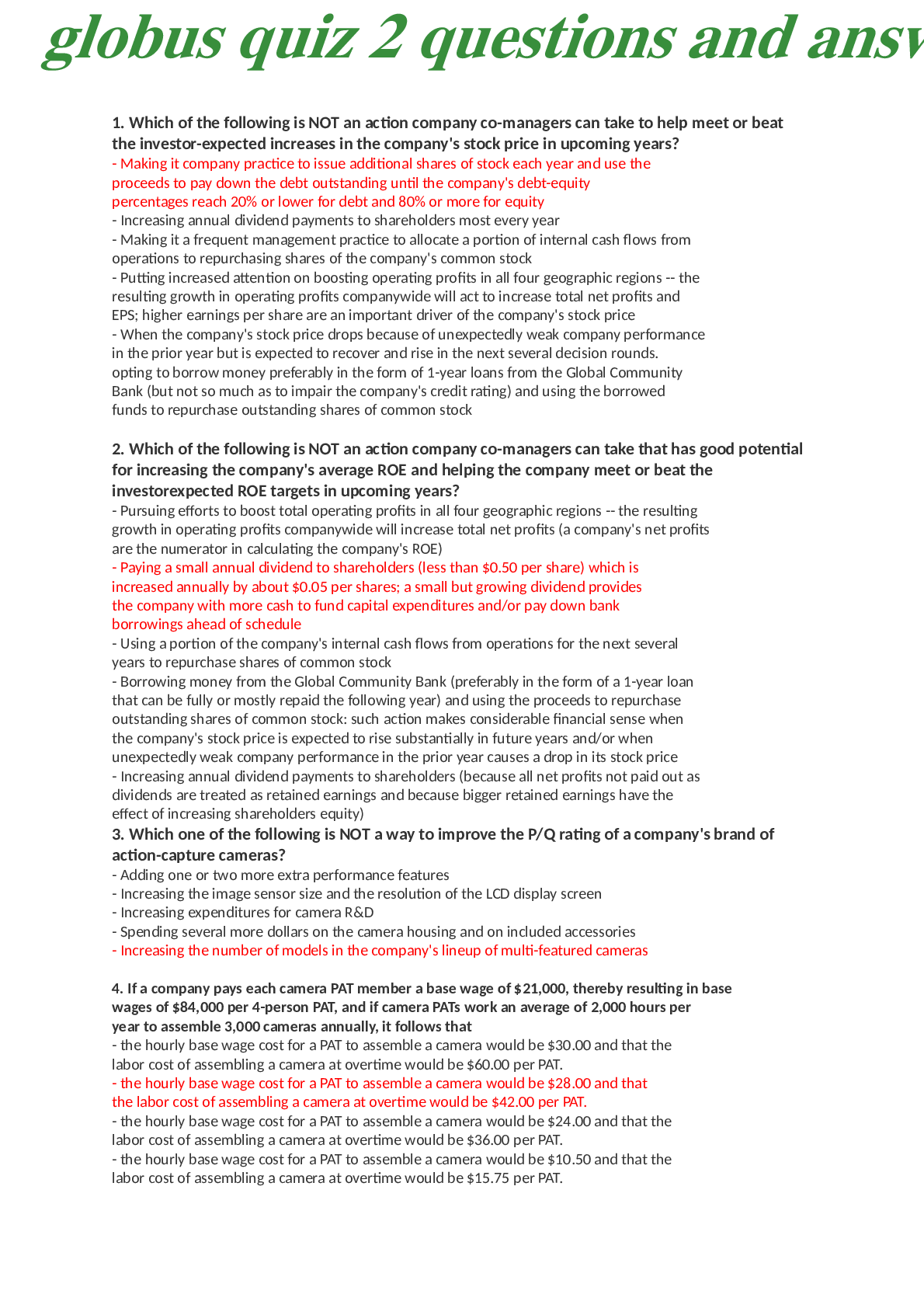

Business Administration > EXAM > Globus Quiz 2 Questions and Answers Part 1,Spring 2021/2022 (All)

