Business > QUESTIONS & ANSWERS > Chapter_09_-_Taxation_of_International_Transactions-TESTBANK-GRADED A+ (All)

Chapter_09_-_Taxation_of_International_Transactions-TESTBANK-GRADED A+

Document Content and Description Below

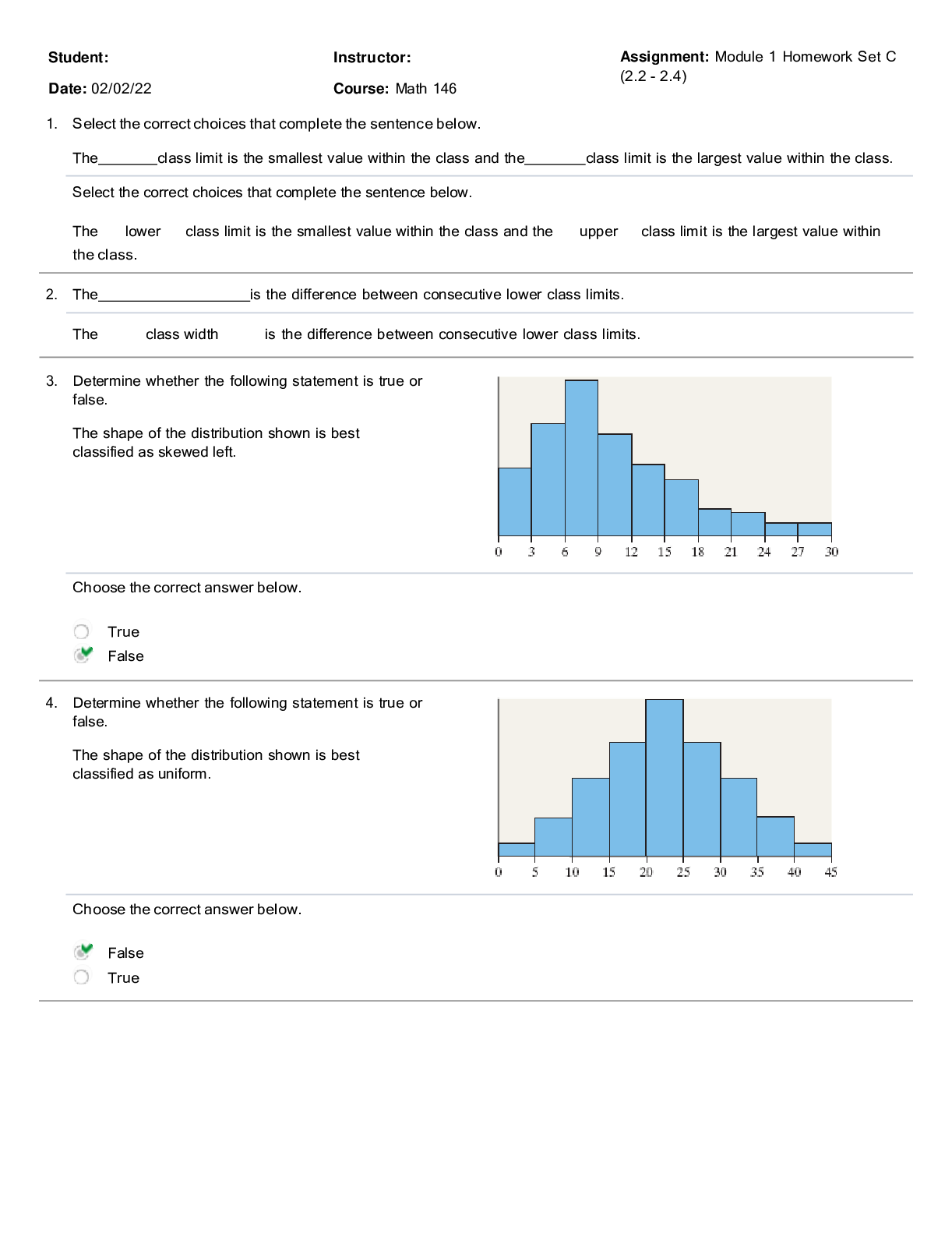

CHAPTER 9: TAXATION OF INTERNATIONAL TRANSACTIONS 1. The United States has in force income tax treaties with about 70 countries. a. True b. False ANSWER: True RATIONALE: The United States has bil... ateral treaties with many countries. 2. Income tax treaties may provide for either higher or lower withholding tax rates on interest income than the rate provided under U.S. statutory law. a. True b. False ANSWER: False RATIONALE: Tax treaties only reduce the interest withholding rate. 3. Interest paid to an unrelated party by a domestic corporation that historically earns more than 50% of its gross income each year from the conduct of an active trade or business outside the United States is foreign-source income. a. True b. False ANSWER: False RATIONALE: Interest income received from the U.S. government, or the District of Columbia, and from noncorporate U.S. residents or domestic corporations generally is sourced within the United States. The 80% foreign business requirement pertains to the sourcing of interest paid by a domestic corporation doing business outside the United States. 4. Dividends received from Murdock Corp., a corporation organized in Sustenato that earns 70% of its income from U.S. business activities, are 70% U.S.-source income. a. True b. False ANSWER: True RATIONALE: A portion of dividends received from foreign corporations are treated as U.S.-source income if the foreign corporation has 25% or more of its gross income for the immediately preceding three tax years effectively connected with the conduct of a U.S. trade or business, to the extent of such dividends times a ratio equal to the effectively connected U.S. income for the threeyear period over the total gross income for the three-year period. Although U.S.-source, such dividends typically are exempt from withholding tax.Chapter 9: Taxation of International Transactions 5. Serena, a nonresident alien, is employed by GlobalCo, a foreign corporation. Serena works in the United States for 3 days during the year, receiving a gross salary of $2,500 for this period. GlobalCo is not engaged in a U.S. trade or business. Under the “commercial traveler” exception, the $2,500 is not classified as U.S.- source income. a. True b. False ANSWER: True RATIONALE: The “commercial traveler” exception applies. Serena is in the United States for less than 90 days and earns less than $3,000, working for a foreign employer. 6. PlantCo is a company based in Adagio. PlantCo uses a formula to manufacture pharmaceuticals. The formula was developed and is owned by DrugCo, a U.S. entity. Royalties paid by PlantCo to DrugCo for the use of the formula are U.S.