Financial Accounting > EXAM > ACC 501 FINANCIAL ACCOUNTING AND ANALYSIS. COMPREHENSIVE QUESTIONS AND ANSWERS (All)

ACC 501 FINANCIAL ACCOUNTING AND ANALYSIS. COMPREHENSIVE QUESTIONS AND ANSWERS

Document Content and Description Below

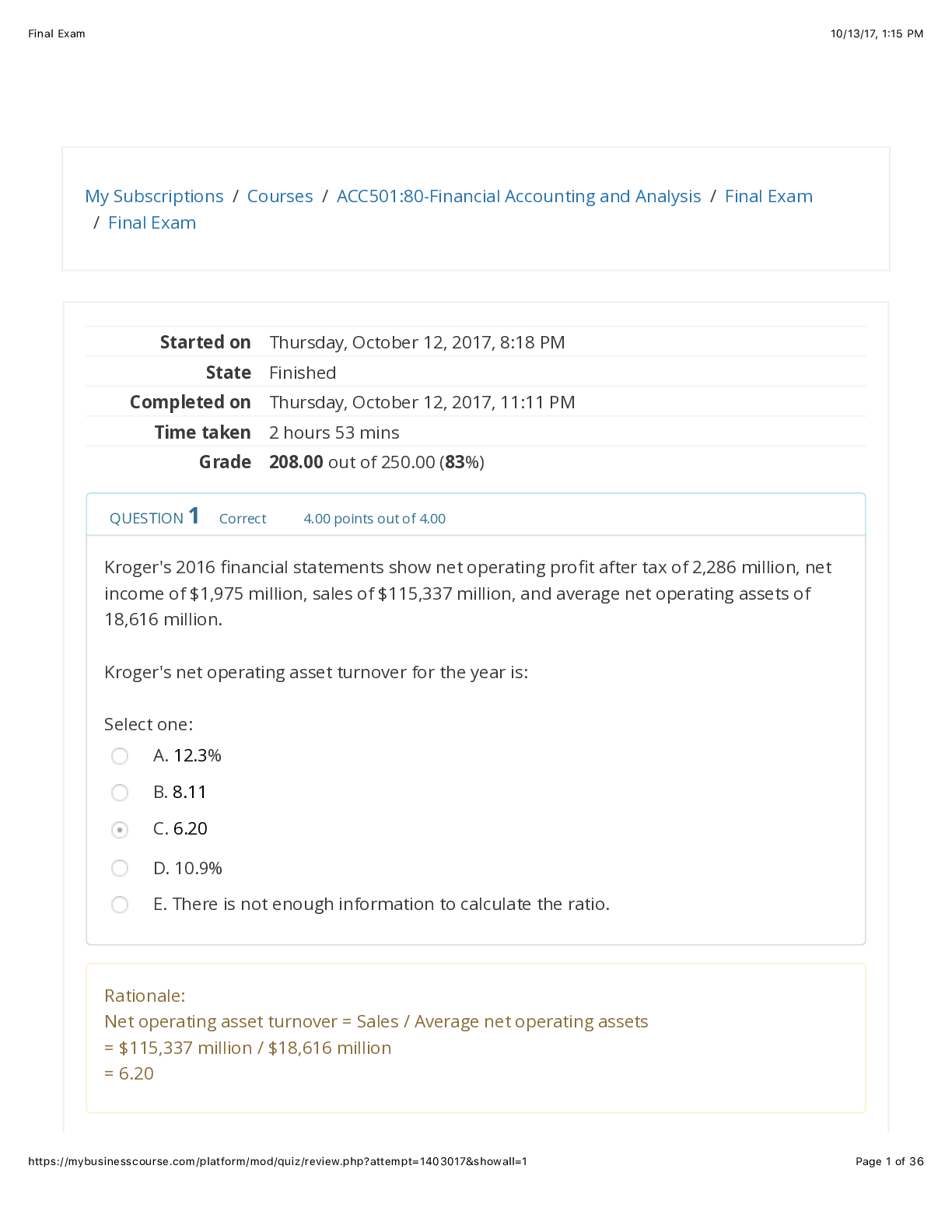

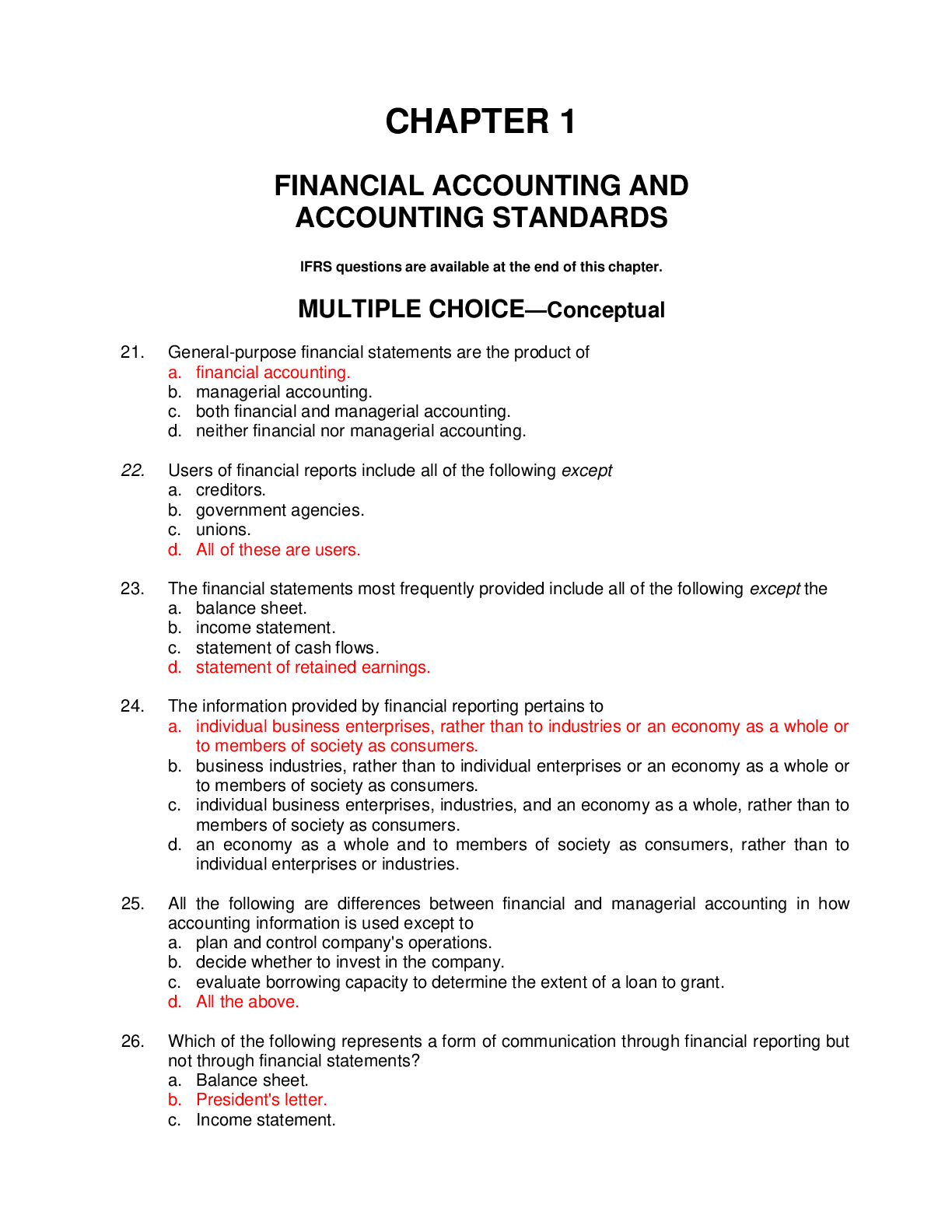

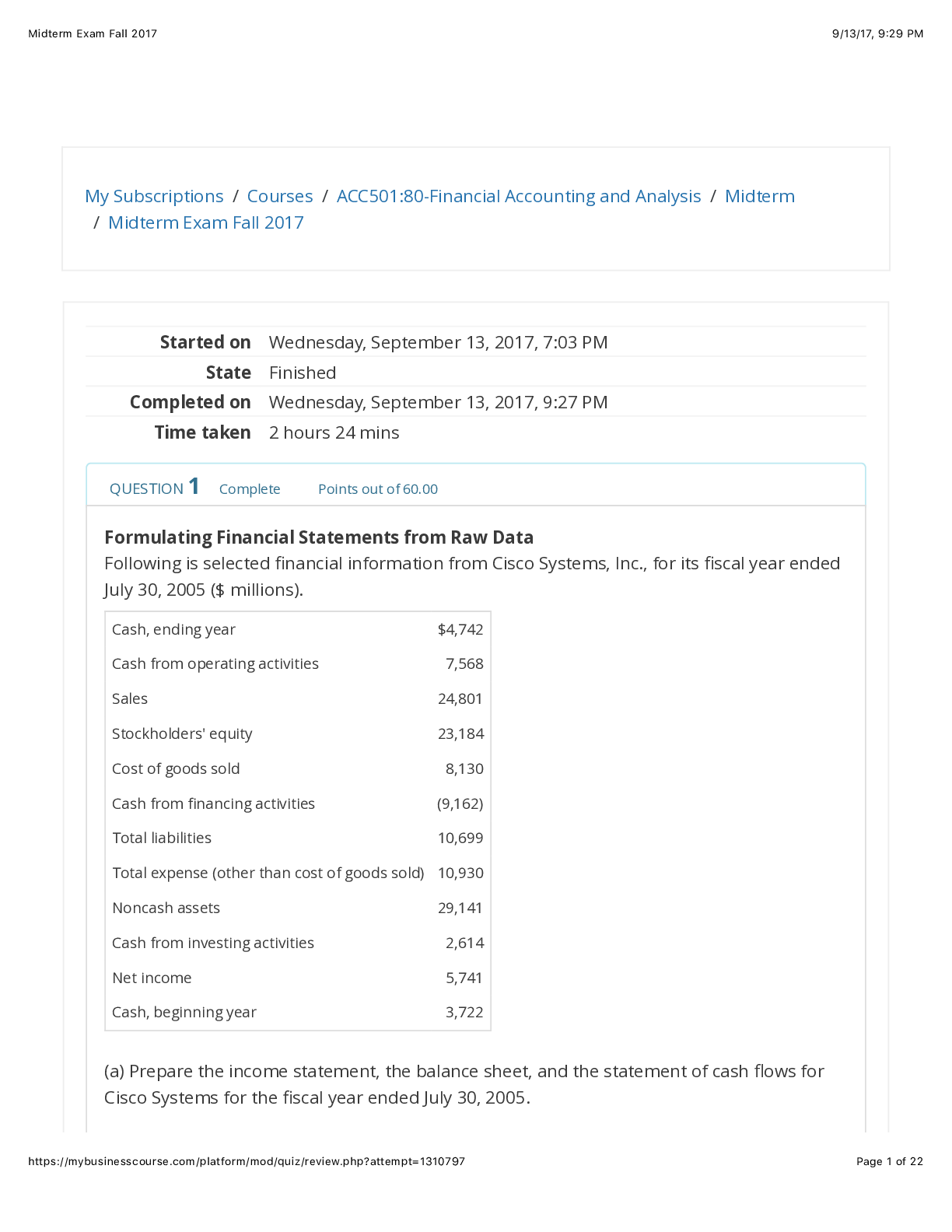

QUESTION 1 Complete Points out of 60.00 Formulating Financial Statements from Raw Data Following is selected financial information from Cisco Systems, Inc., for its fiscal year ended July 30, 20... 05 ($ millions). Cash, ending year $4,742 Cash from operating activities 7,568 Sales 24,801 Stockholders' equity 23,184 Cost of goods sold 8,130 Cash from financing activities (9,162) Total liabilities 10,699 Total expense (other than cost of goods sold) 10,930 Noncash assets 29,141 Cash from investing activities 2,614 Net income 5,741 Cash, beginning year 3,722 (a) Prepare the income statement, the balance sheet, and the statement of cash flows for Cisco Systems for the fiscal year ended July 30, 2005. Hint: Enter negative numbers only in answers for the statement of cash flows (if applicable). Cisco Systems, Inc Income Statement ($ millions) For Year Ended July 30, 2005 Revenue $ 24,801 Cost of goods sold 8,130 Gross profit 16,671 Total expenses 10,930 Net income $ 5,741 Cisco Systems, Inc Balance Sheet ($ millions) July 30, 2005 