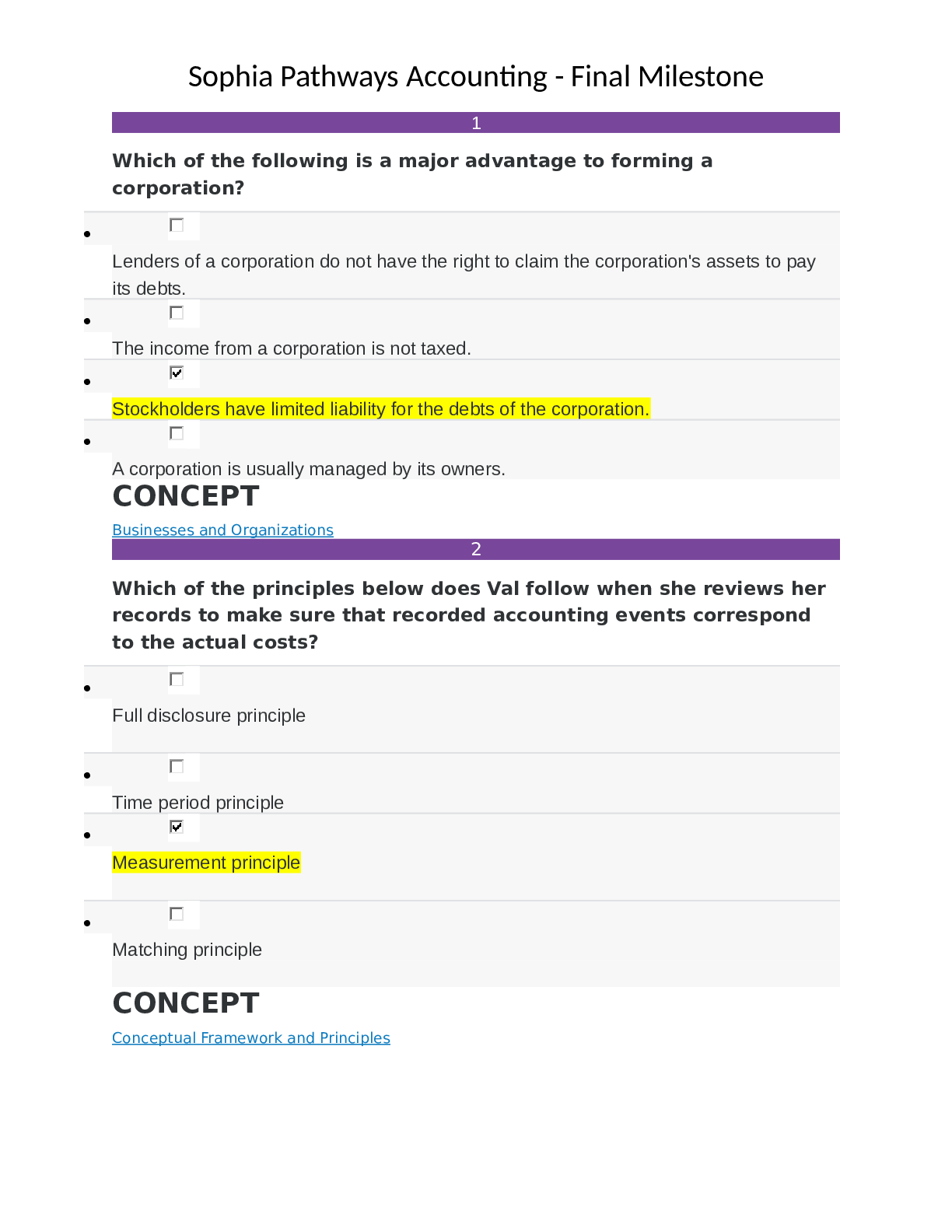

Financial Accounting > QUESTIONS & ANSWERS > Sophia Pathways Accounting - Final Milestone,100% CORRECT (All)

