Finance > Research Paper > Texas Tech University - PFP 3301Project 7 INSURANCE (All)

Texas Tech University - PFP 3301Project 7 INSURANCE

Document Content and Description Below

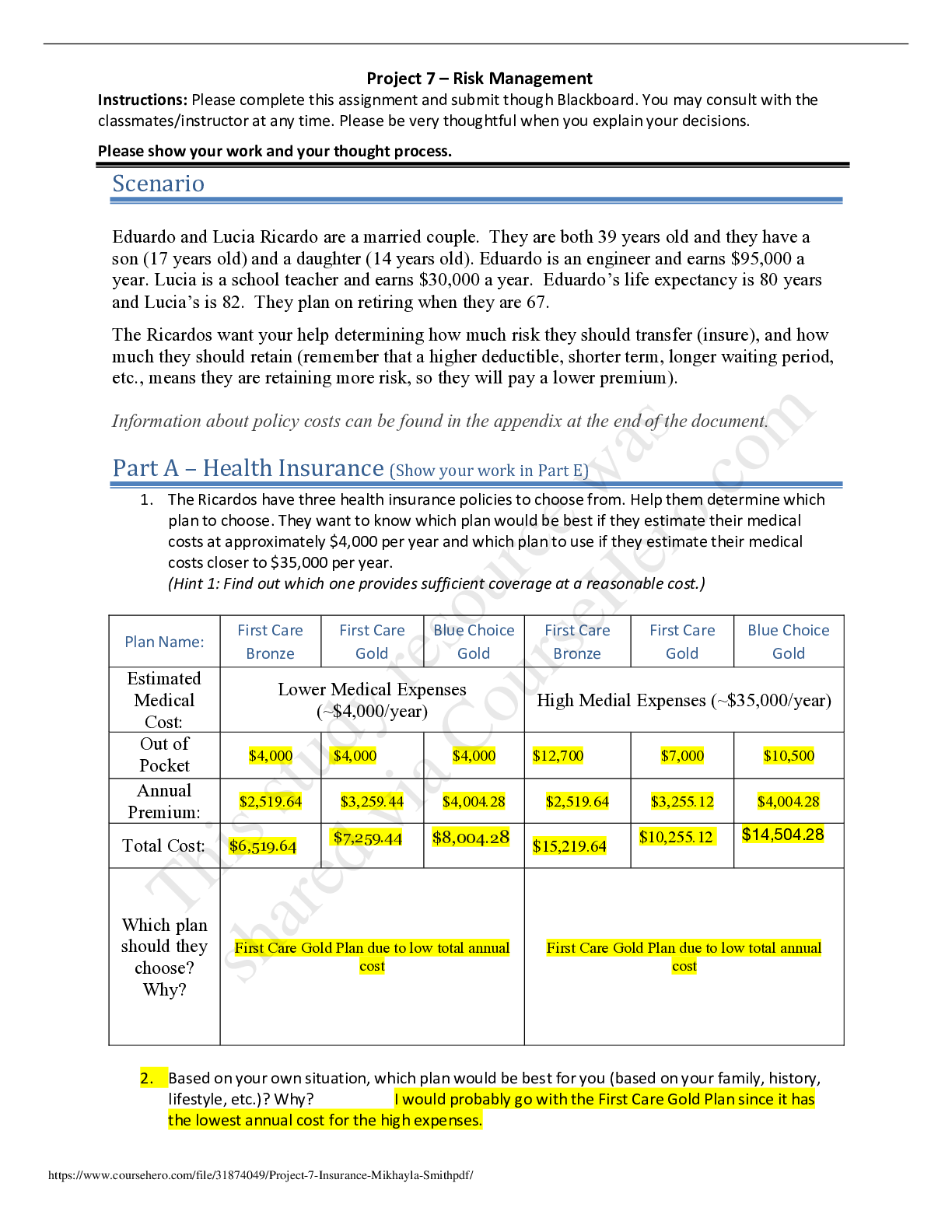

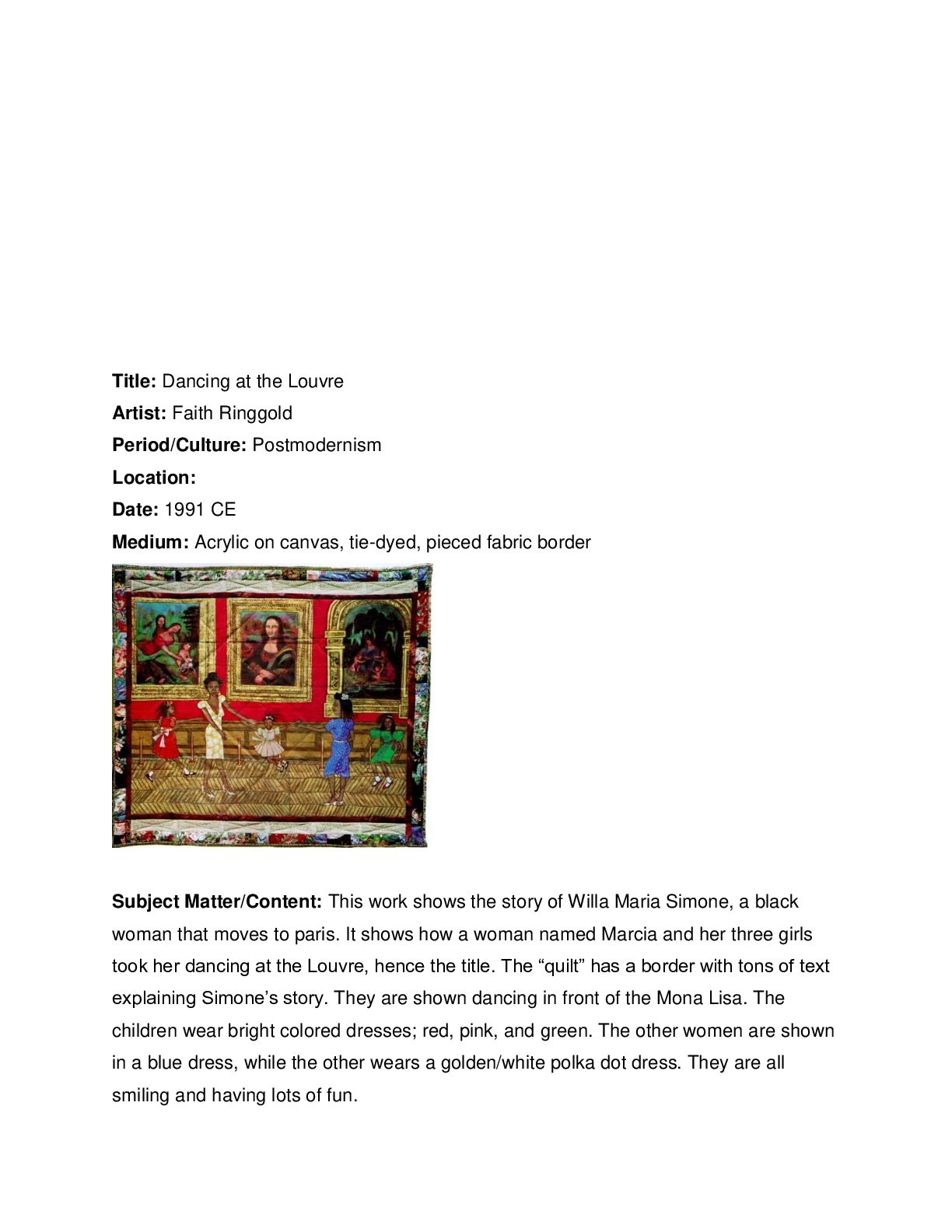

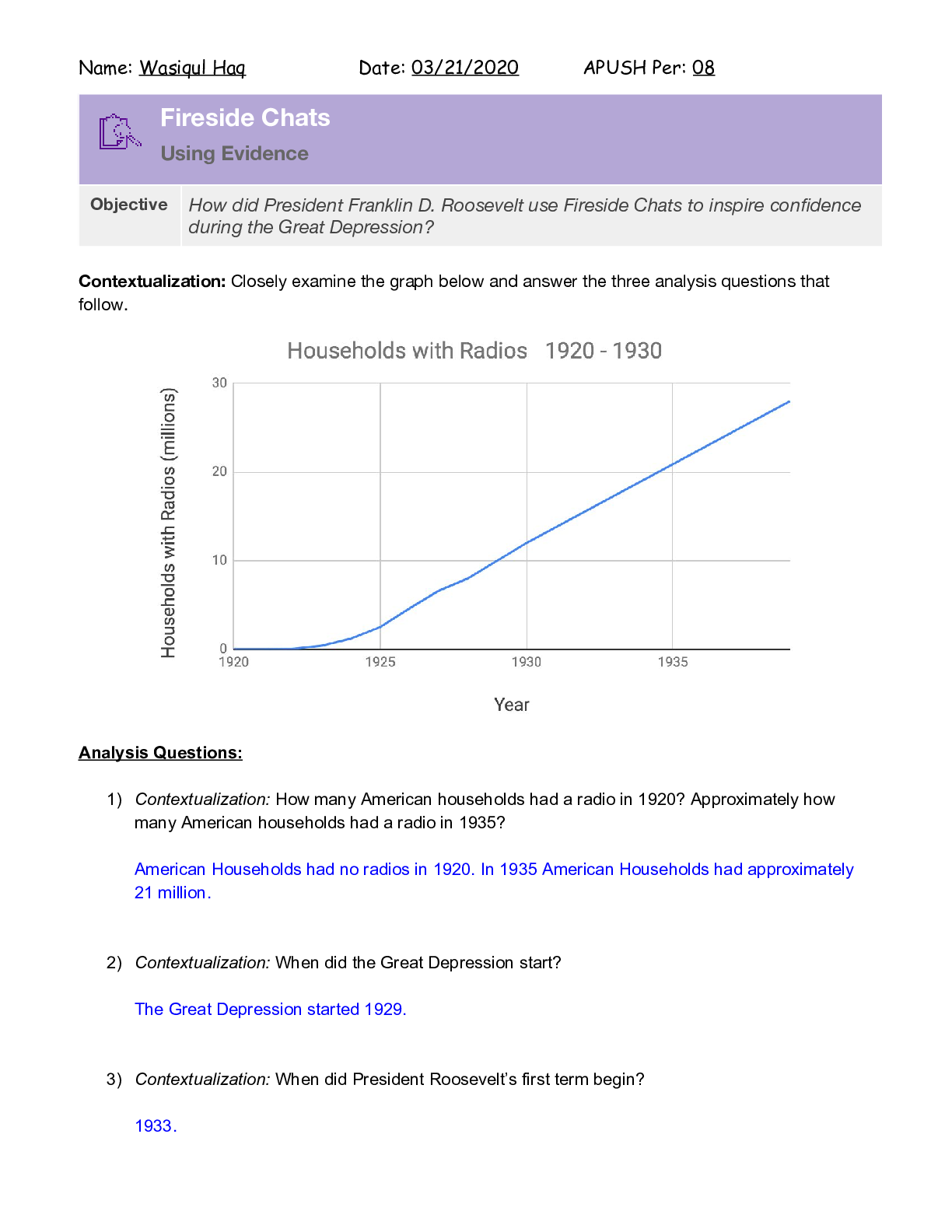

Project 7 – Risk Management Instructions: Please complete this assignment and submit though Blackboard. You may consult with the classmates/instructor at any time. Please be very thoughtful when y... ou explain your decisions. Please show your work and your thought process. Scenario Eduardo and Lucia Ricardo are a married couple. They are both 39 years old and they have a son (17 years old) and a daughter (14 years old). Eduardo is an engineer and earns $95,000 a year. Lucia is a school teacher and earns $30,000 a year. Eduardo’s life expectancy is 80 years and Lucia’s is 82. They plan on retiring when they are 67. The Ricardos want your help determining how much risk they should transfer (insure), and how much they should retain (remember that a higher deductible, shorter term, longer waiting period, etc., means they are retaining more risk, so they will pay a lower premium). Information about policy costs can be found in the appendix at the end of the document. Part A – Health Insurance (Show your work in Part E) 1. The Ricardos have three health insurance policies to choose from. Help them determine which plan to choose. They want to know which plan would be best if they estimate their medical costs at approximately $4,000 per year and which plan to use if they estimate their medical costs closer to $35,000 per year. (Hint 1: Find out which one provides sufficient