Finance > QUESTIONS & ANSWERS > FAMBA 4e Test Bank Mod10 09 10 09. Module 10 Reporting and Analyzing Off-Balance-Sheet Financing (All)

FAMBA 4e Test Bank Mod10 09 10 09. Module 10 Reporting and Analyzing Off-Balance-Sheet Financing

Document Content and Description Below

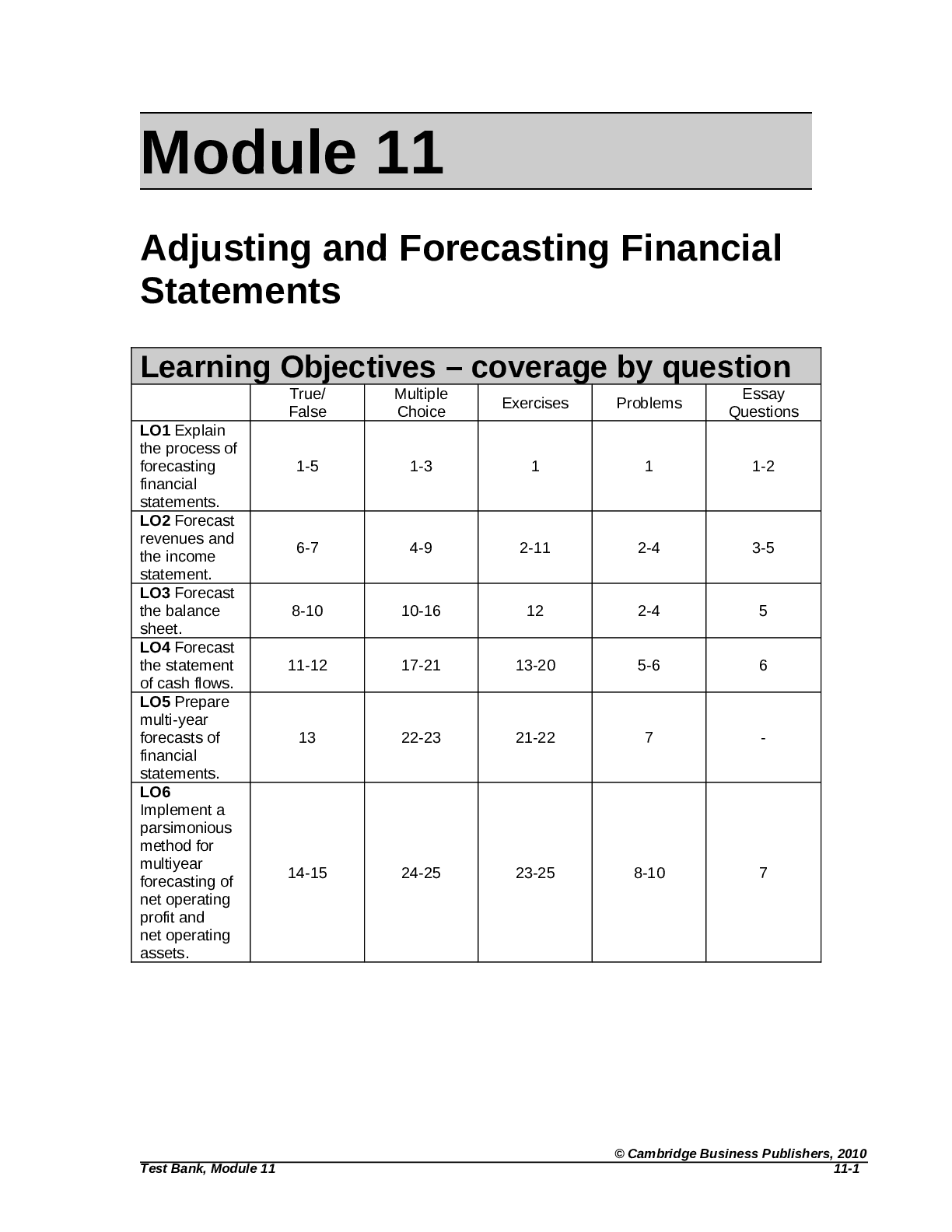

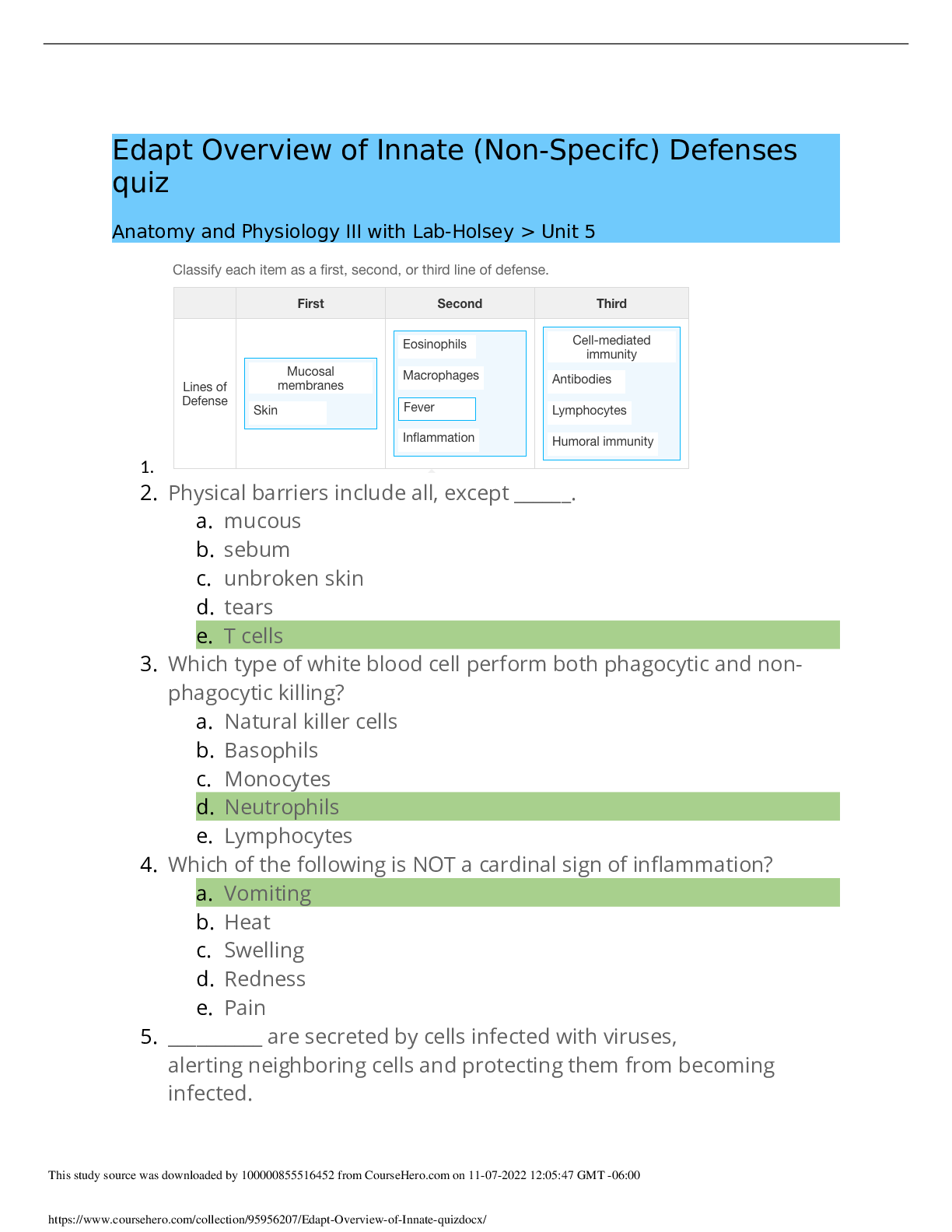

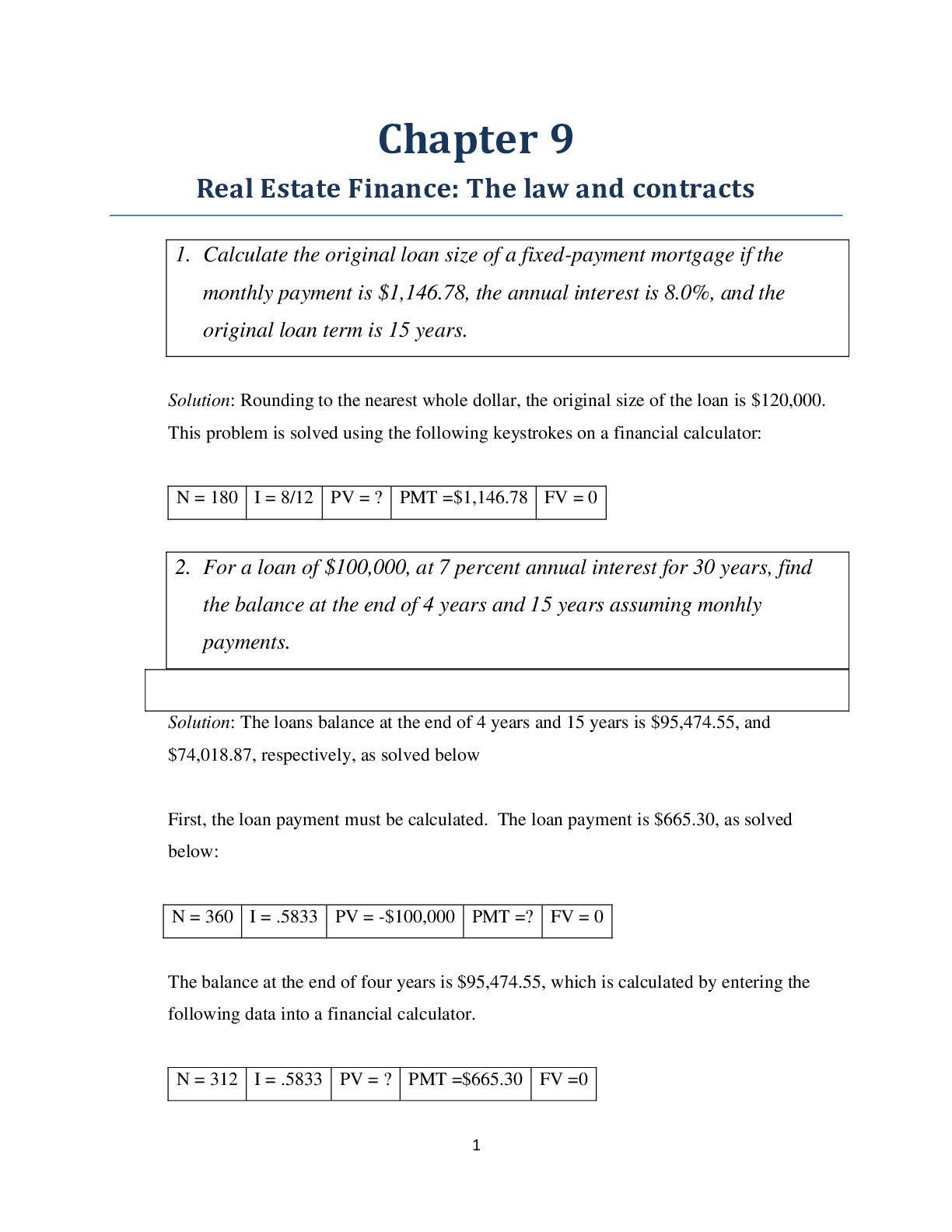

Learning Objectives – coverage by question True/ False Multiple Choice Exercises Problems Questions Essay LO1 Describe and illustrate the accounting for capitalized leases. LO2 Describe ... and illustrate the accounting for pensions. LO3 Explain the accounting for special purpose entities (SPEs). Module 10: Reporting and Analyzing Off-Balance-Sheet Financing True/False Topic: Operating leases LO: 1 1. Operating leases appear as liabilities on the lessee’s balance sheet. Answer: False Rationale: Operating leases do not appear on the lessee’s balance sheet. An operating lease is considered a form of off-balance sheet financing for the lessee. The company merely footnotes their existence and key details in the annual report. Lease payments are reported as rent expense on the lessee’s income statement. Topic: Lease capitalization LO: 1 2. Capitalizing leases have little effect on a company’s return on equity (ROE) ratio. Answer: True Rationale: ROE is largely unaffected since net income and stockholders’ equity are largely unaffected. However, capitalizing leases does affect the components of ROE such as FLEV and NOAT and RNOA. Topic: Leases as a financing source LO: 1 3. Leases can be a better financing vehicle because leases often require less equity investment than traditional bank financing. Answer: True Rationale: Leases generally require less up-front investment than does bank financing. Topic: Financial statements of non-capitalization LO: 1 4. Failure to recognize lease assets and liabilities results in understated financial leverage and understated net operating profit (NOPAT). Answer: False Rationale: Failure to recognize lease assets and liabilities does understate because liabilities are lower the FLEV numerator. However, failure to recognize lease assets and liabilities usually overstates NOPAT because the entire lease payment is deducted from NOPAT instead of just the depreciation portion. Topic: Expenses and cash flows relating to operating leases LO: 1 5. Operating leases increase interest expense in the income statement, while decreasing net cash flows in the cash flow statement, compared with capital leases. Answer: False Rationale: Operating leases record rent expense, rather than interest and depreciation. Further, the lease payments (e.g., cash outflows) are the same, whether or not the lease is capitalized. Cambridge Business Publishers, ©2010 10-2 Financial Accounting for MBAs, 4th EditionTopic: Financial statement effects of capital leases LO: 1 6. Using the capital lease method requires that both the lease asset and lease liability be reported off the balance sheet. Answer: False Rationale: The capital lease method requires that both the lease asset and lease liability be reported on the balance sheet. The leased asset is depreciated like any other long-term asset. The lease liability is amortized like a note, with lease payments separated into interest and principal repayment. Topic: Actual vs. expected returns on pension investments LO: 2 7. GAAP permits companies to choose to report pension income based either on actual investment returns of pension investments or on expected returns. However, once a company makes the choice, it cannot switch methods. Answer: False Rationale: GAAP allows companies to report pension income based on the expected return of the pension investment. The aim is to stabilize long-term returns versus seeing annual or quarterly swings due to the fluctuation in the market. Topic: Reporting of pension investments and liabilities LO: 2 8. Companies are required to report total pension assets and pension liabilities on their balance sheets. Answer: False Rationale: Companies are required to report only the funded status (that is, the net pension asset or liability) on their balance sheets. Topic: Pension plans LO: 2 9. The defined contribution plan and the defined benefit plan are the two general types of pension plans offered by companies. Answer: True Rationale: For defined contribution plans, the company records the expense at the time the liability is accrued. For defined benefit plans, the obligation is not satisfied until paid; companies are only required to report the net pension liability on the balance sheet. Topic: Service cost LO: 2 