Finance > QUESTIONS & ANSWERS > FAMBA4e TestBank Mod11_09 10 09. Module 11. Adjusting and Forecasting Financial Statements. (All)

FAMBA4e TestBank Mod11_09 10 09. Module 11. Adjusting and Forecasting Financial Statements.

Document Content and Description Below

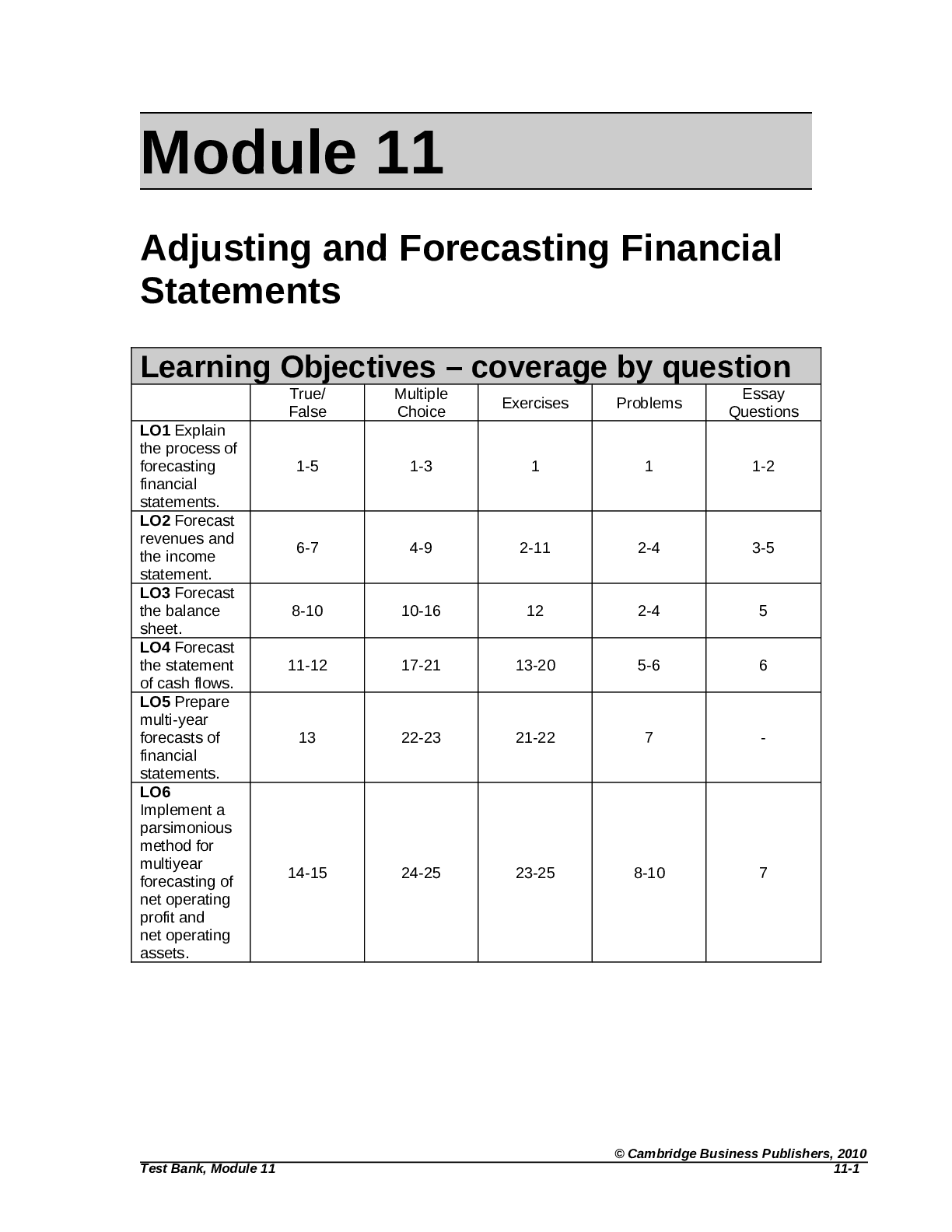

FAMBA4e TestBank Mod11_09 10 09. Module 11. Adjusting and Forecasting Financial Statements. Learning Objectives – coverage by question True/ False Multiple Choice Exercises Problems Questions ... Essay LO1 Explain the process of forecasting financial statements. LO2 Forecast revenues and the income statement. LO3 Forecast the balance sheet. LO4 Forecast the statement of cash flows. LO5 Prepare multi-year forecasts of financial statements. Implement a parsimonious method for multiyear forecasting of net operating profit and net operating assets Module 11: Adjusting and Forecasting Financial Statements True/False Topic: Eliminating transitory activities LO: 1 1. To forecast future performance, we should first create a set of financial statements that reflects items we expect to persist. Answer: True Rationale: Persistent activities are those that will recur – that is the point of forecasting, to predict what will recur. Topic: Conservatism versus optimism LO: 1 2. When forecasting future events, it is better to take a more conservative view for items such as revenue growth and profit margins. Answer: False Rationale: The best forecasts are the most realistic ones. Being overly conservative can lead to missed opportunities. Topic: Bias resulting from accruals LO: 1 3. Accruals can be used to bias financial statements in order to achieve certain reporting objectives. Answer: True Rationale: Managers can use accruals to depress current period income by writing off an excessive amount of assets and accruing an excessive amount of liabilities (big bath). Managers can also increase current period income by accruing an insufficient allowance for uncollectible accounts, for example. Topic: Adjusting process LO: 1 4. The adjusting process is useful for historical analysis, but not for prospective analysis. Answer: False Rationale: The adjusting process parses the financial statements into operating/nonoperating and core/transitory components. It is useful for both historical and prospective analysis. Topic: Order of projections LO: 1 5. The usual financial statement projection process is completed in the following order: balance sheet, income statement, statement of cash flows. Answer: False Rationale: The usual projection process begins with the income statement, followed by the balance sheet, and finished with the statement of cash flows. Cambridge Business Publishers, ©2010 11-2 Financial Accounting for MBAs, 4th EditionTopic: Projecting revenues LO: 2 6. An unbiased approach to forecasting future revenues gives equal weight to historical organic revenue growth and revenue growth from mergers and acquisitions. Answer: False Rationale: The most accurate forecast of future revenue is one that considers future organic versus M&A revenue growth. Historic numbers are informative to the extent that we expect past trends to continue. Topic: Projecting revenues LO: 2 7. Revenue forecasts derived from unit sales and current prices are usually more accurate than those derived from dollar sales. Answer: True Rationale: Using units and prices allows the forecaster to alter each separately which is a