Assets Liabilities Cash $ 4,742 Total liabilities Stockholders' equity Total liabilities and equity $ 10,699 Noncash assets 29,141 23,184 Total assets $ 33,883 $ 33,883 Cash from operating activities $ Cash from financing activities (b) Does the negative amount for cash from financing activities concern us? Explain. A negative amount for cash from financing activities implies that the company is unable to pay its debts as they come due and should be interpreted negatively. A negative amount for cash from financing activities is the result of additional borrowings. Because the additional funds are invested in earnings-generating assets, this should be viewed positively. A negative amount for cash from financing activities implies that the market value of the company's long-term debt has declined and this change should be viewed negatively. A negative amount for cash from financing activities reflects the reduction of long-term debt, which is a positive sign of the company’s ability to retire debt obligations. (c) Using the statements prepared for part a. compute the following ratios (for this part only, use the year-end balance instead of the average for assets and stockholders' equity). Round all answers to two decimal places. For example, asset turnover is rounded like this: 0.34567 = 0.35; all other percentage ratios are rounded like this: 0.12345 = 12.35%. (i) Profit margin 23.15 % (ii) Asset turnover 0.73 (iii) Return on assets 16.94 % (iv) Return on equity 24.76 % Analyzing Transactions Using the Financial Statement Effects Template Following are selected transactions of Mogg Company. Record the effects of each using the financial statement effects template. Shareholders contribute $10,000 cash to the business in exchange for common stock. Employees earn $500 in wages that have not been paid at period-end. Inventory of $3,000 is purchased on credit. The inventory purchased in transaction 3 is sold for $4,500 on credit. The company collected the $4,500 owed to it per transaction 4. Equipment is purchased for $5,000 cash. Depreciation of $1,000 is recorded on the equipment from transaction 6. The Supplies account had a $3,800 balance at the beginning of this period; a physical count at period-end shows that $800 of supplies are still available. No supplies were purchased during this period. 9. The company paid $10,000 cash toward the principal on a note payable; also, $500 cash is paid to cover this note's interest expense for the period. 10. The company receives $8,000 cash in advance for services to be delivered next period. Use negative signs with your answers, when appropriate. Hint: For transaction 4, enter net effect amount for balance sheet answers. Balance Sheet Transaction Cash Asset + Noncash Assets = Liabilities + Contributed Capital + Earned