Accounting > QUESTIONS & ANSWERS > ACCT 304 final Exam|acct304 final exam > Latest spring 2020/2021; Rated 100% by other students. (All)

ACCT 304 final Exam|acct304 final exam > Latest spring 2020/2021; Rated 100% by other students.

Document Content and Description Below

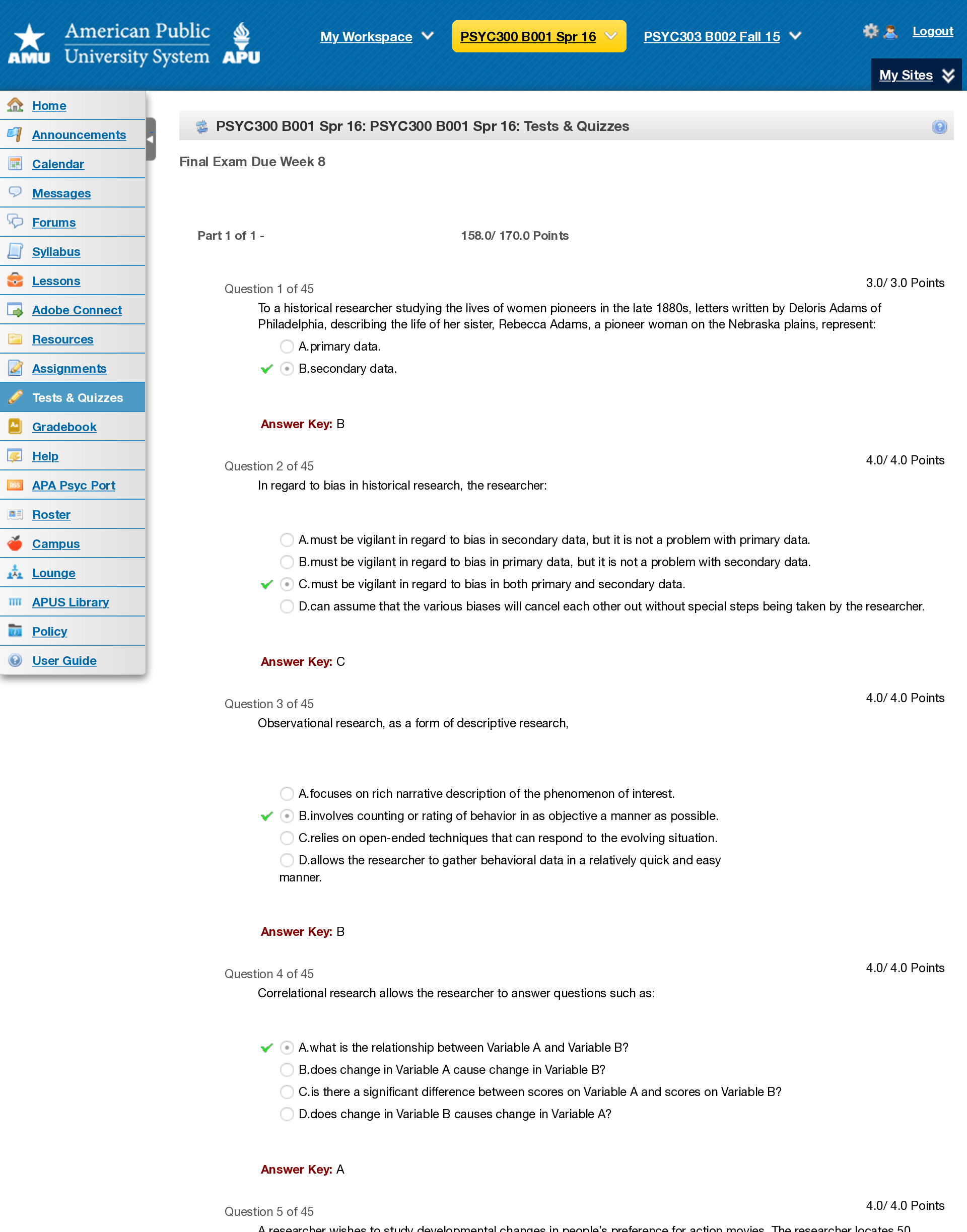

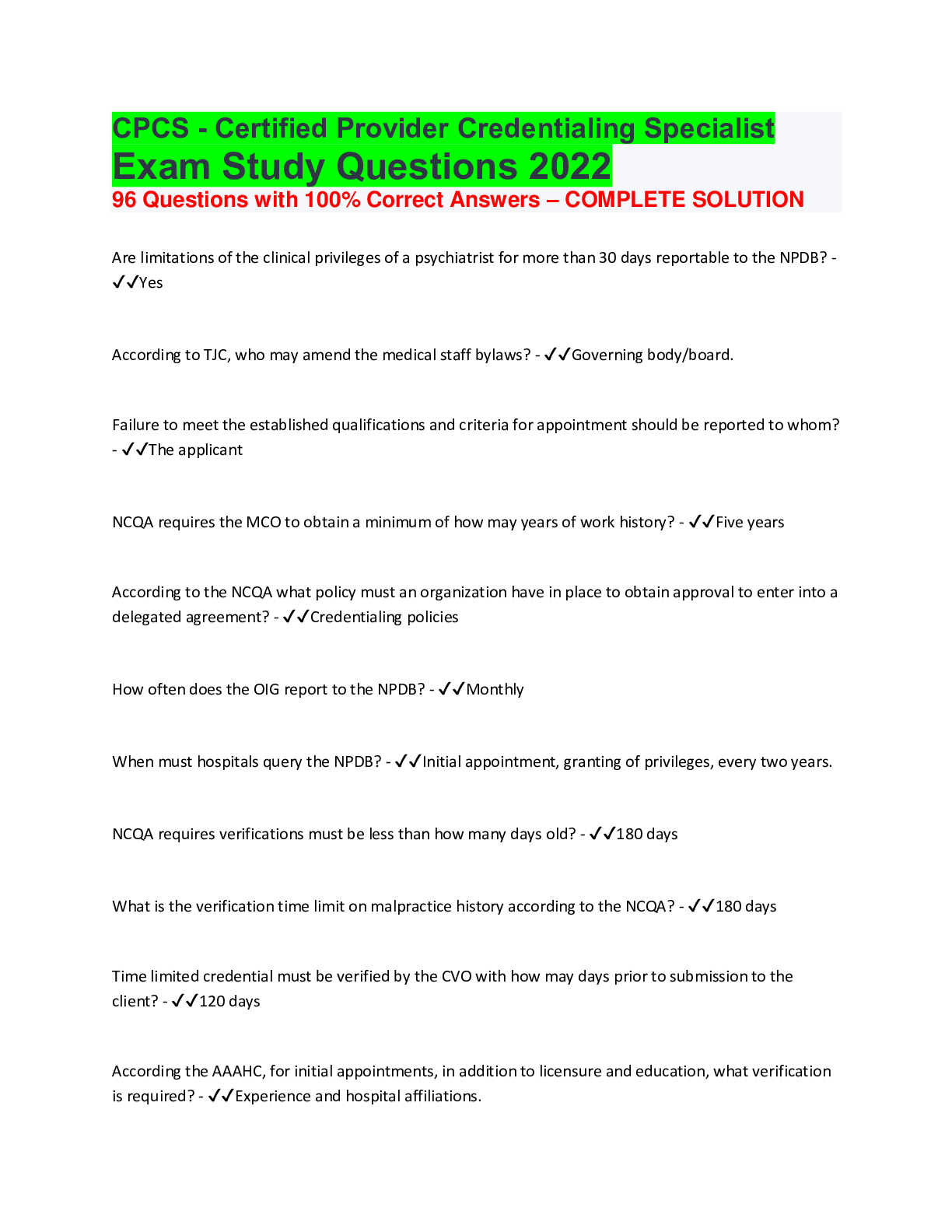

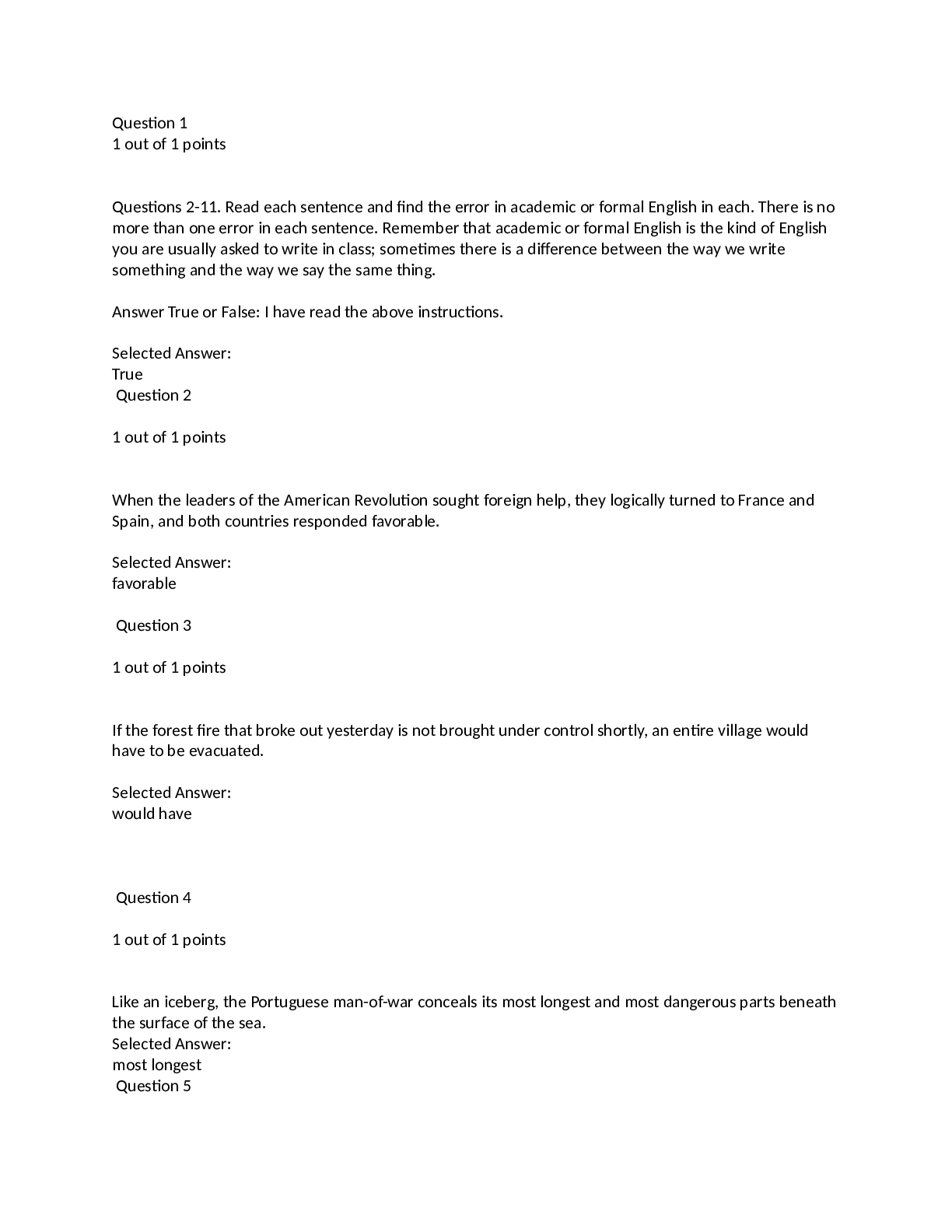

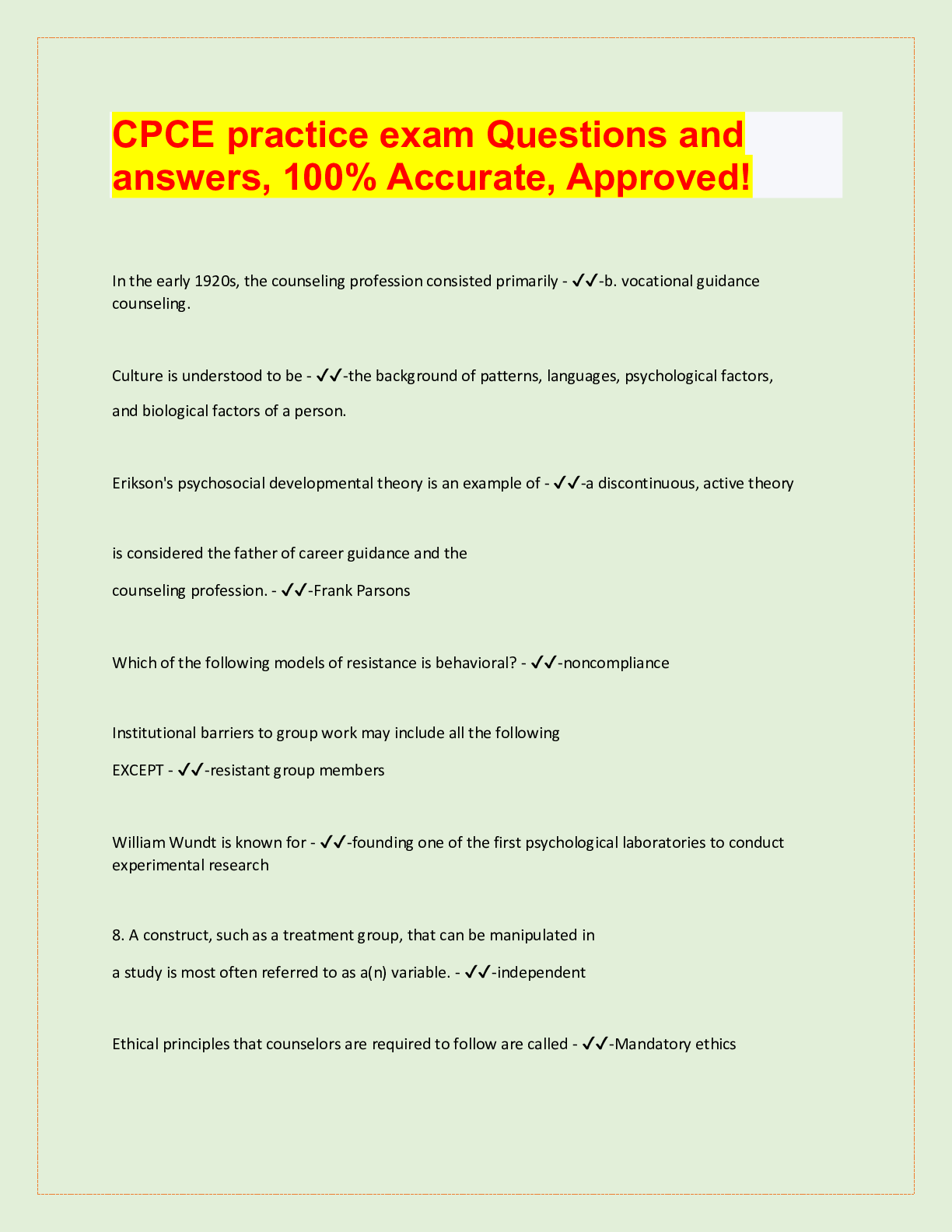

ACCT 304 final Exam acct304 final exam Question 1.1. (TCO 1) The SEC issues accounting standards in the form of (Points : 6) accounting research bulletins. financial reporting releases. financial acco... unting standards. financial technical bulletins. Question 2.2. (TCO 1) When a registrant company submits its annual filing to the SEC, it uses (Points : 6) Form 10-A. Form 10-K. Form 10-Q. Form S-1. Question 3.3. (TCO 2) The conceptual framework’s qualitative characteristic of relevance includes (Points : 6) predictive value. verifiability. completeness. neutrality. Question 4.4. (TCO 2) Enhancing qualitative characteristics of accounting information include each of the following, except (Points : 6) timeliness. materiality. comparability. verifiability. Question 5.5. (TCO 3) A sale on account would be recorded by (Points : 6) debiting revenue. crediting assets. crediting liabilities. debiting assets. Question 6.6. (TCO 3) Prepayments occur when (Points : 6) cash flow precedes expense recognition. sales are delayed pending credit approval. customers are unable to pay the full amount due when goods are delivered. manufactured goods await quality control inspections. Question 7.7. (TCO 4) An asset that is not expected to be converted to cash or consumed within 