Sophia Pathways Accounting - Final Milestone,100% CORRECT

Document Content and Description Below

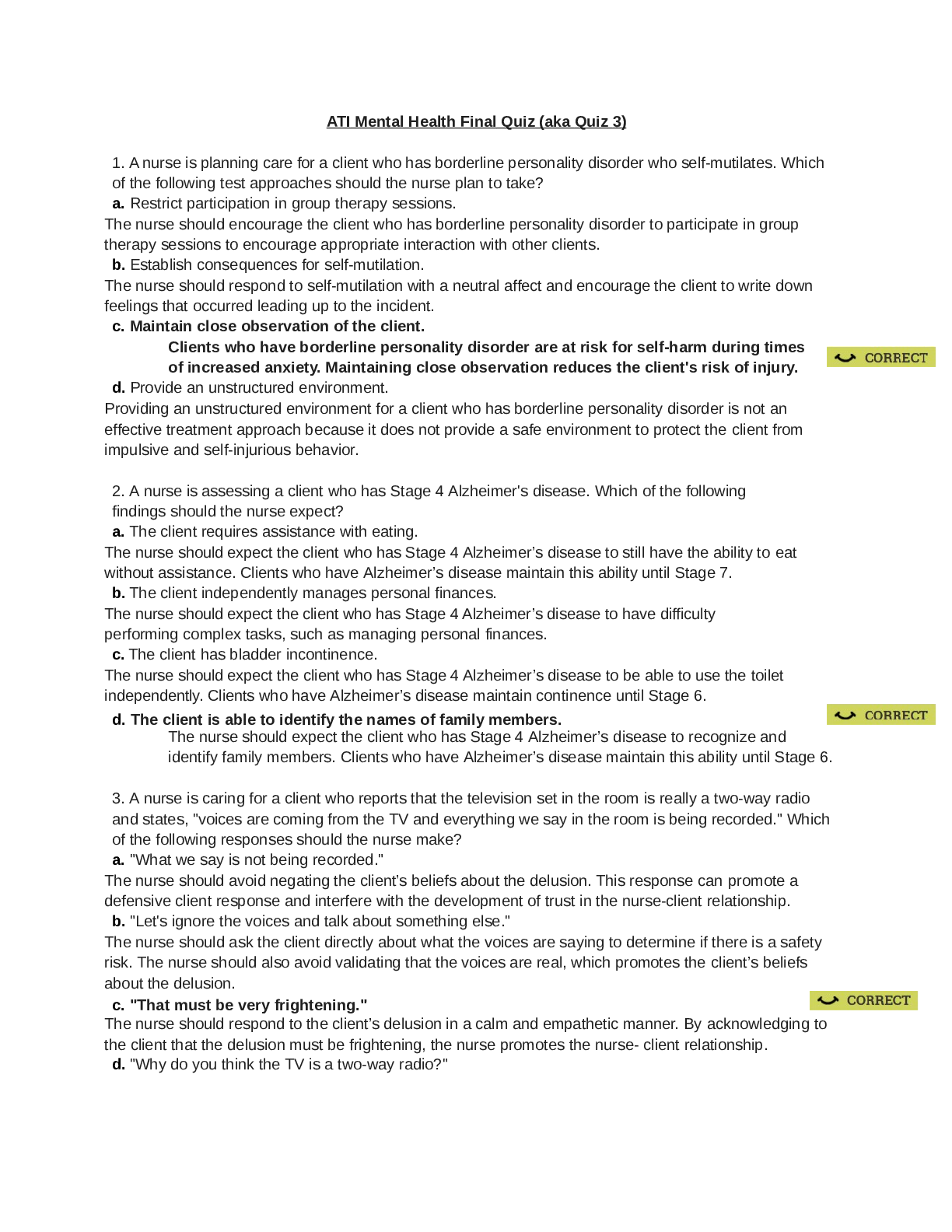

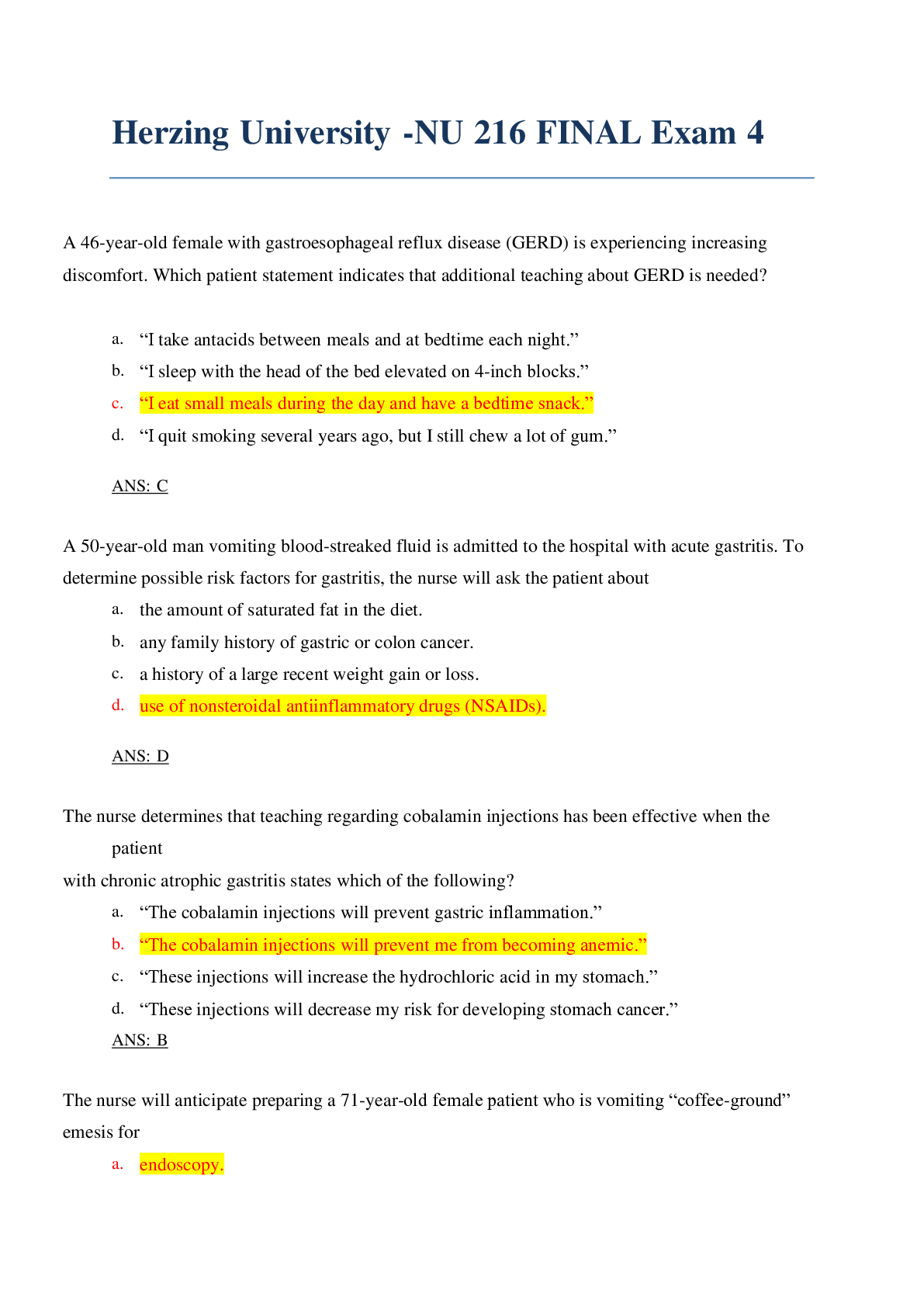

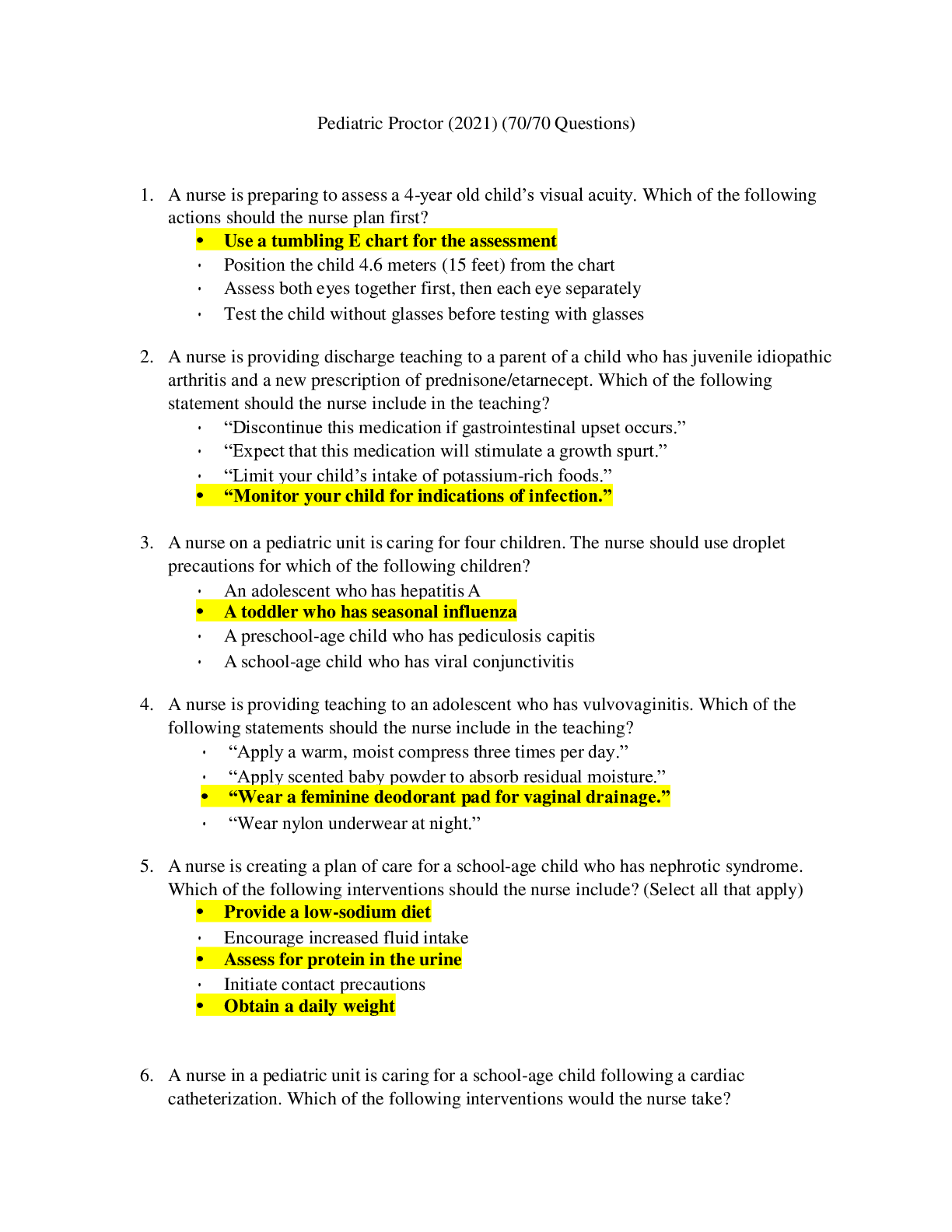

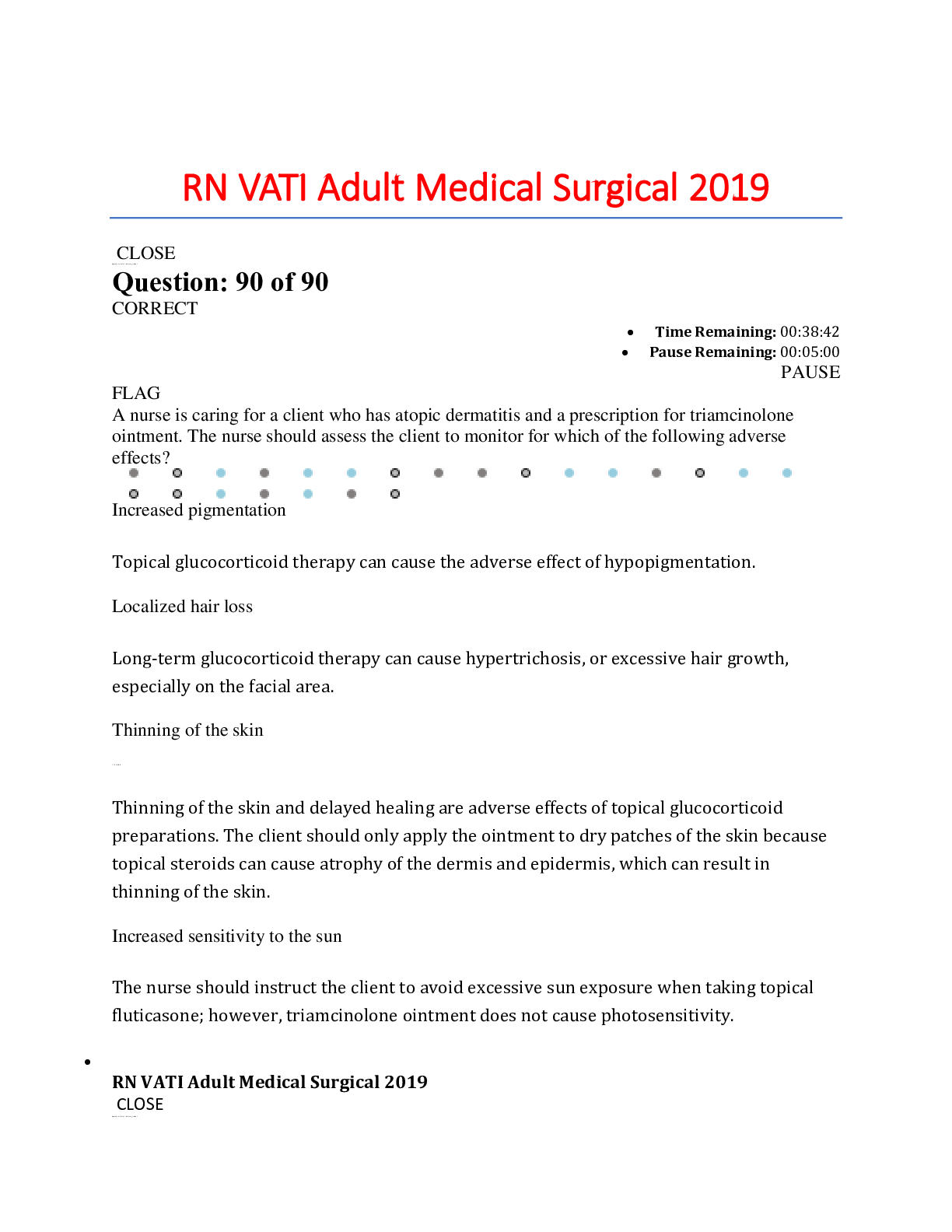

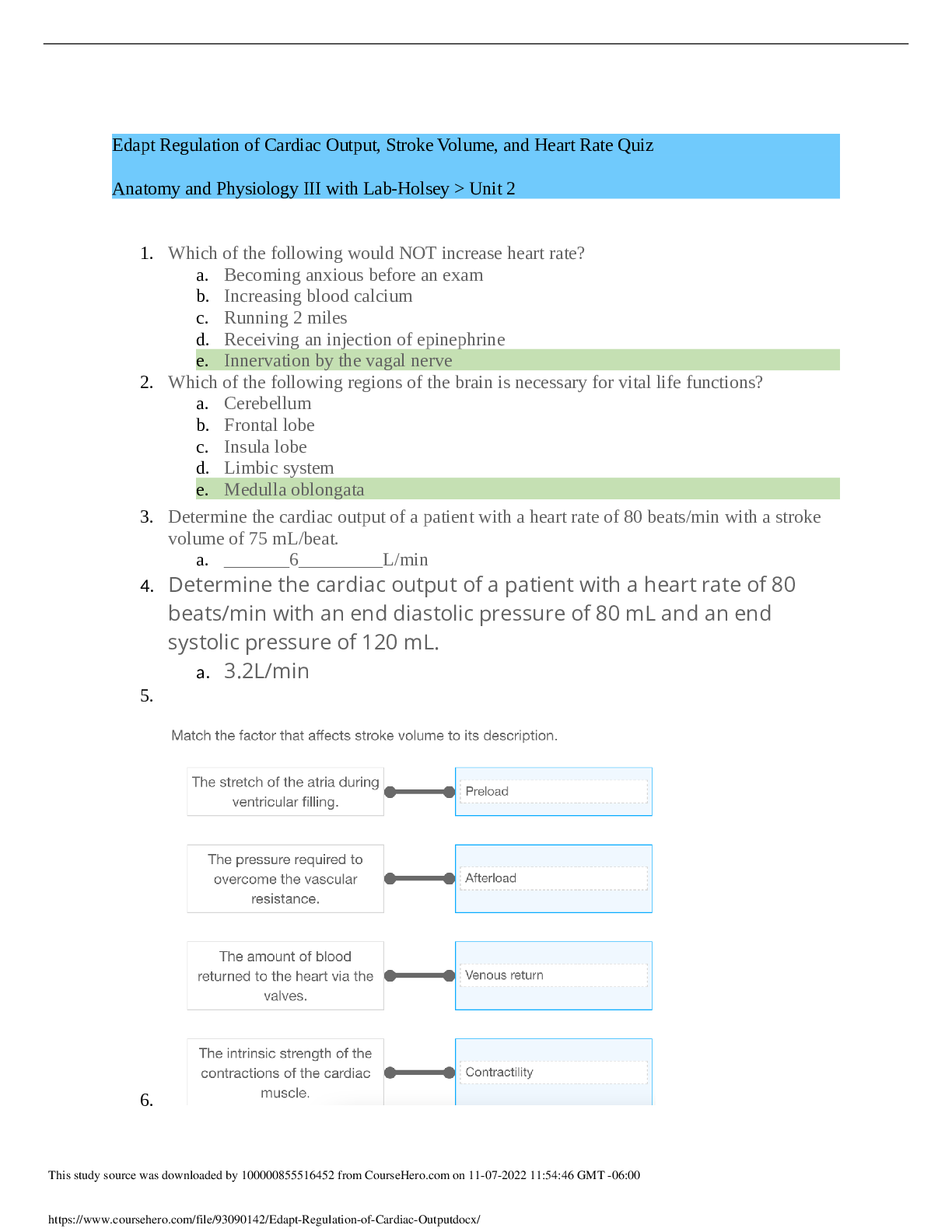

Which of the following is a major advantage to forming a corporation? • Lenders of a corporation do not have the right to claim the corporation's assets to pay its debts. • The income from a corpo... ration is not taxed. • Stockholders have limited liability for the debts of the corporation. • A corporation is usually managed by its owners. 2 Which of the principles below does Val follow when she reviews her records to make sure that recorded accounting events correspond to the actual costs? • Full disclosure principle • Time period principle • Measurement principle • Matching principle 3 The employees of Catherine's business earned $22,800 in wages during December, but the next payday is not until January 2nd. When Catherine makes an adjustment on her December 31st trial balance worksheet to account for these wages, what two types of accounts will be affected? • An asset account and an expense account • A payable