FIN 320 SOPHIA Principles of Finance Unit 3 Challenge 4. All Answers Correct

Document Content and Description Below

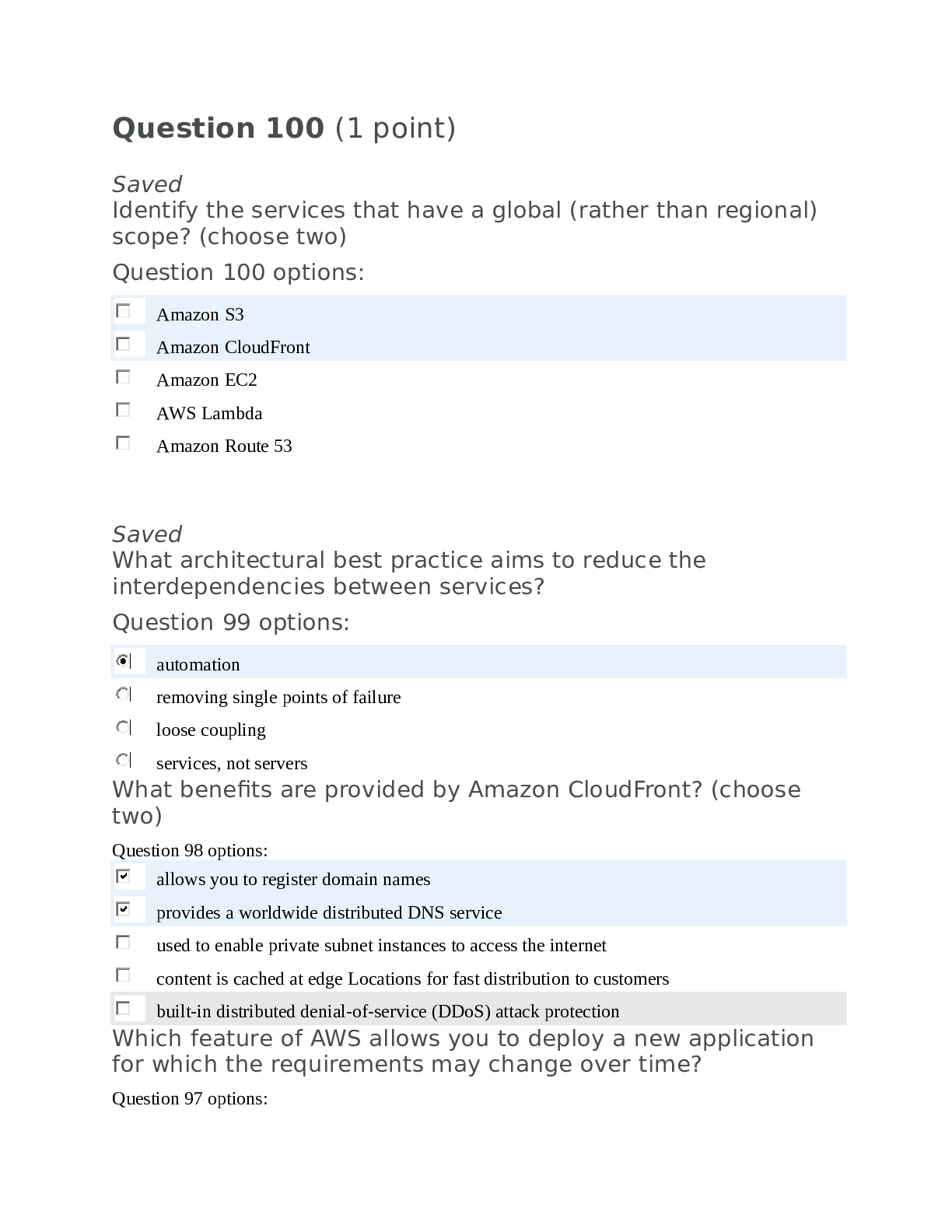

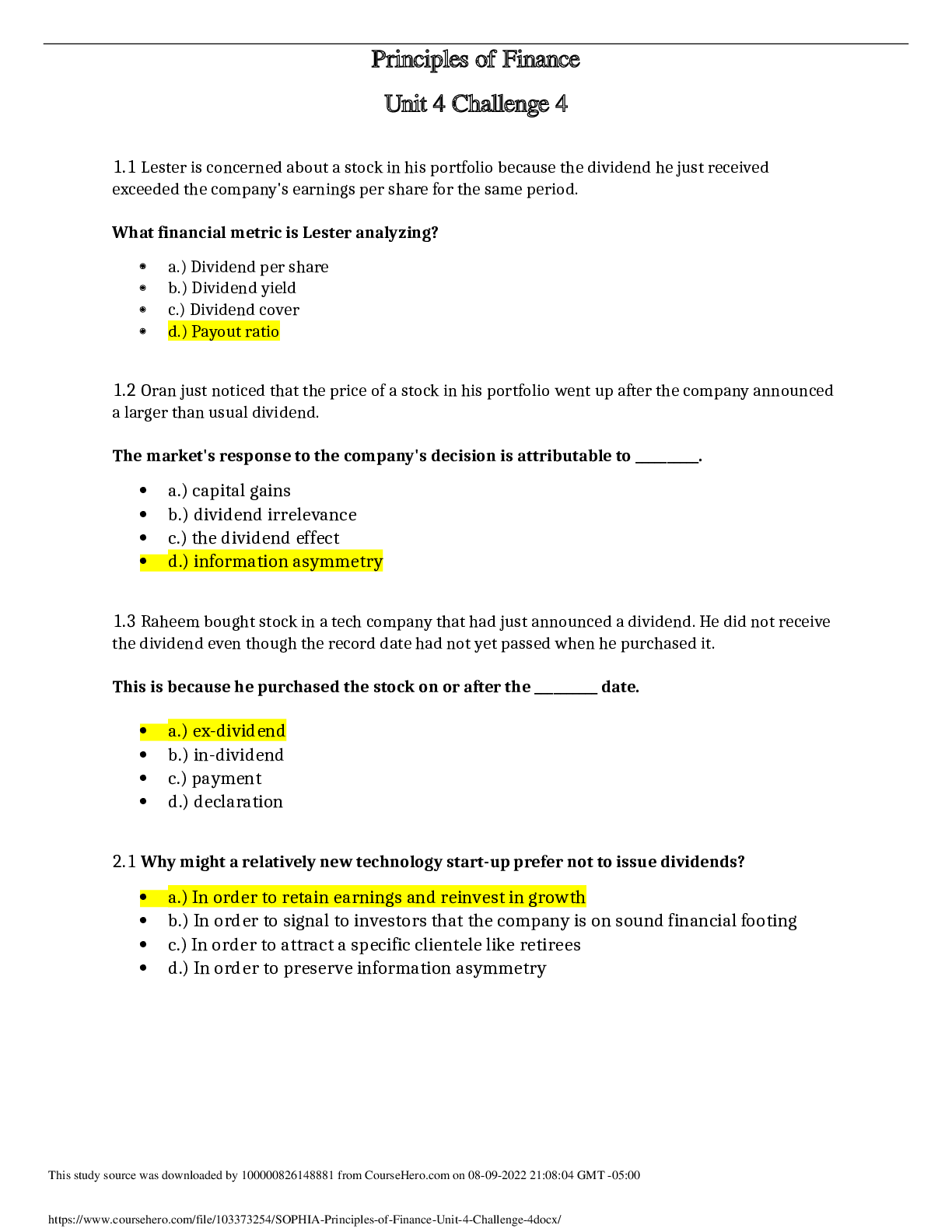

Principles of Finance Unit 3 Challenge 4 1.1 One reason a company may choose to issue additional debt instead of equity when raising capital is that __________. • a.) there are tax advantages to... debt • b.) too much equity can increase a company's interest rate • c.) debt always has a lower cost of capital • d.) it decreases the risk that the company will default on its obligations 1.2 One reason a company's capital structure may include more equity than debt is that relying too heavily on debt could __________. • a.) increase the company's risk of bankruptcy • b.) decrease the company's volatility • c.) increase the company's taxes • d.) decrease the company's leverage 1.3 A company is considering a new plan for its capital structure. Which of the following is true if, under the new plan, the company's weighted average cost of capital is less than the expected return? • a.) The company's cost of capital is too high. • b.) The company is under-leveraged. • c.) The company is unlikely to encounter bankruptcy. • d.) The company is probably going to go bankrupt. 2.1 Which of the following steps happens last in a Chapter 11 bankruptcy? • a.) The company liquidates all of its assets. • b.) The company's debtholders vote on a plan of debt reorganization. • c.) The company receives a stay from any collections activity. • d.) The company considers modifications to its operations as an alternative to bankruptcy. 