1 year or the operating cycle is (Points : 6) goodwill. accounts receivable. inventory. supplies. Question 8.8. (TCO 4) Which of the following is never a current liability account? (Points : 6) Accrued payroll Dividends payable Prepaid rent Subscriptions collected in advance Question 9.9. (TCO 5) The distinction between operating and nonoperating income relates to (Points : 6) continuity of income. principal activities of the reporting entity. consistency of income stream. reliability of measurements. Question 10.10. (TCO 5) On May 1, Foxtrot Co. agreed to sell the assets of its Footwear Division to Albanese Inc. for $80 million. The sale was completed on December 31, 2012. The following additional facts pertain to the transaction: The Footwear Division qualifies as a component of the entity, according to GAAP, regarding discontinued operations. The book value of Footwear’s assets totaled $48 million on the date of the sale. Footwear’s operating income was a pre-tax loss of $10 million in 2012. Foxtrot’s income tax rate is 40%. In the 2012 income statement for Foxtrot Co., it would report (Points : 6) income (loss) on its total operations for the year without separation. income (loss) on its continuing operation only. income (loss) from its continuing and discontinued operations separately. income and gains separately from losses. Question 11.11. (TCO 5) Operating cash outflows would include (Points : 6) purchase of investments. purchase of equipment. payment of cash dividends. purchases of inventory. Question 12.12. (TCO 5) The FASB’s stated preference for reporting operating cash flows is the (Points : 6) indirect method. direct method. working capital method. all financial resources