account and a revenue account. • An expense account and a payable account • Owner's equity and a payable account 4 Which of the following is responsible for conducting an independent examination of a company's financial statements and records? • Bookkeeper • Stakeholder • Auditor • Controller 5 A car valued at $30,000 has $600 of depreciation to be adjusted as of January 31st. Which entry should be made? • Credit Accumulated Depreciation, Debit Depreciation Expense, both for $600 • Debit Accumulated Depreciation, Credit Car, both for $600 • Debit Accumulated Depreciation, Credit Depreciation Expense, both for $600 • Debit Car, Credit Depreciation, both for $600 6 Which of the following is NOT a temporary account? • Revenue • Expense • Drawings • Equity 7 Which of the following concerning unearned revenues is NOT true? • They are found on a balance sheet. • Adjusting entries are made at the end of a period to report unearned revenues. • They are receipts for services or products that will be performed or delivered at a future date. • They are recorded as a revenue account entry. 8 Which one of the businesses below would most likely use the FIFO method of inventory valuation? • Luxury car dealership • Produce stand • Petroleum company • Stone and brick company 9 Which of the amounts below is the total interest Scott will pay when he is approved for a 9-month loan at an interest rate of 2.9% for a new, $12,500 company car? • $259.89 • $282.54 • $264.63 • $271.88 10 Which of the following about inventory turnover is true? • It measures the number of times that the inventory is sold and replaced. • It measures the inventory that is bought and replaced. • It measures the number of times that the inventory is replaced. • It measures the inventory that is sold and replaced. 11 Money borrowed from a bank to purchase new machinery would be considered which of the following? • Equity • Liabilities • Revenue • Assets 12 Examine the partial balance sheet vertical analysis below. ASSETS Cash $97,500 15% Accounts Receivable $552,500 85% Total Assets $650,000 100% LIABILITIES Accounts Payable $78,000 12% Notes Payable _______ ____ Total Liabilities 50% EQUITY Total Equity $325,000 50% Based on the information shown, what is the correct amount and percentage of notes payable? • $247,000; 38% • $572,000; 88% • $325,000; 50% • $403,000; 62% 13 ABC Pipe Supply ordered inventory from a PVC pipe manufacturer. The terms of freight on the order acknowledgement