-source income. a. True b. False ANSWER: False RATIONALE: The source of income received for the use of intangible property is the country in which the property is used. 7. Julio, a nonresident alien, realizes a gain on the sale of commercial real estate located in Omaha. The real estate was sold to Mariana, Julio’s cousin who is also a nonresident alien. Julio recognizes foreignsource income from the sale because his home country is not the U.S. a. True b. False ANSWER: False RATIONALE: The source of income from the sale of real estate is determined by where the real estate is located. 8. The “residence of seller” rule is used in determining the sourcing of all gross income and deductions of a U.S. multinational business. a. True b. False ANSWER: False RATIONALE: There are numerous exceptions to the residence of seller rule. 9. A U.S. business conducts international communications activities between the U.S. and Spain. The resulting income is sourced 100% to the U. S., the residence of the taxpayer. a. True b. False ANSWER: False RATIONALE: Income from international communications activities earned by a U.S. person is sourced 50% in the United States when the transmission is between the United States and a foreign country.Chapter 9: Taxation of International Transactions 10. The sourcing rules of Federal income taxation apply to deductions as well as to income items. a. True b. False ANSWER: True RATIONALE: Deductions and losses are allocated and apportioned between U.S.- and foreign-source gross income. 11. In allocating interest expense between U.S. and foreign sources, a taxpayer elects to use either the tax basis of the income-producing assets or their fair market values. a. True b. False ANSWER: True RATIONALE: The taxpayer can elect to use either method. 12. The IRS can use § 482 reallocations to assure that transactions between related parties are properly reflected in a tax return. a. True b. False ANSWER: True 13. A Qualified Business Unit of a U.S. corporation that operates in Germany generally uses the Euro as its functional currency. a. True b. False ANSWER: True RATIONALE: A QBU usually uses the local currency as its functional currency. 14. When a business taxpayer “goes international,” the first step usually is to create an overseas branch sales office. a. True b. False ANSWER: False RATIONALE: The first steps usually are to make export sales and to license domestic property overseas. 15. LocalCo merges into HeirCo, a nonU.S. entity, in a transaction that would qualify as a “Type A” reorganization. The resulting realized gain is taxdeferred under U.S. income tax law, using §§ 351 and 368. a. True b. False ANSWER: Fal [Show More]

Last updated: 1 year ago

Preview 1 out of 52 pages

Instant download

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jul 22, 2021

Number of pages

52

Written in

Additional information

This document has been written for:

Uploaded

Jul 22, 2021

Downloads

0

Views

16

.png)

.png)