method. Question 13.13. (TCO 5) Merchandise sold FOB shipping point indicates that (Points : 6) the seller pays the freight. the buyer holds title after the merchandise leaves the seller’s location. the common carrier holds title until the merchandise is delivered. the sale is not consummated until the merchandise reaches the point to which it is being shipped. Question 14.14. (TCO 5) Todd Sweeney is an artist who sells his work under consignment. (He displays his work in local barbershops, and customers buy the work there.) Sweeney recently transferred a painting to a local barbershop. After Sweeney has transferred a painting to a barbershop, the painting (Points : 6) should be counted in Sweeney’s inventory until the barbershop sells it. should be counted in the barbershop’s inventory, as they now possess it. should be counted in either Sweeney’s or the barbershop’s inventory, depending on which incurred the cost of preparing the painting for display. None of the above Question 15.15. (TCO 6) Reba wishes to know how much money would be in her savings account if she deposits a given sum in an account and leaves it there at 6% interest for 5 years. She should use a table for the (Points : 6) future value of an ordinary annuity of 1. future value of 1. future value of an annuity of 1. present value of an annuity due of 1. Question 16.16. (TCO 6) Loan A has the same original principal, interest rate, and payment amount as Loan B. However, Loan A is structured as an annuity due, while Loan B is structured as an ordinary annuity. The maturity date of Loan A will be (Points : 6) earlier than Loan B. later than Loan B. the same as Loan B. indeterminate with respect to Loan B. Question 17.17. (TCO 