Social Sciences > Report > SOC 200 - Case Study Report 1: THREE JAYS CORPORATION - Complete solution (University Of Arizona) (All)

SOC 200 - Case Study Report 1: THREE JAYS CORPORATION - Complete solution (University Of Arizona)

Document Content and Description Below

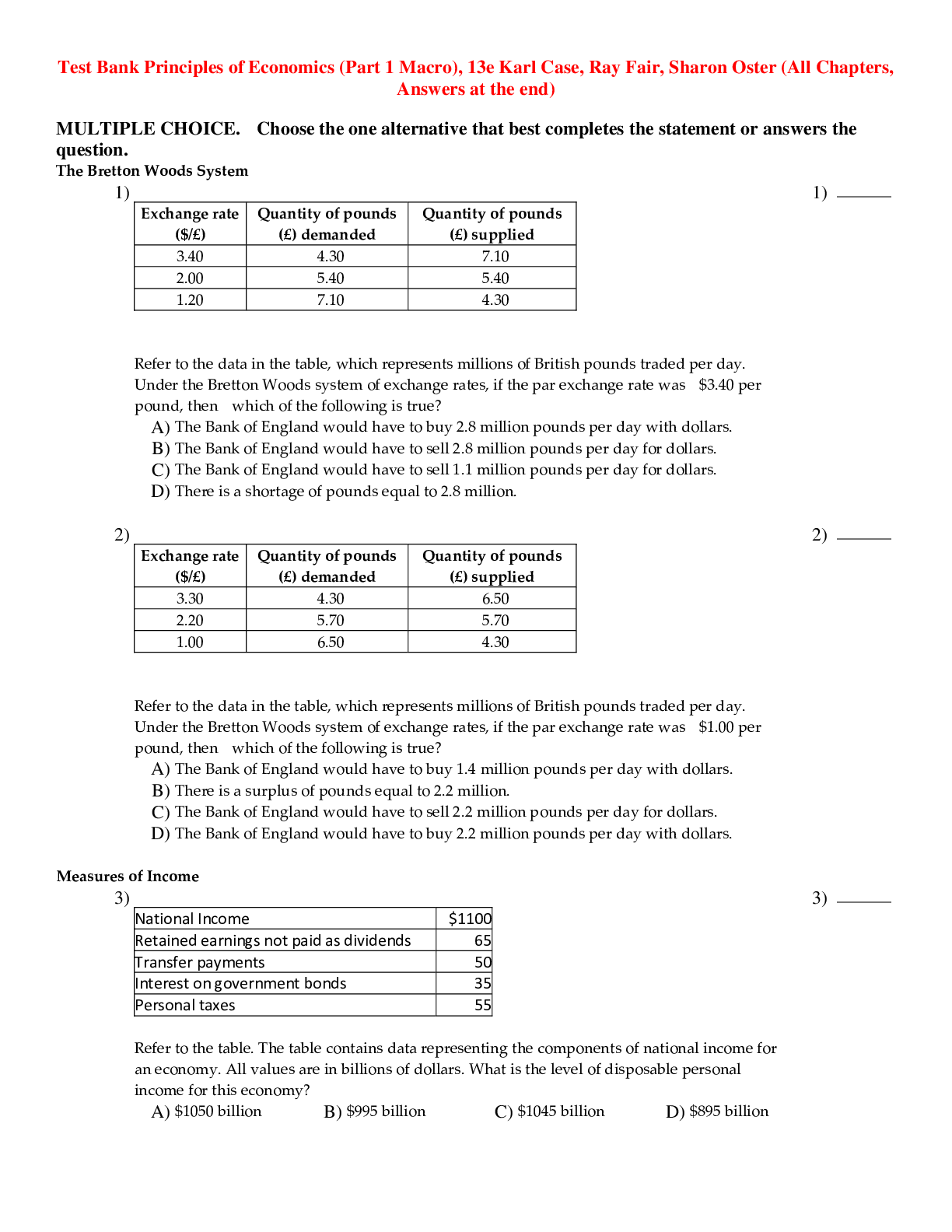

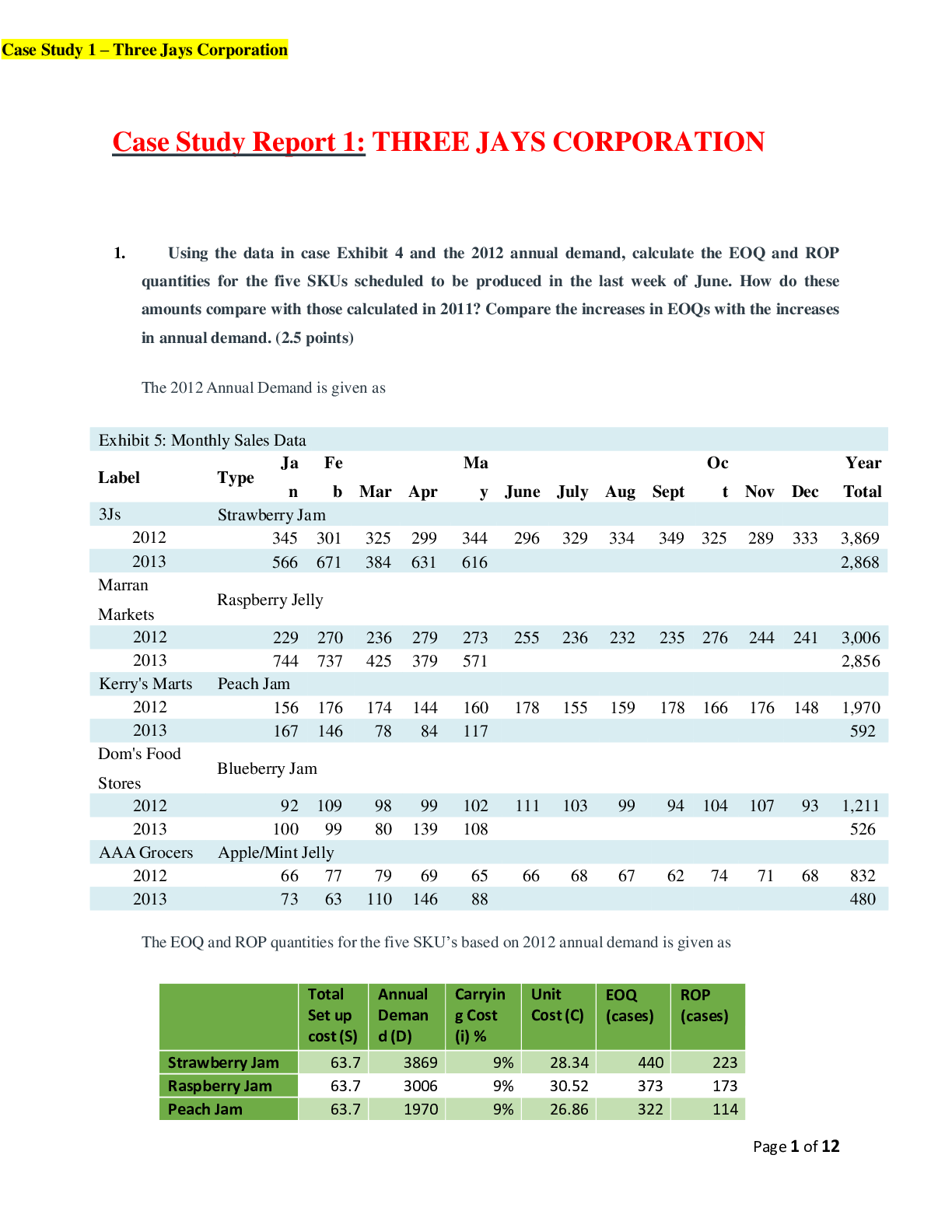

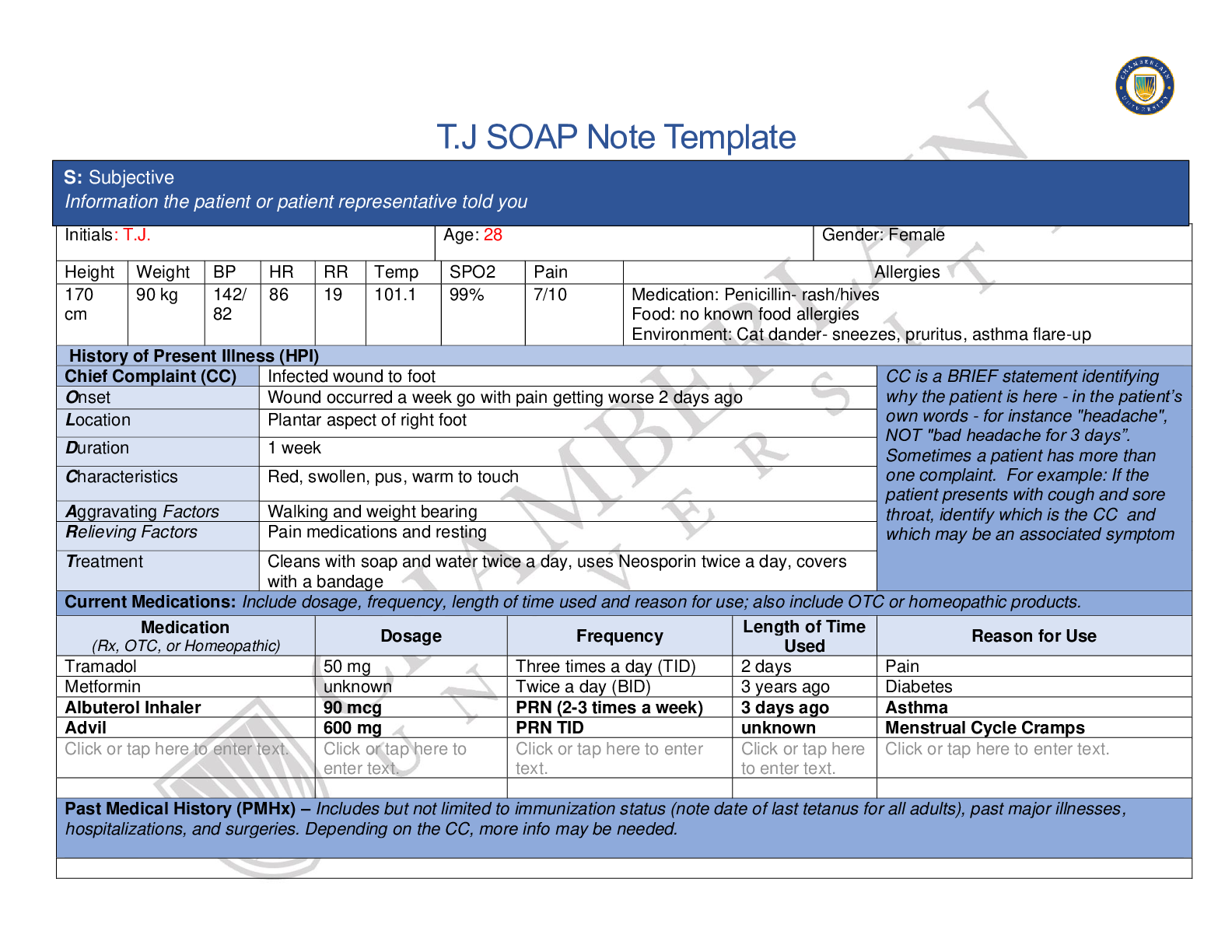

Case Study Report 1: THREE JAYS CORPORATION 1. Using the data in case Exhibit 4 and the 2012 annual demand, calculate the EOQ and ROP quantities for the five SKUs scheduled to be produced in the last ... week of June. How do these amounts compare with those calculated in 2011? Compare the increases in EOQs with the increases in annual demand. (2.5 points) The 2012 Annual Demand is given as The EOQ and ROP quantities for the five SKU’s based on 2012 annual demand is given as As Demand increased from 2011 to 2012, the EOQ’s also increased So, if Annual Demand doubles, the EOQ will increase by sqrt(2) 2. Brodie is uncertain if the costs presented in case Exhibit 2 are appropriate for determining the EOQs. What changes would you recommend, and why? Should the cost of the three idle part-time workers be included when the production line is down? Using the 2012 annual demand, and your recommendations, recalculate the EOQs for the five SKUs. (2.5 points) Brodie’s first assignment in his internship is to update the EOQ and