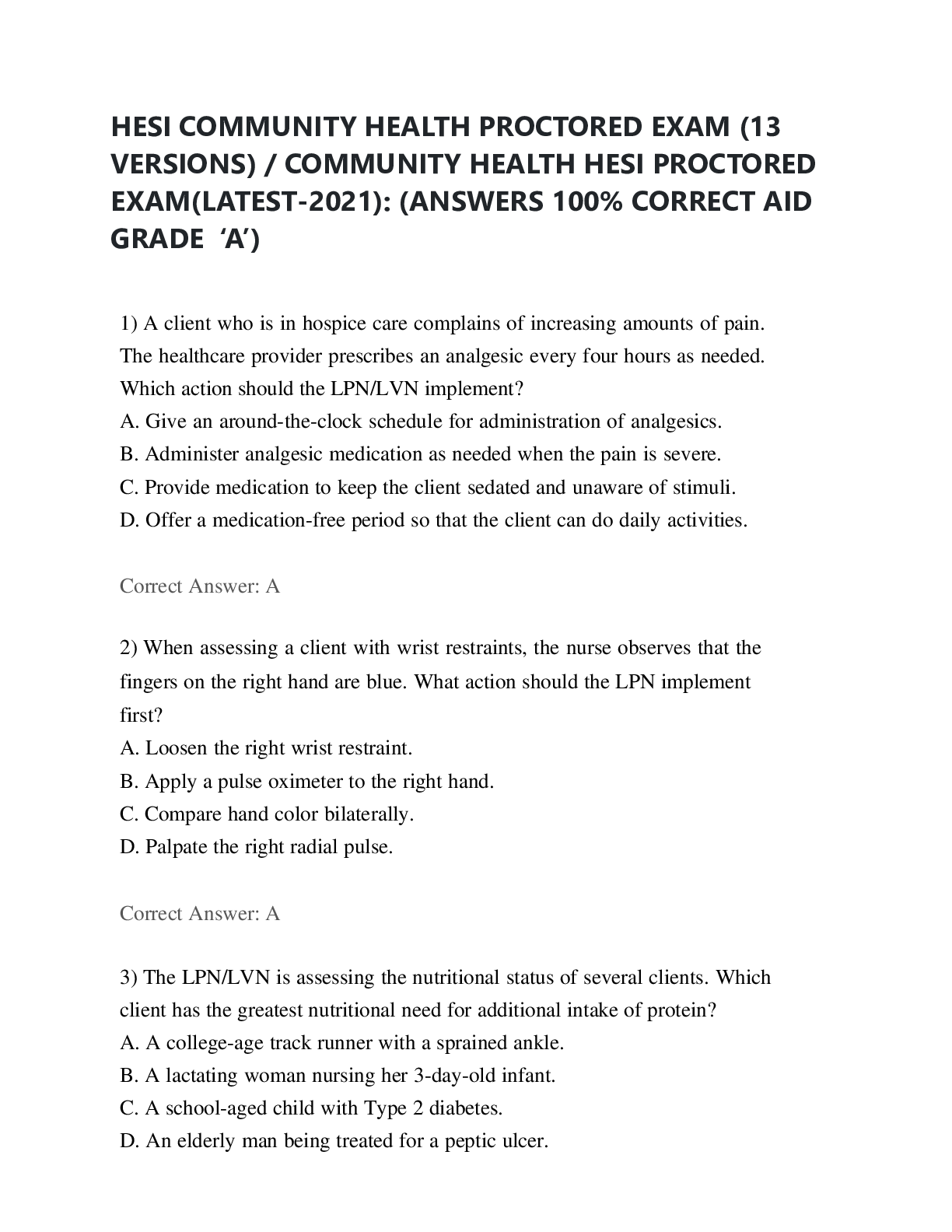

Accounting > EXAM > ACCT 212 Week 5 Homework ALL ANSWERS 100% CORRECT (All)

