Finance > EXAM > MGMT E-2600: Financial Statement Analysis / Module 12. Grade 97.50 out of 100.00. (All)

MGMT E-2600: Financial Statement Analysis / Module 12. Grade 97.50 out of 100.00.

Document Content and Description Below

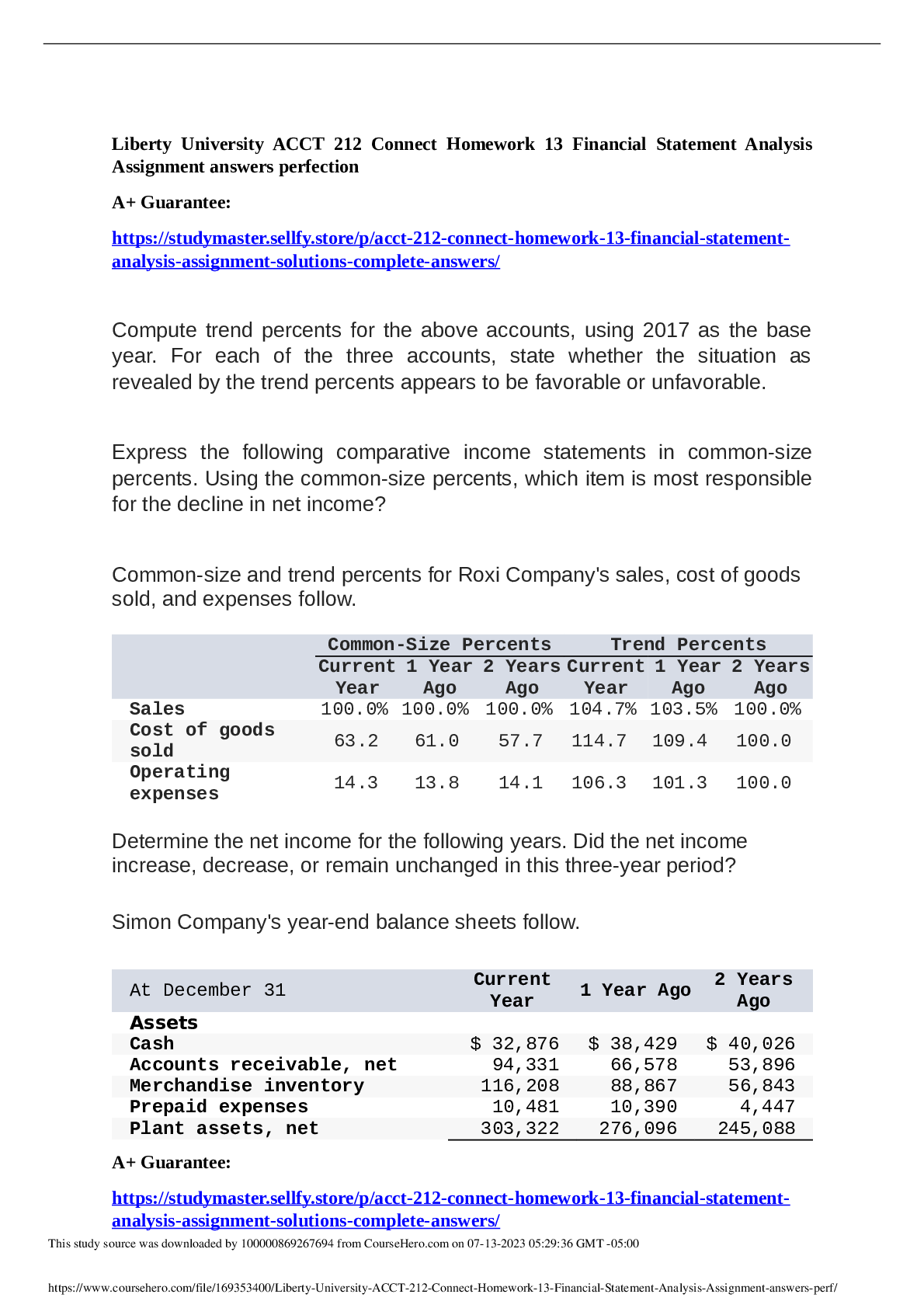

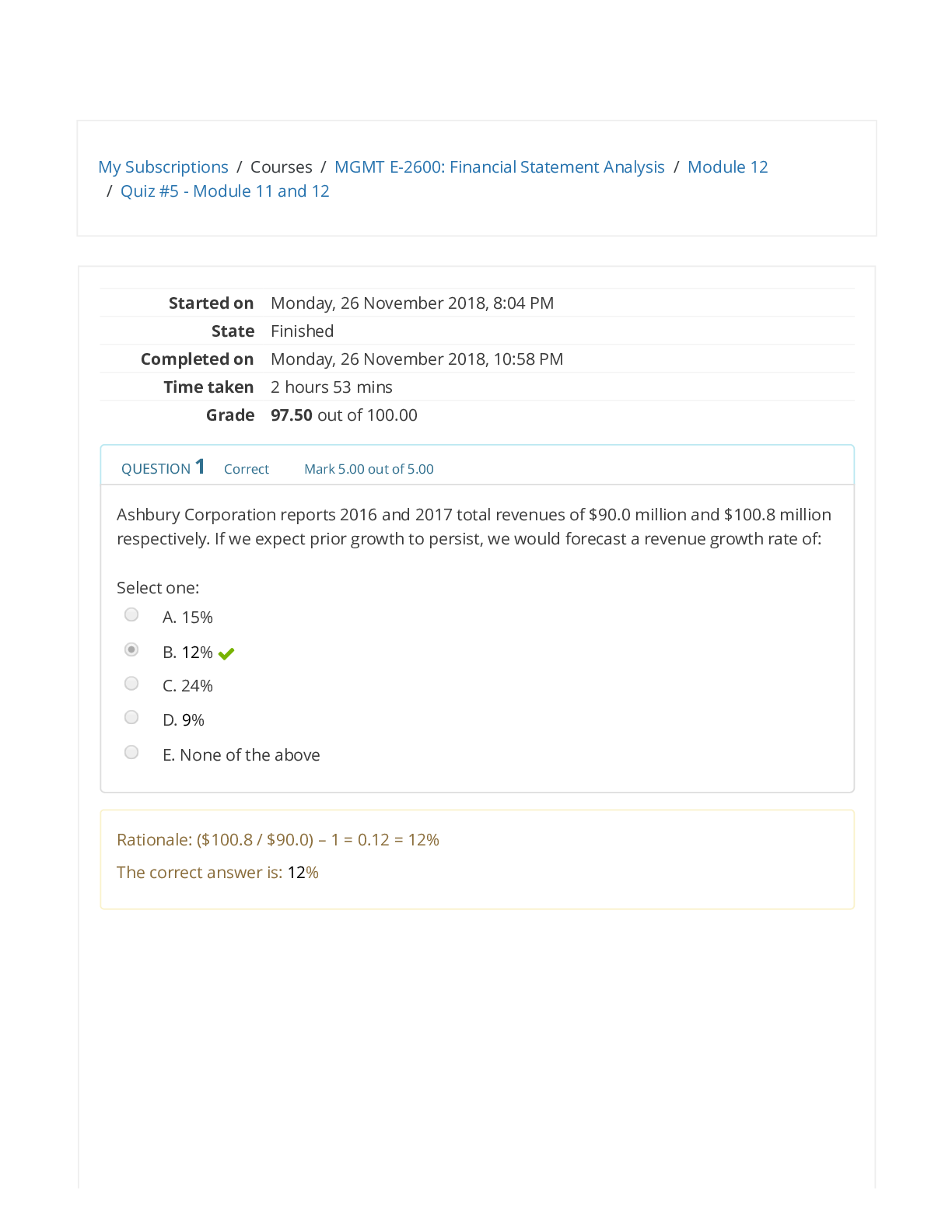

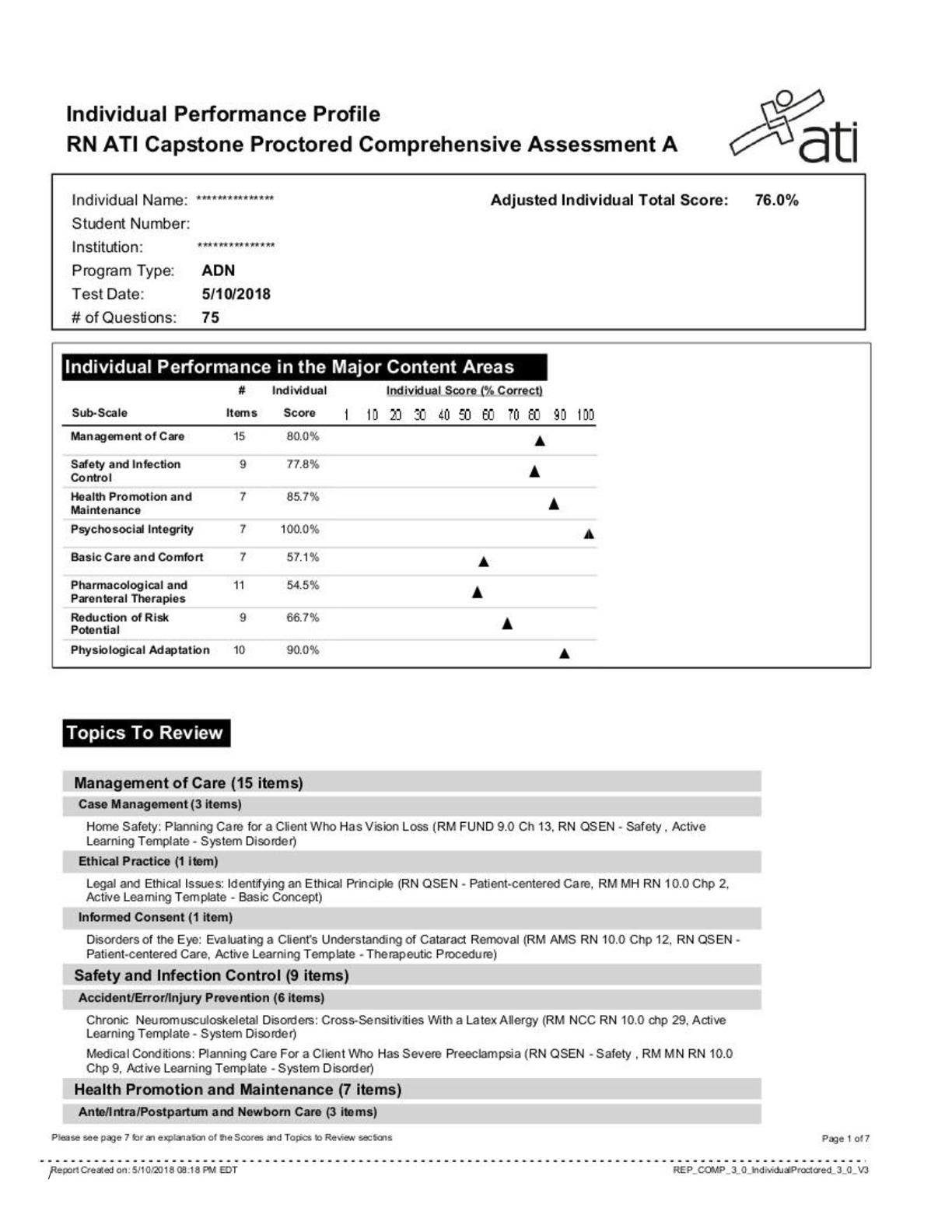

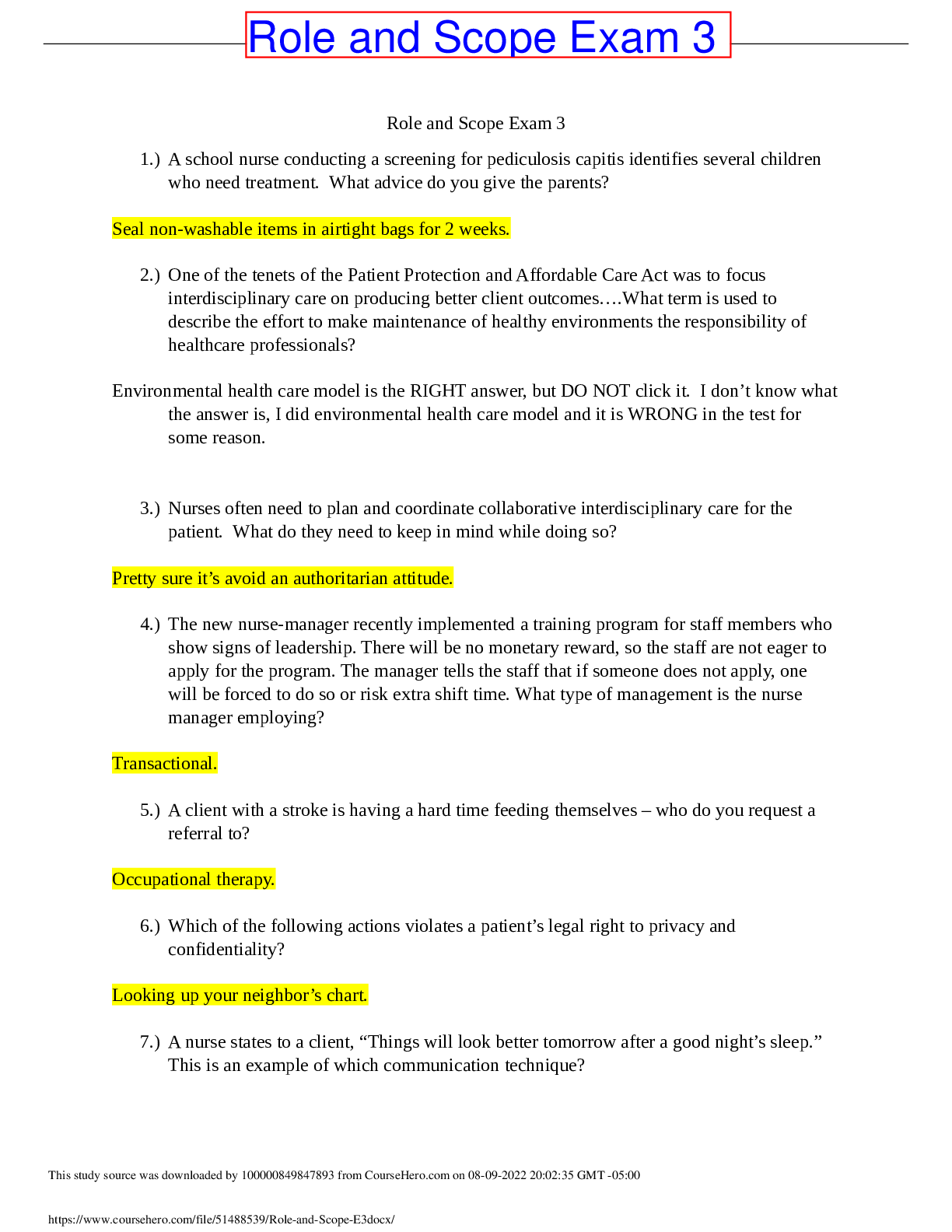

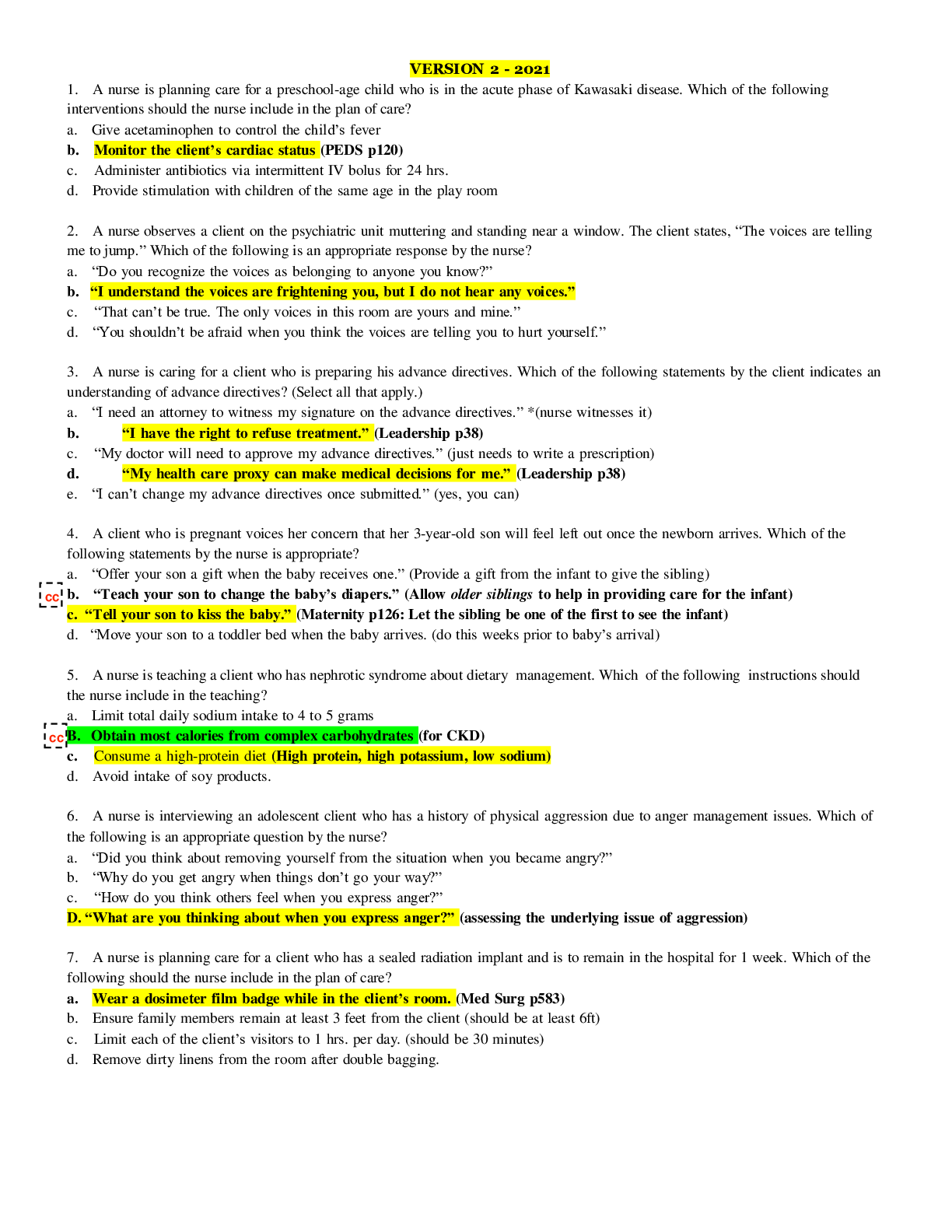

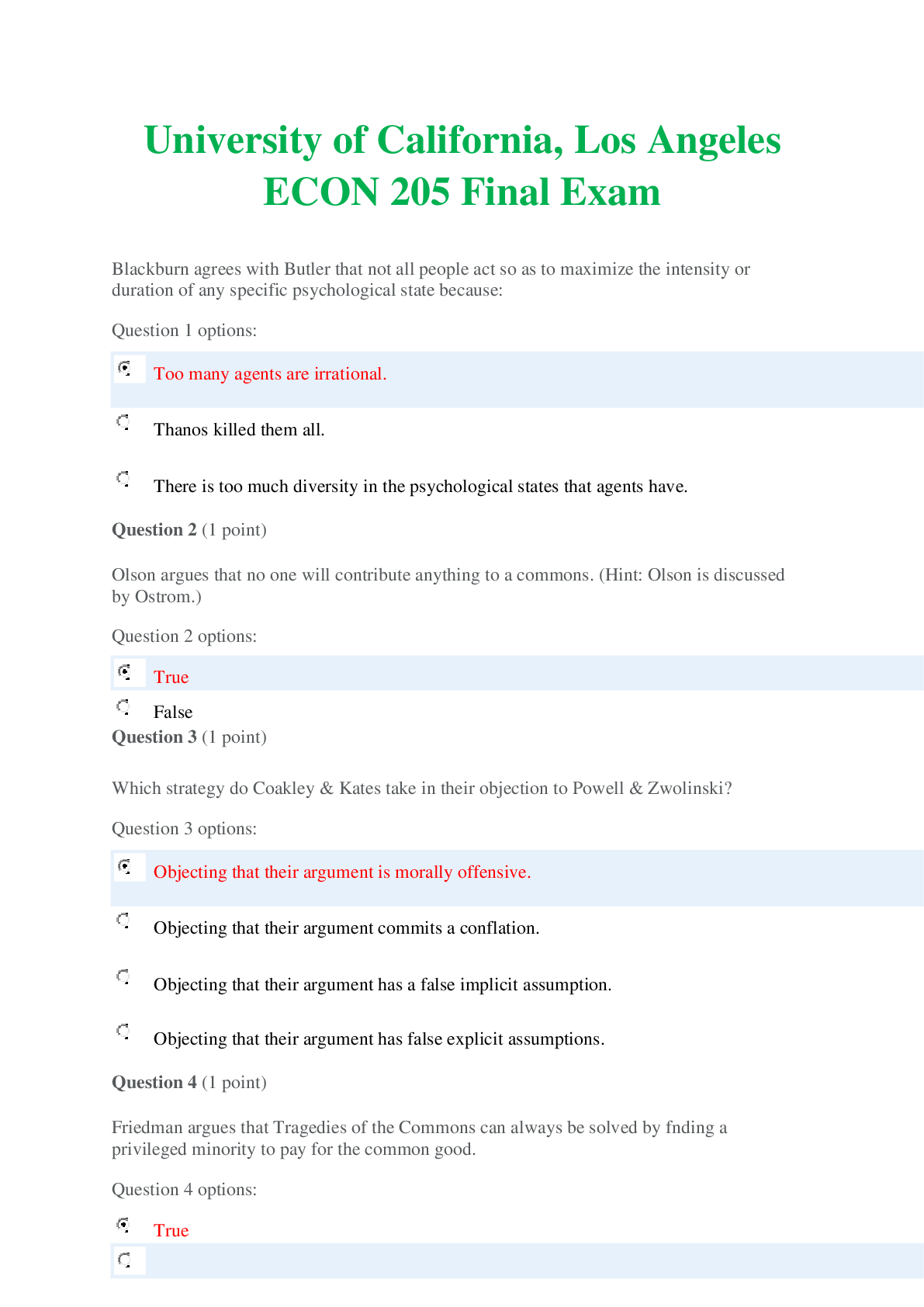

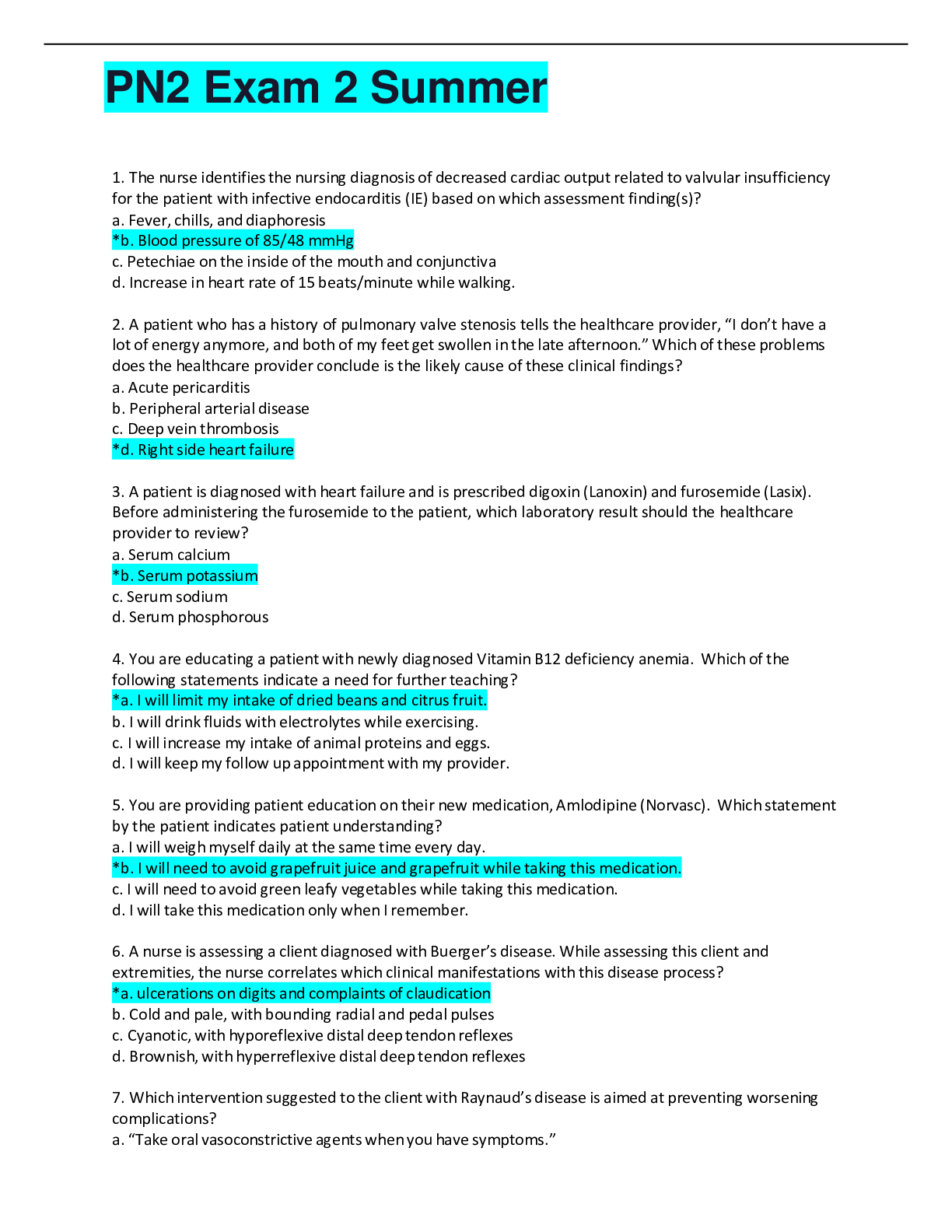

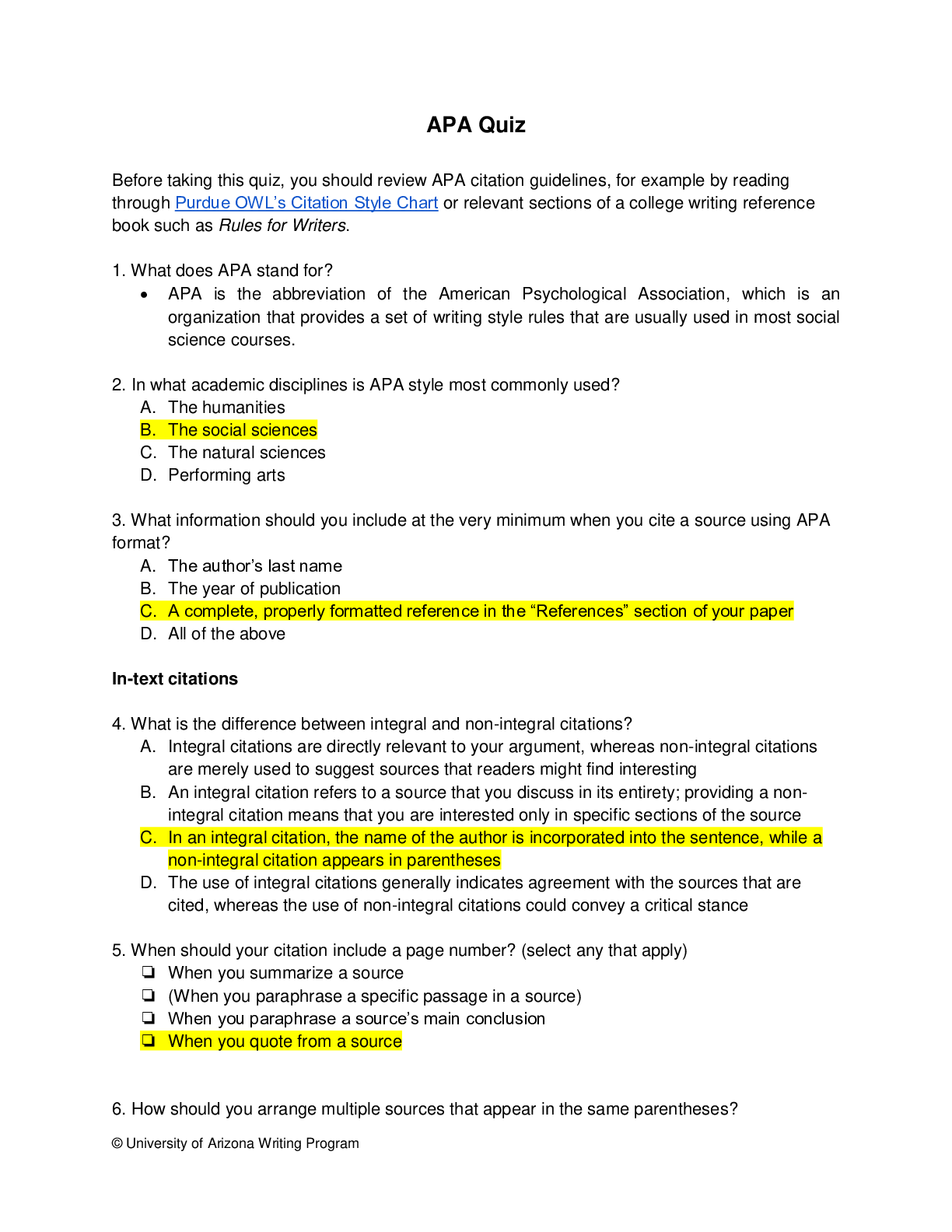

MGMT E-2600: Financial Statement Analysis / Module 12 / Quiz #5 - Module 11 and 12 Started on Monday, 26 November 2018, 8:04 PM State Finished Completed on Monday, 26 November 2018, 10:58 PM Time... taken 2 hours 53 mins Grade 97.50 out of 100.00 QUESTION 1 Correct Mark 5.00 out of 5.00 Ashbury Corporation reports 2016 and 2017 total revenues of $90.0 million and $100.8 million respectively. If we expect prior growth to persist, we would forecast a revenue growth rate of: Select one: A. 15% B. 12% C. 24% D. 9% E. None of the above Rationale: ($100.8 / $90.0) – 1 = 0.12 = 12% 12% QUESTION 2 Correct Mark 5.00 out of 5.00 Ogden Corporation has a projected balance sheet