2.2 What happens after a company files for Chapter 7 bankruptcy? • a.) Creditors vote on the business's reorganization plan. • b.) The business has an opportunity to restructure its debts. • c.) Creditors are paid through the sale of assets. • d.) Creditors may begin collections actions. 2.3 Select the true statement about Chapter 11 bankruptcy. • a.) Under Chapter 11, a company's creditors are paid with the proceeds of the sale of all of the company's assets. • b.) Under Chapter 11, a company is permanently dissolved. • c.) Under Chapter 11, a company can reorganize without officially filing a bankruptcy petition. • d.) Under Chapter 11, a company may be able to continue its operations, but with a potentially higher cost of capital. 3.1 You own a small manufacturing business that produces widgets. You have spent $300,000 acquiring the fixed assets you need to produce widgets. Each widget costs you $2 to make and they sell for $20 each, so your variable cost is 10% of the overall revenue. At your current level of operating leverage, how many widgets must you sell to break even? • a.) 24,500 • b.) 30,000 • c.) 16,667 • d.) 15,000 3.2 You own a small manufacturing business that produces widgets. You have spent $200,000 acquiring the fixed assets you need to produce widgets. Each widget costs you $4 to make and they sell for $20 each, so your variable cost is 20% of the overall revenue. At your current level of