ACCT 212 Week 5 Homework ALL ANSWERS 100% CORRECT

Document Content and Description Below

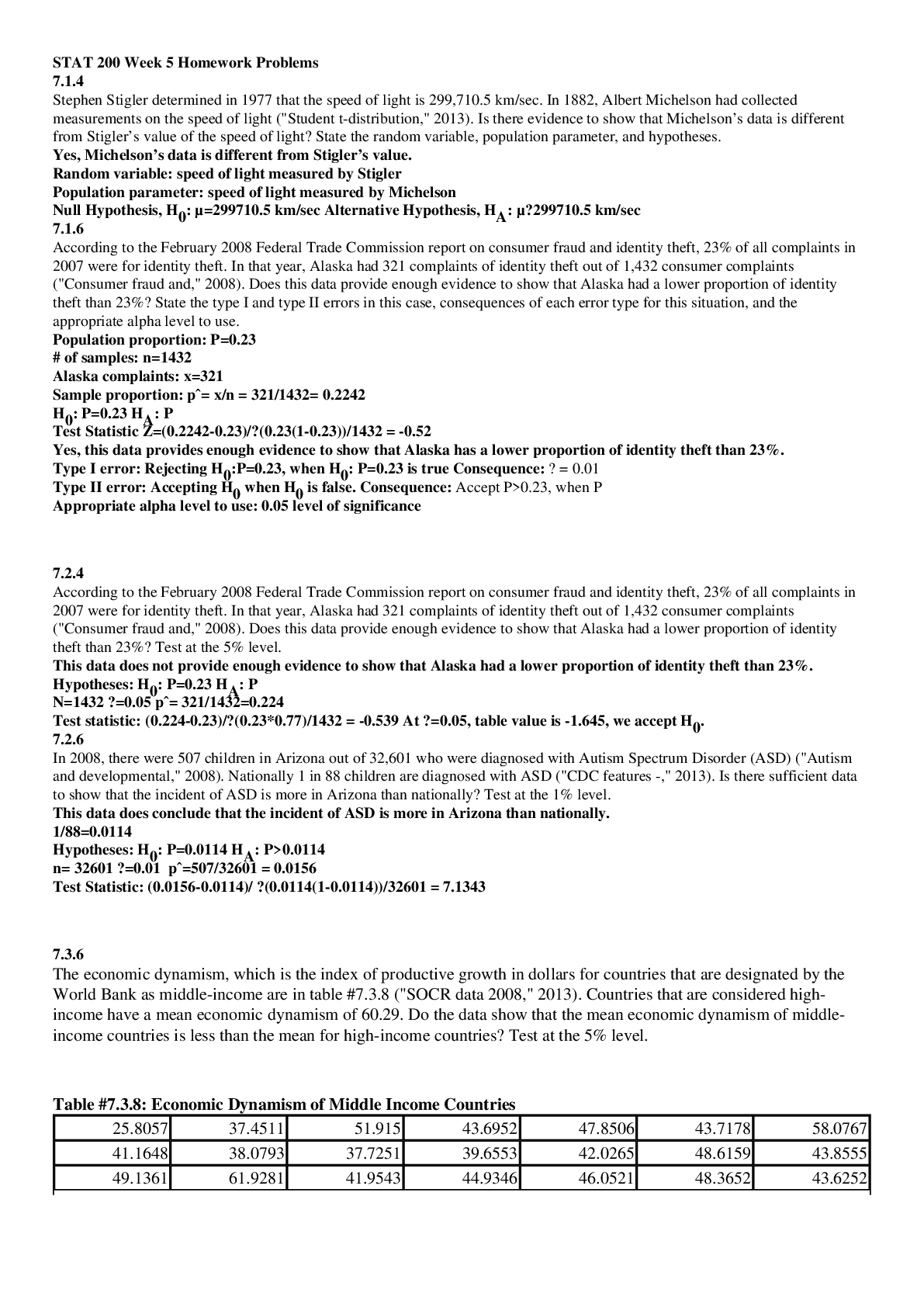

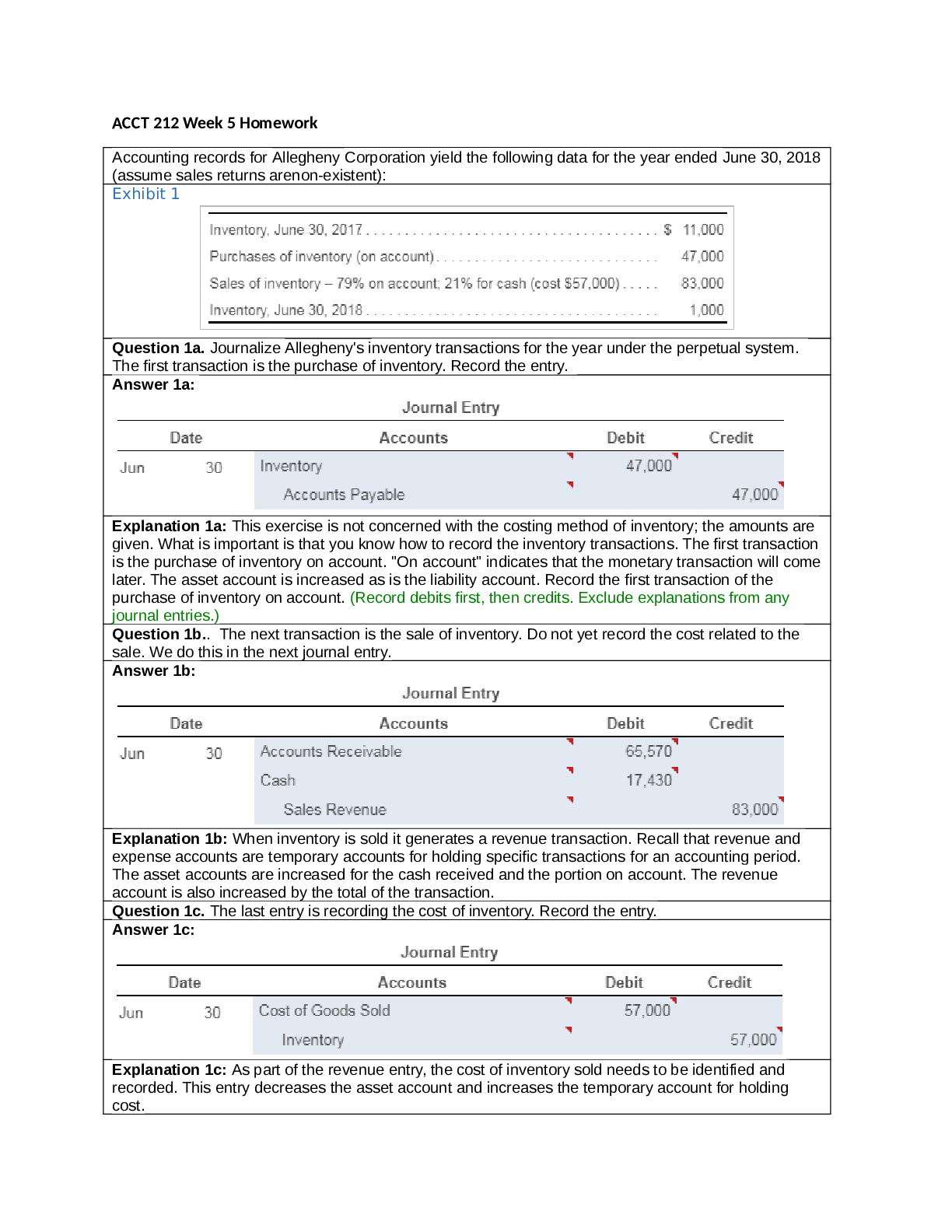

Question: Accounting records for Allegheny Corporation yield the following data for the year ended June 30, 2018(assume sales returns arenon-existent): Journalize Allegheny’s inventory transactions... for the year under the perpetual system.The first transaction is the purchase of inventory. Record the entry. The next transaction is the sale of inventory. Do not yet record the cost related to the sale. We do this in the next journal entry. The last entry is recording the cost of inventory. Record the entry. Report endinginventory, sales, cost of goods sold, and gross profit on the appropriate financial statement. Reportsales, cost of goods sold, and gross profit on the income statement: Question: KenCompany’s inventory records for its retail division show the following at March31. At March31, 11of these units are on hand.Compute cost of goods sold and ending inventory, using each of the following four inventory methods Calculate the cost of goods sold and ending inventory using the Specific Identification method with Seven$165 units and four$175 units still on hand at the end Now let’s calculate the the cost of goods sold and ending inventory using the Average cost method Now let’s calculate the cost of goods sold and ending inventory using the First-in, first-out(FIFO)method. Remember, KenCompany’s inventory records for its retail division show the following at March31. At March31, 11 of these units are on hand. Now let’s calculate the cost of goods