Economics > QUESTIONS & ANSWERS > Chapter 47 Antitrust Law. All Answers (All)

Chapter 47 Antitrust Law. All Answers

Document Content and Description Below

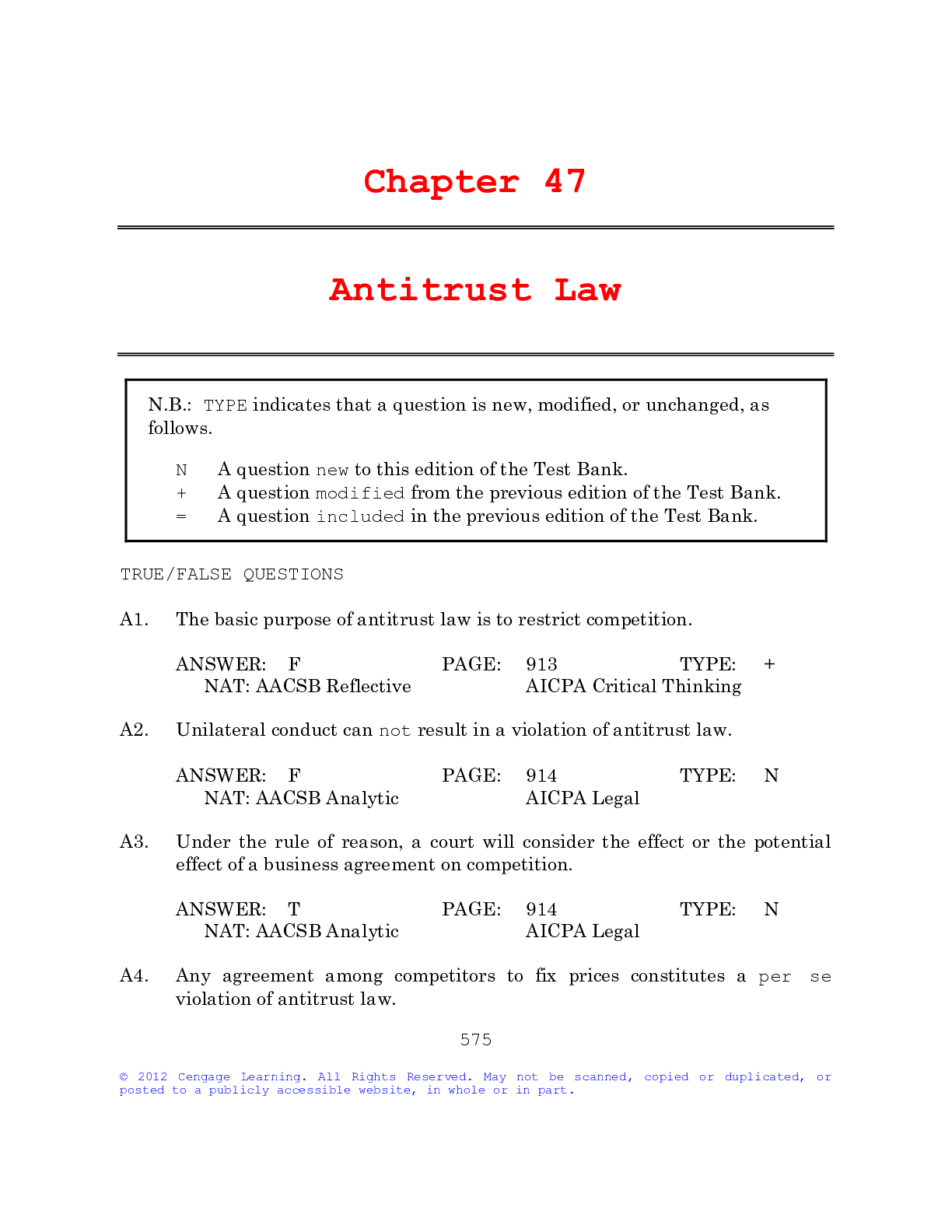

N.B.: TYPE indicates that a question is new, modified, or unchanged, as follows. N A question new to this edition of the Test Bank. + A question modified from the previous edition of the Test Ban... k. = A question included in the previous edition of the Test Bank. TRUE/FALSE QUESTIONS A1. The basic purpose of antitrust law is to restrict competition. F PAGE: 913 TYPE: + NAT: AACSB Reflective AICPA Critical Thinking A2. Unilateral conduct can not result in a violation of antitrust law. F PAGE: 914 TYPE: N NAT: AACSB Analytic AICPA Legal A3. Under the rule of reason, a court will consider the effect or the potential effect of a business agree¬ment on competition. T PAGE: 914 TYPE: N NAT: AACSB Analytic AICPA Legal A4. Any agreement among competitors to fix prices constitutes a per se violation of antitrust law. T PAGE: 916 TYPE: N NAT: AACSB Analytic AICPA Legal A5. Most group boycotts are legal. F PAGE: 917 TYPE: N NAT: AACSB Analytic AICPA Legal A6. Joint ventures undertaken by competitors are not subject to antitrust laws. F PAGE: 917 TYPE: N NAT: AACSB Analytic AICPA Legal A7. A horizontal restraint of trade results from an agreement between firms at different levels in the manu¬facturing and distribution process. F PAGE: 918 TYPE: N NAT: AACSB Analytic AICPA Legal A8. Territorial and customer restrictions are currently considered per se violations of antitrust law. F PAGE: 918 TYPE: N NAT: AACSB Analytic AICPA Legal A9. Resale price maintenance agreements are subject to analysis under the rule of reason. T PAGE: 918 TYPE: + NAT: AACSB Analytic AICPA Legal A10. A firm may be a monopolist even though it is not the sole seller in a market. T PAGE: 920 TYPE: N NAT: AACSB Analytic AICPA Legal A11. For products that are sold nationwide, there are no geographic boundaries for the market. F PAGE: 921 TYPE: N NAT: AACSB Analytic AICPA Legal A12. Any action challenged as an attempt to monopolize must have been specifically intended to exclude competitors and garner monopoly power. T PAGE: 922 TYPE: N NAT: AACSB Analytic AICPA Legal A13. Monopsony power is market power on the buy side of a market. T PAGE: 922 TYPE: N NAT: AACSB Analytic AICPA Legal A14. Price discrimination occurs when a seller charges the same price to competing buyers for identical goods or services. F PAGE: 924 TYPE: N NAT: AACSB Analytic AICPA Legal A15. A contract under which a seller forbids a buyer to purchase products from the seller’s competitors is a tying arrangement. F PAGE: 924 TYPE: N NAT: AACSB Analytic AICPA Legal A16. When a small number of companies share a large part of a market, the market is concentrated. T PAGE: 925 TYPE: N NAT: AACSB Analytic AICPA Legal A17. Mergers between firms that compete in the same market are vertical mergers. F PAGE: 925 TYPE: = NAT: AACSB Analytic AICPA Legal A18. Only the U.S. Department of Justice can prosecute violations of all of the antitrust laws. F PAGE: 926 TYPE: N NAT: AACSB Analytic AICPA Legal A19. In a situation involving a price-fixing agreement, normally each competitor is liable for the total amount of any damages. T PAGE: 927 TYPE: N NAT: AACSB Analytic AICPA Legal A20. Any conspiracy—even if it occurs outside the United States—that has a substantial effect on U.S. commerce is within the reach of the U.S. antitrust laws. T PAGE: 928 TYPE: N NAT: AACSB Analytic AICPA Legal MULTIPLE CHOICE QUESTIONS A1. North Mining Company and South Excavation Company agree to abide by the decisions of East Coast Financial Corporation as to their respective levels of production, markets, and prices, effectively reducing competition and increasing profits. This is most likely a. a common, legal, time-honored type of business arrangement. b. an illegal restraint on trade. c. an innovative, legally efficient approach to doing business. d. an outdated, but legal business trust. B PAGE: 913 TYPE: = NAT: AACSB Reflective AICPA Legal A2. Helio Company can process hydrogen into an inexpensive fuel for internal combustion engines. As an innovator in its market, Helio currently has the power to affect the price of its product. This is a. market power. b. predatory pricing. c. price discrimination. d. price-fixing. A PAGE: 914 TYPE: = NAT: AACSB Reflective AICPA Legal A3. Health Resources Corporation makes and sells Intake, the most prescribed name-brand cholesterol-lowering medication. Jenerica Company has the potential to make a generic version of the same drug. Health Resources pays Jenerica not to sell its product. This is a. a customer restriction. b. a joint venture. c. an exclusive-dealing contract. d. a price-fixing agreement. D PAGE: 916 TYPE: = NAT: AACSB Reflective AICPA Legal A4. Delta Services, Inc., is the major wholesale distributor of software in the state of Florida. Its closest competitor is Efficient Systems Company, an¬other Florida firm. The two firms agree that Delta will operate in south Florida and Efficient will operate in north Florida. This is a. a group boycott. b. a market division. c. a price-fixing agreement. d. a tying arrangement. B PAGE: 917 TYPE: = NAT: AACSB Reflective AICPA Legal A5. Engine Components, Inc., a manufacturer of vehicle parts, refuses to sell to Fix-It, Inc., a national vehicle service firm. Engine Components convinces Greasy Motor Parts Company, a competitor, to do the same. This is a. a group boycott. b. an exclusive-dealing contract. c. a price-fixing agreement. d. a tying arrangement. A PAGE: 917 TYPE: = NAT: AACSB Reflective AICPA Legal A6. Lightning Cycles, Inc., makes Lightning-brand motorcycles and accessories, which are distributed to authorized dealers, including Macho Motors, Inc. Macho operates dealerships in several locations. Lightning imposes territorial restrictions on Macho to insulate other dealers from direct competition. This is a. a situation that neither restrains trade or harms competition. b. a legal restraint of trade. c. a per se violation of antitrust law. d. subject to analysis under the rule of reason. D PAGE: 918 TYPE: + NAT: AACSB Reflective AICPA Legal A7. USA Cellphone Corporation requires all distribu¬tors of its products to sell the products at specified minimum prices. This resale price mainte¬nance agreement is a. a per se violation of antitrust law. b. a legal restraint of trade. c. subject to evaluation under the rule of reason. d. not subject to antitrust law. C PAGE: 918 TYPE: + NAT: AACSB Reflective AICPA Legal A8. Imperio Caffeine