Economics > QUESTIONS & ANSWERS > Chapter 45 Consumer Law. All Answers (All)

Chapter 45 Consumer Law. All Answers

Document Content and Description Below

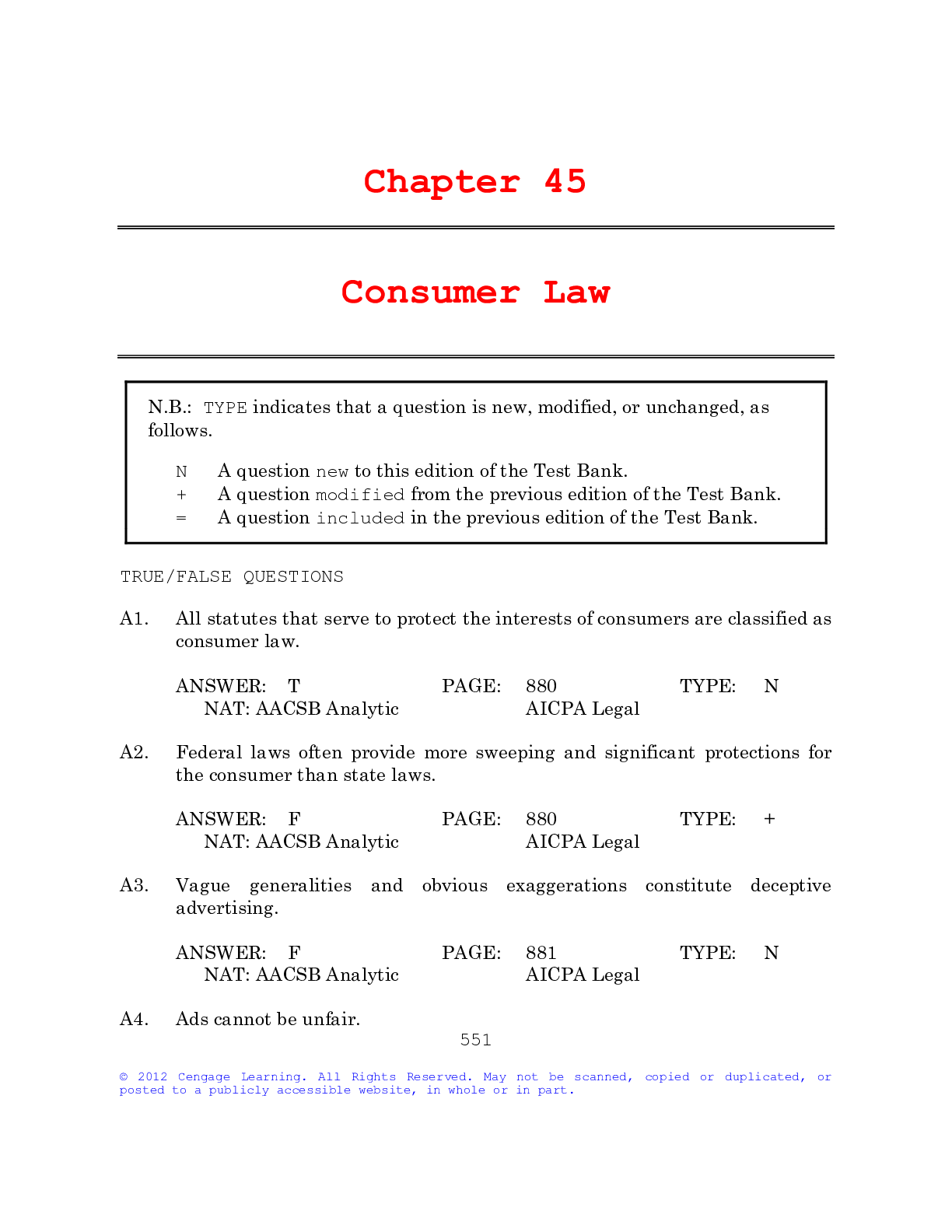

N.B.: TYPE indicates that a question is new, modified, or unchanged, as follows. N A question new to this edition of the Test Bank. + A question modified from the previous edition of the Test Ban... k. = A question included in the previous edition of the Test Bank. TRUE/FALSE QUESTIONS A1. All statutes that serve to protect the interests of consumers are classified as consumer law. T PAGE: 880 TYPE: N NAT: AACSB Analytic AICPA Legal A2. Federal laws often provide more sweeping and significant protections for the consumer than state laws. F PAGE: 880 TYPE: + NAT: AACSB Analytic AICPA Legal A3. Vague generalities and obvious exaggerations constitute deceptive advertising. F PAGE: 881 TYPE: N NAT: AACSB Analytic AICPA Legal A4. Ads cannot be unfair. T PAGE: 882 TYPE: N NAT: AACSB Analytic AICPA Legal A5. Bait-and-switch advertising occurs when a salesperson lures a consumer into a store by advertising a low-priced item in order to switch the consumer to a more expensive item. T PAGE: 882 TYPE: N NAT: AACSB Analytic AICPA Legal A6. A sanction known as counteradvertising requires a company to advertise the products of its competitor to counter its own false claims. F PAGE: 883 TYPE: N NAT: AACSB Analytic AICPA Legal A7. Labels must use words that are easily understood by the ordinary marketing executive. F PAGE: 884 TYPE: N NAT: AACSB Analytic AICPA Legal A8. Food products are not required to bear labels detailing the nutritional content. F PAGE: 885 TYPE: N NAT: AACSB Analytic AICPA Legal A9. Labels on fresh meat must indicate where the food originated. T PAGE: 885 TYPE: N NAT: AACSB Analytic AICPA Legal A10. Buyers of goods sold door to door can cancel their contracts within three business days. F PAGE: 886 TYPE: N NAT: AACSB Analytic AICPA Legal A11. The key federal statute regulating the credit and credit-card industries is basically a disclosure law. T PAGE: 887 TYPE: N NAT: AACSB Analytic AICPA Legal A12. Merchants must ship orders within the time promised in their ads. T PAGE: 887 TYPE: N NAT: AACSB Analytic AICPA Legal A13. Credit can be denied solely on the basis of marital status. F PAGE: 888 TYPE: N NAT: AACSB Analytic AICPA Legal A14. A credit-cardholder is liable for all unauthorized charges made before the creditor is notified that the card has been lost. F PAGE: 888 TYPE: N NAT: AACSB Analytic AICPA Legal A15. Major credit reporting agencies must provide consumers with free copies of their own credit reports every twelve months. T PAGE: 889 TYPE: N NAT: AACSB Analytic AICPA Legal A16. Creditors attempting to collect debts are generally considered to be debt-collection agencies. F PAGE: 890 TYPE: N NAT: AACSB Analytic AICPA Legal A17. A collection agency must include a validation notice whenever it initially contacts a debtor for payment of a debt. T PAGE: 890 TYPE: N NAT: AACSB Analytic AICPA Legal A18. A creditor has the right to