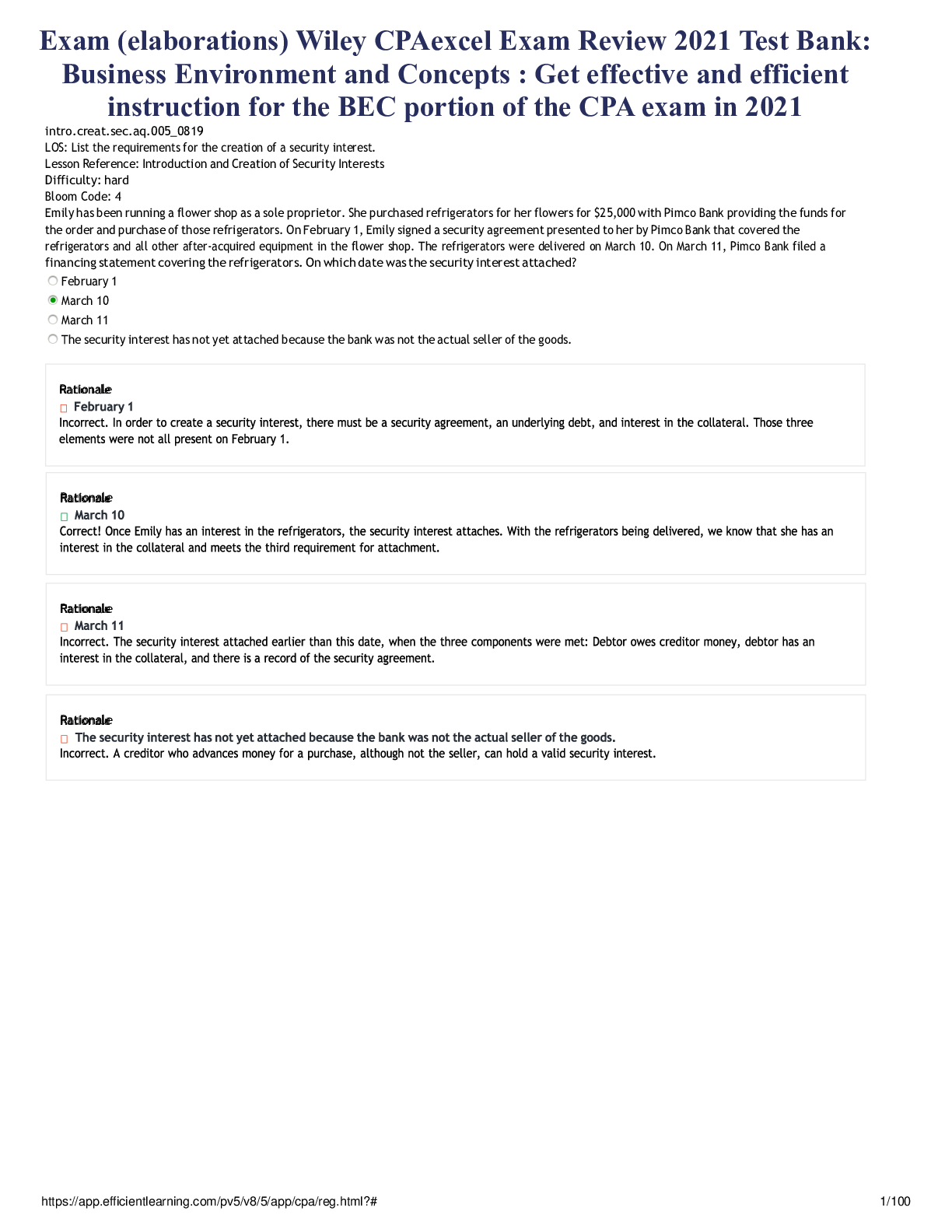

Finance > EXAM > Wiley CPAexcel Exam Review 2021 Test Bank: Business Environment and Concepts : Get effective and eff (All)

Wiley CPAexcel Exam Review 2021 Test Bank: Business Environment and Concepts : Get effective and efficient instruction for the BEC portion of the CPA exam in 2021

Document Content and Description Below