more dynamic and usually more accurate way to forecast demand and revenue. Topic: Projections using most current ratios LO: 3 8. Projecting balance sheet items is most accurate if we use the most recent ratios. Answer: False Rationale: For accurate forecasts, we want to use the most stable and relevant ratios concerning the company’s financial condition. Sometimes, the most recent ratios are not stable. Topic: Projecting property, plant, and equipment (PPE) LO: 3 9. To forecast property, plant, and equipment (PPE) we first determine capital expenditures (CAPEX) and add that to historical PPE. Answer: True Rationale: We do not forecast disposals unless the MD&A specifically mentions them. Topic: Projection of cash LO: 3 10. An analyst’s cash projection is calculated as projected total assets (total liabilities and equity) less noncash assets. Answer: True Rationale: This is how an analyst should project the amount of cash on the balance sheet. © Cambridge Business Publishers, 2010 Test Bank, Module 11 11-3Topic: Projected cash-flow statement LO: 4 11. The forecasted statement of cash flow uses either the forecasted income statement or the balance sheet. Answer: False Rationale: The statement of cash flow uses both to explain the change in cash on the balance sheet. Topic: Depreciation expense on the statement of cash flows LO: 4 12. Depreciation expense, determined as a percentage of actual property, plant, and equipment, is added back to net income in the operating cash flow section. Answer: True Rationale: Depreciation is a non-cash expense that does not affect cash. Topic: Multi-year forecast LO: 5 13. The drawback of a multi-year forecast is that the same revenue growth assumption must be used for each year and this may not be the most accurate assessment of future revenue growth especially for firms that have not yet reached maturity. Answer: False Rationale: The statement of cash flow uses both to explain the change in cash on the balance sheet. Topic: Parsimonious method of projection LO: 6 14. The parsimonious projection method relies on sales growth, net operating profit margin (NOPM), and asset turnover (AT) to project net operating profit after tax and net operating assets. Answer: False Rationale: The parsimonious projection method relies on net operating asset turnover (NOAT) and not total asset turnover (AT). Topic: Projecting property plant and equipment with parsimonious method LO: 6 15. The parsimonious projection method is the more efficient method for projecting property, plant and equipment. Answer: False Rationale: The parsimonious projection method does not project individual income statement and balance sheet items, it is used to project net operating profit (NOPAT) and net operating assets (NOA). Cambridge Business Publishers, ©2010 11-4 Financial Accounting for MBAs, 4th EditionMultiple Choice Topic: Adjusting operating cash flows LO: 1 1. Which of the following should an analyst consider moving out of operating cash flows for analysis purposes: a. Decreases in accounts payable b. Decreases in accounts receivable from securitization c. Increases in inventory d. Increases in environmental liabilities e. None of the above Answer: b Rationale: Companies often securitize (sell-off) their account receivables which removes the receivables from the balance sheet, resulting in an increase in operating cash flows. Many analysts consider this to be a financing, not an