Counseling > EXAM > Exam (elaborations) Wiley CPAexcel Exam Review 2021 Test Bank: Business Environment and Concepts : G (All)

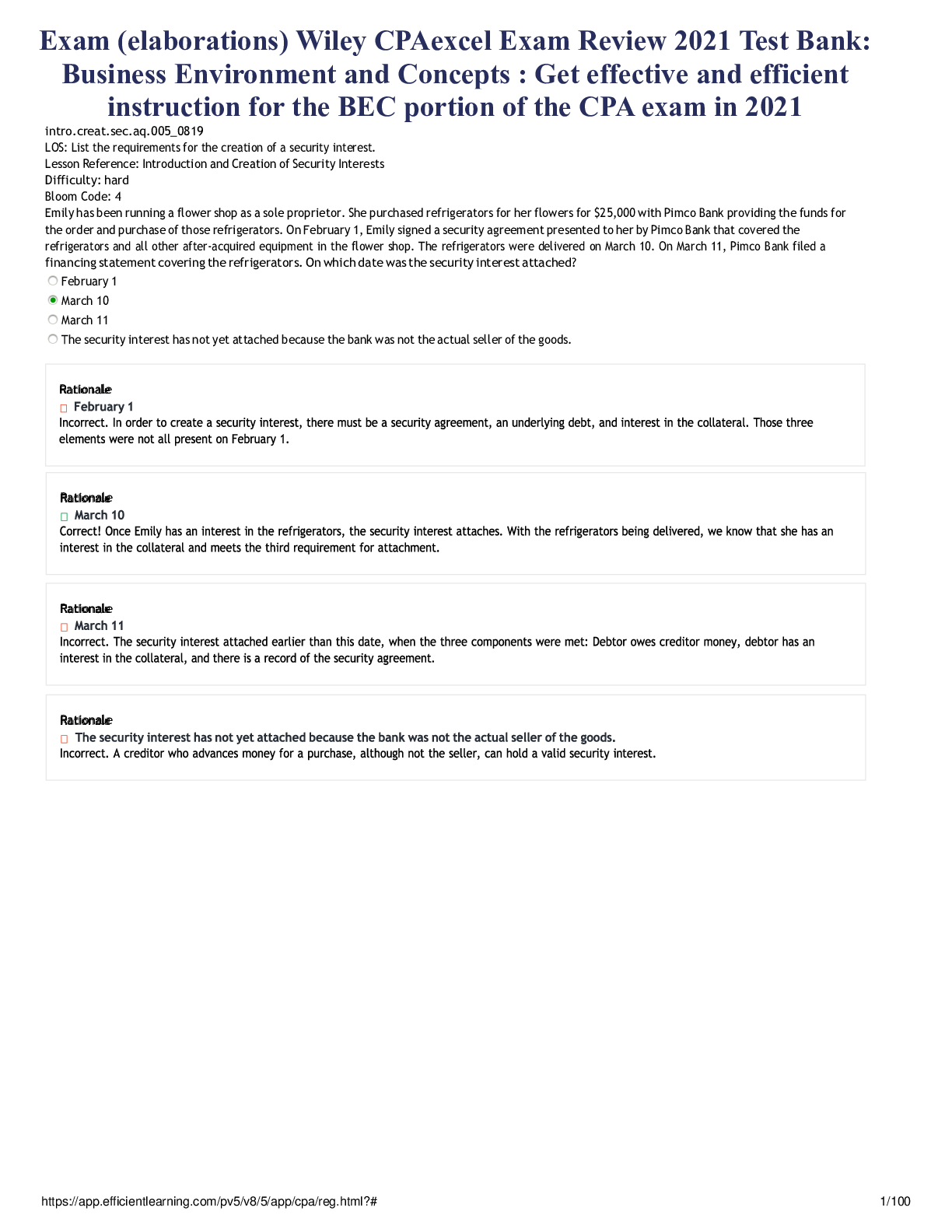

Exam (elaborations) Wiley CPAexcel Exam Review 2021 Test Bank: Business Environment and Concepts : Get effective and efficient instruction for the BEC portion of the CPA exam in 2021