that includes the following accounts. What is the projected cash balance? Select one: A. $-0- B. $487,000 C. $560,000 D. $576,000 E. None of the above Rationale: $576,000. Cash is calculated as a plug value by subtracting assets from projected total assets. Total assets equals total liabilities and equity. $576,000 QUESTION 3 Correct Mark 5.00 out of 5.00 When forecasting balance sheet financials, an unusually high forecasted cash balance suggests which of the following? Select one: A. Sales are projected to increase in coming years. B. The company will need to sell additional stock. C. The company is generating a lot of cash, most typically from operations. D. Account receivables have dipped to an unacceptable level. E. None of the above Rationale: Our forecasts might assume that such excess liquidity can be invested in marketable securities, used to pay down debt, repurchase stock, increase dividend payments, or any combination of these actions. The company is generating a lot of cash, most typically from operations. QUESTION 4 Correct Mark 5.00 out of 5.00 When forecasting the balance sheet, what happens when the initial balance sheet yields estimated total assets greater than the sum of total liabilities and equity? Select one: A. The company will need additional financing from external sources. B. The company will not be able to pay for expenses in the future. C. The company projected a loss. D. The company has negative stockholders' equity. E. None of the above Rationale: The company will need additional financing from debt or equity providers in the future in order to support company growth. The company will need additional financing from external sources. QUESTION 5 Partially correct Mark 2.50 out of 5.00 When projecting the statement of cash flows, the following represent operating cash outflows (select all that apply): Select one or more: A. Decrease in accounts receivable. B. Decrease in accounts payable C. Increase in wages payable D. Increase in property, plant, and equipment E. Increase in inventory Rationale: A projected increase in current assets or a decrease in current liabilities results in a projected cash outflow. Acquiring PPE is not an operating cash flow. The correct answers are: Increase in inventory, Decrease in accounts payable QUESTION 6 Correct Mark 5.00 out of 5.00 The forecasted statement of cash flows uses either the forecasted income statement or the balance sheet. Select one: True False Rationale: The statement