Corporation makes and sells coffee under a variety of brand names. Imperio wants to merge with Java Company, its main competitor. In weighing a challenge to the deal, a court looks at the relevant product market. This most likely includes coffee and a. no other products. b. products that are not identical but are related, such as spin-offs. c. products that are reasonably interchangeable. d. products with identical attributes only. C PAGE: 920 TYPE: = NAT: AACSB Reflective AICPA Legal A9. International Products, Inc. (ICI), has exclusive control over the market for its product. ICI’s market power is most likely a. a situation that neither restrains trade or harms competition. b. a legal restraint of trade. c. a per se violation of antitrust law. d. subject to further evaluation. D PAGE: 920 TYPE: N NAT: AACSB Reflective AICPA Legal A10. To acquire monopoly power in its market, Pure Plastics, Inc., sets its prices substantially below the normal costs of production. Under antitrust law, this is a. a per se violation. b. a violation if its competitors make similar deals. c. a violation if it thereby acquires monopoly power. d. not a violation. C PAGE: 920 TYPE: + NAT: AACSB Reflective AICPA Legal A11. Rally Speedboat Corporation refuses to sell its products to Super Weekends, Inc., a recreational water products dealership. This is a. a group boycott. b. a horizontal market division. c. attempted monopolization. d. a unilateral refusal to deal. D PAGE: 921 TYPE: = NAT: AACSB Reflective AICPA Legal A12. A suit is filed against Urbana Corporation, alleging that the firm commit¬ted the offense of monopolization. To determine whether Urbana has mo¬nopoly power requires looking at a. the company’s size alone. b. business ethics and corporate gamesmanship. c. production methods and marketing techniques. d. the relevant geographic market and the relevant product market. D PAGE: 921 TYPE: + NAT: AACSB Reflective AICPA Legal A13. Seaside Cannery, Inc., is one of many producers of canned seafood. Seaside refuses to sell its products to Port Harbor Restaurant Corporation. Under antitrust law, this refusal is most likely a. a per se violation. b. a violation if its competitors make similar deals. c. a violation if it thereby acquires monopoly power. d. not a violation. D PAGE: 921 TYPE: + NAT: AACSB Reflective AICPA Legal A14. An antitrust action is brought against Tri-State Transport Company, al-leging the offense of attempted monopolization. To be guilty of this of¬fense, Tri-State’s attempt must have a. a dangerous probability of success. b. a deadly guaranty of success. c. a distant possibility of success. d. a distinct improbability of success. A PAGE: 922 TYPE: = NAT: AACSB Reflective AICPA Legal A15. To prevent its competitors from obtaining sufficient supplies to make their products, Molded Plastics, Inc., uses its market power to increase the prices of those supplies. This is a. a refusal to deal. b. business judgment. c. predatory bidding. d. predatory pricing. C PAGE: 922 TYPE: N NAT: AACSB Reflective AICPA Legal A16. By contract, Quality Metals Corporation forbids Resource Refining, Inc., a wholesale buyer of Quality’s products, from purchasing the products of Quality’s competitors. This exclusive-dealing contract is allowed a. under any circumstances. b. unless its