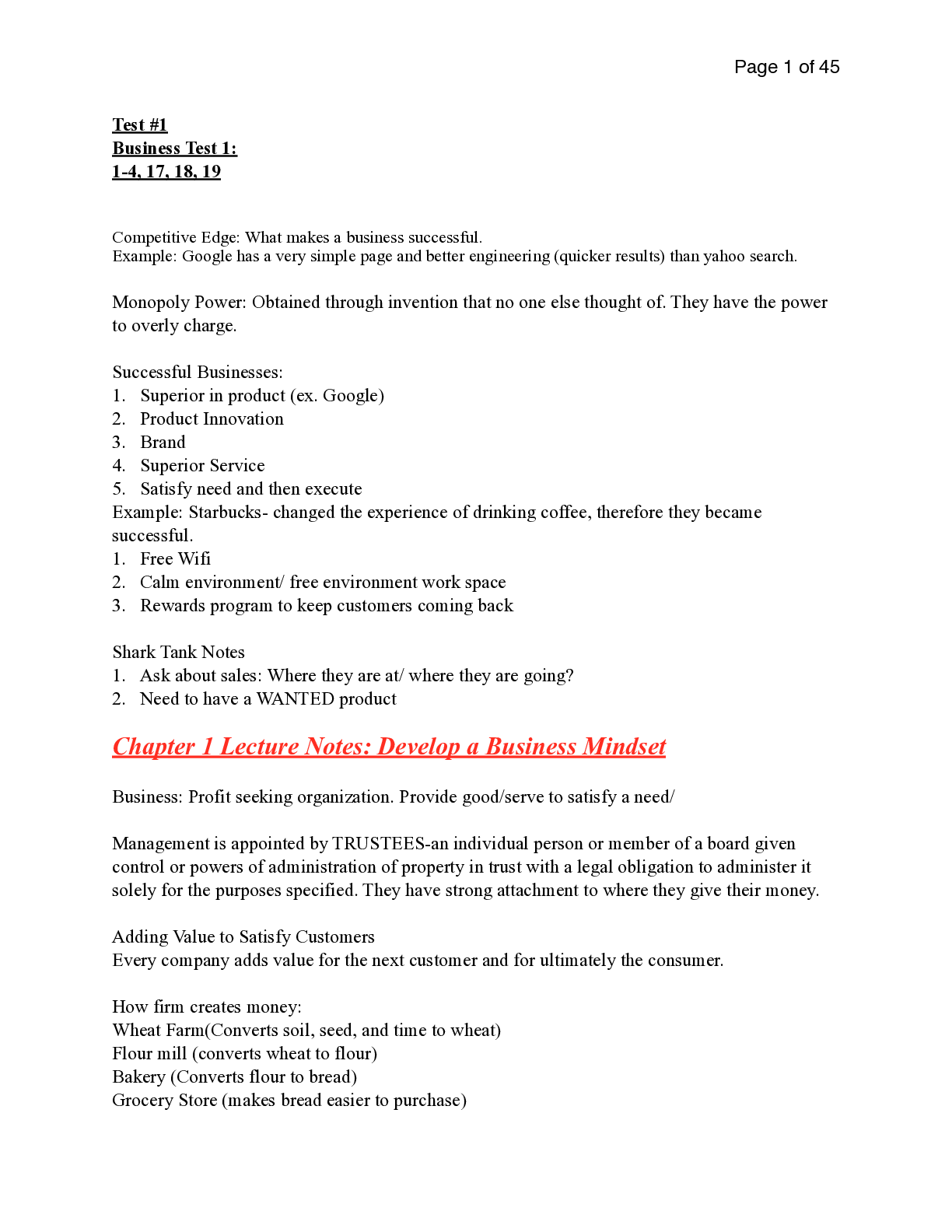

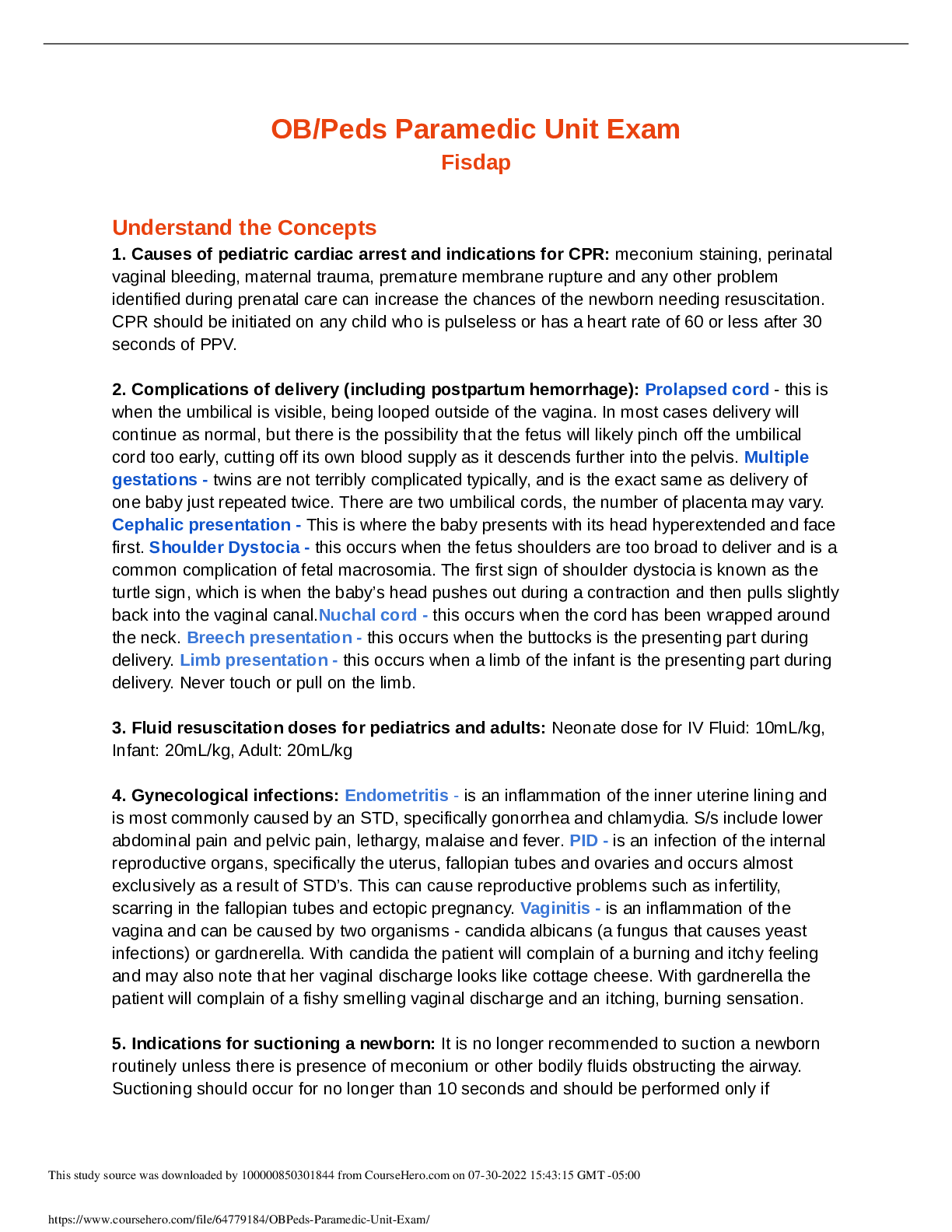

Financial Accounting > EXAM REVIEW > Miami University - ACC 221acc221 exam 1 study guide. Acc 221 – Exam #1 – Review Guide and Check (All)

Miami University - ACC 221acc221 exam 1 study guide. Acc 221 – Exam #1 – Review Guide and Check List. This check-list is provided to guide your final review in preparation for Exam #1. It is not a replacement for completing all of the reading and homework assignments. Often the concepts in a question are covered in more Solid Footing pages and more homework problems than just the pages and homework problems listed under the question.