Document Content and Description Below

Wiley CPAexcel Exam Review 2021 Test Bank: Business Environment and Concepts Get effective and efficient instruction for the BEC portion of the CPA exam in 2021 Wiley CPAexcel Exam Review 2021 Test Ba... nk Business Environment and Concepts (1-year access) is the ultimate online practice tool for the business environment and concepts portion of the Certified Public Accountant exam. Containing 1 year of access to over 900 CPA exam multiple-choice questions, complete with answer explanations, this exam review tool dramatically improves retention and learning. You’ll also get access to five task-based simulations that sharpen your skills and prepare you to succeed on this challenging exam the first time you take it. 9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 1 .005_0819 LOS: List the requirements for the creation of a security interest. Lesson Reference: Introduction and Creation of Security Interests Difficulty: hard Bloom Code: 4 Emily has been running a flower shop as a sole proprietor. She purchased refrigerators for her flowers for $25,000 with Pimco Bank providing the funds for the order and purchase of those refrigerators. On February 1, Emily signed a security agreement presented to her by Pimco Bank that covered the refrigerators and all other after-acquired equipment in the flower shop. The refrigerators were delivered on March 10. On March 11, Pimco Bank filed a financing statement covering the refrigerators. On which date was the security interest attached? February 1 March 10 March 11 The security interest has not yet attached because the bank was not the actual seller of the goods. Rationale February 1 Incorrect. In order to create a security interest, there must be a security agreement, an underlying debt, and interest in the collateral. Those three elements were not all present on February 1. Rationale March 10 Correct! Once Emily has an interest in the refrigerators, the security interest attaches. With the refrigerators being delivered, we know that she has an interest in the collateral and meets the third requirement for attachment. Rationale March 11 Incorrect. The security interest attached earlier than this date, when the three components were met: Debtor owes creditor money, debtor has an interest in the collateral, and there is a record of the security agreement. Rationale The security interest has not yet attached because the bank was not the actual seller of the goods. Incorrect. A creditor who advances money for a purchase, although not the seller, can hold a valid security interest.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 2 BSTR-0071 Lesson Reference: Termination Difficulty: medium Under the Revised Uniform Limited Partnership Act and in the absence of a contrary agreement by the partners, which of the following events is most likely to dissolve a limited partnership? A majority vote in favor by the partners. A two-thirds vote in favor by the partners. A withdrawal of a majority of the limited partners. Withdrawal of the only general partner. Rationale A majority vote in favor by the partners. This answer is incorrect because dissolution requires unanimous consent of all partners. Rationale A two-thirds vote in favor by the partners. This answer is incorrect because dissolution requires unanimous consent of all partners. Rationale A withdrawal of a majority of the limited partners. This answer is incorrect because withdrawal by all limited partners would be required to dissolve the partnership. Rationale Withdrawal of the only general partner. This answer is correct because the withdrawal of the only general partner will dissolve the partnership.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 3 AICPA.REG-2.D.1 Lesson Reference: Criminal Liability Difficulty: medium Bloom Code: 3 Turtle was audit partner on ABC Accounting's audit of Jemison Corporation. Turtle knew that the audit was ineptly performed, although he hoped (without much reason) that the financial statements were accurate. He certified them as such. Which of the following is true? If a court decided that Turtle had acted willfully, he could be held criminally liable under the federal securities laws. If a court decided that Turtle had acted negligently, he could be held criminally liable under the federal securities laws. Both A and B. None of the above. Rationale If a court decided that Turtle had acted willfully, he could be held criminally liable under the federal securities laws. The federal securities laws' criminal provisions punish "willful" violations of the 1933 and 1934 securities acts. Rationale If a court decided that Turtle had acted negligently, he could be held criminally liable under the federal securities laws. Mere negligence is an insufficient basis for criminal liability under the federal securities laws. Rationale Both A and B. Because B is wrong, this answer is necessarily wrong. Rationale None of the above. Because A is correct, this answer is necessarily wrong.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 4 BSTR-0028B Lesson Reference: Selection of a Business Entity Difficulty: medium Which form(s) of a business organization can have characteristics common to both the corporation and the general partnership? Limited liability company Subchapter S corporation Yes Yes Yes No No Yes No No Rationale Yes Yes A limited liability company provides for limited liability of its members, similar to the limited liability of the shareholders of a corporation. However, it typically has a limited duration of existence, similar to that of a partnership in which the death or withdrawal of a member or partner causes the business to dissolve unless the remaining members or partners choose to continue the business. The limited liability company can also be taxed similar to a partnership if formed to do so. The Subchapter S corporation has the limited liability of the corporation but is taxed similar to a partnership. Rationale Yes No A limited liability company provides for limited liability of its members, similar to the limited liability of the shareholders of a corporation. However, it typically has a limited duration of existence, similar to that of a partnership in which the death or withdrawal of a member or partner causes the business to dissolve unless the remaining members or partners choose to continue the business. The limited liability company can also be taxed similar to a partnership if formed to do so. The Subchapter S corporation has the limited liability of the corporation but is taxed similar to a partnership. Rationale No Yes A limited liability company provides for limited liability of its members, similar to the limited liability of the shareholders of a corporation. However, it typically has a limited duration of existence, similar to that of a partnership in which the death or withdrawal of a member or partner causes the business to dissolve unless the remaining members or partners choose to continue the business. The limited liability company can also be taxed similar to a partnership if formed to do so. The Subchapter S corporation has the limited liability of the corporation but is taxed similar to a partnership. Rationale No No A limited liability company provides for limited liability of its members, similar to the limited liability of the shareholders of a corporation. However, it typically has a limited duration of existence, similar to that of a partnership in which the death or withdrawal of a member or partner causes the business to dissolve unless the remaining members or partners choose to continue the business. The limited liability company can also be taxed similar to a partnership if formed to do so. The Subchapter S corporation has the limited liability of the corporation but is taxed similar to a partnership.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 5 BSTR-0034B Lesson Reference: Selection of a Business Entity Difficulty: medium Under the federal Subchapter S Revision Act, all corporations are designated as Subchapter S corporations only. Either a Subchapter S corporation or a Subchapter C corporation. One of seven different types of corporations. Both a Subchapter S corporation and a Subchapter C corporation at the same time. Rationale Subchapter S corporations only. The Act provides that a corporation is either a Subchapter S or Subchapter C co-poration but not both at the same time. Rationale Either a Subchapter S corporation or a Subchapter C corporation. The federal Subchapter S Revision Act specifies that all corporations that do not meet the criteria of a Subchapter S corporation are categorized as a Subchapter C corporation. Rationale One of seven different types of corporations. The Act provides that a corporation is either a Subchapter S or Subchapter C corporation but not both at the same time. Rationale Both a Subchapter S corporation and a Subchapter C corporation at the same time. The Act provides that a corporation is either a Subchapter S or Subchapter C corporation but not both at the same time.