garnish a debtor’s wages unless the debt has gone unpaid for a prolonged period. F PAGE: 892 TYPE: N NAT: AACSB Analytic AICPA Legal A19. Drugs can be marketed to the public before they are ensured to be safe and effective. F PAGE: 892 TYPE: + NAT: AACSB Analytic AICPA Legal A20. Manufacturers are required to report on any products already sold if the products have proved to be hazardous. T PAGE: 892 TYPE: N NAT: AACSB Analytic AICPA Legal MULTIPLE CHOICE QUESTIONS A1. Through unfair trade practices, Super Sales Company induces Trey and other consumers to enter into one-sided deals. This may be subject to sanctions under a. federal and state law. b. federal law only. c. no law, according to the principles of freedom to contract. d. state law only. A PAGE: 880 TYPE: = NAT: AACSB Reflective AICPA Legal A2. Home Brand Products, Inc., in its ads, makes claims about its prod¬ucts that are obvious exaggerations and claims that are false but appear to be true. Home Brand may be subject to sanctions for a. neither the claims nor the exaggerations. b. only the claims. c. only the exaggerations. d. the claims and the exaggerations. B PAGE: 881 TYPE: = NAT: AACSB Reflective AICPA Legal A3. Quackity Quack Company’s ad states that its product is “the best on the market today.” Because of this ad, the Federal Trade Com¬mission is most likely to a. do nothing. b. draft a formal complaint. c. issue a cease-and-desist order. d. require counteradvertising. A PAGE: 881 TYPE: N NAT: AACSB Reflective AICPA Legal A4. Frosty’s Appliance Store advertises freezers at a “Special Low Price of $299.” When Garth tries to buy one of the freezers, Huey, the salesperson, tells him that they are all sold and no more are obtainable. Huey adds that Frosty’s has other freezers for $2,299. This is a. a legitimate sales technique. b. bait-and-switch advertising. c. counteradvertising. d. puffery. B PAGE: 882 TYPE: = NAT: AACSB Reflective AICPA Legal A5. Va-Va-Voom Products, Inc., engages in de¬ceptive advertising when it markets its product Weight-No-More as able to help consumers lose weight in their sleep. Va-Va-Voom is ordered to include in all future adver¬tising of Weight-No-More the statement, “This product will not cause anyone to lose weight while sleeping.” This is a. a counteradvertising order. b. a multiple product order. c. a “cooling-off” law. d. a validation notice. A PAGE: 883 TYPE: + NAT: AACSB Reflective AICPA Legal A6. Tonya and many other consumers complain to the Federal Trade Commission (FTC) that a Whoopie Wonders Company ad is deceptive. The FTC’s first step is to a. draft a formal complaint. b. investigate. c. issue a cease-and-desist order. d. require counteradvertising. B PAGE: 883 TYPE: = NAT: AACSB Reflective AICPA Legal A7. Penny Stock Company faxes ads to Quality Personnel Corporation and other businesses without the recipients’ permission. This is a. illegal. b. legal and smart because such ads are generally cheap. c. legal but not smart because such ads are generally ineffective. d. legal but only potentially smart, depending on the response rate. A