Document Content and Description Below

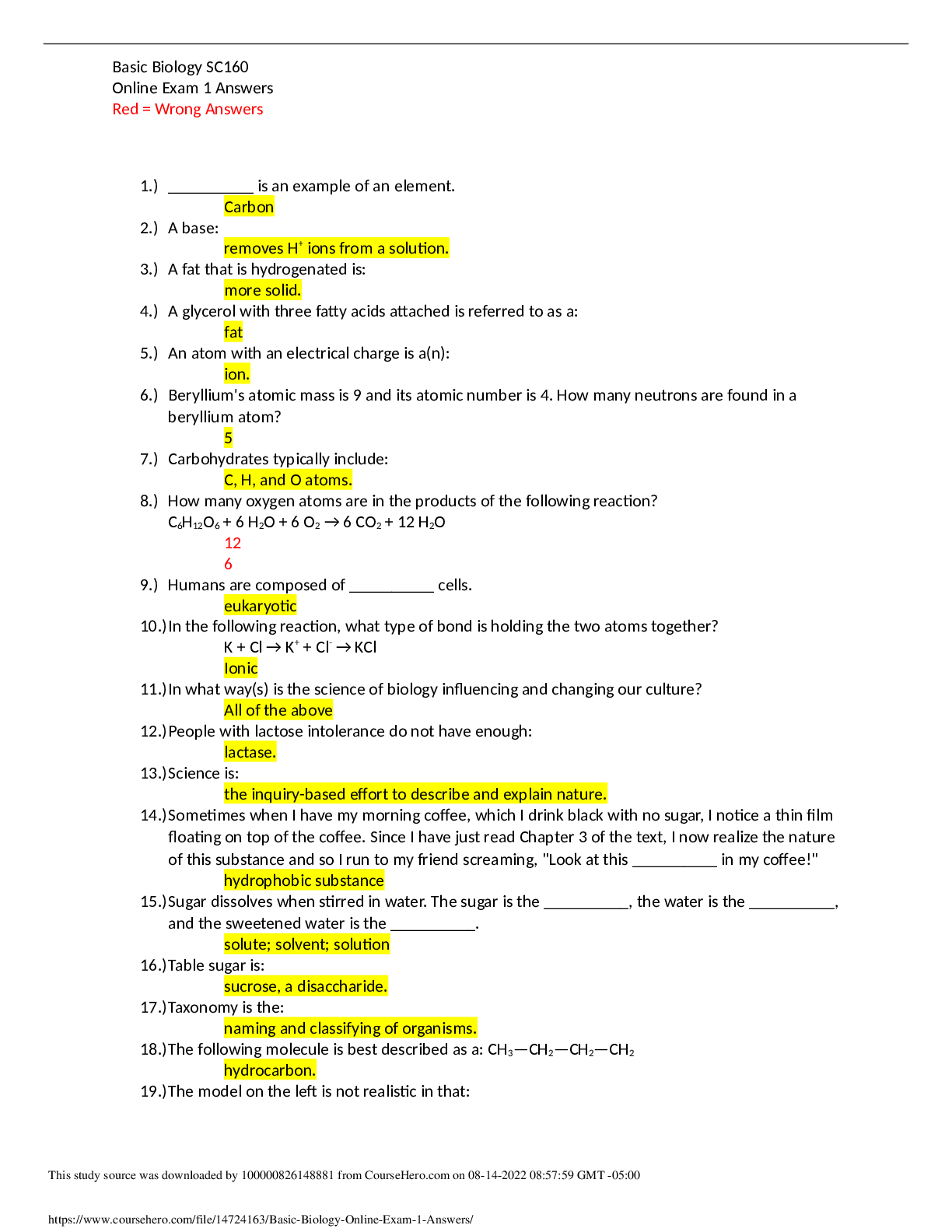

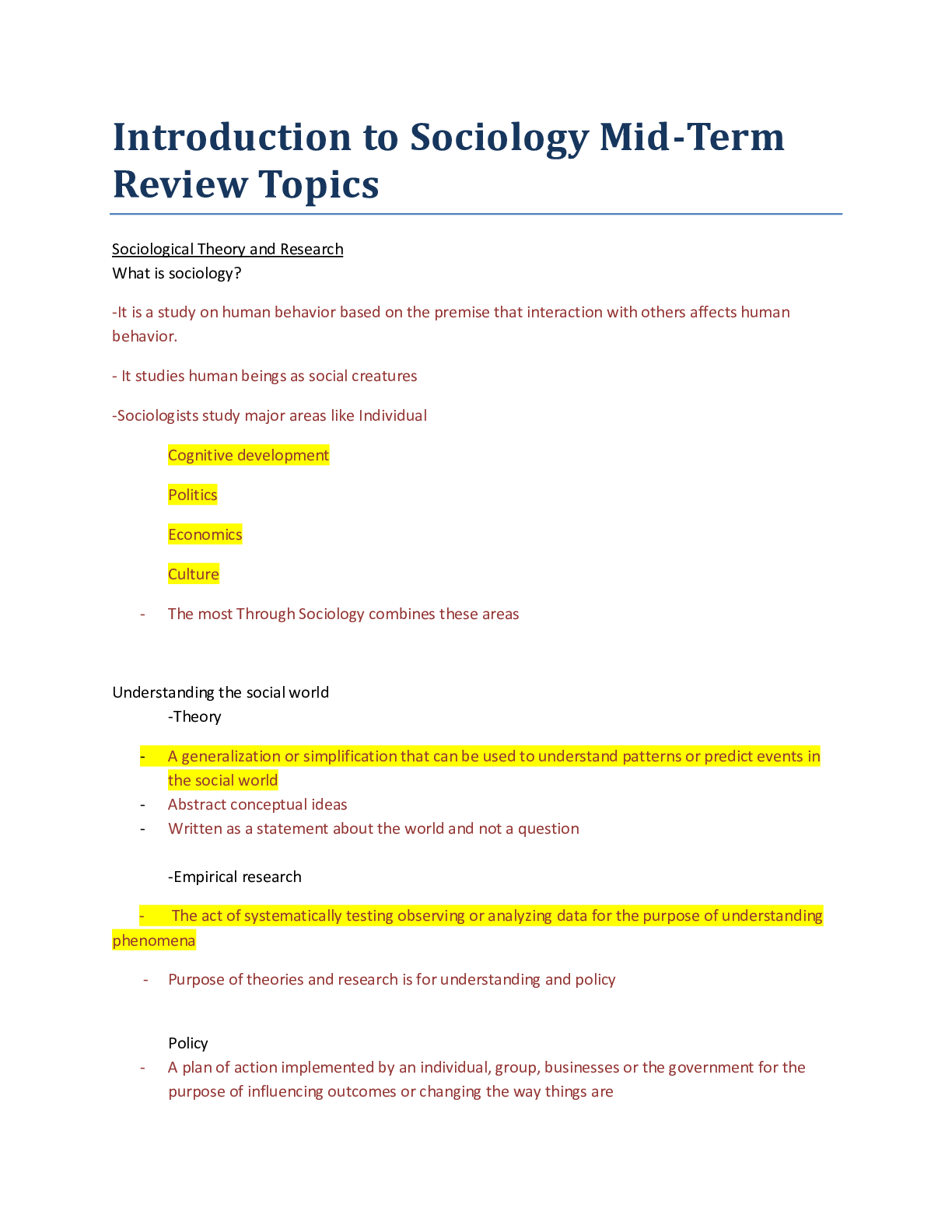

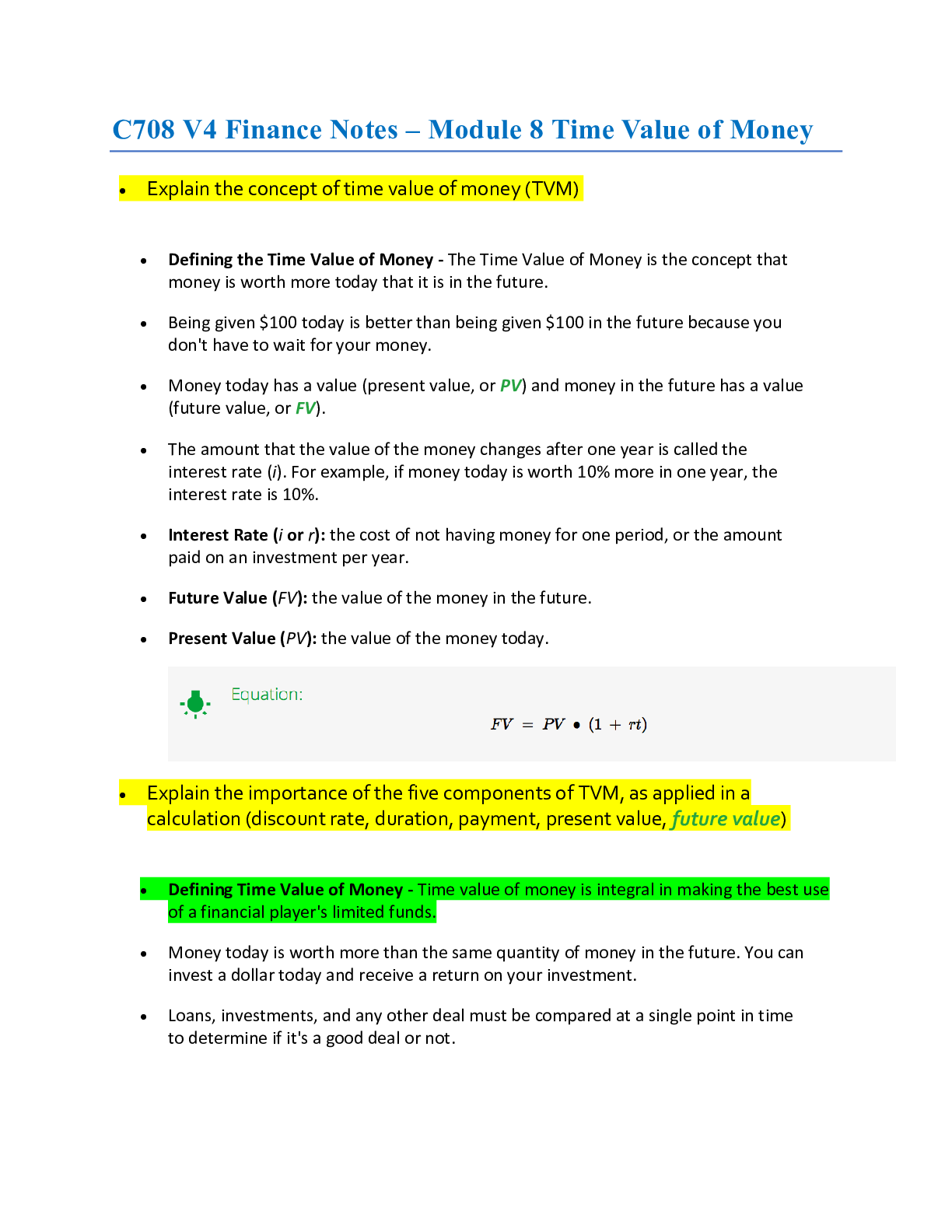

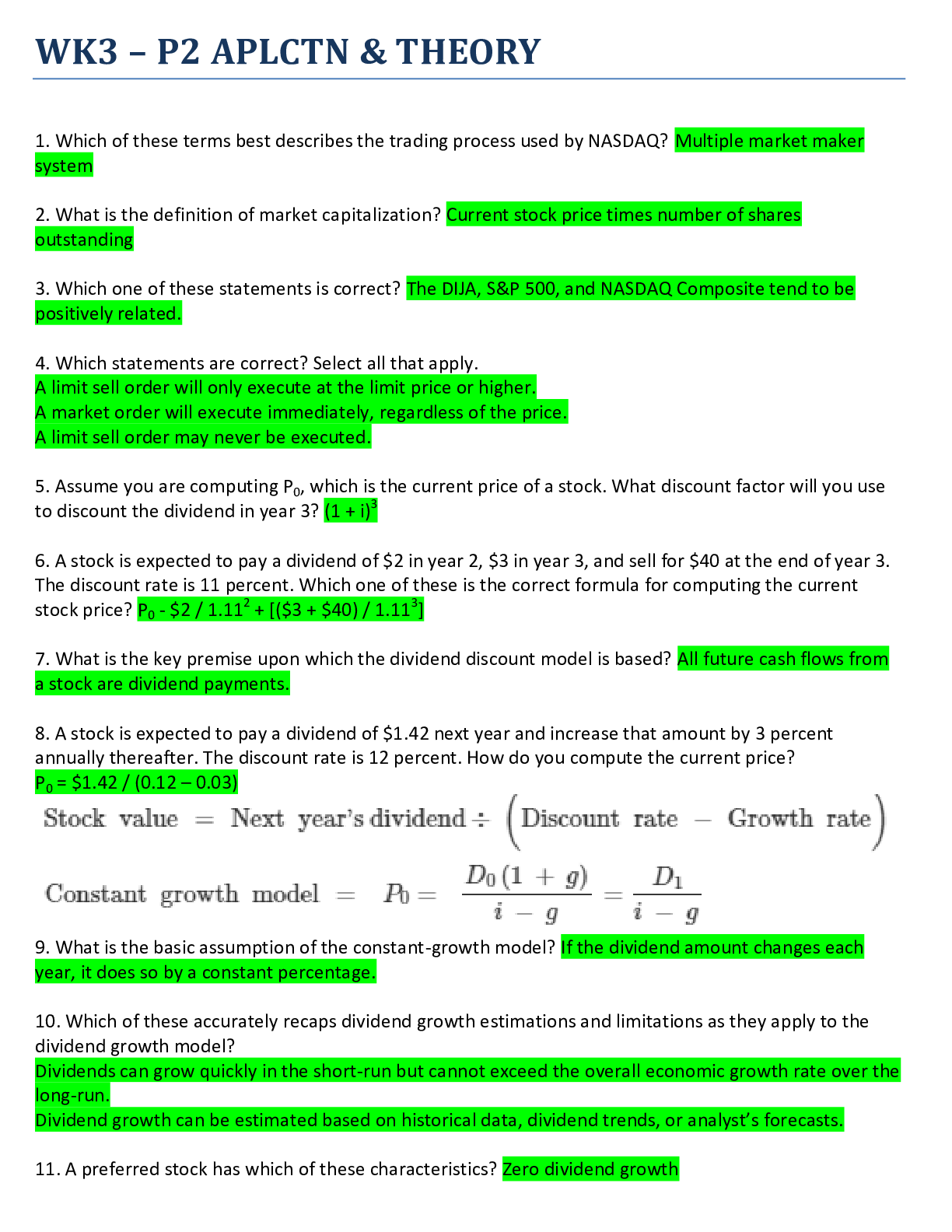

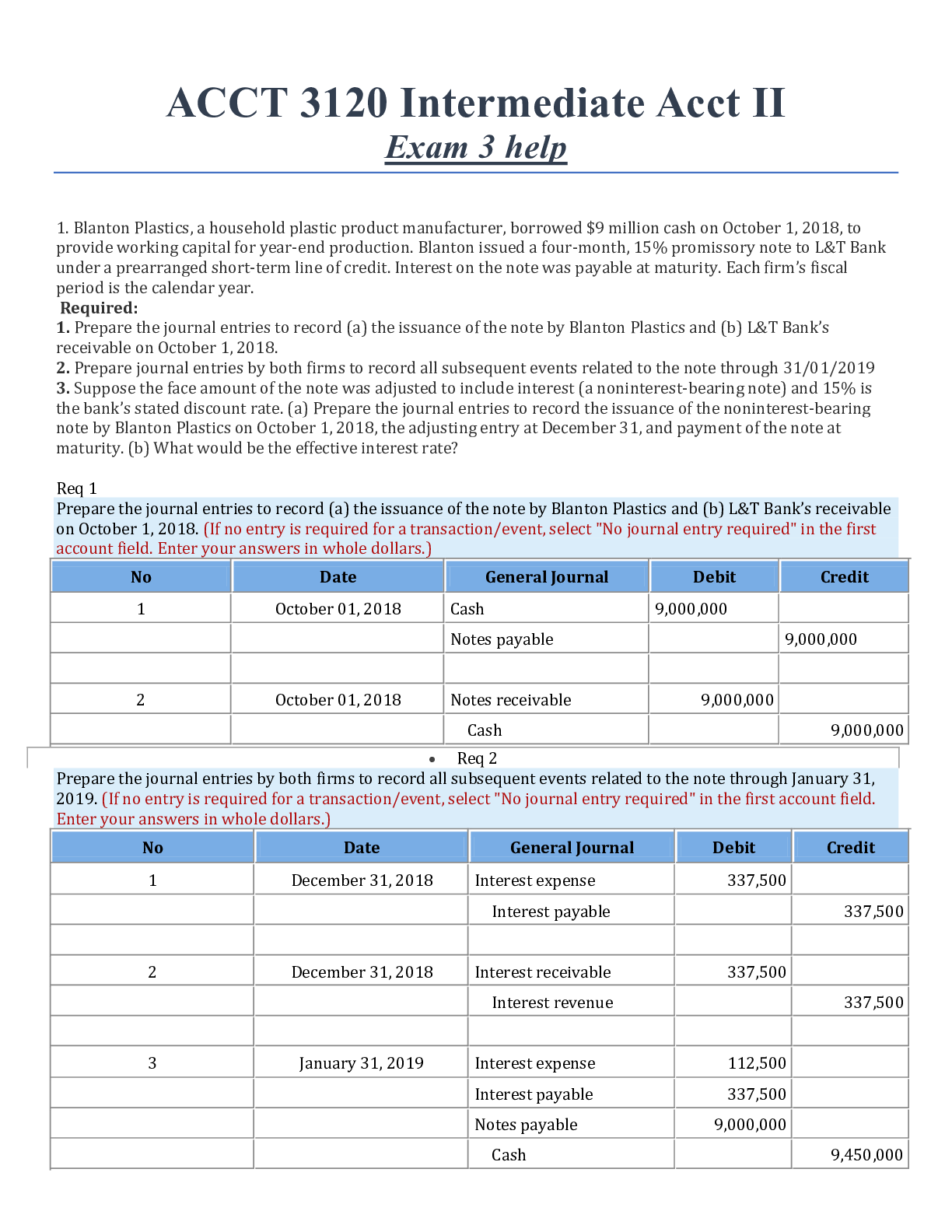

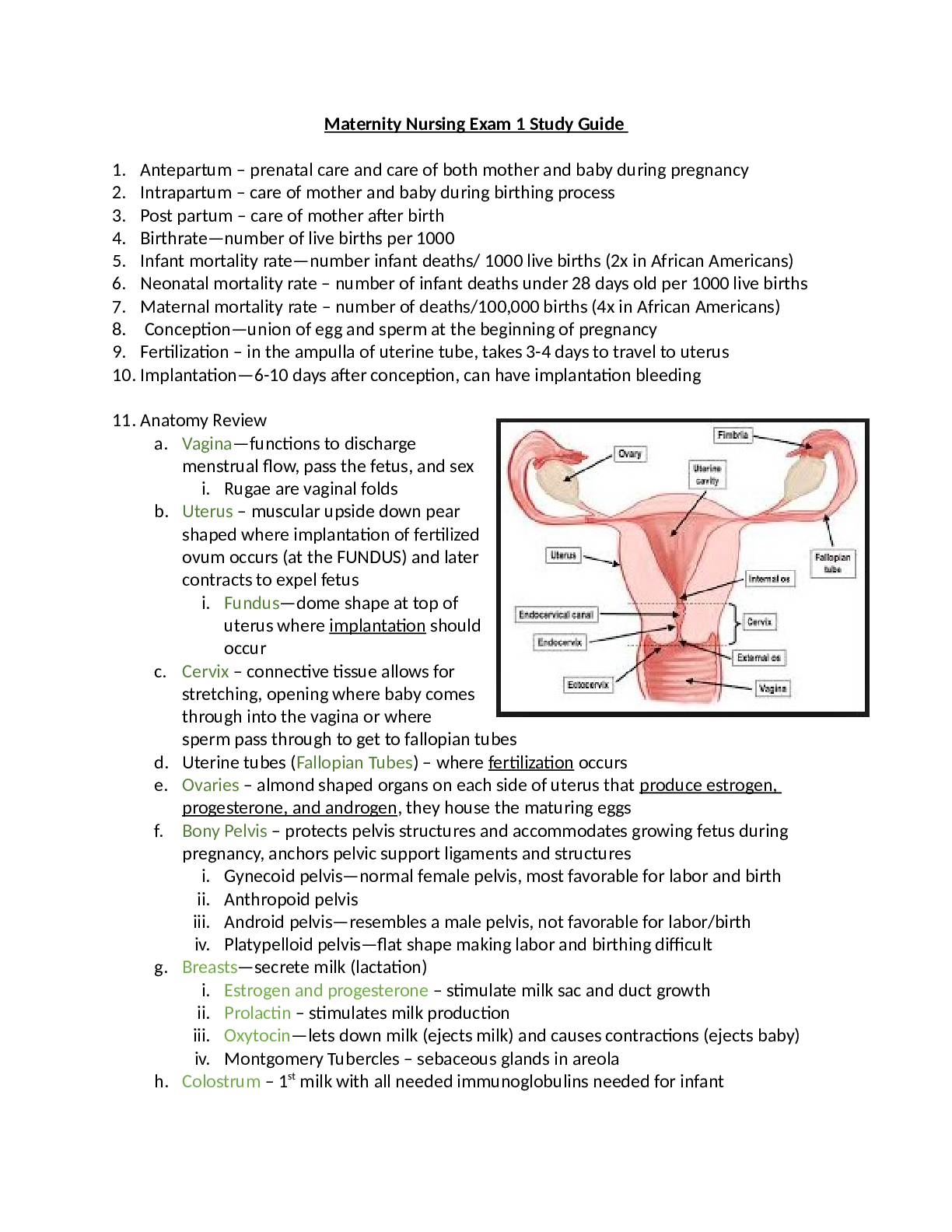

Acc 221 – Exam #1 – Review Guide and Check List This check-list is provided to guide your final review in preparation for Exam #1. It is not a replacement for completing all of the reading and... homework assignments. Often the concepts in a question are covered in more Solid Footing pages and more homework problems than just the pages and homework problems listed under the question. Exam Question #: 1 Recording the Borrowing of Money from the Bank • Exam Question #: 2 Recording the Sale of Common Stock • Exam Question #: 3 Recording the Purchase of Equipment • Exam Question #: 4 Recording the Purchase of Supplies on Credit • Exam Question #: 5 Recording the Payment of Rent o Exam Question #: 6 Recording a Sale that is Both for Cash and On Account • Exam Question #: 7 Recording the Receipt of an Advance Payment • Debit the Cash account • Credit the unearned revenue (liability account) o Exam Question #: 8 Recording the Payment of an Accounts Payable • When you pay back a vendor • Exam Question #: 9 Recording the Collection of an Accounts Receivable • When a customer pays you back • Exam Question #: 10 Recording the Payment of Wages • Credit (decrease) cash account o Exam Question #: 11 Depreciation and Adjusting the Accumulated Depreciation Account • Depreciation is the process of allocating the cost of property, plant, and equipment • Exam Question #: 12 Adjusting a Prepaid Asset Account • Adjusting based off how much of the supplies was used • 3 questions to determine the supplies adjusting entry • Exam Question #: 13 Adjusting a Liability Account • Wages payable is a liability account • Exam Questions #: 14 and 15 Recording the Receipt of an Advance Payment Calculating the “Should Be” Balance in an Unearned Revenue Liability Account Adjusting