Financial Accounting > QUESTIONS & ANSWERS > Strayer University, Washington ACC 557 Quantitative Methods Week 1 Homework (All)

Strayer University, Washington ACC 557 Quantitative Methods Week 1 Homework

Document Content and Description Below

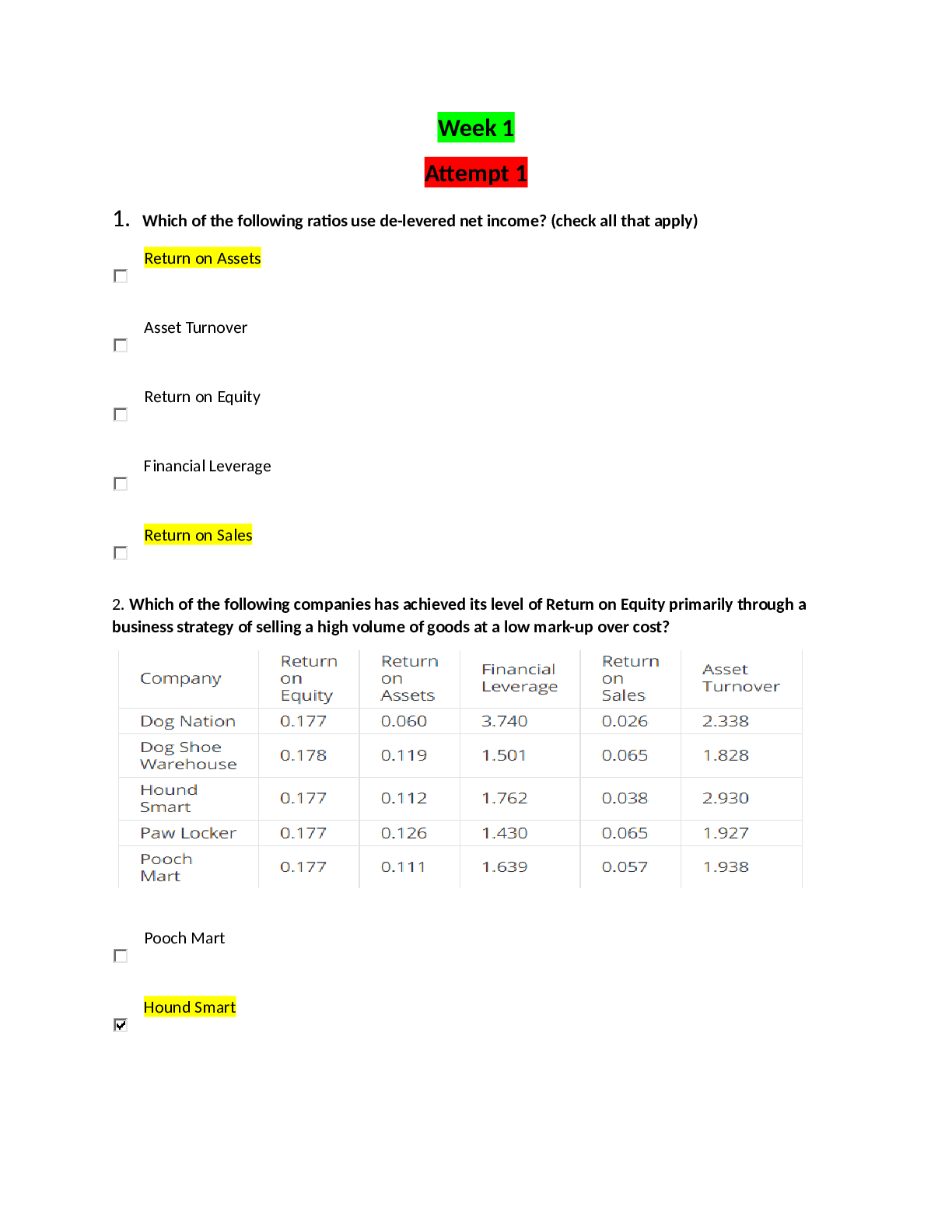

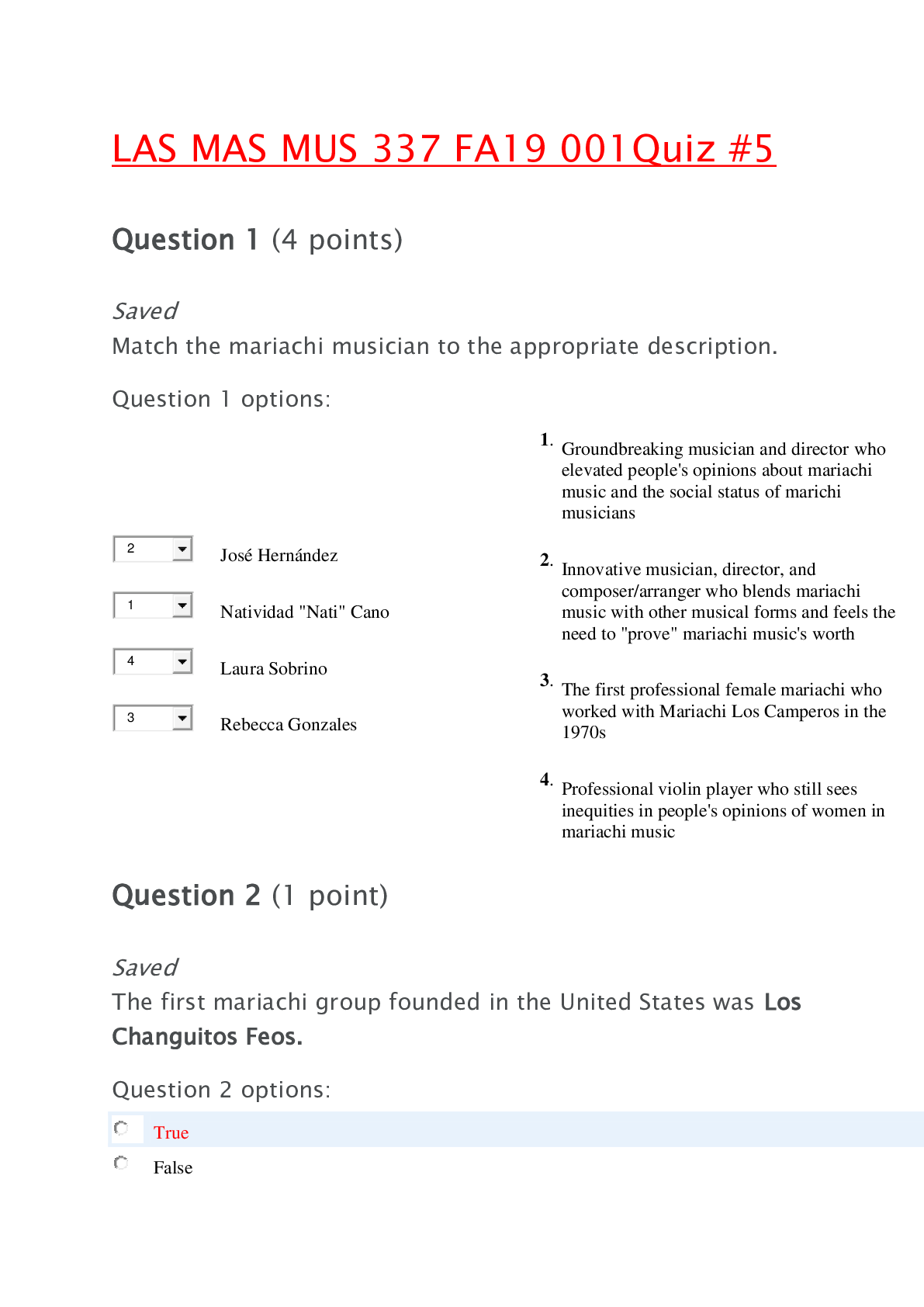

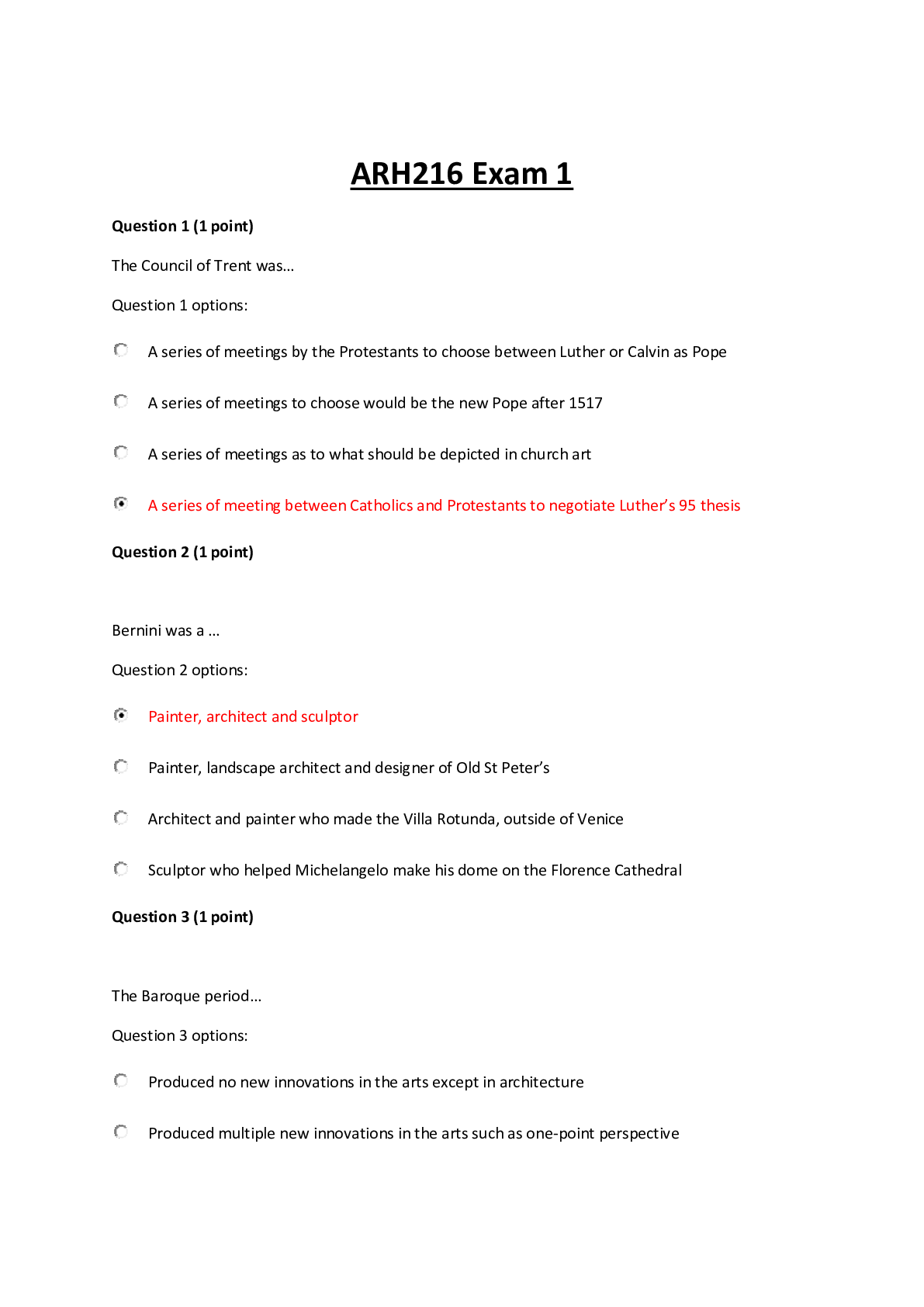

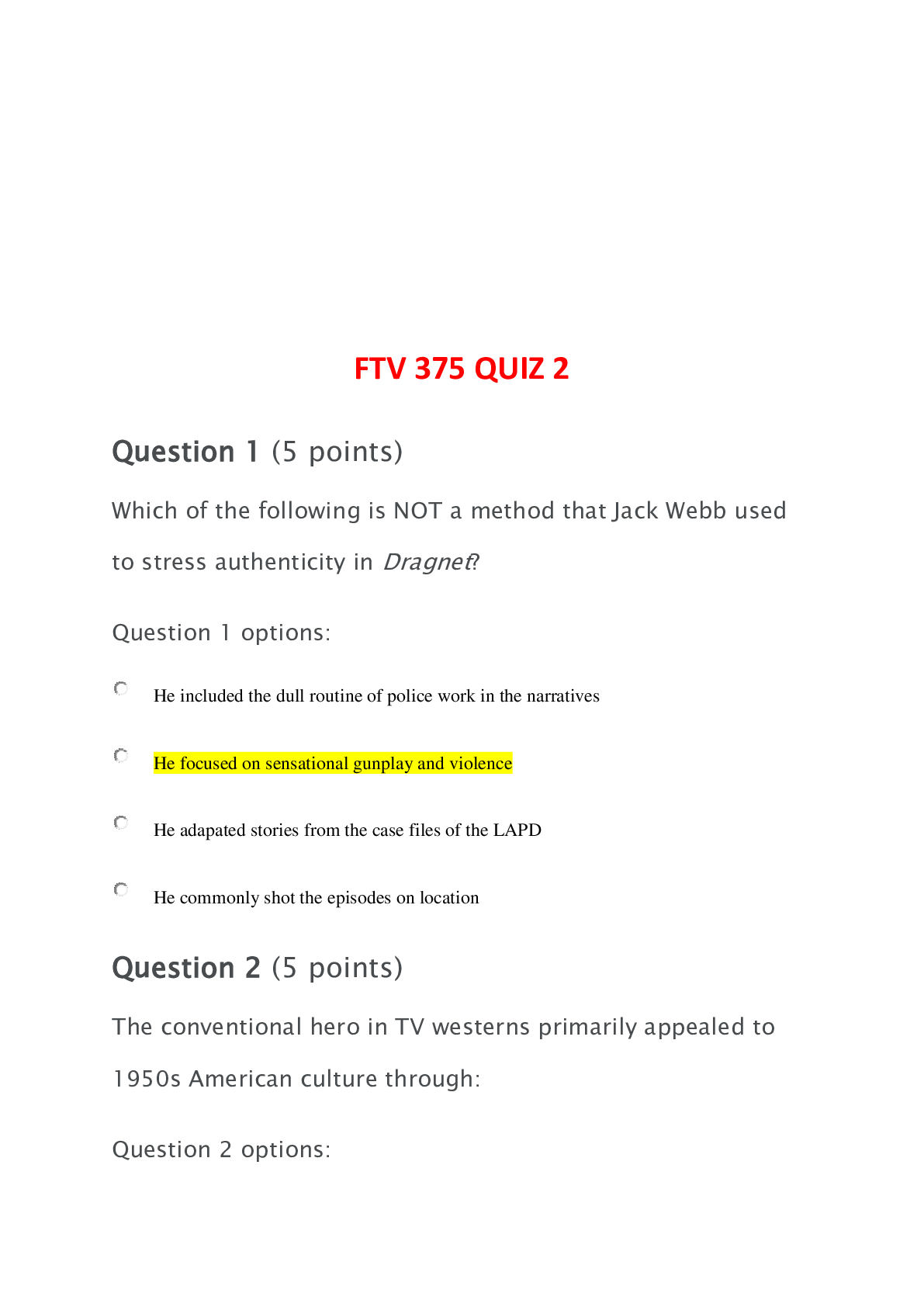

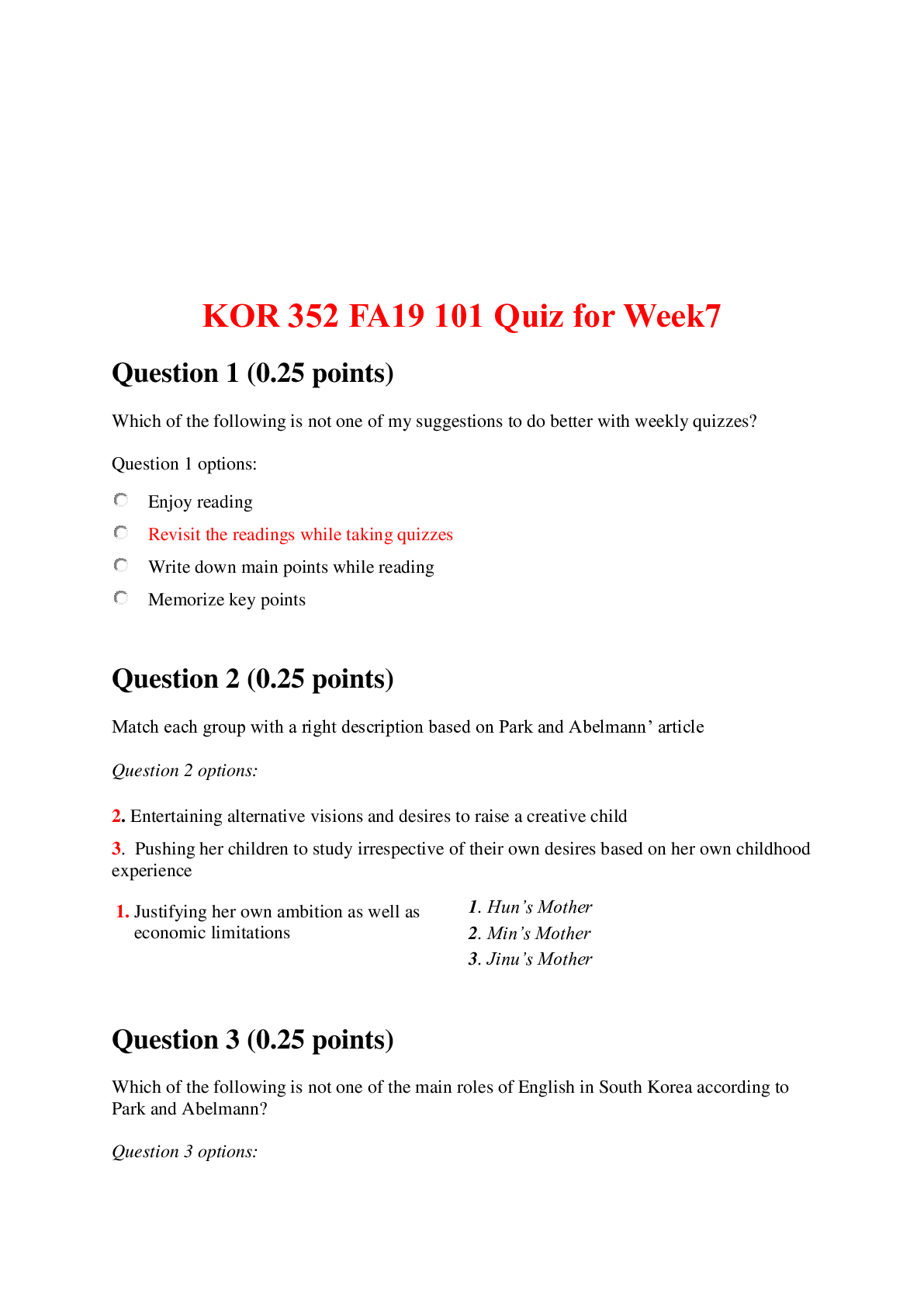

Week 1 Attempt 1 1. Which of the following ratios use de-levered net income? (check all that apply) Return on Assets Asset Turnover Return on Equity Financial Leverage Return on Sales 2. Which... of the following companies has achieved its level of Return on Equity primarily