Accounting > EXAM > ACC317 > ACC 317 Assignment 1: What Business Entity Works Best? Due Week 8 and worth 295 points, Rat (All)

ACC317 > ACC 317 Assignment 1: What Business Entity Works Best? Due Week 8 and worth 295 points, Rated 95% already by student like you.

Document Content and Description Below

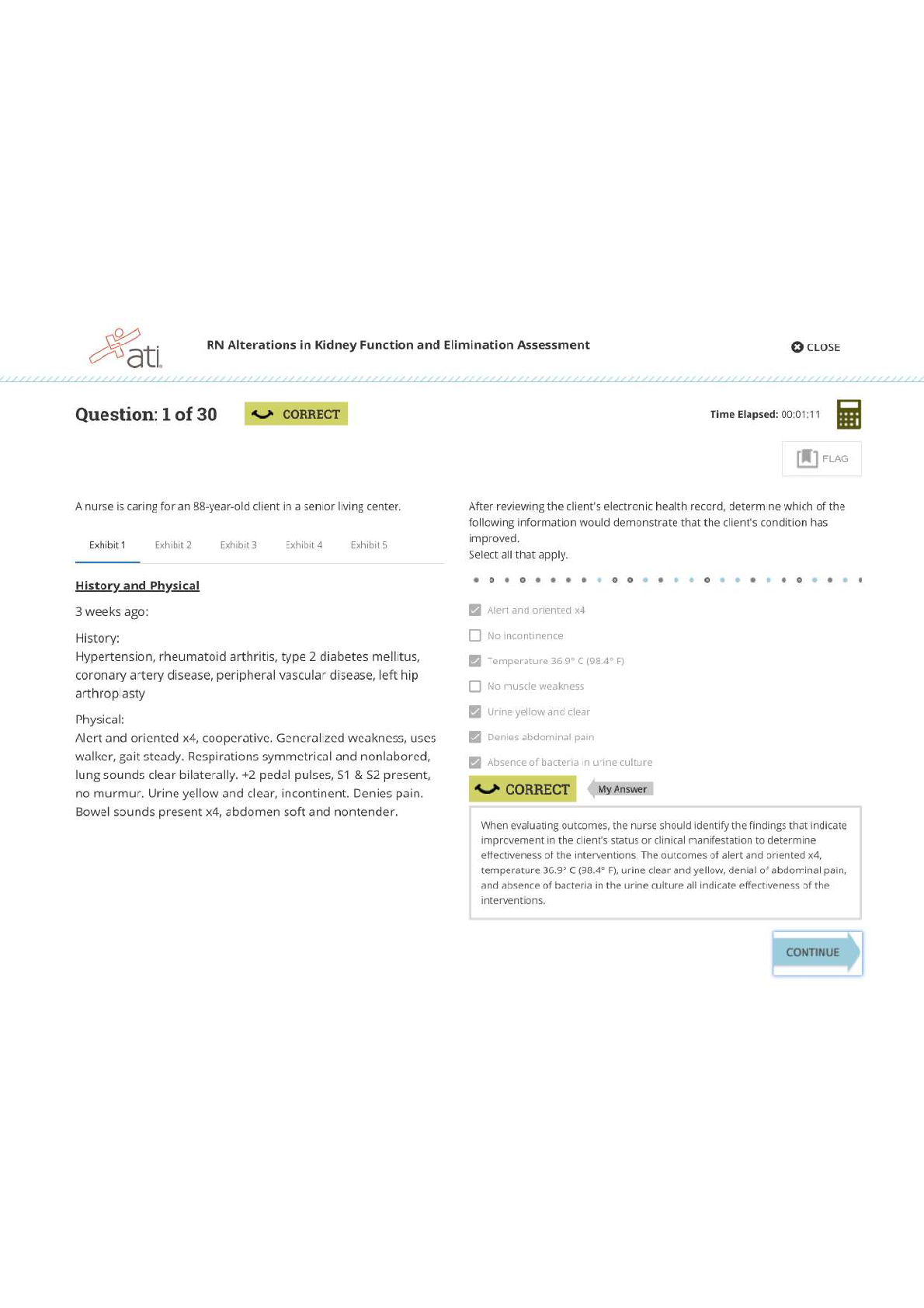

Assignment 1: What Business Entity Works Best? Due Week 8 and worth 295 points For Assignment 1, you will conduct research on , consult your textbook, and refer to other similar, reputable resources o... n taxation. Your goal is to compare the three major forms of corporate organizations: partnerships, s-corporations, and corporations. You will then select a domestic organization, identify its entity type, and describe how the organization’s tax methods are detailed in its financial report. To complete Assignment 1, write a four to five (4-5) page paper in which you do the following: Compare and contrast the tax rules and treatment applicable to those three forms of organization and the major way in which the tax treatment affects the shareholders or partners. Explain at least two reasons why a business owner might opt for one form of organization over another. Provide support for your rationale. Identify two sources of tax guidance (e.g. IRS code, Revenue Procedure) for each form of organization and how it defines a component of the tax policy for that form of organization. Research an organization by identifying its entity type (corporation, s-corporation, or partnership) and describe how that organization’s tax methods are detailed in their financial reports. Go to to locate at least three quality academic resources for this assignment. Note: Wikipedia and similar websites do not qualify as academic resources. Your assignment must follow these formatting requirements: This course requires use of Strayer Writing Standards (SWS). The format is different than other Strayer University courses. Please take a moment to review the SWS documentation for details. Include a cover page containing the title of the assignment, the student’s name, the professor’s name, the course title, and the date. The cover page and the source list are not included in the required assignment page length. The specific course learning outcome associated with this assignment is: Evaluate the tax rules and treatment applicable to organizations and their impact on shareholders. Grading for this assignment will be based on answer quality, logic / organization of the paper, and language and writing skills, using this rubric. [Show More]

Last updated: 1 year ago

Preview 1 out of 6 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 13, 2020

Number of pages

6

Written in

Additional information

This document has been written for:

Uploaded

Dec 13, 2020

Downloads

0

Views

66

.png)