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 6 act.004_0718 Lesson Reference: Types of Contracts Difficulty: medium Bloom Code: 2 A contract with a minor is Voidable at the option of either the minor or adult parties (once they discover that there is a minor involved). Unenforceable. Void. Voidable at the option of the minor. Rationale Voidable at the option of either the minor or adult parties (once they discover that there is a minor involved). Incorrect. The adult is bound to the contract and does not have the option of getting out after learning that he or she has contracted with a minor. Rationale Unenforceable. Incorrect. Rationale Void. Incorrect. Rationale Voidable at the option of the minor. Correct! It is the minor's choice whether to honor the contract or disaffirm it any time prior to his or her 18th birthday and for a reasonable time thereafter.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 7 PLR-0100 Lesson Reference: Privileged Communications, Confidentiality, and Privacy Acts Difficulty: medium Which of the following is required by the Gramm-Leach Bliley (Financial Modernization) Act of 1999? Accountants are prohibited from providing confidential client information to outsourcing firms. Accountants may provide confidential client information only to outsourcing firms that the accountants have an equity interest in. Accountants are responsible for maintaining the confidentiality of information that is outsourced for processing. Accountants may provide confidential client information only to outsourcing firms that are subject to federal laws and regulations regarding confidentiality. Rationale Accountants are prohibited from providing confidential client information to outsourcing firms. This answer is incorrect. Firms may outsource processing of client information. Rationale Accountants may provide confidential client information only to outsourcing firms that the accountants have an equity interest in. This answer is incorrect. Accountants are not required to have an equity interest in the firm. Rationale Accountants are responsible for maintaining the confidentiality of information that is outsourced for processing. This answer is correct. The Gramm-Leach Bliley (Financial Modernization) Act of 1999 contains this requirement. Rationale Accountants may provide confidential client information only to outsourcing firms that are subject to federal laws and regulations regarding confidentiality. This answer is incorrect. Accountants are allowed to outsource information processing to firms outside the U.S. and not subject to U.S. laws or regulations.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 8 .007_2-18 Lesson Reference: Exempt Transactions and Securities Difficulty: medium Bloom Code: 3 Pix Corporation needs to raise $7.5 million within the next 12 months. It wishes to do so without filing a registration statement with the SEC. It will need to raise money in more than one state. Which of the following is the best option for Pix? Rule 504 Rule 506 Regulation Crowdfunding Rule 147A Rationale Rule 504 Incorrect. The cap for Rule 504 is $5 million in a 12-month period. Rationale Rule 506 Correct! Rule 506 will work if all the requirements are met. Rationale Regulation Crowdfunding Incorrect. The cap for Regulation Crowdfunding is $1 million (inflation-adjusted) in a 12-month period. Rationale Rule 147A Incorrect. Rule 147A will not work for an offering making sales to nonresidents.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 9 .002 Lesson Reference: Common Law Duties and Liabilities to Clients and Third Parties Difficulty: medium CPA Lurie placed a disclaimer in his engagement letter with tax client Wert. The disclaimer essentially stated that Wert promised not to sue Lurie for any errors Lurie might make. If problems arise and Wert seeks to sue Lurie, which of the following types of claims will be barred by the disclaimer? Breach of contract Negligence Fraud None of the above. Rationale Breach of contract Choice A: Incorrect. Most courts are not inclined to give effect to disclaimer provisions in breach of contract cases. Rationale Negligence Choice B: Incorrect. Most courts are not inclined to give effect to disclaimer provisions in negligence contract cases. Rationale Fraud Choice C: Incorrect. No court will give effect to disclaimer provisions in a fraud case. Rationale None of the above. Choice D: Correct! Most courts will not allow professionals to escape liability for their professional wrongs by use of such a contractual provision.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 10 BSTR-0041 Lesson Reference: Authority of Owners and Managers Difficulty: medium Fairwell is executive vice president and treasurer of Wonder Corporation. He was named as a party in a shareholder derivative action in connection with certain activities he engaged in as a corporate officer. In the lawsuit, it was determined that he was liable for negligence in performance of his duties. Fairwell seeks indemnity from the corporation for his liability. The board would like to indemnify him. The Articles of Incorporation do not contain any provisions regarding indemnification of officers and directors. Indemnification Is not permitted since the Articles of Incorporation do not so provide. Is permitted only if he is found not to have been grossly negligent. Cannot include attorney’s fees since he was found to have been negligent. May be permitted by court order despite the fact the Fairwell was found to be negligent. Rationale Is not permitted since the Articles of Incorporation do not so provide. This answer is incorrect because the court in which the action or suit was brought may determine that, despite the adjudication of liability, the director or officer is fairly and reasonably entitled to indemnification under the circumstances. Rationale Is permitted only if he is found not to have been grossly negligent. This answer is incorrect because in shareholder derivative suits, normally no indemnification is permitted where the director or officer has been adjudged to be liable for negligence in the performance of his duty to the corporation. However, indemnification may be permitted under certain circumstances. Rationale Cannot include attorney’s fees since he was found to have been negligent. This answer is incorrect because under indemnification, Fairwell is entitled to expenses, judgments, fines, and amounts actually paid and reasonably incurred by him, which include reasonable attorney’s fees. Rationale May be permitted by court order despite the fact the Fairwell was found to be negligent. This answer is correct because corporations have the power to properly indemnify their directors or officers for expenses incurred in defending suits against them for conduct undertaken in their official and representative capacity on behalf of the corporation. However, in shareholder derivative suits, normally no indemnification is permitted where the director or officer has been adjudged to be liable for negligence in the performance of his duty to the corporation. However, if the court in which the action or suit was brought determines that, despite the adjudication of liability, the director or officer is fairly and reasonably entitled to indemnification under the circumstances, then indemnification may be permitted regardless of the fact that the Articles of Incorporation do not provide therefor.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 11 BSTR-0065B Lesson Reference: Formation Difficulty: medium Norwood was a promoter of Parker Corporation. On March 15, Norwood purchased some real estate from Burrows in Parker's name and signed the contract "Norwood, as agent of Parker Corporation." Parker Corporation, however, did not legally come into existence until June 10. Norwood never informed Burrows on or before March 15 that Parker Corporation was not yet formed. After the corporation was formed, the board of directors refused to adopt the preincorporation contract made by Norwood concerning the real estate deal with Burrows. Burrows sued Parker, Norwood, and the board of directors. Which of the following is correct? None of these parties can be held liable. Norwood only is liable. Norwood and Parker are liable but not the board of directors. Norwood, Parker, and the board of directors are all liable. Rationale None of these parties can be held liable. Norwood is liable. Rationale Norwood only is liable. Norwood is personally liable on the contract because he signed the contract and agency law will not protect him. This is true because he was not an agent, even though he claimed to be, because there was no principal to authorize him when the contract was made on March 15. Rationale Norwood and Parker are liable but not the board of directors. Since the corporation never adopted the contract by words or actions, it is not liable. The board of directors is not personally liable either because they never agreed to the contract. Rationale Norwood, Parker, and the board of directors are all liable. Since the corporation never adopted the contract by words or actions, it is not liable. The board of directors is not personally liable either because they never agreed to the contract.