PAGE: 883 TYPE: = NAT: AACSB Reflective AICPA Legal A8. To generate sales, Yakkity-Yak, Inc., uses phone solicitation. Under federal law, in soliciting business, Yakkity-Yak’s telemarketers must a. disclose all material facts related to a sale. b. identify the seller’s name (only if asked). c. refrain from calling consumers who have not requested a call. d. speak clearly and conspicuously. A PAGE: 883 TYPE: = NAT: AACSB Reflective AICPA Legal A9. Special Roast Coffee, Inc., processes and sells a variety of coffee products. Special Roast’s product packages must include a. the company owner’s identity. b. the contents’ net quantity. c. the restaurants and stores in which the product is sold. d. the type of consumer most likely interested in the product. B PAGE: 885 TYPE: + NAT: AACSB Reflective AICPA Legal A10. Sweet Treats, Inc., wants to market a new snack food. On the prod¬uct’s la¬bel, standard nutrition facts are a. prohibited. b. required. c. strictly voluntary. d. warranted by the nature of the food. B PAGE: 885 TYPE: + NAT: AACSB Reflective AICPA Legal A11. In the ordinary course of business, Xtra Credit Company sells goods to Yvon and other consumers on credit under installment sales contracts that typically require at least one year of monthly payments. Xtra does not disclose all of the credit terms to its customers. This is most likely to result in a. a cease-and-desist order. b. a fine. c. no sanctions. d. rescission of the contracts. D PAGE: 887 TYPE: = NAT: AACSB Reflective AICPA Legal A12. Wheels & Deals Corporation is subject to the Truth-in-Lending Act, which is a key statute regulating the credit and credit-card industries and concerns a. the credit-worthiness of financial institutions. b. the disclosure of credit terms. c. the limits on types of credit. d. the limits on types of debt. B PAGE: 887 TYPE: + NAT: AACSB Analytic AICPA Legal A13. Kristen receives unsolicited merchandise in the mail. Kristen a. may keep the merchandise without any obligation to the sender. b. must return the merchandise within five days to avoid payment. c. must return the merchandise within fifteen days to avoid payment. d. must return the merchandise within thirty days to avoid payment. A PAGE: 887 TYPE: = NAT: AACSB Reflective AICPA Legal A14. Shep buys a car from his neighbor, Tyrone, for $8,000 and agrees to make monthly payments of $800 until the price is paid. This transaction is not sub¬ject to federal credit regulations because a. the parties are two consumers. b. the transaction is a sale. c. the sale involves a car. d. the parties are neighbors. A PAGE: 887 TYPE: + NAT: AACSB Reflective AICPA Legal A15. Bodie’s application to City Bank for a credit card is denied. Bodie can obtain information on her credit history in a credit agency’s files under a. no federal law. b. the Equal Credit Opportunity Act. c. the Fair Credit Reporting Act. d. the Fair Debt Collection Practices Act. C PAGE: 888 TYPE: = NAT: AACSB Reflective AICPA Legal A16. On behalf of RiteNow Collection Agency, Sid poses as a police officer in an attempt to collect