specify that ABC Pipe Supply must take ownership of the order and pay the shipping costs when the order is loaded on the truck at the manufacturer's docks. Which FOB terms will be stated on the order acknowledgement? • FOB Destination • FOB Shipping Point • FOB In Transit • FOB 2% 10, Net 30 14 Which of the following allowances for bad debt should the company enter into their financials for an Accounts Receivable account with a balance of $50,000 if the company estimates that 1.9% of receivables will be uncollectible? • $950.00 • $1,025.00 • $9,500.00 • $10,250.00 15 Which of the steps in preparing a trial balance worksheet (below) will Joe complete next if he has already prepared an adjusted trial balance and an income statement? • Make adjusting entries • Prepare a balance sheet • Close out temporary accounts • Determine net income for the period 16 Which of the following examples can be classified as an accounts receivable? • The Animal Shop decided a goldfish could stay for a week and they'd be paid when itwas picked up. • The Animal Shop signed up for a new credit card to receive 0% financing for the first six months. • The building management company agreed that The Animal Shop could pay September's rent in October. • Due to an extra shipment, the Animal Shop had a special this week on kitty litter. 17 The organization responsible for analyzing how the government spends taxpayer dollars is the __________. • GAO • IRS • GASB • SEC 18 What are the total liabilities of John's Tackle if the total assets are $142,000 and the equity is $39,000? • $220,000 • $181,000 • $284,000 • $103,000 19 Based on this information in this partial income statement, what is the total of the Goods Available for Sale? • $83,000 • $90,000 • $65,300 • $87,800 20 Elijah currently has six strollers that he purchased for $235 each and four cribs that he purchased for $450 each on the floor of his baby supply store. He also has three strollers and two cribs in his storeroom. Using the weighted average cost method, what is the cost of each item being sold at Elijah's baby supply store? • $342.50 • $301.15 • $364.00 • $321.00 21 Beginning Assets Beginning Revenues Beginning Balance Liabilities Capital Added/Investment During the Period Net Income/Net Loss Drawings Expenses Ending Balance/Owner's Capital Which of the above accounts would be included in the Statement of Changes in Owner's Equity? • Beginning Revenues Expenses Ending Balance/Owner's capital • Beginning Balance Expenses Ending Balance/Owner's Capital • Beginning Balance Capital Added/Investment During the Period Net Income/Net Loss Drawings Ending Balance/Owner's Capital • Beginning Assets Capital Added/Investment During the Period Liabilities Ending Balance/Owner's Capital 22 Which inventory method was used to calculate cost of goods sold, based on the information above? • Weighted average • Specific ID • FIFO • LIFO 23 Which of the following kinds of companies would use a 990 tax form? • LLC • Non-profit • Sole proprietorship • LLP 24 Which of the following is NOT depreciated because it does not get used up? • Land • Automobiles • Land fixtures • Buildings 25 __________________ includes policies, procedures and mindset of top management. A tangible representation can be found in the employee handbook or annual statement. • Risk assessment • Control environment • Monitoring process • Control activity [Show More]

Last updated: 1 year ago

Preview 1 out of 15 pages

Instant download

Instant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 14, 2021

Number of pages

15

Written in

Additional information

This document has been written for:

Uploaded

Apr 14, 2021

Downloads

1

Views

104

.png)

.png)

.png)