through a business strategy of selling a high volume of goods at a low mark-up over cost? Pooch Mart Hound Smart Paw Locker Dog Nation Dog Shoe Warehouse 3. Paw Locker has the highest Return on Assets in its comparison group. Which of the following could be a secret to its success? (check all that apply) 4. Which of the following companies has the lowest Return on Assets? BowWow Center MuttMax Rex Retail Trans Pup Dogstr 5. Dogwell decides to pay its suppliers more quickly to take advantage of discounts and thus acquire its raw materials for a lower price. Dogwell makes no other changes (e.g., it buys the same volume of raw material). Which of the following ratios would be affected by this decision? (check all that apply) Days receivable SG&A-to-sales Days inventory Gross margin Days payable 6. Which of the following companies has a strategy of high spending on advertising in order to build a strong brand name and charge a higher price for its product? Paw Locker Lassie Corp Dogtail Holdings Dog Shoe Warehouse Advanced Puppy 7. Which of the following companies offers its own credit card? Dogstrom BowWow Center Trans Pup MuttMax Rex Ret 8. Which company has the strongest short-term liquidity position? Destination Kennel Bow-Wow Stores Ren Inc. Spartan Dog Dog Orange Group 9. Which of the following is needed to produce pro forma financial statements? (check all that apply) Common size balance sheet Common size income statement Common size cash