of cash flows uses both to explain the change in cash on the balance sheet. The correct answer is 'False'. QUESTION 7 Correct Mark 5.00 out of 5.00 The forecasting process assumes that the cash on the balance sheet is a plug. Select one: True False Rationale: Our forecasting process estimates the balances of all assets other than cash, all liabilities, and all equity accounts. The last step is to compute the amount of cash needed to balance the balance sheet (the plug). The plug is computed as total assets (equal to total liabilities and equity) less all other asset balances. The correct answer is 'True'. QUESTION 8 Correct Mark 5.00 out of 5.00 To forecast property, plant, and equipment (PPE) we increase the prior year’s balance by estimated CAPEX and reduce the estimate by forecasted depreciation expense. Select one: True False Rationale: Forecasted capital expenditures (CAPEX) = (Current year CAPAX / Current year sales) / Forecasted sales. Forecasted depreciation expense = (Current year depreciation expense / Prior year PPE, net) x Current year PPE, net. The correct answer is 'True'. QUESTION 9 Correct Mark 5.00 out of 5.00 In its 2016 annual report, Lockheed Martin reported net earnings of $5,302 million and dividends paid of $2,048 million. Your forecast of net income for Lockheed Martin for 2017 is $5,504 million. What are projected dividends for the company for 2017? Select one: A. $2,126 million B. $2,048 million C. $2,307 million D. $2,069 million E. None of the above Rationale: $5,504 million × ($2,048 million / $5,302 million) = $2,126 million $2,126 million QUESTION 10 Correct Mark 5.00 out of 5.00 A company's intrinsic value is its: Select one: A. Stock price B. Market value C. Carrying value of debt D. Economic value assuming actual payoffs are known Rationale: Intrinsic value represents the “true” value, which is the economic value of the company assuming that actual future payoffs are known today. Economic value assuming actual payoffs are known QUESTION 11 Correct Mark 5.00 out of 5.00 Alphabet Inc. (formerly Google) has a market beta of 0.94, if the market increases by 1.7% on a given day we would expect that Google's stock price would: Select one: A. Increase by 1.60% B. Decrease by 1.86% C. Increase by 2.36% D. Increase by 1.39% Rationale: Beta x 1.7% gives the price change = 0.94 x 0.017 = 0.01598 =1.60% Increase by 1.60% QUESTION 12 Correct Mark 5.00 out of 5.00 Assume that a company has a beta of 0.78 and the