operating, activity. Topic: Adjusting the income statement LO: 1 2. Which of the following is not a typical adjustment made to the income statement for projection purposes? a. Adjusting net income for perceived under- or over-accruals. b. Adjusting revenues to only include organic revenue growth. c. Separating operating and non-operating items. d. Removing transitory items such as restructuring charges. e. None of the above Answer: b Rationale: Distinguishing between organic and acquired income is important because acquired growth is expensive. However, the acquired income should be considered for projection purposes as long as the expenditures to acquire that income are included in the projections. Topic: Adjusting the balance sheet LO: 1 3. What adjustments might you consider making to the balance sheet before you began the forecasting process? a. Capitalization of operating leases b. Consolidation of equity method investments c. Elimination of impaired goodwill not recognized yet by the company d. All of the above Answer: d Rationale: All of these adjustments are legitimate, helpful adjustments. © Cambridge Business Publishers, 2010 Test Bank, Module 11 11-5Topic: Projecting revenue – Numerical calculations required LO: 2 4. Wind Power Corp. reports 2007 and 2008 total revenues of $55 million and $77 million respectively. If we expect prior growth to persist, we would forecast a revenue growth rate of: a. 29% b. 40% c. 71% d. 50% e. None of the above Answer: b Rationale: ($77 / $55) – 1 = 0.4 = 40% Topic: Projecting revenue – Numerical calculations required LO: 2 5. Following are financial statement numbers and ratios for Snap-On Corp. for the year ended January 3, 2009 (in millions). If we expected revenue growth of 2% in the next year, what would projected revenue be for the year ended December 31, 2009? Total revenue $2,853.3 NOPAT 256.9 NOA 1,701.9 Net operating profit margin (NOPM) 9.0% Net operating asset turnover (NOAT) 1.68 a. $2,911.5 million b. $2,900.6 million c. $2,910.4 million d. $2,916.3 million e. None of the above Answer: c Rationale: $2,853.3 million × 1.02 = $2,910.4 million Topic: Projecting revenue – Numerical calculations required LO: 2 6. Following are financial statement numbers and ratios for Lockheed Martin Corp. for the year ended December 31, 2008. If we expected revenue growth of 2.67% in the next year, what would projected revenue be for 2009? Total revenue (in millions) $42,731 Net operating profit margin (NOPM) 8.2% Net operating asset turnover (NOAT) 6.4 a. $46,576.9 million b. $43,825.9 million c. $46,234.9 million d. $43,871.9 million e. None of the above Answer: d Rationale: $42,731 million × 1.0267 = $43,871.9 million Cambridge Business Publishers, ©2010 11-6 Financial Accounting for MBAs, 4th EditionTopic: Projected COGS – Numerical calculations required LO: 2 7. MicroFiber company reports in its 2008 10-K, sales of $565 million and cost of goods sold of $226 million. For next year, you project that sales will grow by 6% and that cost of goods sold percentage will be 1 percentage point higher. Projected cost of goods sold for 2009 will be: a. $246 million b. $240 million c. $242 million d. $248 million e. There is not enough information to determine the amount. Answer: a Rationale: $565 million ×1.06 × (($226 / $565) +1%) = $246 million Topic: Projected interest expense – Numerical calculations required LO: 2 8. Solar Energy company reports in