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 12 BSTR-0080B Lesson Reference: Rights and Duties Difficulty: medium Which of the following statements is a general requirement for the merger of two corporations? The merger plan must be approved unanimously by the stockholders of both corporations. The merger plan must be approved unanimously by the boards of both corporations. The absorbed corporation must amend its articles of incorporation. The stockholders of both corporations must be given due notice of a special meeting, including a copy or summary of the merger plan. Rationale The merger plan must be approved unanimously by the stockholders of both corporations. Unanimous approval is not needed by either the stockholders or the boards of either corporation. Rationale The merger plan must be approved unanimously by the boards of both corporations. Unanimous approval is not needed by either the stockholders or the boards of either corporation. Rationale The absorbed corporation must amend its articles of incorporation. The absorbed corporation will no longer exist after the merger plan is accomplished. Rationale The stockholders of both corporations must be given due notice of a special meeting, including a copy or summary of the merger plan. As one of the steps leading up to a merger of two corporations, the stockholders need to be given notice of the merger plan. This is true of the stockholders of both corpora-tions, so a special meeting is called inviting both sets of stockholders.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 13 AICPA.REG-1D Lesson Reference: Licensing and Disciplinary Systems Difficulty: medium Bloom Code: 2 When an ethics complaint carrying national implications arises, which entity typically handles it? SEC. PCAOB. State CPA society. AICPA. Rationale SEC. The SEC will handle legal matters within its jurisdiction but not ethics complaints. Rationale PCAOB. The PCAOB will handle legal matters within its jurisdiction but not ethics complaints. Rationale State CPA society. Where ethical complaints arise, the AICPA handles certain types, including matters of national concern. The state CPA societies will handle the rest. Rationale AICPA. The AICPA handles ethical complaints with national implications.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 14 BANK-0030 Lesson Reference: Discharge and Reaffirmation Agreements Difficulty: medium Dark Corp. is a general creditor of Blue. Blue filed a petition in bankruptcy under the liquidation provisions of the Bankruptcy Code. Dark wishes to have the bankruptcy court either deny Blue a general discharge or not have its debt discharged. The discharge will be granted and it will include Dark’s debt even if Dark’s debt is unscheduled. Dark was a secured creditor which was not fully satisfied from the proceeds obtained upon disposition of the collateral. Blue has unjustifiably failed to preserve the records from which Blue’s financial condition might be ascertained. Blue had filed for and received a previous discharge in bankruptcy under the liquidation provisions within 8 years of the filing of the present petition. Rationale Dark’s debt is unscheduled. This answer is incorrect because unscheduled debts are not discharged in a bankruptcy proceeding. Rationale Dark was a secured creditor which was not fully satisfied from the proceeds obtained upon disposition of the collateral. This answer is correct because the fact that the debt of a secured party was not fully satisfied from the proceeds obtained from disposition of the collateral will not result in a denial of a general discharge, nor will the remaining portion of the secured debt be nondischargeable. In such situations the secured party has the same priority as a general unsecured creditor (lowest priority) concerning the unpaid portion of the debt. Rationale Blue has unjustifiably failed to preserve the records from which Blue’s financial condition might be ascertained. This answer is incorrect because a debtor who fails to keep books will be denied a general discharge. Rationale Blue had filed for and received a previous discharge in bankruptcy under the liquidation provisions within 8 years of the filing of the present petition. This answer is incorrect because a debtor who has received a previous discharge in bankruptcy under the liquidation provisions within 8 years will be denied a general discharge.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 15 CONT-0014 Lesson Reference: Offer and Acceptance Difficulty: medium On March 1, Mirk Corp. wrote to Carr offering to sell Carr its office building for $280,000. The offer stated that it would remain open until July 1. It further stated that acceptance must be by telegram and would be effective only upon receipt. On May 10, Mirk mailed a letter to Carr revoking its offer of March 1. Carr did not learn of Mirk’s revocation until Carr received the letter on May 17. Carr had already sent a telegram of acceptance to Mirk on May 14, which was received by Mirk on May 16. Which of the following statements is correct? Carr’s telegram of acceptance was effective on May 16. Mirk’s offer of March 1 was irrevocable and therefore could not be withdrawn prior to July 1. Mirk’s letter of revocation effectively terminated its offer of March 1 when mailed. Carr’s telegram of acceptance was effective on May 14. Rationale Carr’s telegram of acceptance was effective on May 16. This answer is correct. Generally, an offeror may revoke an offer at any time prior to acceptance by the offeree. However, notice of revocation must be received by the offeree before the revocation becomes effective. Since Carr’s telegram of acceptance was received by Mirk and became effective on May 16, per the terms of the offer, and Mirk did not receive the letter of revocation until May 17, acceptance occurred on May 16, and the letter of revocation was not effective. Rationale Mirk’s offer of March 1 was irrevocable and therefore could not be withdrawn prior to July 1. This answer is incorrect. Generally an offeror can revoke an offer at any time prior to acceptance by the offeree. Rationale Mirk’s letter of revocation effectively terminated its offer of March 1 when mailed. This answer is incorrect. Notice of revocation must be received by the offeree before the revocation becomes effective. Rationale Carr’s telegram of acceptance was effective on May 14. This answer is incorrect. The offer stated that acceptance would only be effective upon receipt by the offeror.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 16 AICPA.BEC-BL Lesson Reference: Rights and Duties Difficulty: medium Bloom Code: 2 For what purpose will a stockholder of a publicly held corporation be permitted to file a stockholder's derivative suit in the name of the corporation? To compel payment of a properly declared dividend. To enforce a right to inspect corporate records. To compel dissolution of the corporation. To recover damages from corporate management for an ultra vires management act. Rationale To compel payment of a properly declared dividend. This answer is incorrect, because a claim to force payment of a dividend seeks to redress an injury to the shareholder who has not been paid, and therefore is primarily an individual injury redressable by an individual suit, not a derivative suit. Rationale To enforce a right to inspect corporate records. This answer is incorrect, because a claim to enforce a right to inspect corporate records seeks to redress an injury to the shareholder who has not been accorded the inspection right and therefore is primarily an individual injury redressable by an individual suit, not a derivative suit. Rationale To compel dissolution of the corporation. This answer is incorrect, because a claim to compel dissolution of the corporation is usually filed to advance an individual shareholder's interests and therefore is primarily an individual injury redressable by an individual suit, not a derivative suit. Rationale To recover damages from corporate management for an ultra vires management act. Shareholders can sue the corporation and its officers and directors for injuries done to them individually. Shareholders may also file derivative lawsuits against persons who have injured the corporation. A shareholder's derivative suit is so named because the shareholder is not suing for an individual injury done to him/her but, instead, for an injury done to the corporation. The shareholder stands in the proverbial shoes of the corporation to bring an action to remedy an injury done to it. A shareholder who sued to force payment of dividends, to enforce a right to inspect records, or to compel dissolution, would most likely be suing to redress an injury done to him/her individually. Such an injury is remedied through an individual lawsuit brought on the shareholder's own behalf, not a derivative lawsuit brought on the corporation's behalf. This is why Choices A, B, and C are not correct. However, an ultra vires act would likely injure the corporation itself, which is why it is the most logical candidate for a derivative suit and why Choice D is the best answer.