Business > QUESTIONS & ANSWERS > GSCM 209 Final Exam, Latest complete solutions, already graded A. (All)

GSCM 209 Final Exam, Latest complete solutions, already graded A.

Document Content and Description Below

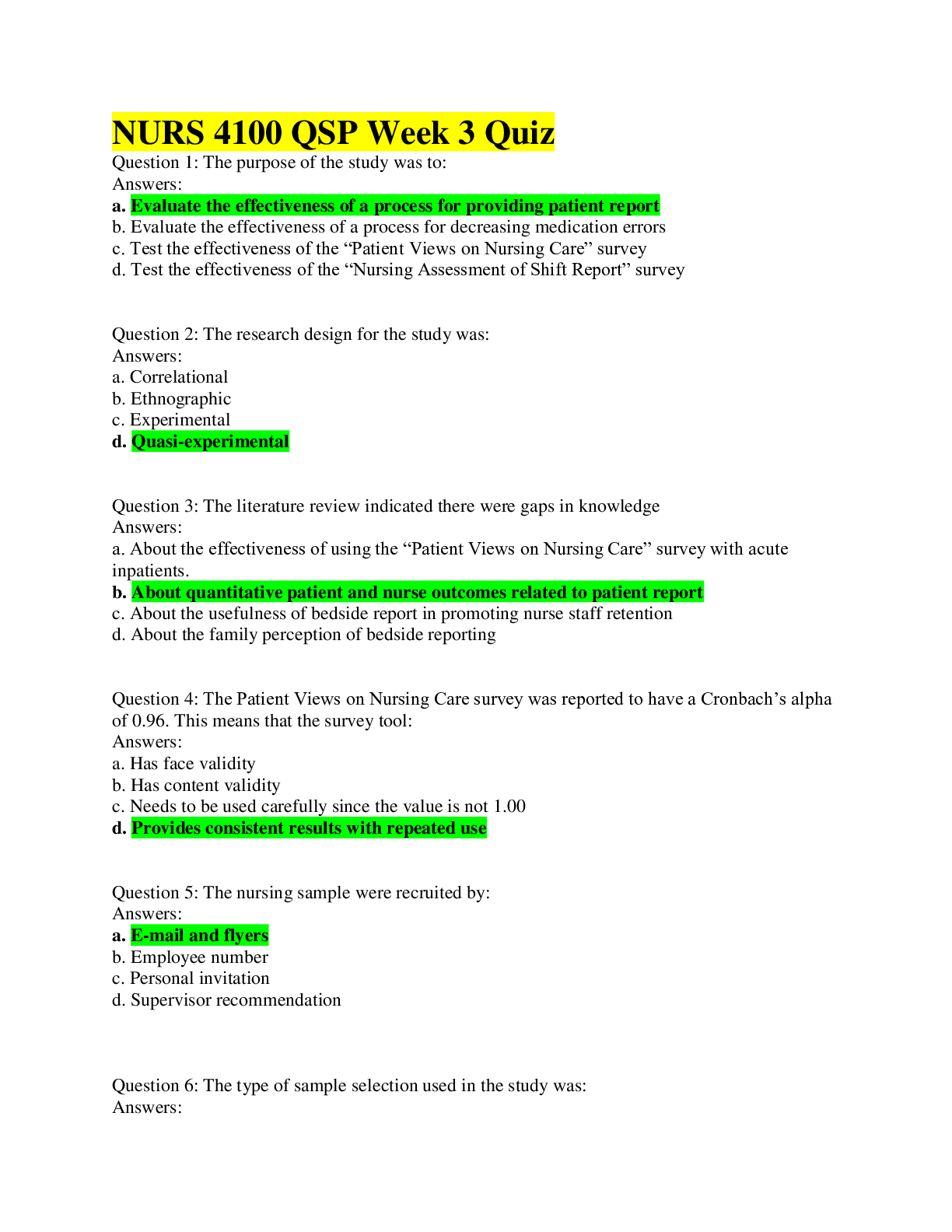

GSCM 209 Final Exam 1. (TCO 8) Name three of the measures of a queue’s performance.(Points : 15) 2. (TCOs 11 and 12) Describe the steps of the simplex method that follow setting up the initial ... tableau.(Points : 15) 3. (TCOs 15 and 16) List the two approaches to setting up a PERT or CPM network, and describe the difference between the two.(Points : 15) 4. (TCO 16) What is meant by the following statement? In PERT, we employ a probability distribution.(Points : 15) 5. (TCOs 3, 4, and 5) Define the term coefficient of correlation, and provide a possible explanation of finding a negative correlation between payroll and sales. (Points : 15) 6. (TCO 8) List the characteristics all waiting line models have in common.(Points : 15) 1. (TCO 9) What is sensitivity analysis and why is it important to a supply chain or operations manager?(Points : 20) 2. (TCO 10) Describe the corner-point method.(Points : 20) 3. (TCO 1) Describe the difference between qualitative and quantitative forecasting and provide an example of each.(Points : 30) 4. (TCO 2) The Tons of Fun Hobby Company general manager knows she can use sales and payroll data to do an estimated regression equation and forecast sales for next year. Her finance director gives her the following data table. Year Sales (millions) y Payroll (millions) x x2 xy 1 3 1 1 3 2 4 1.5 4 6 3 4 2 9 8 4 4.5 2.4 16 10.8 5 5 3 25 15 20.5 9.9 55 42.8 Ey Ex Ex2 Exy Define the regression equation she is able to deduce from the table, and calculate her year six sales forecast if Year 6 payroll is $3.1 million (please show your work). (Points : 30) 5. (TCOs 13 and 14) Consider the following decision table, which Sally Smith has developed for her firm, Production Enterprises. 6. Decision Probability 0.2 0.6 0.2 Alternatives Low Medium High A $60 $100 $85 B $65 $75 $85 C $80 $135 $90 D $70 $90 $50 E $70 $85 $75 Which decision alternative maximizes the expected value of the payoff? (Points : 30) 6. (TCO 6, 7) ZXY is going ahead on an expansion project. It will be able to earn $750 per hour and run 4,700 hours per year. What is the net present value for the next 5 years with an interest rate of 6%?(Points : 30) [Show More]

Last updated: 1 year ago

Preview 1 out of 10 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jun 28, 2020

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Jun 28, 2020

Downloads

0

Views

33

.png)

Week 8 Final Exam, Latest Questions and Answers with Explanations, All Correct Study Guide, Download to Score A.png)