sold using the Last-in, first-out(LIFO) method Which method produces the highest cost of goodssold? Which method produces the lowest cost of goods sold? What causes the difference in cost of goods sold? Question: The Dock side Shop had the following inventory data….. Company managers need to know the company’s gross profit percentage and rate of inventory turnover for 2018 under: FIFO LIFO Which method produces a higher gross profitpercentage? A higher inventory turnover? Question: The company sold 247 stoves,and at July 31, the ending inventory consisted of 53 stoves. The sales price of each stove was $44. Determine the cost of goods sold and ending inventory amounts for July under the average-cost, FIFO, and LIFO costing methods. Round the average cost per unit to two decimal places, and round all other amounts to the nearest dollar. Under the FIFO method, the first costs into inventory are the first costs assigned to cost of goods sold hence, the name first-in, first-out. Under FIFO, the cost of ending inventory is always based on the latest costs incurred. Calculate the cost of goods sold and under the LIFOmethod Explain why cost of goods sold is highest under LIFO. Be specific. Prepare Camp Surplus’income statement for Report gross profit. Operating expenses totaled $3,750. The company uses the average costing for inventory. The income tax rate is 32%. [Show More]

Last updated: 1 year ago

Preview 1 out of 13 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Feb 21, 2021

Number of pages

13

Written in

Additional information

This document has been written for:

Uploaded

Feb 21, 2021

Downloads

0

Views

114