Globus Quiz 2 Questions and Answers Part 1,Spring 2021/2022

Document Content and Description Below

Globus Quiz 2 - Answers - Part 1. Which of the following is NOT an action company co-managers can take to help meet or beat the investor-expected increases in the company's stock price in upcoming y e... ars? - Making it company practice to issue additional shares of stock each year and use the proceeds to pay down the debt outstanding until the company's debt-equity percentages reach 20% or lower for debt and 80% or more for equity - Increasing annual dividend payments to shareholders most every year - Making it a frequent management practice to allocate a portion of internal cash flows from operations to repurchasing shares of the company's common stock - Putting increased attention on boosting operating profits in all four geographic regions -- the resulting growth in operating profits companywide will act to increase total net profits and EPS; higher earnings per share are an important driver of the company's stock price - When the company's stock price drops because of unexpectedly weak company performance in the prior year but is expected to recover and rise in the next several decision rounds. opting to borrow money preferably in the form of 1-year loans from the Global Community Bank (but not so much as to impair the company's credit rating) and using the borrowed funds to repurchase outstanding shares of common stock 2. Which of the following is NOT an action company co-managers can take that has good potential for increasing the company's average ROE and helping the company meet or beat the investorexpected ROE targets in upcoming years? - Pursuing efforts to boost total operating profits in all four geographic regions -- the resulting growth in operating profits companywide will increase total net profits (a company's net profits are the numerator in calculating the company's ROE) - Paying a small annual dividend to shareholders (less than $0.50 per share) which is increased annually by about $0.05 per shares; a small but growing dividend provides the company with more cash to fund capital expenditures and/or pay down bank borrowings ahead of schedule - Using a portion of the company's internal cash flows from operations for the next several years to repurchase shares of common stock - Borrowing money from the Global Community Bank (preferably in the form of a 1-year loan that can be fully or mostly repaid the following year) and using the proceeds to repurchase outstanding shares of common stock: such action makes considerable financial sense when the company's stock price is expected to rise substantially in future years and/or when unexpectedly weak company performance in the prior year causes a drop in its stock price - Increasing annual dividend payments to shareholders (because all net profits not paid out as dividends are treated as retained earnings and because bigger retained earnings have the effect of increasing shareholders equity) 3. Which one of the following is NOT a way to improve the P/Q rating of a company's brand of action-capture cameras? - Adding one or two more extra performance features - Increasing the image sensor size and the resolution of the LCD display screen - Increasing expenditures for camera R&D - Spending several more dollars on the camera housing and on included accessories - Increasing the number of models in the company's lineup of multi-featured cameras 4. If a company pays each camera PAT member a base wage of $21,000, thereby resulting in base wages of $84,000 per 4-person PAT, and if camera PATs work an average of 2,000 hours per year to assemble 3,000 cameras annually, it follows that - the hourly base wage cost for a PAT to assemble a camera would be $30.00 and that the labor cost of assembling a camera at overtime would be $60.00 per PAT. - the hourly base wage cost for a PAT to assemble a camera would be $28.00 and that the labor cost of assembling a camera at overtime would be $42.00 per PAT. - the hourly base wage cost for a PAT to assemble a camera would be $24.00 and that the labor cost of assembling a camera at overtime would be $36.00 per PAT. - the hourly base wage cost for a PAT to assemble a camera would be $10.50 and that the labor cost of assembling a camera at overtime would be $15.75 per PAT. - the hourly base wage cost of assembling a camera would be $28.00 and that the labor cost of assembling a camera at overtime cannot be determined from the available information due to the lack of information about compensation payments for assembly quality incentives. perfect attendance bonuses, and the cost of fringe benefit packages 5. Actions that can lead to higher labor productivity in assembling cameras/drones do NOT include - increasing the annual bonus for perfect attendance paid to cameraidrone PAT members from $800 to $875. - reducing the number of camera/drone models being assembled. - boosting the minimum number of cameras/drones that camera/drone PATs are expected to assemble each week -- such failure to achieve the weekly quota in as