operating leverage, how many widgets must you sell to break even? • a.) 40,000 • b.) 12,500 • c.) 22,500 • d.) 10,000 3.3 You own a small manufacturing business that produces widgets. You have spent $400,000 acquiring the fixed assets you need to produce widgets. Each widget costs you $3 to make and they sell for $25 each, so your variable cost is 12% of the overall revenue. At your current level of operating leverage, how many widgets must you sell to break even? • a.) 18,182 • b.) 48,000 • c.) 22,451 • d.) 16,000 4.1 Calculate a company's total leverage given the following information: • Change in sales = 3% • Change in earnings = 9% • a.) Cannot calculate without net income data • b.) 0.33 • c.) 3 • d.) Cannot calculate without EBIT data 4.2 Calculate a company's total leverage given the following information: • Net income = $35,000 • Revenue = $70,000 • Variable costs = $15,000 • a.) 1.57 • b.) Cannot calculate without ROE data • c.) 2.33 • d.) Cannot calculate without knowing the degree of operating leverage 4.3 Calculate a company's total leverage given the following information: • Net income = $40,000 • Revenue = $60,000 • Variable costs = $10,000 • a.) Cannot calculate without EPS data • b.) 1.25 • c.) 2 • d.) Cannot calculate without EBIT data [Show More]

Last updated: 1 year ago

Preview 1 out of 3 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 10, 2022

Number of pages

3

Written in

Additional information

This document has been written for:

Uploaded

Aug 10, 2022

Downloads

0

Views

54