FIN 560 Week 4 Midterm exam

Document Content and Description Below

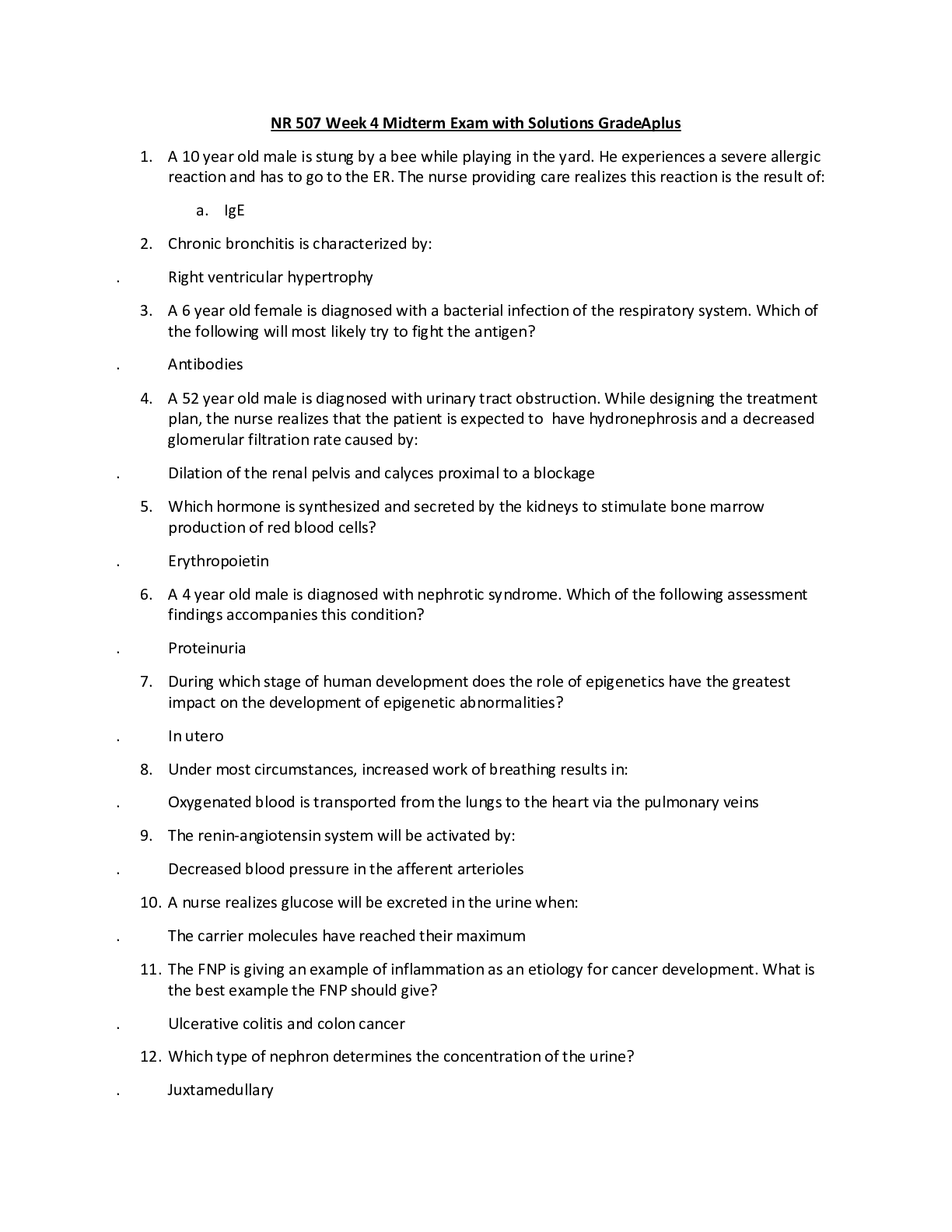

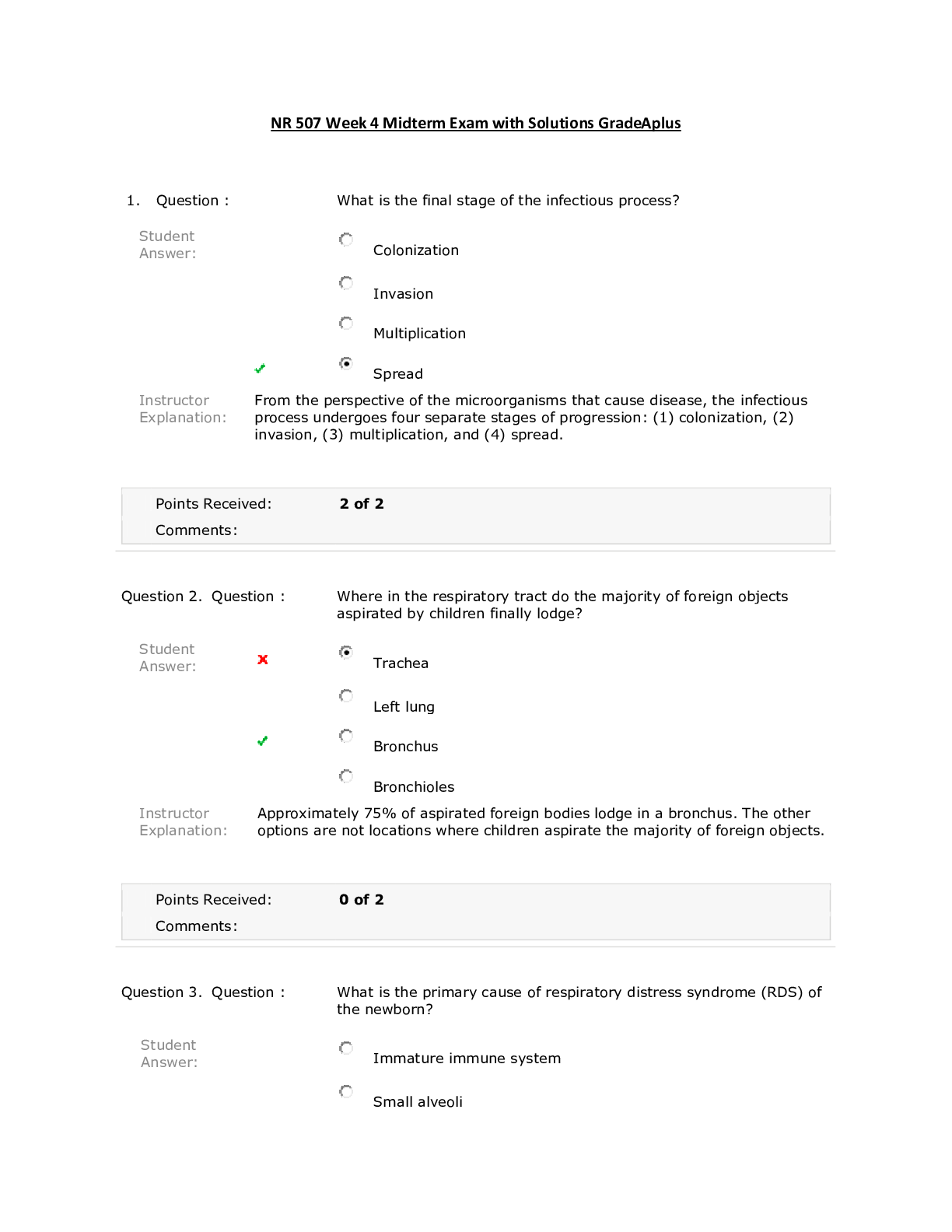

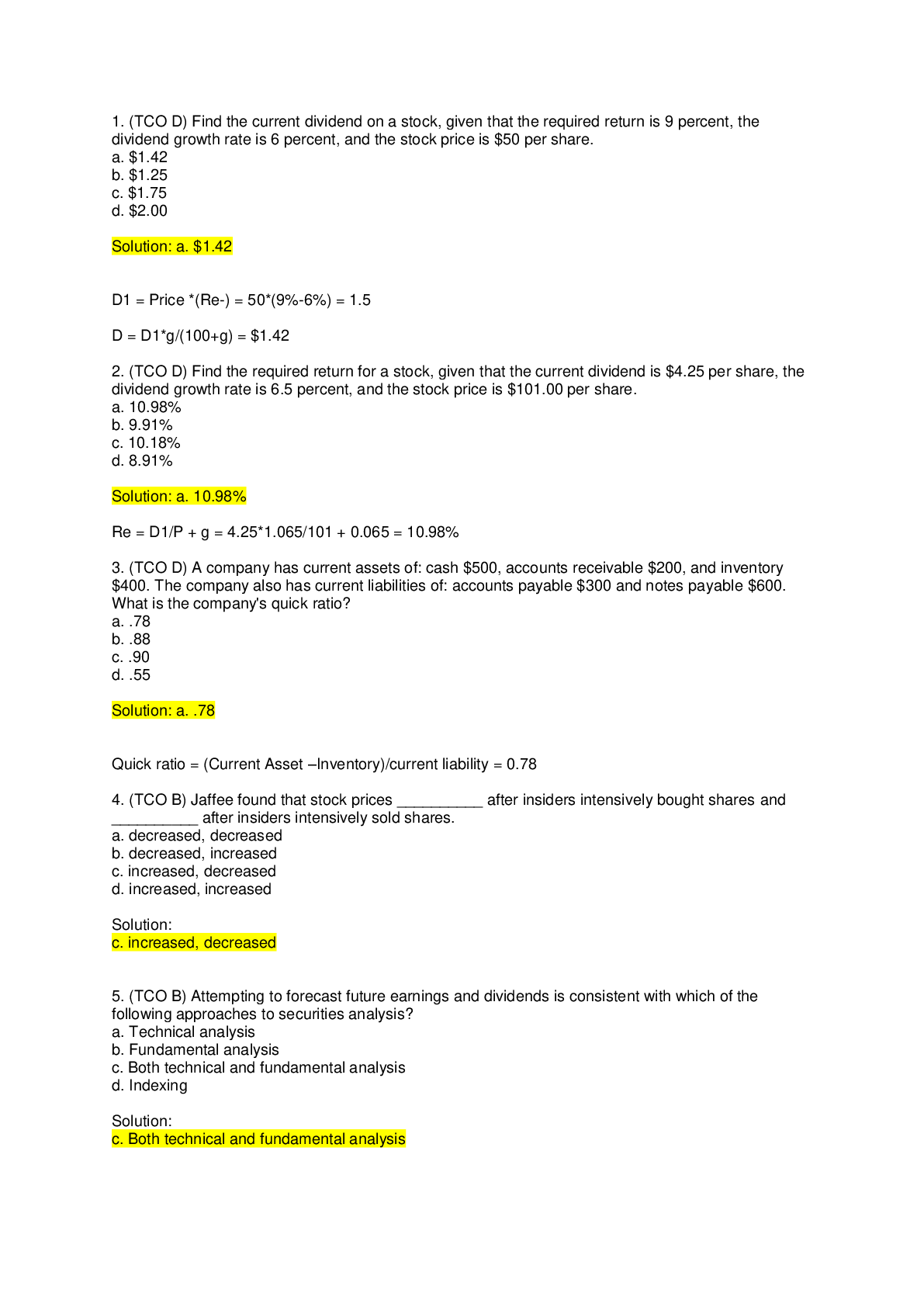

1. (TCO D) Find the required return for a stock, given that the current dividend is $4.45 per share, the dividend growth rate is 6.5 percent, and the stock price is $101.00 per share. 2. TCO D) Fi... nd the next dividend on a stock given that the required return is 9.78 percent, the dividend growth rate is 7.77 percent, and the stock price is $94.89 per share. 3. (TCO D) A company has current assets of: cash $500, accounts receivable $200, and inventory $400. The company also has current liabilities of: accounts payable $300 and notes payable $600. What is the company's quick ratio? 4. (TCO B) Behavioralists point out that even if market prices are ____________ there may be _______________. 5. (TCO B) Attempting to forecast future earnings and dividends is consistent with which of the following approaches to securities analysis? 