risk-free rate is 5%. If the market risk premium is 7% calculate cost of equity capital, using the capital asset pricing model: Select one: A. 11.2% B. 5.3% C. 6.0% D. 10.5% Rationale: Cost of equity capital = 0.05 + 0.78 x (0.07) = 0.1046 10.5% QUESTION 13 Correct Mark 5.00 out of 5.00 Determine the present value of a $60,000 to be received in 10 years when the discount rate is 4%. Select one: A. $33,778 B. $40,534 C. $25,000 D. $30,696 Rationale: $40,534 QUESTION 14 Correct Mark 5.00 out of 5.00 Good Investments Company forecasts a $1.74 dividend for 2017, $1.87 dividend for 2018 and a $1.98 dividend for 2019 for Mountain Vacations Corporation. For all years after 2019, Good Investments Company forecasts that Mountain Vacations will pay a $2.10 dividend. Using the dividend discount valuation model determine the intrinsic value of Mountain Vacations Corporation, assuming the company's cost of equity capital is 7%. Select one: A. $18.12 B. $27.91 C. $24.48 D. $29.37 Rationale: Sum of PVs is: $1.63 + $1.63 + $1.62 + $24.49 = $29.37 Period 1 (2017) Period 2 (2018) Period 3 (2019) Period 4 and thereafter, (discounted to the end of 2019) *Terminal value = D/(r–g) = $2.10 / 0.07 = $30.00 as of the end of 2019. $29.37 QUESTION 15 