10. The increase in pension obligation due to an employee working an additional year for the employer will cause the net pension liability on the balance sheet to increase. Answer: True Rationale: The increase in the pension obligation arises from increases in service and interest costs. © Cambridge Business Publishers, 2010 Test Bank, Module 10 10-3Topic: Financing using VIEs LO: 3 11. Financially savvy companies use VIEs as a last source of financing, due to the significantly higher cost associated with VIEs compared to traditional debt instruments. Answer: False Rationale: VIEs can provide a lower cost financing alternative than borrowing from the traditional debt markets. This is because the activities of the VIEs are limited, and the cash flows are well secured. The risk to the lender is, therefore, reduced. Reduced risk requires less of a risk premium than if the parent company borrows directly from the debt market. Topic: Financial statement effects of using VIES as a financing source LO: 3 12. By using VIEs, the sponsoring company realizes an increase in reported assets. Answer: False Rationale: One of the reasons for creating VIEs is to remove assets from the balance sheet, together with their related liabilities. Topic: Financial reporting of VIEs under FIN 46R LO: 3 13. FIN 46R makes it less difficult for companies to maintain VIEs as an off-balance sheet financing source. Answer: False Rationale: FIN 46R identifies conditions that will require VIEs be consolidated with the sponsoring company’s balance sheet, making it more difficult for companies to keep special purpose entities off of the balance sheet. Topic: Off-balance sheet financing LO: 3 14. Off-balance-sheet financing is not reported on the financial statements or the footnotes to those statements. Answer: False Rationale: Although not reported on the face of the financial statements, GAAP requires detailed footnote disclosures for off-balance-sheet financing. Topic: Off-balance-sheet financing LO: 1, 2, & 3 15. Off-balance-sheet financing is the financing of investing activities where both the financing and investing accounts are not reported in the financial reports. Answer: False Rationale: The off-balance-sheet financing means that the assets and the liabilities are both not reported on the balance sheet. However, these