flow statement Sales forecasts Cash flow forecasts 10. McDognals has sales of $100 million this year and a gross margin of 30%. Next year, sales are forecasted to grow 10% and the gross margin is forecasted to remain at 30%. What is McDognals’ forecasted Cost of Goods Sold for next year? $70 million $7 million $3 million $77 million $30 million $33 million Attempt 2 1. Which of the following ratios are affected by the amount of debt a company has borrowed? (check all that apply) Asset Turnover Return on Assets Return on Sales Financial Leverage Return on Equity 5. HoneyDog decides to offer price discounts to customers who pay what they owe the company within 20 days. HoneyDog makes no other changes (e.g., it sells the same volume of goods). Which of the following ratios would be affected by this decision? (check all that apply) Days inventory Gross margin SG&A-to-sales Days payable Days receivable 9. Which of the following causes the “sawtooth” effect in pro forma financial statements? High forecasted growth in sales Forecasting Sales using historical trends Forecasting Cash Flows using the Cash Coverage Ratio Forecasting Total Assets using the Total Asset Turnover Ratio High forecasted growth in total assets Attempt 3 2. Which of the following companies has achieved its level of Return on Equity primarily through a high reliance on debt financing? Dog Nation Dog Shoe Warehouse Hound Smart Paw Locker Pooch Mart 6. Which of the following companies has the highest Effective Tax Rate? (You can assume they all had similar levels of interest expense and non-operating gains and losses). Dog Shoe Warehouse Advanced Puppy Paw Locker Lassie Corp Dogtail Holdings 7. Which of the following companies has the highest average number of days of short-term borrowing from its bank? Rex Retail MuttMax Dogstrom Trans Pup BowWow Center 8. Which company has the highest risk of bankruptcy? Ren Inc. Dog Orange Group Bow-Wow Stores Spartan Dog Destination Kennel [Show More]

Last updated: 1 year ago

Preview 1 out of 10 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 29, 2022

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Sep 29, 2022

Downloads

0

Views

86

.png)

.png)