Accounting > EXAM > University of Texas, ArlingtonACCT 23012301 exam1 2007-K (1) ( VERIFIED ANSWERS, 100% CORRECT ) (All)

University of Texas, ArlingtonACCT 23012301 exam1 2007-K (1) ( VERIFIED ANSWERS, 100% CORRECT )

Document Content and Description Below

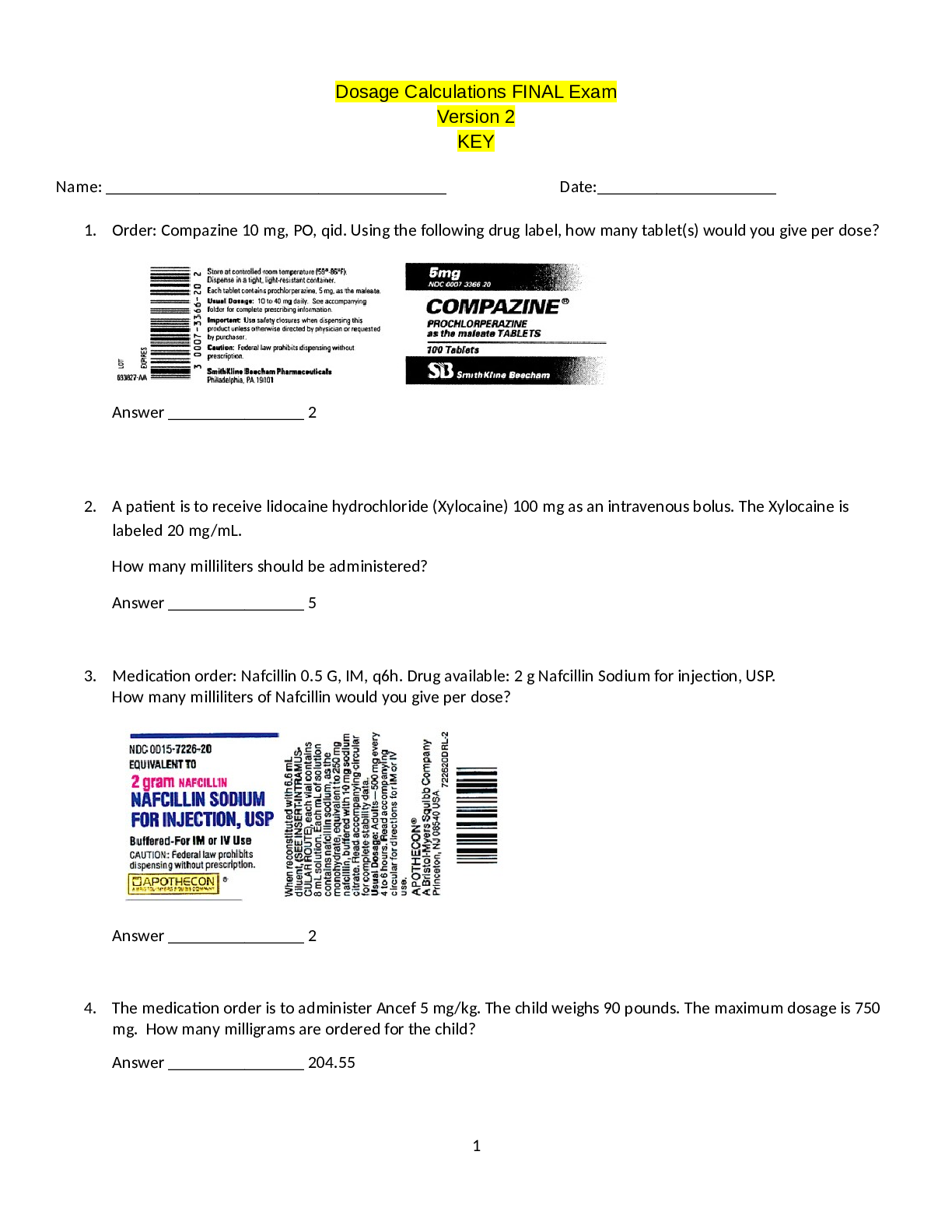

ACCT 2301, Exam 1 1. Which of the items below is not a business organization form? a. entrepreneurship b. proprietorship c. partnership d. corporation 2. An entity that is organized according ... to state or federal statutes and in which ownership is divided into shares of stock is a a. proprietorship b. corporation c. partnership d. governmental unit 3. Financial reports are used by a. management b. creditors c. investors d. all of the above 4. Which of the following best describes accounting? a. records economic data but does not communicate the data to users according to any specific rules b. is an information system that provides reports to stakeholders c. is of no use by individuals outside of the business d. is used only for filling out tax returns and for financial statements for various type of governmental reporting requirements 5. The two most common specialized fields of accounting in practice are a. forensic accounting and financial accounting b. managerial accounting and financial accounting c. managerial accounting and environmental accounting d. financial accounting and tax accounting systems 6. The initials GAAP stand for 1 a. General Accounting Procedures b. Generally Accepted Plans c. Generally Accepted Accounting Principles d. Generally Accepted Accounting Practices 7. The business entity concept means that a. the owner is part of the business entity b. an entity is organized according to state or federal statutes c. an entity is organized according to the rules set by the FASB d. the entity is an individual economic unit for which data are recorded, analyzed, and reported 8. Smith Company purchased $105,000 of computer equipment from Brown Company. Smith Company paid for the equipment using cash that had been obtained from the initial investment by Connie Smith. The transaction involving the computer equipment should be recorded on the accounting records of which of the following entities? a. Smith Company and Connie Smith's personal records b. Brown Company and Connie Smith's personal records c. Brown Company d. Smith Company and Brown Company 9. The objectivity principle requires that a. business transactions must be consistent with the objectives of the entity b. the Financial Accounting Standards Board must be fair and unbiased in its deliberations over new accounting standards c. accounting principles must meet the objectives of the Security and Exchange Commission d. amounts recorded in the financial statements must be based on independently verifiable evidence 10.The Reynolds Company estimated that the value of its land had increased from $10,000 to $16,000 and therefore wrote up the land account to $16,000. Which accounting concept(s) was (were) violated? a. cost concept b. objectivity concept c. all of the above d. none of the above 2 11. Assets are a. Always greater than liabilities. b. either cash or accounts receivables c. the same as expenses because they are acquired with cash d. financed by the owner and/or creditors 6 12. The accounting equation may be expressed as a. Assets = Equities - Liabilities b. Assets + Liabilities = Owner's Equity c. Assets = Revenues less Liabilities d. Assets - Liabilities = Owner's Equity 13. Expenses are recorded when a. cash is paid for services rendered b. a bill is received in advance of services rendered c. services are rendered d. none of the above 14. Goods purchased on account for future use in the business, such as supplies, are called a. prepaid liabilities b. revenues c. prepaid expenses d. liabilities Chapter 2 | DIF: 2 | OBJ: 0715. Revenue should be recognized when a. cash is received b. the service is performed c. the customer places an order d. the customer charges an order 16. Which of the following accounts is an owner's equity account? a. Cash 3 b. Accounts Payable c. Prepaid Insurance d. Julia Davis, Capital 17. A chart of accounts is a. the same as a balance sheet b. usually a listing of accounts in alphabetical order c. usually a listing of accounts in financial statement order d. used in place of a ledger 18. The debit side of an account