its 2008 10-K, sales of $48 million, long-term debt of $5 million, and interest expense of $500,000. If sales are projected to increase by 4.1% next year, projected interest expense for 2009 will be: a. $450,000 b. $520,000 c. $500,000 d. $470,000 e. None of the above. Answer: c Rationale: The most common approach to non-operating expenses is to assume that they do not change from year to year. Topic: Projected tax expense – Numerical calculations required LO: 2 9. FuelCell Company reports 2008 sales of $88.5 million, income before income taxes of $17.7 million and tax expense of $3.54 million. If sales are projected to increase by 4.1% next year, projected tax expense for 2009 will be: a. $3.54 million b. $3.69 million c. $3.79 million d. $4.99 million e. There is not enough information to determine the amount. Answer: e Rationale: The tax expense will be a function of forecasted pre-tax income. Knowing the sales growth rate is insufficient to determine pre-tax income because certain expenses may remain unchanged from prior dollar levels. © Cambridge Business Publishers, 2010 Test Bank, Module 11 11-7Topic: Implication of projected cash balance LO: 3 10. When forecasting balance sheet financials, an unusually high cash balance suggests which of the following? a. Sales are projected to increase in coming years. b. The company will need to sell additional stock. c. The company could pay off debt in the next year. d. Account receivables have dipped to an unacceptable level. e. None of the above Answer: c Rationale: If initial balance sheet projection produces a high amount of cash, the company will most likely decrease short or long-term debt to reduce cash levels to a more consistent level. Topic: Projected PPE based on forecasted sales – Numerical calculations required LO: 3 11. CVS Caremark reported sales of $ 87,471.9 million and property, plant and equipment (PPE) of $8,125.2 million in 2008. If sales are projected to increase 10% per year over the next five years, what is the projected capital expenditures (purchases of new PPE) for 2009? a. $8,937.7 million b. $8,125.2 million c. $8,747.2 million d. $8,766.7 million e. There is not enough information to determine the amount. Answer: e Rationale: We do not know the proportion of 2008 sales spent on CAPEX that year, so we are unable to determine the 2009 CAPEX. Topic: Projected accounts receivable – Numerical calculations required LO: 3 12. The 2008 financial statements of CVS Caremark reported sales of $87,471.9 million and accounts receivable of $5,384.3 million. If sales are projected to increase 2% next year, what is the projected accounts receivable balance for 2009? a. $5,492.0 million b. $5,384.3 million c. $5,278.7 million d. $5,472.9 million e. None of the above Answer: a Rationale: $5,492.0 million: $5,384 million × 1.02 (sales growth) Cambridge Business Publishers, ©2010 11-8 Financial Accounting for MBAs, 4th EditionTopic: Projected cash – Numerical calculations required LO: 3 13. Kinney’s Pizza Garden has a projected balance sheet that includes the following accounts. What is the projected cash balance? [Show More]

Last updated: 1 year ago

Preview 1 out of 48 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 30, 2022

Number of pages

48

Written in

Additional information

This document has been written for:

Uploaded

Apr 30, 2022

Downloads

0

Views

60

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)