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 17 SALE-0041 Lesson Reference: Formulas for Damages Difficulty: medium On April 5, Anker, Inc. furnished Bold Corp. with Anker’s financial statements dated March 31. The financial statements contained misrepresentations which indicated that Anker was solvent when in fact it was insolvent. Based on Anker’s financial statements, Bold agreed to sell Anker 90 computers, “FOB—Bold’s loading dock.” On April 14, Anker received 60 of the computers. The remaining 30 computers are in the possession of the common carrier and in transit to Anker. With respect to the remaining 30 computers in transit, which of the following statements is correct if Anker refuses to pay Bold in cash and Anker is not in possession of a negotiable document of title covering the computers? Bold may stop delivery of the computers to Anker since their contract is void due to Anker’s furnishing of the false financial statements. Bold may stop delivery of the computers to Anker despite the fact that title had passed to Anker. Bold must deliver the computers to Anker on credit since Anker has not breached the contract. Bold must deliver the computers to Anker since the risk of loss had passed to Anker. Rationale Bold may stop delivery of the computers to Anker since their contract is void due to Anker’s furnishing of the false financial statements. This answer is incorrect. The furnishing of false financial statements does not void the contract, instead it extends the time the seller has to reclaim goods already delivered to the insolvent buyer. Rationale Bold may stop delivery of the computers to Anker despite the fact that title had passed to Anker. This answer is correct. A seller is entitled to stop the delivery of goods in the hands of a carrier if an insolvent buyer who is not in possession of the document of title refuses to pay cash. Therefore, Bold may stop delivery of the computers since Anker refuses to pay in cash and is not in possession of the document of title. Rationale Bold must deliver the computers to Anker on credit since Anker has not breached the contract. This answer is incorrect. A seller is entitled to stop the delivery of goods in the hands of a carrier if an insolvent buyer who is not in possession of the document of title refuses to pay cash. Therefore, Bold may stop delivery of the computers since Anker refuses to pay in cash and is not in possession of the document of title. Rationale Bold must deliver the computers to Anker since the risk of loss had passed to Anker. This answer is incorrect. The fact that Anker has assumed risk of loss will not prevent Bold from stopping delivery of the computers.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 18 BANK-0019 Lesson Reference: Bankruptcy Process Difficulty: medium On February 28, Master, Inc. had total assets with a fair market value of $1,200,000 and total liabilities of $990,000. On January 15, Master made a monthly installment note payment to Acme Distributors Corp., a creditor holding a properly perfected security interest in equipment having a fair market value greater than the balance due on the note. On March 15, Master voluntarily filed a petition in bankruptcy under the liquidation provisions of Chapter 7 of the Federal Bankruptcy Code. One year later, the equipment was sold for less than the balance due on the note to Acme. Master’s payment to Acme could Be set aside as a preferential transfer because the fair market value of the collateral was greater than the installment note balance. Be set aside as a preferential transfer unless Acme showed that Master was solvent on January 15. Not be set aside as a preferential transfer because Acme was over secured. Not be set aside as a preferential transfer if Acme showed that Master was solvent on March 15. Rationale Be set aside as a preferential transfer because the fair market value of the collateral was greater than the installment note balance. This answer is incorrect. This payment could not be a preferential transfer since the creditor did not receive more than he would have under a Chapter 7 liquidation. Rationale Be set aside as a preferential transfer unless Acme showed that Master was solvent on January 15. This answer is incorrect. This payment could not be a preferential transfer since the creditor did not receive more than he would have under a Chapter 7 liquidation. Furthermore, the need is for the debtor to be insolvent rather than solvent at the point of the alleged preferential transfer. Rationale Not be set aside as a preferential transfer because Acme was over secured. This answer is correct. The trustee has the power to set aside preferential transfers made to a creditor within 90 days before the filing of the bankruptcy petition while the debtor is insolvent. To be a preferential transfer, it must be a transfer for an antecedent debt that enables the creditor to receive more than s/he otherwise would have in a Chapter 7 liquidation. Since the creditor already had a perfected security interest in the equipment, he did not receive a preferential transfer because at that time the equipment had a fair market value greater than the note. This is true because perfected security interests have a priority above all others in the bankruptcy proceedings. Rationale Not be set aside as a preferential transfer if Acme showed that Master was solvent on March 15. This answer is incorrect. This is not a preferential transfer whether Master was solvent or not on any of the dates in the question.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 19 AICPA.REG-BL Lesson Reference: Duties of Agents and Principals Difficulty: easy Bloom Code: 2 Ogden Corp. hires Thorp as a sales representative for nine months at a salary of $3,000 per month, plus 4% of sales. Which of the following statements is correct? Thorp is obligated to act solely in Ogden's interest in matters concerning Ogden's business. The agreement between Ogden and Thorp formed an agency coupled with an interest. Ogden does not have the power to dismiss Thorp during the nine-month period without cause. The agreement between Ogden and Thorp is not enforceable, unless it is in writing and signed by Thorp. Rationale Thorp is obligated to act solely in Ogden's interest in matters concerning Ogden's business. Thorp is an agent, as he has been hired to act on Ogden's behalf by representing it. A primary duty of an agent is one of loyalty - an agent must act in his principal's interests and not his own when participating in matters affecting the principal's business. Rationale The agreement between Ogden and Thorp formed an agency coupled with an interest. An agency coupled with an interest is one that is created primarily for the benefit of the AGENT. For example: Alex borrows $100,000 from Bill, and gives Bill some of his stock to secure the loan. He says to Bill, "In case I do not repay you, I give you agency power to sell my stock to get your money." Bill has an agency coupled with an interest. Rationale Ogden does not have the power to dismiss Thorp during the nine-month period without cause. There is nothing in the contract that guarantees Thorp's job. Most agency agreements may be terminated at the will of either side if there is not a prohibition in the original agreement. Rationale The agreement between Ogden and Thorp is not enforceable, unless it is in writing and signed by Thorp. Most agency agreements need not be in writing. Generally, a writing is required only if the agent will be conveying interests in real property, such as houses and land.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 20 BSTR-0048 Lesson Reference: Rights and Duties Difficulty: medium A stockholder’s right to inspect books and records of a corporation will be properly denied if the purpose of the inspection is to Commence a stockholder’s derivative suit. Obtain stockholder names for a retail mailing list. Solicit stockholders to vote for a change in the board of directors. Investigate possible management misconduct. Rationale Commence a stockholder’s derivative suit. This answer is incorrect. This purpose relates to a shareholder’s interest as an owner of the corporation. Rationale Obtain stockholder names for a retail mailing list. This answer is correct. The shareholder’s right may be denied if the corporation can show that the shareholder’s motive is for an unwarranted purpose, for a purpose hostile to the corporation (to engage in competing business), or to satisfy idle curiosity. Obtaining a stockholder list for its commercial value (a retail mailing list) is considered an unwarranted purpose that is not related to the shareholder’s corporate interest. Rationale Solicit stockholders to vote for a change in the board of directors. This answer is incorrect. This purpose relates to a shareholder’s interest as an owner of the corporation. Rationale Investigate possible management misconduct. This answer is incorrect. This purpose relates to a shareholder’s interest, and the purpose is substantiated by more than idle curiosity.