a. depends on whether the account is an asset, liability or owner's equity b. can be either side of the account depending on how the accountant set up the system c. is the right side of the account d. is the left side of the account 19. An account is said to have a debit balance if a. the amount of the debits exceeds the amount of the credits b. there are more entries on the debit side than on the credit side c. its normal balance is debit without regard to the amounts or number of entries on the debit side d. the first entry of the accounting period was posted on the debit side 20. A debit may signify a(n) a. decrease in asset accounts b. decrease in liability accounts c. increase in the capital account d. decrease in the drawing account 21. Which of the following types of accounts have a normal credit balance? a. assets and liabilities b. liabilities and expenses c. revenues and liabilities d. capital and drawing 4 22. Which of the following groups of accounts have a normal debit balance? a. revenues, liabilities, capital b. capital, assets c. liabilities, expenses d. assets, expenses 23. Which of the following describes the classification and normal balance of the fees earned account? a. asset, credit b. liability, credit c. owner's equity, debit d. revenue, credit 24. The classification and normal balance of the drawing account is a. an expense with a credit balance b. an expense with a debit balance c. a liability with a credit balance d. owner's equity with a debit balance 25. In which of the following types of accounts are increases recorded by debits? a. assets, liabilities b. drawing, liabilities c. expenses, liabilities d. assets, expenses Chapter 3 | DIF: 1 | OBJ: 0326. Using accrual accounting, revenue is recorded and reported only a. when cash is received without regard to when the services are rendered b. when the services are rendered without regard to when cash is received c. when cash is received at the time services are rendered d. if cash is received after the services are rendered 27. Using accrual accounting, expenses are recorded and reported only a. when they are incurred, whether or not cash is paid 5 b. when they are incurred and paid at the same time c. if they are paid before they are incurred d. if they are paid after they are incurred 28. If the effect of the debit portion of an adjusting entry is to increase the balance of an expense account, which of the following describes the effect of the credit portion of the entry? a. decreases the balance of an owner's equity account b. increases the balance of an liability account c. increases the balance of an asset account d. decreases the balance of an expense account 29. The primary difference between deferred and accrued expenses is that deferred expenses have a. been incurred and accrued expenses have not b. not been incurred and accrued expenses have been incurred c. been recorded and accrued expenses have not been incurred d. not been recorded and accrued expenses have been incurred 30. The balance in the prepaid rent account before adjustment at the end of the year is $15,000, which represents three months' rent paid on December 1. The adjusting entry required on December 31 is a. debit Rent Expense, $5,000; credit Prepaid Rent, $5,000 b. debit Prepaid Rent, $10,000; credit Rent Expense, $5,000 c. debit Rent Expense, $10,000; credit Prepaid Rent, $5,000 d. debit Prepaid Rent, $5,000; credit Rent Expense, $5,000 31. A business pays weekly salaries of $20,000 on Friday for a five-day week ending on that day. The adjusting entry necessary at the end of the fiscal period ending on Thursday is a. debit Salaries Payable, $16,000; credit Cash, $16,000 b. debit Salary Expense, $16,000; credit Drawing, $16,000 c. debit Salary Expense, $16,000; credit Salaries Payable, $16,000 32. The adjusting entry to record the depreciation of equipment for the fiscal period is a. debit Depreciation Expense; credit Equipment 6 b. debit Depreciation Expense; credit Accumulated Depreciation c. debit Accumulated Depreciation; credit Depreciation Expense d. debit Equipment; credit Depreciation Expense 33. Data for an adjusting entry described as "accrued wages, $2,020" means to debit a. Wages Expense and credit Wages Payable b. Wages Payable and credit Wages Expense c. Accounts Receivable and credit Wages Expense d. Drawing and credit Wages Payable 34. Supplies are