Capital 1 10,000 0 = 0 10,000 0 2 0 0 = 500 0 (500) 3 0 3,000 = 3,000 0 0 4 0 1,500 = 0 0 1,500 5 4,500 (4,500) = 0 0 0 6 (5,000) 5,000 = 0 0 0 7 0 (1,000) = 0 0 (1,000) 8 = 0 (3,000) 0 0 (3,000) 9 (10,500) 0 = (10,000) 0 (500) 10 8,000 0 = 8,000 0 0 has been incurred, but no utility bill has yet been received or paid. (d) On the first day of the current period, rent for four periods was paid and recorded as a $2,800 debit to Prepaid Rent and a $2,800 credit to Cash. (e) Nine months ago, a one-year policy was sold to a customer and recorded the receipt of the premium by crediting Unearned Revenue for $1,248. No accounting adjustments have been prepared during the nine-month period. Allstate's annual financial statements are now being prepared. (f) At the end of the period, employee wages of $965 have been incurred but not paid or recorded. (g) At the end of the period, $300 of interest has been earned but not yet received or recorded. Use negative signs with answers, when appropriate. 0 2,800 28,000 936 0 936 0 965 965 300 0 300 Total assets $14,329.5 Total stockholders' equity 5,890.7 Total current liabilities 4,546.9 [Show More]

Last updated: 1 year ago

Preview 1 out of 23 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 04, 2021

Number of pages

23

Written in

Additional information

This document has been written for:

Uploaded

Mar 04, 2021

Downloads

0

Views

147