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 21 SECU-0012B Lesson Reference: Perfection of Security Interests Difficulty: medium Rally Co. has purchased some inventory from Kantar Corporation to sell to customers who will use the inventory primarily for consumer use. Which of the following is not correct? If Kantar sells the inventory to Rally on credit and takes out a security interest using the inventory as collateral, this a purchase money security interest. If Kantar sells the inventory to Rally on credit and takes out a security interest using the inventory as collateral, this is a purchase money security interest in consumer goods. If Kantar sells the inventory to Rally but Rally pays for it by getting a loan from a bank who takes out a security interest using the inventory as collateral, this is a purchase money security interest. If a customer purchases some inventory on credit from Rally for home use and signs a written security agreement presented by Rally that lists the inventory as collateral for the credit, this is a purchase money security interest in consumer goods. Rationale If Kantar sells the inventory to Rally on credit and takes out a security interest using the inventory as collateral, this a purchase money security interest. This does describe a PMSI since Kantar retained a security interest in the same items sold on credit to secure payment. Rationale If Kantar sells the inventory to Rally on credit and takes out a security interest using the inventory as collateral, this is a purchase money security interest in consumer goods. Because Kantar has a security interest in the inventory it sold and is also using the same inventory as collateral for the credit, this is a purchase money security interest. However, because the items Rally purchased are inventory, not consumer goods, in Rally's hands, this is not a PMSI in consumer goods. Rationale If Kantar sells the inventory to Rally but Rally pays for it by getting a loan from a bank who takes out a security interest using the inventory as collateral, this is a purchase money security interest. A PMSI includes a third party giving a loan who retains a security interest in the same items purchased by the loan. Rationale If a customer purchases some inventory on credit from Rally for home use and signs a written security agreement presented by Rally that lists the inventory as collateral for the credit, this is a purchase money security interest in consumer goods. A PMSI in consumer goods since the customer purchased the items for his/her home use.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 22 .005 Lesson Reference: Worker Classification Laws and Regulations Difficulty: medium XYZ Corporation classified large numbers of its workers as independent contractors, but in litigation brought by the IRS, the court held that they were actually employees who had been deprived of their rightful benefits. Which of the following is likely true if XYZ's classification was erroneous, but not intentional? An unintentional error is not punished in this context. Even an unintentional error will result in XYZ paying stiff fines. XYZ's unintentional error will probably not be punished if its decision had a reasonable basis within the meaning of the safe harbor that exists of these decisions. All of the above. Rationale An unintentional error is not punished in this context. Choice a: Incorrect. Even unintentional misclassifications are often punished. Rationale Even an unintentional error will result in XYZ paying stiff fines. Choice b: Incorrect. An unintentional misclassification might result if stiff fines, but this will not be the case if XYZ can fit within the safe harbor. Rationale XYZ's unintentional error will probably not be punished if its decision had a reasonable basis within the meaning of the safe harbor that exists of these decisions. Choice c: Correct! If XYZ can fit itself within the safe harbor by proving that it had a reasonable basis for its classification, perhaps one based on an IRS letter ruling, it will probably not be punished. Rationale All of the above. Choice d: Because the first and second choices are incorrect, the last choice cannot be correct.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 23 AICPA.REG-BL Lesson Reference: Distribution of Debtor’s Estate Difficulty: easy Bloom Code: 2 Which of the following claims would have the highest priority in the distribution of a bankruptcy estate under the liquidation provisions of Chapter 7 of the Federal Bankruptcy Code if the petition was filed June 1, 20XX? Federal tax lien filed May 15, 20XX. A secured debt properly perfected on February 10, 20XX. Trustee's administration cost filed September 30, 20XX. Employee wages due March 30, 20XX. Rationale Federal tax lien filed May 15, 20XX. A secured creditor with a perfected interest will generally have top priority. After secured creditors are paid, the bankruptcy code sets forth an order of priority for unsecured creditors. A federal tax lien is fairly low on that list. The administrative expenses would come first among the unsecured claims, followed by wages, and the tax lien would come last. Rationale A secured debt properly perfected on February 10, 20XX. A secured creditor with a perfected interest will generally have top priority. After secured creditors are paid, the bankruptcy code sets forth an order of importance for unsecured creditors. The administrative expenses would come first among the unsecured claims, followed by the wages, and the tax lien would come last. Rationale Trustee's administration cost filed September 30, 20XX. A secured creditor with a perfected interest will generally have top priority. After secured creditors are paid, the bankruptcy code sets forth an order of importance for unsecured creditors. The administrative expenses would come first among the unsecured claims, followed by the wages, and the tax lien would come last. Rationale Employee wages due March 30, 20XX. A secured creditor with a perfected interest will generally have top priority. After secured creditors are paid, the bankruptcy code sets forth an order of importance for unsecured creditors. The administrative expenses would come first among the unsecured claims, followed by the wages, and the tax lien would come last.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 24 CONT-0089 Lesson Reference: Defining Performance and Breach Difficulty: medium Diel entered into a written contract to sell a building to Stone. The contract was properly recorded. Stone breached the contract and Diel has brought an action for breach of contract. Stone pleads the statute of limitations as a defense. The time period fixed by the statute of limitations is uniform throughout the states. recording of the contract stops the running of the statute of limitations. time period fixed by the statute of limitations begins when the contract is recorded. remedy sought by Diel will be barred when the period of time provided by the statute of limitations has expired. Rationale time period fixed by the statute of limitations is uniform throughout the states. This answer is incorrect because the time period fixed under the statute of limitations varies from state to state. Rationale recording of the contract stops the running of the statute of limitations. This answer is incorrect because the recording of a contract has no impact on the running of the statute of limitations. Rationale time period fixed by the statute of limitations begins when the contract is recorded. This answer is incorrect because the time period covered by the statute of limitations begins to run from the date on which the cause of action occurred, not from the date of recording. Rationale remedy sought by Diel will be barred when the period of time provided by the statute of limitations has expired. This answer is correct because the statute of limitations bars action at law on contracts unless they are brought within prescribed periods of time. In this case, if Diel did not bring an action against Stone before the statute of limitations had expired, the court would rule in favor of Stone and would not allow Diel to pursue the action further.