recorded as assets when purchased. Therefore, the credit to supplies in the adjusting entry is for the amount of supplies a. that are in the ending balance b. purchased c. used d. either used or remaining ANS: C DIF: 2 OBJ: 03 35. The general term employed to indicate an expense that has not been paid and has not yet been recognized in the accounts by a routine entry is a. capital b. deferral c. accrual d. inventory 36. The cost of office supplies to be used in future periods is ordinarily shown on the balance sheet as a(n) a. capital b. asset c. contra asset d. liability 37. The unearned rent account has a balance of $40,000. If $3,000 of the $40,000 is unearned at the end of the accounting period, the amount of the adjusting entry is a. $3,000 b. $40,000 c. $37,000 7 d. $43,000 Chapter 4 38. A work sheet includes columns for a. adjusting entries b. closing entries c. reversing entries d. both a and b 39. When a work sheet is complete, the adjustment columns should have a. total credits greater than total debits if a net income was earned b. total debits grater than total credits if a net loss was incurred c. total debits greater than total credits if a net income was earned d. total debits equal total credits 40. The difference between the totals of the debit and credit columns of the Adjusted Trial Balance columns on a work sheet a. is the amount of net income or loss b. indicates there is an error on the work sheet c. is not unusual when preparing the work sheet d. is the net difference between revenue, expenses, and drawing NS: B DIF: 2 OBJ: 0241. Net income appears on the work sheet in the a. debit column of the Balance Sheet columns b. debit column of the Adjustments columns c. debit column of the Income Statement columns d. credit column of the Income Statement columns 42. A net loss appears on the work sheet in the a. debit column of the Balance Sheet columns b. credit column of the Balance Sheet columns c. debit column of the Income Statement columns d. credit column of the Adjustments columns ANS: A DIF: 2 OBJ: 02 8 43. The work sheet at the end of September has $4,000 in the Balance Sheet credit column for Accumulated Depreciation. The work sheet at the end of October has $4,750 in the Balance Sheet credit column for Accumulated Depreciation. What was the amount of the depreciation expense adjustment for the month of October? a. amount can not be determined b. $4,750 c. $4,000 d. $750 44. After all of the account balances have been extended to the Balance Sheet columns of the work sheet, the totals of the debit and credit columns are $25,250 and $21,825, respectively. What is the amount of net income or net loss for the period? a. $3,425 net income b. $25,250 net loss c. $3,425 net loss d. $21,825 net income 45. After all of the account balances have been extended to the Income Statement columns of the work sheet, the totals of the debit and credit columns are $87,500 and $98,300, respectively. What is the amount of the net income or net loss for the period? a. $10,800 net income b. $10,800 net loss c. $98,300 net income d. $87,500 net loss 46. Unearned Fees appear on the a. balance sheet in the current assets section b. balance sheet as a current liability c. balance sheet in the owner's equity section d. income statement as revenue 47. Which one of the fixed asset accounts listed below will not have a related contra asset account? a. Office Equipment b. Land c. Delivery Equipment d. Building 48. Balance sheet accounts a. represent amounts accumulated during a specific period of time b. are called real accounts c. have zero balances after the closing entries have been posted d. are equal to assets and liabilities 49. Adjusting entries a. need not be journalized since they appear on the work sheet b. need not be posted if the financial statements are prepared from the work sheet c. are not needed if reversing entries are prepared d. must be journalized and posted 50. Which of the following accounts should be closed to Income Summary at the end of the fiscal year? a. Supplies Expense b. Accumulated Depreciation c. Prepaid Insurance d. Unearned Rent [Show More]

Last updated: 1 year ago

Preview 1 out of 10 pages

Instant download

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jun 11, 2021

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Jun 11, 2021

Downloads

0

Views

44

.png)

.png)

.png)