7) Compensating balances represent (Points : 6) funds in a bank account that cannot be spent. balances in a payroll checking account. accounts that are subject to bank service charges. accounts on which banks pay interest, such as NOW accounts. Question 18.18. (TCO 7) Oswego Clay Pipe Company sold $46,000 of pipe to Southeast Water District #45 on April 12 of the current year with terms 1/15, n/60. Oswego uses the gross method of accounting for cash discounts. What entry would Oswego make on April 23, assuming the customer made the correct payment on that date? (Points : 6) Option a Option b Option c Option d Question 19.19. (TCO 8) In a periodic inventory system, the cost of purchases is debited to (Points : 6) purchases. cost of goods sold. inventory. accounts payable. Question 20.20. (TCO 8) During periods when costs are rising and inventory quantities are stable, cost of goods sold will be (Points : 6) higher under FIFO than LIFO. higher under FIFO than average cost. lower under average cost than LIFO. lower under LIFO than FIFO. Question 21.21. (TCO 8) In applying LCM, market cannot be (Points : 6) less than net realizable value. greater than the normal profit. less than the normal profit margin. greater than net realizable value. Question 22.22. (TCO 8) In calculating the cost-to-retail percentage for the retail method, the retail column will not include (Points : 6) purchases. purchase returns. abnormal shortages. freight-in. Question 1. 1. (TCO 8) Fulbright Corp. uses the periodic inventory system. During its first year of operation, Fulbright made the following purchases (listed in chronological order of acquisition): • 40 units at $100 • 70 units at $80 • 170 units at $60 Sales for the year totaled 270 units, leaving 10 units on hand at the end of the year. What is the ending inventory using the average cost method (rounded)? (Points : 15) Question 2. 2. (TCO 5) Describe what is meant by unearned revenues, and give two examples. (Points : 28) Question 3. 3. (TCO 7) Briefly compare and contrast the two allowance estimation approaches to estimating bad debt expense. In your answer, indicate which approach, if either, is superior and explain your reasoning. (Points : 25) 1. (TCO 8) Briefly explain when there would be a tax benefit from electing LIFO rather than FIFO. (Points : 25) Question 2. 2. (TCO 4) You are the independent accountant assigned to the audit of Neophyte Company. The company’s accountant, a graduate of Rival State University, has prepared financial statements that contained the following questionable items: a. The balance sheet reports land at $100,000. Included in this amount is a piece of property held for speculation at a cost of $30,000. b. Current liabilities include $50,000 for long-term debt that comes due in 3 months. The company has received a suitable firm commitment to refinance the debt for 5 years and intends to do so. c. Long-term Investments (non-current) in marketable securities include $20,000 in short-term, high-grade commercial paper. Please discuss how the above items should be correctly classified and accounted for. (Points : 25) [Show More]

Last updated: 1 year ago

Preview 1 out of 13 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 13, 2020

Number of pages

13

Written in

Additional information

This document has been written for:

Uploaded

Dec 13, 2020

Downloads

0

Views

48

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)