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 25 SECU-0025 Lesson Reference: Priorities in Security Interests Difficulty: medium Roth and Dixon both claim a security interest in the same collateral. Roth’s security interest attached on January 1, and was perfected by filing on March 1. Dixon’s security interest attached on February 1, and was perfected on April 1, by taking possession of the collateral. Which of the following statements is correct? Roth’s security interest has priority because Roth perfected before Dixon perfected. Dixon’s security interest has priority because Dixon’s interest attached before Roth’s interest was perfected. Roth’s security interest has priority because Roth’s security interest attached before Dixon’s security interest attached. Dixon’s security interest has priority because Dixon is in possession of the collateral. Rationale Roth’s security interest has priority because Roth perfected before Dixon perfected. This answer is correct because perfection of a security interest takes place when all of the elements for attachment have occurred as well as one of the alternate methods of perfection. Roth’s security interest was perfected on March 1. Dixon’s security interest was perfected on April 1. Therefore, Roth’s security interest has priority over that of Dixon because Roth’s was perfected first. Rationale Dixon’s security interest has priority because Dixon’s interest attached before Roth’s interest was perfected. This answer is incorrect because the comparison is between the perfection dates of March 1, (the date Roth perfected) and April 1, (the date Dixon perfected). Rationale Roth’s security interest has priority because Roth’s security interest attached before Dixon’s security interest attached. This answer is incorrect because the dates of perfection are relevant rather than the dates of attachment. Rationale Dixon’s security interest has priority because Dixon is in possession of the collateral. This answer is incorrect because the dates of the perfection control the priorities, not the method of perfection.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 26 BSTR-0010 Lesson Reference: Operations: Nonfinancial Factors Difficulty: medium Ted Fein, a partner in the ABC Partnership, wishes to withdraw from the partnership and sell his interest to Gold. All of the other partners in ABC have agreed to admit Gold as a partner and to hold Fein harmless for the past, present, and future liabilities of ABC. A provision in the original partnership agreement states that the partnership will continue upon the death or withdrawal of one or more of the partners. As a result of Fein’s withdrawal and Gold’s admission to the partnership, Gold Is personally liable for partnership liabilities arising before and after his admission as a partner. Has the right to participate in the management of ABC. Acquired only the right to receive Fein’s share of the profits of ABC. Must contribute cash or property to ABC in order to be admitted with the same rights as the other partners. Rationale Is personally liable for partnership liabilities arising before and after his admission as a partner. This answer is incorrect. A person admitted as a partner into an existing partnership is only liable for existing debts of the partnership to the extent of the incoming partner’s capital contribution. Rationale Has the right to participate in the management of ABC. This answer is correct. An incoming partner has the same rights as all of the existing partners. Thus, an incoming partner has the right to participate in the management of the partnership. Rationale Acquired only the right to receive Fein’s share of the profits of ABC. This answer is incorrect. An incoming partner has the same rights as all of the existing partners. Rationale Must contribute cash or property to ABC in order to be admitted with the same rights as the other partners. This answer is incorrect. A partner need not make a capital contribution to be admitted with the same rights as the other partners.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 27 AICPA.BEC-BL Lesson Reference: Financial Structure Difficulty: hard Bloom Code: 2 Price owns 2,000 shares of Universal Corp.'s $10 cumulative preferred stock. During its first year of operations, cash dividends of $5 per share are declared on the preferred stock, but were never paid. In the second year, dividends on the preferred stock were neither declared, nor paid. If Universal is dissolved, which of the following statements is correct? Universal will be liable to Price as an unsecured creditor for $10,000. Universal will be liable to Price as a secured creditor for $20,000. Price will have priority over the claims of Universal's bond owners. Price will have priority over the claims of Universal's unsecured judgment creditors. Rationale Universal will be liable to Price as an unsecured creditor for $10,000. Cumulative preferred stock gives the holder the right to payment of dividends before common shareholders are paid. It does not guarantee that dividends will be declared, but if dividends are declared, they must be paid. Once a corporation declares dividends, the payments become corporate debt. Here, Price is owed $5 x 2,000 shares = $10,000. He is an unsecured creditor, because this debt has not been secured by a separate agreement that creates a security interest. His debt does not have priority over judgment creditors, bond owners, or secured creditors. Rationale Universal will be liable to Price as a secured creditor for $20,000. This answer is incorrect, because the amount is wrong and shareholders are typically unsecured creditors for declared, but unpaid dividends. Corporate property is not typically used as a security for unpaid dividends. Rationale Price will have priority over the claims of Universal's bond owners. This answer is incorrect, because bondholders typically have priority over preferred shareholders who, in turn, typically have priority over common shareholders. Rationale Price will have priority over the claims of Universal's unsecured judgment creditors. This answer is incorrect, because preferred shareholders are viewed as part-equity holders and therefore are in line behind creditors, such as judgment holders.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 28 BSTR-0031B Lesson Reference: Rights and Duties Difficulty: medium Owners and managers of a limited liability company (LLC) owe A duty of due care. A duty of loyalty. Both a duty of due care and a duty of loyalty. Neither a duty of due care or a duty of loyalty. Rationale A duty of due care. Owners and managers of an LLC owe a duty of due care. They also owe a duty to be loyal to their LLC. Rationale A duty of loyalty. Owners and managers of an LLC owe a duty of due care. They also owe a duty to be loyal to their LLC. Rationale Both a duty of due care and a duty of loyalty. Owners and managers of an LLC owe a duty of due care. They also owe a duty to be loyal to their LLC. Rationale Neither a duty of due care or a duty of loyalty. Owners and managers of an LLC owe a duty of due care. They also owe a duty to be loyal to their LLC.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 29 CONT-0039 Lesson Reference: Contracts: Defenses to Formation Difficulty: medium A party to a contract who seeks to rescind the contract because of that party’s reliance on the unintentional but materially false statements of the other party will assert Reformation. Actual fraud. Misrepresentation. Constructive fraud. Rationale Reformation. This answer is incorrect. Reformation is a remedy used to correct a mutual or unilateral mistake. Reformation allows for the contract to be rewritten so that it is in agreement with the original intentions of the contract. In this case, the party is seeking rescission; he wants to cancel the contract and return both parties to their precontract positions. Rationale Actual fraud. This answer is incorrect. Actual fraud requires scienter or intent to mislead. In this case, the materially false misstatement was unintentional. Rationale Misrepresentation. This answer is correct. Misrepresentation may involve an innocent misstatement made in good faith (i.e., there is no scienter or intent to mislead). In order to rescind a contract because of a misrepresentation, the rescinding party must prove that there was a misrepresentation of a material fact, that there was reliance on this fact, and that there was injury as a result. Rationale Constructive fraud. This answer is incorrect. Constructive fraud requires reckless disregard for the truth (i.e., more than unintentional conduct).9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 30 CONT-0008B Lesson Reference: Writing and Records: The Statute of Frauds Difficulty: medium Cherry contracted orally to purchase Picks Company for $1,500,000 if it is profitable for one full year after the making of the oral contract. An auditor would be brought in at the end of the year to verify this. Even though the company turns out to be profitable during the upcoming year, Cherry refuses to go through with the contract, claiming that it was unenforceable because it was not in writing. Is Cherry correct? Yes, because the contract could not be completed within one year. Yes, because the contract was for $500 or more. No, because the company was profitable as agreed for one year. No, because Picks Company relied on Cherry's promise. Rationale Yes, because the contract could not be completed within one year. Contracts that cannot be performed within one year must be in writing. In this case Cherry agreed to purchase Picks Company if an audit after one year shows that the company has been profitable. This would take longer than a year to perform. Rationale Yes, because the contract was for $500 or more. The $500 provision is in the Uniform Commercial Code for a sale of goods. Rationale No, because the company was profitable as agreed for one year. Despite the actual profitability, the contract could not be completed within one year of the making of the contract. Rationale No, because Picks Company relied on Cherry's promise. Although promissory estoppel may be used in the absence of a writing, there are not the facts sufficient to show promissory estoppel.