are reported in the footnotes to the financial statements. Cambridge Business Publishers, ©2010 10-4 Financial Accounting for MBAs, 4th EditionMultiple Choice Topic: Operating lease LO: 1 1. This type of lease is considered a form of off-balance-sheet financing. a. Capital lease b. Special purpose lease c. Operating lease d. Variable interest lease e. None of the above. Answer: c Rationale: Under operating leases, neither the leased asset nor the lease liability appear on the lessee’s balance sheet. Therefore, operating leases are a form of off-balance-sheet financing. Topic: Reporting of operating leases LO: 1 2. How are operating leases reported in the lessee’s balance sheet? a. As an asset that is depreciated, similar to the company’s other assets. b. As either a short-term or long-term liability, depending on the length of the lease c. At the present value of the future minimum lease payments. d. Operating leases are not disclosed in the lessee’s balance sheet or annual report. e. None of the above Answer: e Rationale: Operating leases are not reported on a company’s balance sheet. However, operating leases are noted in the footnotes to the financial statements, which provide key details regarding the company’s current and future lease payment obligations. © Cambridge Business Publishers, 2010 Test Bank, Module 10 10-5Topic: Present value of operating lease payments – Numerical calculations required LO: 1 3. Wickersham Global disclosed the following minimum rental commitments under noncancelable operating leases in its 2009 annual report: Minimum operating lease payments Amount (in millions) 2008 $ 43 2009 28 2010 22 2011 18 2012 16 Thereafter 15 Total $142 What is the present value of these operating lease payments, assuming a 6% discount rate? a. $121 million b. $142 million c. $134 million d. $100 million e. None of the above Answer: a Rationale: The following chart shows the calculation used to determine the present value of operating leases at Wickersham Global (amounts are in millions): [Show More]

Last updated: 1 year ago

Preview 1 out of 47 pages

Instant download

Instant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 30, 2022

Number of pages

47

Written in

Additional information

This document has been written for:

Uploaded

Apr 30, 2022

Downloads

0

Views

79

.png)