many as 4 weeks a year constitutes automatic disqualification for year-end perfect attendance bonuses. - increasing total annual compensation per camera/drone PAT member by a minimum of 2% and a maximum of 5% annually. - increasing annual expenditures to train camera/drone PATs in best practice assembly methods and ways to improve productivity from S2.000 per PAT to $2,250 per PAT 6. The website prices virtually all companies in the industry charge Asia-Pacific buyers for UAV drones are likely to be higher than the website prices they charge UAV drone buyers in North America because the administrative costs per drone sold that companies incur on sales to buyers in the Asia-Pacific region are over $10 higher than those incurred on sales to buyers in North America. because unfavorable exchange rate adjustments are consistently $10 to $30 higher on sales to buyers in the Asia-Pacific region than for buyers in North America. because the corporate profits taxes that all companies have to pay to governments in the Asia-Pacific region are 35% higher on average than the corporate profits companies have to pay governments in North America. when the import duties on shipments of UAV drones to buyers in the Asia-Pacific region are significantly bigger than the import duties on shipments of UAV drones to buyers in North America. because the production/assembly costs per drone that companies incur on UAV drones shipped to the Asia-Pacific region are many dollars higher than production/assembly costs per drone shipped to North America. 7. After each decision round, company managers should make a point of examining the information on p. 2 of the Company Operating Report that concerns the company's profitability in the action camera segment in each geographic region because total operating profits and operating profit margins are very likely to be lower in some regions than others and because management needs to take actions to boost its profitability in the underperforming regions in the upcoming decision round. this report provides the company's management team with convincing documentation of the precise reasons why the company's camera-related operating profits and operating profit margins were bigger in some regions than in others. this report provides superb guidance about how much the company needs to raise/lower its average wholesale camera prices in each geographic region. this report provides superb documentation about whether the company spent too much or too little in each region on advertising, retailer support, and website product displays/info in the just-completed decision round. the information in this report allows managers to see in which regions the company was most competitively successful and least competitively successful, competitive factor by competitive factor. 8. Which one of the following actions helps boost a company's image rating/brand reputation? Using environmentally friendly camera components and recycled materials for manuals and packaging for the company's action cameras Charging camera retailers an average wholesale price that is typically 10% or more below the highest price being charged in the region Paying camera/drone PAT members attractively high total annual compensation packages. thereby enabling them to enjoy a standard of living well above the Taiwan average Making it standard practice for the company to offer all buyers of its camera and drones a full 1-year warranty Increasing the PIQ rating of the company's UAV drones 9. Which of the following combinations of actions will likely provide the LEAST competitive benefits in helping a company catch the eye of action camera shoppers. significantly boost overall buyer appeal for its cameras versus rival brands, and cause more camera shoppers to purchase its brand instead of rival brands in each of the four geographic regions? Increasing expenditures for website product displays/info $100,000 in all four regions and increasing advertising expenditures by $250,000 in all four regions Increasing the warranty period from 90 days in each region to 180 days in each region and increasing the number of camera models from 4 to 6 Boosting spending for retailer support by $500,000 in all four geographic regions and instituting $7 reductions in the average wholesale prices charged to camera retailers in each geographic region Boosting its P/Q rating from 5.5 stars to 6.3 stars and increasing spending for advertising from levels that are $1,000,000 above the prior-year regional averages to levels about $3,000,000 above the prior-year regional averages in all four geographic regions. Boosting the number of weekly sales promotion from 4 to 7 in all four regions and also increasing the percentage discounts to camera retailers during these promotions from 11% to 15% 10. If a company earns net income of $40 million in Year 8, has 10 million shares of common stock outstanding, pays a dividend of $1.00 per share, and has annual interest costs of $10 million, then the company would have Year 8 earnings per share of $3.00 and retained earnings of $20 