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 31 .006_0718 Lesson Reference: Exempt Transactions and Securities Difficulty: medium Bloom Code: 3 The Salmon Croquette Corporation (SCC) is investigating an offering under Rule 147A. Which of the following will its lawyers learn once they have completed their research? SCC will not be allowed to use Rule 147A if it is an investment company. SCC may not use general advertising to sell its securities under Rule 147A. SCC must be incorporated in the state where it intends to hold the Rule 147A offering. The shares SCC sells will not be burdened by any resale restrictions. Rationale SCC will not be allowed to use Rule 147A if it is an investment company. Correct! Although most in-state issuers may use Rule 147A, investment companies cannot. Rationale SCC may not use general advertising to sell its securities under Rule 147A. Incorrect. Although general solicitation may not be used under Rule 147, it may be used under Rule 147A. However, issuers must be careful not to sell securities to nonresidents. Rationale SCC must be incorporated in the state where it intends to hold the Rule 147A offering. Incorrect. SCC must have its principal place of business in the state where it intends to hold the offering. It may also be incorporated there, but it need not be. Rationale The shares SCC sells will not be burdened by any resale restrictions. Incorrect. Rule 147A investors may not resell the exempt securities to nonresidents for at least six months.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 32 AICPA.REG-BL Lesson Reference: Defining Performance and Breach Difficulty: easy Bloom Code: 3 Ordinarily, in an action for breach of a construction contract, the statute of limitations time period would be computed from the date the Contract is negotiated. Contract is breached. Construction is begun. Contract is signed. Rationale Contract is negotiated. The statute of limitations will begin to run when a cause of action accrues. In this example, that is when the contract is breached. Rationale Contract is breached. The statute of limitations will begin to run when a cause of action accrues. In this example, that is when the contract is breached. Rationale Construction is begun. The statute of limitations will begin to run when a cause of action accrues. In this example, that is when the contract is breached. Rationale Contract is signed. The statute of limitations will begin to run when a cause of action accrues. In this example, that is when the contract is breached.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 33 AICPA.REG.-0019 Lesson Reference: Purposes, Requirements and Provisions of the 1934 Act Difficulty: medium Under the Section 10(b) Rule 10b-5 antifraud provisions of the Securities Exchange Act of 1934, which of the following conditions must a plaintiff prove to recover damages from an accountant? The plaintiff is in privity of contract with the accountant. The plaintiff relied on the accountant's intentional misstatement of material facts. The plaintiff is free from contributory negligence. The accountant acted without due diligence. Rationale The plaintiff is in privity of contract with the accountant. Incorrect. Privity of contract is not a requirement for a successful 10b-5 suit. Investors may under the proper circumstances sues lawyers, accountants, officers, directors, and all sorts of defendants whom they did not purchase shares from. Rationale The plaintiff relied on the accountant's intentional misstatement of material facts. CORRECT! Section 10(b)/Rule 10b-5 are fraud provisions; they do not remedy mere negligence. Rationale The plaintiff is free from contributory negligence. Incorrect. Because Section 10(b)/Rule 10b-5 are fraud provisions, mere carelessness by a plaintiff does not provide a defense. Rationale The accountant acted without due diligence. Incorrect. Accountants are not liable under Section 10(b)/Rule 10b-5 for merely acting carelessly.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 34 BSTR-0105 Lesson Reference: Financial Structure Difficulty: medium Under the Revised Model Business Corporation Act, which of the following dividends is not defined as a distribution? Cash dividends. Property dividends. Liquidating dividends. Stock dividends. Rationale Cash dividends. This answer is incorrect because it is defined as a distribution under the Act. Rationale Property dividends. This answer is incorrect because it is defined as a distribution under the Act. Rationale Liquidating dividends. This answer is incorrect because it is defined as a distribution under the Act. Rationale Stock dividends. This answer is correct. A stock dividend is not defined as a distribution under the Revised Model Business Corporation Act.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 35 BSTR-0060 Lesson Reference: Formation Difficulty: medium Under the Revised Model Business Corporation Act, which of the following items of information should be included in a corporation’s Articles of Incorporation (charter)? Name and address of each preincorporation subscriber. Number of shares authorized. Name and address of the corporation’s promoter. Election of either C corporation or S corporation status. Rationale Name and address of each preincorporation subscriber. This answer is incorrect because the name and address of each incorporator should be included, not the name and address of each preincorporation subscriber. Rationale Number of shares authorized. This answer is correct because the Articles of Incorporation should include the number of shares authorized. Rationale Name and address of the corporation’s promoter. This answer is incorrect because the name and address of the registered agent of the corporation should be included, not the name and address of the corporation’s promoter. Rationale Election of either C corporation or S corporation status. This answer is incorrect because the election of C or S corporation status is a federal tax election.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 36 FEDE-0014B Lesson Reference: Exempt Transactions and Securities Difficulty: medium Under Regulation D of the Securities Act of 1933, which of the following conditions apply to private placement offerings? The securities Cannot be sold for longer than a six-month period. Cannot be the subject of an immediate unregistered reoffering to the public. Must be sold to accredited institutional investors. Must be sold to fewer than twenty nonaccredited investors. Rationale Cannot be sold for longer than a six-month period. There is no such restriction of sale. Rationale Cannot be the subject of an immediate unregistered reoffering to the public. The private placement exemption permits sales of an unlimited number of securities for any dollar amount when sold to accredited investors. This exemption also allows sales to up to 35 nonaccredited investors if they are also sophisticated investors under the Act. Resales of these securities are restricted to six months after the date that the issuer sells the last of the securities. Rationale Must be sold to accredited institutional investors. Sales may be made to an unlimited number of accredited investors and up to 35 nonaccredited investors. Rationale Must be sold to fewer than twenty nonaccredited investors. Sales can be made to up to 35 nonaccredited investors.9/14/2020 Wiley CPAexcel - REG - Assessment Review Question 37 AICPA.REG-SIM Lesson Reference: Internal Revenue Code and Regulations Related to Tax Return Preparers Difficulty: medium Bloom Code: 2 Under which of the following scenarios will Jenny be in trouble under Section 6713's confidentiality provisions? When she sells a celebrity client's confidential tax information to a tabloid newspaper. When she discloses a rich client's confidential tax information pursuant to court order. When she shows several of her clients' tax returns to another accountant performing a peer review of Jenny's firm. All of the above. Rationale When she sells a celebrity client's confidential tax information to a tabloid newspaper. This is an improper disclosure of the client's confidential information and will violate 6713 (as well as 7216). Rationale When she discloses a rich client's [Show More]

Last updated: 1 year ago

Preview 1 out of 100 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 13, 2021

Number of pages

100

Written in

Additional information

This document has been written for:

Uploaded

Oct 13, 2021

Downloads

0

Views

41