Correct Mark 5.00 out of 5.00 The following data pertains to Xena Corp.: Xena Corp. Assuming that the risk-free rate is 4.5% and the market risk premium is 6.2%, calculate Xena's cost of equity capital using the capital asset pricing model. Select one: A. 13.4% B. 10.4% C. 15.2% D. 8.9% Rationale: Cost of equity capital = 0.045 + 1.73(0.062) = 0.15226 15.2% QUESTION 16 Correct Mark 5.00 out of 5.00 The proper discount rate when using the dividend discount valuation model is the: Select one: A. Weighted average cost of capital B. Cost of debt capital C. Average borrowing rate D. Cost of equity capital Rationale: Dividends accrue to common shareholders so the cost of equity capital should be used. Cost of equity capital QUESTION 17 Correct Mark 5.00 out of 5.00 The weighted average cost of capital is used when valuing the payoffs: Select one: A. To debt holders B. To equity holders less the payoff to debt holders C. To equity holders D. To both equity and debt holders Rationale: WACC is used when the payoffs accrue to the entire firm. To both equity and debt holders QUESTION 18 Correct Mark 5.00 out of 5.00 Which of the following would be a non-diversifiable risk? Select one: A. Inflation B. The risk that a company may lose market share C. A strike that shuts down production at a specific plant D. A disruption in a company's supply chain Rationale: Non-diversifiable risk is risk that is common to an entire class of assets. Inflation QUESTION 19 Correct Mark 5.00 out of 5.00 WVWC Corporation currently pays a $1.68 dividend and its current stock price is $51.36. Assuming the company's cost of equity capital is 7% use the dividend discount valuation model to estimate the company's growth rate. Select one: A. 3.73% B. 5.37% C. 1.48% D. 10.72% Rationale: Use the following formula to solve for the growth rate: QUESTION 20 Correct Mark 5.00 out of 5.00 Brent Company currently pays a $1.00 dividend and its current stock price is $26.94. Assuming the company's cost of equity capital is 10% use the dividend discount valuation model to estimate the company's growth rate. Select one: A. 6.29% B. 6.75% C. 4.07% D. 10.02% Rationale: Use the following formula to solve for the growth rate: [Show More]

Last updated: 1 year ago

Preview 1 out of 13 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 30, 2022

Number of pages

13

Written in

Additional information

This document has been written for:

Uploaded

Apr 30, 2022

Downloads

0

Views

70

(1).png)