million. the company's EPS for Year 8 would be $2.00, its dividend payout for Year 8 would equal 25% of net income, and its cash flow from operations would be $20 million (net income of $40 million less dividend payments of $10 million less interest costs of $10 million). the company's retained earnings for the year would be $30 million: the $30 million in retained earnings would be shown on the company's balance sheet as a reduction in equity investment by stockholders in Year 9. the company's EPS for Year 8 would be $4.00 and its retained earnings for Year 8 would be $30 million (net income of $40 million less dividend payments of $10 million); the $30 million addition to retained earnings would cause shareholders' equity investment to increase by $30 million in Year 8. the company's retained earnings for the year would be $20 million (net income of $40 million less dividend payments of $10 million less interest costs of $10 million) and its earnings per share would be $2.00. 11. Which one of the following is NEITHER an advantage or disadvantage of shifting to roboticsassisted camera assembly methods? The capital cost of converting to robot-assisted camera assembly can increase a company's interest costs, to the extent that a portion of the capital costs are financed by bank loans. Robot-assisted camera assembly boosts the annual productivity of camera PATs by 500 cameras per year. Installing robots at each camera workstation enables the size of PATs to be cut from 4 members to 3 members. Robot-assisted assembly reduces total annual compensation costs per PAT and also reduces the overtime cost of assembling a camera. Robot-assisted camera assembly increases annual workstation maintenance costs 12. The industry-low, industry-average, and industry-high cost benchmarks on pp. 6-7 of each issue of the Camera & Drone Journal have the greatest value to the managers of companies whose camera costs per unit and drone costs per unit are above the industry averages. are of little value to company managers in making decisions to improve company performance in the upcoming decision round. except in those cases when a company is losing money in one or more geographic regions. are particularly valuable to company managers who are actively considering undertaking robotics upgrades in their camera and drone assembly facilities in the upcoming decision round. are of considerable value to the managers of companies selling low-cost/low-price action cameras and/or UAV drones but are of very limited value to the managers of all other companies. are worth careful scrutiny by the managers of all companies because they help managers determine if corrective actions are needed in the event their company's camera/drone costs for the benchmarked cost categories do NOT appear to be competitive (or "in line") with those of rival companies. 13. If a company adds 60 new workstations at a cost of $75,000 each and also spends $20 million for addition space in its camera/drone assembly facilities to accommodate more workstations, then its annual depreciation costs will rise by $24,500,000 $1,750,000. $3,500.000. $980,000. • $1,225,000. 14. Which of the following is NOT an action that can help boost a company's credit rating? In answering this question, you may wish to consult the Help section for page 5 of the Camera & Drone Journal and read the discussion pertaining to "The Credit Rating Measures." • Repurchase shares of the company's common stock to enhance the company's debtto-equity percentages Put increased attention on boosting operating profits and operating profit margins in all four geographic regions -- the resulting growth in operating profits companywide will increase the company's interest coverage ratio Issue additional shares of stock and use the proceeds to pay down 5-year and 10-year loans Pay off any 1-year loans (and temporarily avoid the use of 1-year loans) because 1-year loans are considered a current liability and thus reduce the company's current ratio Temporarily reduce dividend payments to shareholders and use the cash saved from lower dividend payments to pay down 5-year and 10-year loans 15. The benefits of pursuing a strategy of social responsibility and corporate citizenship include the positive impact that such a strategy has on the company's PiQ ratings for both action cameras and UAV drones the boost such a strategy gives to increasing the company's global sales volume and global market share for both action cameras and UAV drones. the enhanced profitability that results when a company opts to spend money on socially responsible activities. • the positive impact that such a strategy can have on the company's image rating if the company spends a meaningful amount on socially responsible activities over a multiyear period. the boost such a strategy gives to the company's stock price. 