ROP quantities for all 141 SKUs, to reflect the current levels of demand (D), because the original calculations were done in 2011 with sales figures from 2010. This task is simple for the ROP, where: Making changes to the EOQ amounts is more complicated, as several logical errors exist in the data that are used as inputs for the EOQ formula. Specifically, these are the setup cost (S), the unit cost (C), and the inventory carrying cost, which is expressed here as a percentage (i). (Note: Sometimes the variables i and C are combined in the EOQ formula. When this occurs, the product of i * C is represented by the symbol H, which is the inventory holding cost in dollars per unit, per year.) Errors in Calculating EOQs Setup cost (S) errors Assumptions in the EOQ Calculations There are several assumptions inherent in the EOQ formula, many of which are not applicable to the 3Js situation. These include: 1) Unit cost remains constant and does not vary (as would be the case with quantity disc unts). This is valid, given the information in the case. 2) There are no stock-out costs. While these costs are not mentioned in the case, they need to be considered in determining how much inventory in the form of safety stock to have on hand. 3) Demand is constant and known. At 3Js, however, the firm is g owing; the actual demand is not known, but estimated based on some type of forecasting method. 4) Production capacity is always available when it is needed. In other words, there is no lag time between when product is required and when it is produced. At 3Js, however, the production of a specific size jar is scheduled for a given week, and any requirements prior to that week will be delayed until that time. (Note: When Assumptions 3 and 4 are valid, stock-outs most likely will not occur, which is why there is no need to consider them in the EOQ formula.) 5) There are no interactions among the different items produced. There are significant interactions at 3Js, however, because of the relatively high setup cost associated with changing the jar size. As a result, items are grouped to reduce this cost, thereby affecting when they are produced. Comparing Old and New EOQs The calculation of the original EOQs shown in Table 1 below (and the attached Excel spreadsheet) are presented in case Exhibit 4: Table 1. EOQ Calculations Using Existing Method (see case Exhibit 2) and 2010 Sales Data If we just update this using the 2012 sales data, we have the comparison shown in Table 2 below (and the attached Excel spreadsheet): Table 2. EOQ Calculations Using Existing Method (see case Exhibit 2) and 2012 Sales Data The increases in sales range from 28.7% to 36.7%, but the increase in EOQs ranges from 13.5% to 16.9%. This difference is attributable to the fact that the EOQ is directly related to the square root of the demand, and not the demand itself. When demand doubles, the EOQ increases approximately 41% (the square root of 2 being 1.41). If we introduce the corrected costs, we have the revised EOQs shown in Table 3 below (and the attached Excel spreadsheet): Table 3. EOQ Calculations with Recommended Costs and 2012 Sales Data As noted in Table 3 above, the new EOQs are significantly less than the initial EOQs, even though sales have increased significantly. This can be attributed mainly to the significant difference in the setup cost and the cost of carrying inventory, both of which drive down the EOQ. 3. Compare your results with those obtained using the data in case Exhibit 2. What do you attribute the differences to? After speaking to Jake and Joshi, Brodie is now not sure if the EOQ model is the most appropriate for the current production process. Evaluate the scheduling method that Jake and Joshi are using. Why are they not following the established system? (2 points) 4. Compare the established EOQ/ROP procedure (described in case Exhibit 2) with the one that Jake and Joshi are using. Which system do you prefer? What improvements do you recommend? (2 points) [Show More]

Last updated: 1 year ago

Preview 1 out of 12 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 15, 2021

Number of pages

12

Written in

Additional information

This document has been written for:

Uploaded

Dec 15, 2021

Downloads

0

Views

77

.png)