6. (TCO A) Active trading in markets and competition among securities analysts helps ensure that __________. I. security prices approach informational efficiency II. riskier securities are priced to offer higher potential returns III. investors are unlikely to be able to consistently find under or overvalued securities 7. TCO A) Barnegat Light sold 200,000 shares in an initial public offering. The underwriter's explicit fees were $90,000. The offering price for the shares was $35, but immediately upon issue, the share price jumped to $43. What is the best estimate of the total cost to Barnegat Light concerning the equity issue? 8. (TCO A) You can tax shelter only one-half of your retirement savings. You want to invest one-half of your savings in bonds and one-half in stocks. How much of the bonds and how much of the stocks should you allocate to the tax sheltered investment? 9. TCO I) CAPM is one of the more popular models for determining the risk premium on a stock. What is the expected market return given an expected return on a security of 15.8%, a stock beta of 1.2, and a risk free interest rate of 5.0%? Find the Expected Market Return. Show your work. 10. (TCO D) XYZ company paid a dividend of $1.25 during the past 12 months. The expected growth rate is 7 percent, and the required rate of return is 9.5 precent based on the cost of capital. Calculate the current price of the stock. Do not use a financial calculator or an online calculator. You must show your work 11. (TCO D) Company XYZ is expected to grow at 12% annually forever, and its dividend in the next 12 months is expected to be $3.50, and its required rate of return is 15.5%. a. What is its intrinsic value? b. If the current price is equal to its intrinsic value, what is next year's expected price? c. Assume you buy the stock now and sell it after receiving the $3.50 dividend one year from now. What would be your anticipated capital gain in percentage terms? What is the dividend yield and the holding period return? 12. (TCO E) In the past 10 years, Behavioral Finance has begun to explain the qualitative side of market movements and investor decisions. Explain the concept and the value it can provide to the investment markets. 13. (TCO B) Although the Efficient Markets Hypothesis is a popular theory, there are several limitations. Identify and explain two of those limitations. [Show More]

Last updated: 1 year ago

Preview 1 out of 10 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 17, 2019

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Oct 17, 2019

Downloads

0

Views

114