coverage at a reasonable cost.) Plan Name: First Care Bronze First Care Gold Blue Choice Gold First Care Bronze First Care Gold Blue Choice Gold Estimated Medical Cost: Lower Medical Expenses (~$4,000/year) High Medial Expenses (~$35,000/year) Out of Pocket Expense: $4,000 $4,000 $4,000 $12,700 $7,000 $10,500 Annual Premium: $2,519.64 $3,259.44 $4,004.28 $2,519.64 $3,255.12 $4,004.28 Total Cost: $6,519.64 $7,259.44 $8,004.28 $15,219.64 $10,255.12 $14,504.28 Which plan should they choose? Why? First Care Gold Plan due to low total annual cost First Care Gold Plan due to low total annual cost 2. Based on your own situation, which plan would be best for you (based on your family, history, lifestyle, etc.)? Why? I would probably go with the First Care Gold Plan since it has the lowest annual cost for the high expenses. https://www.coursehero.com/file/31874049/Project-7-Insurance-Mikhayla-Smithpdf/ This study resource was shared via CourseHero.comProject 7 – Risk Management Instructions: Please complete this assignment and submit though Blackboard. You may consult with the classmates/instructor at any time. Please be very thoughtful when you explain your decisions. Please show your work and your thought process. Part B – Life Insurance 3. Based on the information from this course, what type of life insurance should the Ricardos get? (Hint 2: Who does life insurance protect? What does life insurance replace?) ☐ Term Life Insurance ü Cash-value Whole Life Insurance ☐ None Explain your reasoning with evidence from the book and lectures. They would get the highest return. Part C – Disability Insurance 4. Based on the information from this course, what type of disability