effect is to cause a competitor a loss of any business. c. unless its effect is to substantially lessen competition. d. unless there is no effect on a competitor. C PAGE: 924 TYPE: = NAT: AACSB Reflective AICPA Legal A17. To drive its competitors out of a certain geographic segment of its market, Fryin’ Potatoes, Inc., sets the prices of its products below cost for the buyers in that area. This is a. a refusal to deal. b. business judgment. c. predatory bidding. d. price discrimination. D PAGE: 924 TYPE: N NAT: AACSB Reflective AICPA Legal A18. Integrated Software, Inc., conditions the sale of one of its products on Inventory Office System’s agreeing to buy another of Integrated’s products. This deal is a. legal, depending on its purpose and the effect on competition. b. legal, depending on production and transportation costs. c. legal under any circumstances. d. not legal under any circumstances. A PAGE: 925 TYPE: = NAT: AACSB Reflective AICPA Legal A19. Midwest Agri-Products Corporation offers to sell its sugar substitute to Nice Candies, Inc., only if Nice Candies agrees to buy all the corn it needs from Midwest Agri-Products, even though there are other corn sellers from whom Nice Candies could buy. This is a. an exclusive-dealing contract. b. a tying arrangement. c. price discrimination. d. price fixing. B PAGE: 925 TYPE: = NAT: AACSB Reflective AICPA Legal A20. Mango Corporation believes that Melon Corporation engages in anticom-peti¬tive behavior in an attempt to drive Mango, its chief competitor, out of the market. Antitrust laws can be enforced against Melon by a. only a disinterested third party. b. Congress. c. Mango. d. none of the choices. C PAGE: 927 TYPE: + NAT: AACSB Reflective AICPA Legal ESSAY QUESTIONS A1. Finely Engineered Parts Corporation (FEPC) and Great Gears & Gauges, Inc. (3G), are competitors selling certain machine parts that are otherwise generally unattainable in their geographic market. This market includes the states of California, Oregon, Washington, and Idaho. FEPC and 3G agree that FEPC will no longer sell in California and that 3G will no longer sell in Oregon, Washington, and Idaho. Have FEPC and 3G violated any antitrust law? If so, which one? Explain. If they had divided their market by type of customer rather than geographic are, would the result be the same? Why or why not? A2. Java Bean Company imports coffee beans and sells them under two-year contracts to Mellow Roast, Inc., and other coffeemakers. The contracts require that during the two-year term a coffeemaker not buy beans from Java Bean’s competitors. The contracts do not limit the coffeemakers’ purchase of tea or other beverage ingredients from other suppliers, how¬ever. In the second year of the contract, Mellow Roast protests that this arrangement violates antitrust law. Is Mellow Roast correct? If not, why not? If so, under which antitrust statute, or statutes, could these con¬tracts be held illegal? [Show More]

Last updated: 1 year ago

Preview 1 out of 15 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$7.00

Document information

Connected school, study & course

About the document

Uploaded On

Jan 03, 2020

Number of pages

15

Written in

Additional information

This document has been written for:

Uploaded

Jan 03, 2020

Downloads

0

Views

56