FINAL EXAM FOR AS1201 Financial & Investment....EDITED 2021

Document Content and Description Below

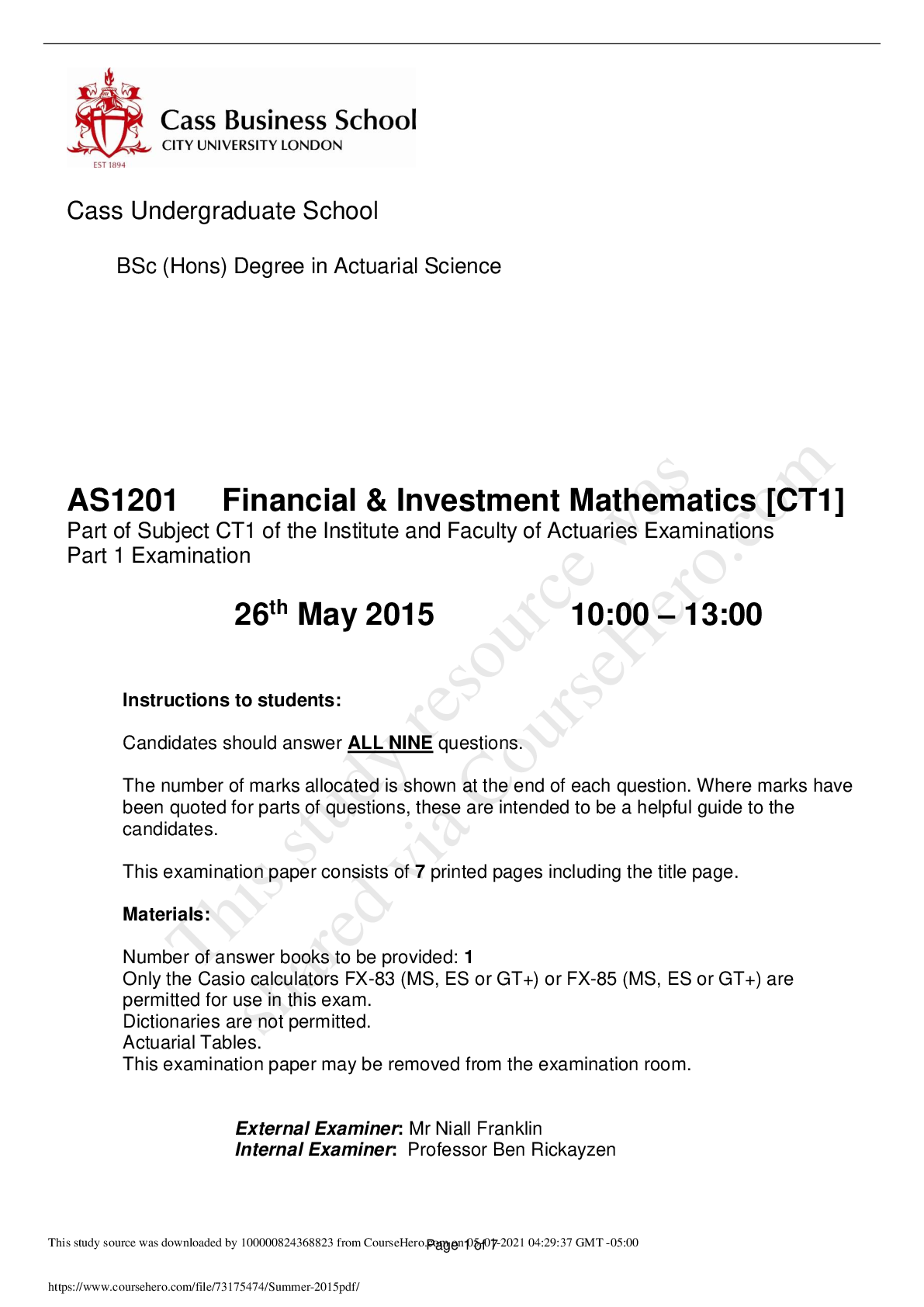

Mathematics [CT1] Part of Subject CT1 of the Institute and Faculty of Actuaries Examinations Part 1 Examination May 2016 180min Instructions to students: Candidates should answer ALL TEN questio... ns. The number of marks allocated is shown at the end of each question. Where marks have been quoted for parts of questions, these are intended to be a helpful guide to the candidates. This examination paper consists of 7 printed pages including the title page. Materials: Number of answer books to be provided: 1 Only the Casio calculators FX-83 (MS, ES or GT+) or FX-85 (MS, ES or GT+) are permitted for use in this exam. Dictionaries are not permitted. Actuarial Tables. This examination paper may be removed from the examination room. External Examiner: Mr Niall Franklin Internal Examiner: Professor Ben Rickayzen BSc (Hons) Degree in Actuarial Science Question 1 A fund had a value of £40m on 1 July 2012. A net cash flow of £7m was received on 1 July 2013 and a further net cash flow of £13m was received on 1 July 2014. Immediately before receipt of the first net cash flow the fund had a value of £42m and immediately before receipt of the second net cash flow the fund had a value of £50m. The value of the fund on 1 July 2015 was £61m. (i) Calculate the annual effective money weighted rate of return earned on the fund over the period from 1 July 2012 to 1 July 2015. [4 marks] (ii) Calculate the annual effective time weighted rate of return earned on the fund over the period from 1 July 2012 to 1 July 2015. [2 marks] [Total 6 marks] Question 2 A loan of nominal amount £50,000 was repaid at par after 3 years. Interest was paid on the loan, annually in arrears, at the rate of 10% per annum. The value of the retail price index at various times was as follows: At the date the loan was made: 490.0 One year later: 536.4 Two years later: 564.4 Three years later: 611.0 (i) Calculate the annual effective real rate of return earned on the loan. [5 marks] (ii) Without doing any further calculations, explain how your answer to part (i) would change if the retail price index at the end of the 3 year period had been greater than 611.0. [2 marks] [Total 7 marks] [Show More]

Last updated: 1 year ago

Preview 1 out of 7 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 01, 2021

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

May 01, 2021

Downloads

0

Views

43

.png)