Accounting > CASE STUDY > EMA Module 6. Pension Consultant who was recently engaged by Awesome Benefit Company (ABC) to become (All)

EMA Module 6. Pension Consultant who was recently engaged by Awesome Benefit Company (ABC) to become the valuation actuary for their frozen defined benefit pension plan: Scenario Q&A

Document Content and Description Below

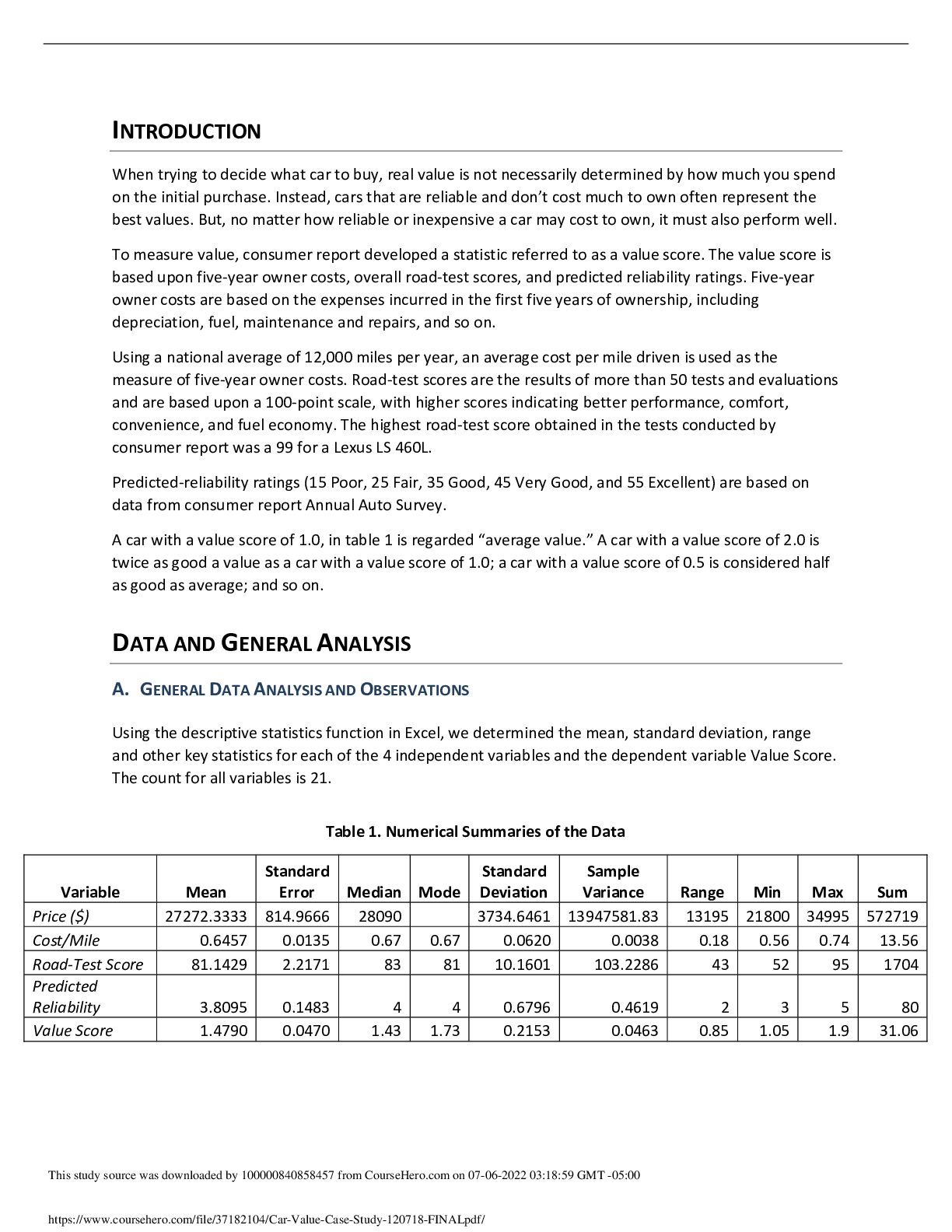

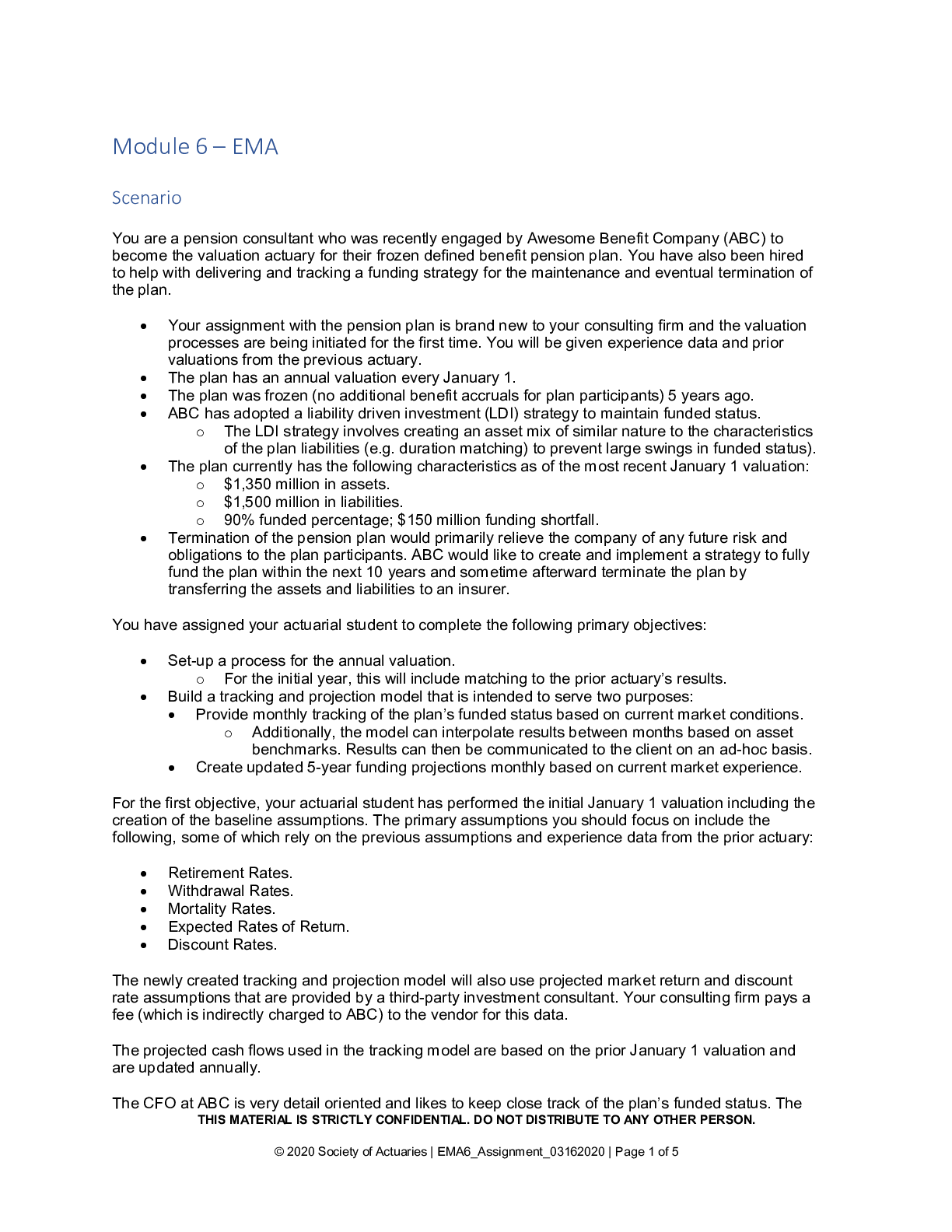

Scenario You are a pension consultant who was recently engaged by Awesome Benefit Company (ABC) to become the valuation actuary for their frozen defined benefit pension plan. You have also been hire... d to help with delivering and tracking a funding strategy for the maintenance and eventual termination of the plan. • Your assignment with the pension plan is brand new to your consulting firm and the valuation processes are being initiated for the first time. You will be given experience data and prior valuations from the previous actuary. • The plan has an annual valuation every January 1. • The plan was frozen (no additional benefit accruals for plan participants) 5 years ago. • ABC has adopted a liability-driven investment (LDI) strategy to maintain funded status. o The LDI strategy involves creating an asset mix of similar nature to the characteristics of the plan liabilities (e.g. duration matching) to prevent large swings in funded status). • The plan currently has the following characteristics as of the most recent January 1 valuation: o $1,350 million in assets. o $1,500 million in liabilities. o 90% funded percentage; $150 million funding shortfall. • Termination of the pension plan would primarily relieve the company of any future risk and obligations to the plan participants. ABC would like to create and implement a strategy to fully fund the plan within the next 10 years and some time afterward terminate the plan by transferring the assets and liabilities to an insurer. You have assigned your actuarial student to complete the following primary objectives: • Set up a process for the annual valuation. o For the initial year, this will include matching to the prior actuary’s results. • Build a tracking and projection model that is intended to serve two purposes: • Provide monthly tracking of the plan’s funded status based on current market conditions. o Additionally, the model can interpolate results between months based on asset benchmarks. Results can then be communicated to the client on an ad-hoc basis. • Create updated 5-year funding projections monthly based on current market experience. For the first objective, your actuarial student has performed the initial January 1 valuation including the creation of the baseline assumptions. The primary assumptions you should focus on include the following, some of which rely on the previous assumptions and experience data from the prior actuary: • Retirement Rates. • Withdrawal Rates. • Mortality Rates. • Expected Rates of Return. • Discount Rates. [Show More]

Last updated: 5 months ago

Preview 1 out of 5 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 11, 2022

Number of pages

5

Written in

Additional information

This document has been written for:

Uploaded

Aug 11, 2022

Downloads

1

Views

375