payment from Tylo for a shipment of scuba equipment that she returned to Undersea Company two months earlier. This violates a. no federal law. b. the Fair Credit Reporting Act. c. the Fair Debt Collection Practices Act. d. the Truth-in-Lending Act. C PAGE: 890 TYPE: = NAT: AACSB Reflective AICPA Legal A17. Dita takes out a student loan from Everloan Bank. When she fails to make the scheduled payments for six months, Everloan advises her of further ac-tion that it will take. This violates a. no federal law. b. the Fair and Accurate Credit Transactions Act. c. the Fair Debt Collection Practices Act. d. the Truth-in-Lending Act. A PAGE: 890 TYPE: = NAT: AACSB Reflective AICPA Legal A18. Kip opens an account at a Lotsa Goodies Store, and buys a digital music player and other items, but makes no payments on the account. To collect the debt, Mako, the manager, contacts Kip’s parents. This violates a. no federal law. b. the Fair and Accurate Credit Transactions Act. c. the Fair Debt Collection Practices Act. d. the Truth-in-Lending Act. A PAGE: 890 TYPE: = NAT: AACSB Reflective AICPA Legal A19. Green Grocer Corporation makes and markets a variety of processed food products. The federal agency responsible for enforcing health regula¬tions con¬cerning food is a. the Consumer Product Safety Commission. b. the Federal Reserve Board of Governors. c. the Federal Trade Commission. d. the Food and Drug Administration. D PAGE: 892 TYPE: = NAT: AACSB Reflective AICPA Legal A20. Fun-E Products, Inc., makes and sells toys. The government agency that has the authority to remove a poten¬tially hazardous toy from the market is a. the Consumer Product Safety Commission. b. the Federal Reserve Board of Governors. c. the Federal Trade Commission. d. the Food and Drug Administration. A PAGE: 892 TYPE: = NAT: AACSB Reflective AICPA Legal ESSAY QUESTIONS A1. Darren wants to go into the business of direct merchandise sales. What are the legal problems that Darren might encounter in telemarketing? In sell¬ing door-to-door? In marketing over the Internet? In soliciting sales through the mail? A2. Milo buys an all-terrain-vehicle (ATV) from No-Limit Toys, Inc., on credit but makes no payments on the account. Odell, the owner of No-Limit Toys, calls Milo at home on a Monday morning at three A.M. Odell represents himself as PayNow Collection Agency and demands payment “or else.” The next day, Odell sends Milo notice that he has thirty days to request verification of the debt, during which its payment will be suspended, but that if he does not pay the full amount due within five business days, Odell will arrange for the “destruction of Milo’s good credit rating.” Which laws has Odell violated, if any, and in what ways? [Show More]

Last updated: 1 year ago

Preview 1 out of 18 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$7.00

Document information

Connected school, study & course

About the document

Uploaded On

Jan 03, 2020

Number of pages

18

Written in

Additional information

This document has been written for:

Uploaded

Jan 03, 2020

Downloads

0

Views

78