16. Which one of the following represent the MOST important/helpful results from the latest decision round that company managers need to review/study in order to guide their strategic moves and decisions to improve their company's competitiveness and overall company performance in the upcoming decision round? Each company's performance on EPS, ROE, stock price, credit rating and image rating displayed on pages 2 and 3 of the Camera & Drone Journal. The comparative competitive efforts of rival companies in each geographic region are found in Competitive Intelligence Report. The Industry Scoreboard data on p.1 of the Camera & Drone Journal. The Industry Overview information on p. 4 of the Camera & Drone Journal. The company's Income Statement on p. 4 of the Company Operating Report. 17. Which one of the following actions helps increase a company's EPS? Minimizing the company's dividend payments so as to boost retained earnings--higher retained earnings divided by the number of shares outstanding result in higher EPS Issuing enough additional shares of stock to raise sufficient cash to pay off all of the company's outstanding loans: cutting interest costs to zero can always be counted on to boost the company's EPS Striving to be the dominant seller of action cameras and UAV drones in all four geographic regions every year by having the highest P/Q ratings and out-marketing rivals: the added profits on large volume sales will drive increases of 10% or more in EPS Cutting the company's selling prices for both action cameras and UAV drones in all four regions to levels at least 5% below those being charged by any company: the resulting increases in sales volumes and revenues will boost the company's EPS Allocating a portion of the company's net income each year to repurchasing shares of the company's common stock 18. A company's managers should give serious consideration to changing from a low-cost/low price strategy for action cameras to a different strategy in the 4 regional markets for action cameras when • all or most of the regional markets are so crowded with companies that are using mostly copycat competitive approaches to selling low-priced cameras to pricesensitive, bargain-hunting buyers that it is difficult for any of these companies to capture sales volumes and revenues big enough to earn profits large enough to meet investor-expected EPS, ROE, and stock price appreciation targets. a big fraction of the companies in the industry are marketing 5 or more models of action cameras with a P/Q rating of 6-stars or higher and selling them at average wholesale prices that are more than $30 above the regional averages. the company's operating profits per action camera sold are not substantially above the industry-average benchmarks in at least three geographic regions (as reported on p. 6 of the most recent Camera & Drone Journal). the company's market share for action cameras has not been the largest in all four geographic regions for two straight years and when its EPS and ROE have also not been the highest in the industry for two straight years. most of the company's low-cost/low-price rivals are offering buyers a 180-day warranty and are spending above-average amounts on advertising in all four geographic regions. 19. If your company earns an ROE of 20% at a time when the investor-expected ROE target is 25% and if the instructor-determined weight for achieving the ROE target is worth 20 points, then your company's ROE score on the Investor Expectations scoring standard will be 17 points 15 points (75% of the 20 points awarded for meeting the ROE target) 18 points 16 points (80% of the 20 points awarded for meeting the ROE target) 20 points (1 point for each 1% the company earned on total shareholders' equity) 20. Which one of the following is NOT an attractive way to reduce the design, assembly, marketing, and other costs per action-capture camera sold in an effort to achieve a sizable low-cost competitive advantage over rivals? Striving to keeping marketing costs per camera sold in all 4 geographic regions sold to levels that are below the industry-average benchmark and. better still close to the industry-low benchmark (as reported on p. 6 of the Camera& Drone Journal) Spending aggressively (but also taking care not to overspend) on camera product R&D Doing whatever it takes to entirely avoid any use of overtime in assembling cameras because paying PAT members 1.5 times the hourly base wage to assemble cameras at overtime is much too expensive. Paying PAT members an attractive assembly quality incentive to help reduce warranty claims on cameras sold and also boost PAT productivity Trying different combinations of components, product enhancements. and extra performance features to be used in action cameras in order to discover the lowest cost combination for achieving a competitively appealing P/Q rating [Show More]

Last updated: 1 year ago

Preview 1 out of 23 pages

Reviews( 1 )

by Misia · 2 years ago

Document information

Connected school, study & course

About the document

Uploaded On

Jul 27, 2021

Number of pages

23

Written in

Additional information

This document has been written for:

Uploaded

Jul 27, 2021

Downloads

1

Views

245

NURS 3247Pharmacology - Proctored Assessment,.png)

Complete solutions.png)

.png)