insurance should the Ricardos get? (Hint 3: What does disability insurance cover? Do NOT confuse this with long-term care insurance [see part D], they are 2 VERY different policies!) Coverage for Eduardo: ☐ Short Term ü Long Term Insurance ☐ None Coverage for Lucia: ü Short Term ☐ Long Term Insurance ☐ None Explain your reasoning with evidence from the book and lectures. Part D – Long-Term Care Insurance 5. Based on the information from this course, should the Ricardos get long-term care insurance? (Hint 4: What does LTC insurance cover? What age should someone start thinking about LTC insurance?) ü Yes ☐ No Explain your reasoning with evidence from the book and lectures. https://www.coursehero.com/file/31874049/Project-7-Insurance-Mikhayla-Smithpdf/ This study resource was shared via CourseHero.comProject 7 – Risk Management Instructions: Please complete this assignment and submit though Blackboard. You may consult with the classmates/instructor at any time. Please be very thoughtful when you explain your decisions. Please show your work and your thought process. Part E – Calculations for Part A First Care Bronze Low Medical Expenses High Medical Expenses shared via CourseHero.comProject 7 – Risk Management Instructions: Please complete this assignment and submit though Blackboard. You may consult with the classmates/instructor at any time. Please be very thoughtful when you explain your decisions. Please show your work and your thought process. Appendix A: Health Care Plan Information Deductibles and Cost Sharing In Network Out of Network Deductible (Individual) $4,500 $0 Deductible (Family) $10,000 $0 Coinsurance 30% $0 Out of Pocket Maximum (Individual) $6,350 $0 Out of Pocket Maximum (Family) $12,700 $0 Deductibles and Cost Sharing In Network Out of Network Deductible (Individual) $0 $0 Deductible (Family) $0 $0 Coinsurance 20% $0 Out of Pocket Maximum (Individual) $6,350 $0 Out of Pocket Maximum (Family) $12,700 $0 https://www.coursehero.com/file/31874049/Project-7-Insurance-Mikhayla-Smithpdf/ This study resource was shared via CourseHero.comProject 7 – Risk Management Instructions: Please complete this assignment and submit though Blackboard. You may consult with the classmates/instructor at any time. Please be very thoughtful when you explain your decisions. Please show your work and your thought process. Deductibles and Cost Sharing In Network Out of Network Appendix B: Life Insurance Information Term Policy Term: 20 years Coverage: $1 million Cost: $50 per month Whole Life Policy Term: Life Coverage: $1 million Cost: $750 per month Appendix C: Other Relevant Information ü The Ricardos have been regularly saving for retirement in their 401(k) and are on track for retirement. ü The Ricardos have a diversified investment account and several small Roth IRA accounts. ü The Ricardos have a college savings account for each child. These accounts are on track to fully fund 5 years of college when the children reach age 18. ü The Ricardos have an emergency fund with 6 months of living expenses. [Show More]

Last updated: 1 year ago

Preview 1 out of 5 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 11, 2020

Number of pages

5

Written in

Additional information

This document has been written for:

Uploaded

Dec 11, 2020

Downloads

0

Views

93

.png)

.png)

.png)

Interdisciplinary Paper.png)

dfdfefe.png)