the Unearned Revenue Liability Account • Questions #: 16, 17, 34 and 35 Closing Entries • “flush” all revenue and expense accounts into retained earnings o all should have a closing balance of 0 (after close bal) o Exam Question #: 18 Calculation of Net Income • Do this on the income statement • Exam Questions #: 19, 20, 21, and 25 Calculation of Balance Sheet Amounts • All asset and liability accounts have ending balances except for retained earnings. Exam Questions #: 22 Financial Statement Errors Exam Question #: 23, 29 and 30 Concepts of Transactions and the Accounting Equation • Assets are essentially “stuff” • Liabilities are “claims-to-stuff” of someone who is not an owner • Equity is claimes-to-stuff of owners • Exam Questions #: 24 What is Shown on the Income Statement • What is shown: o Sales revenue o Cost of goods sold o Exam Question #: 26 Concepts of the Balance Sheet and Income Statement • Income statement shows what caused the change in retained earnings • Step 5 of the accounting cycle: prepare an Income statement from the ending Exam Question #: 28 Effect of Closing Entries on Retained Earnings • Step 8 of the accounting cycle: prepare and enter the revenue and expense closing entries into the general journal, and post the closing entries to the general ledger Exam Question #: 31 Concepts of Accrual Accounting System and Recording Rent • Exam Question #: 32 Concepts of Adjusting Entries • Step 3 of the accounting cycle: at the end of the accounting period, before preparing the financial statements, determine if any of the general ledger accounts balances Exam Question #: 33 Concepts of Temporary and Permanent Accounts • Permanent: asset, liability, common stock, retained earnings—never closed • Temporary: revenue and expense—closed at the end of ever PERIOD [Show More]

Last updated: 1 year ago

Preview 1 out of 6 pages

.png)

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jan 12, 2021

Number of pages

6

Written in

Additional information

This document has been written for:

Uploaded

Jan 12, 2021

Downloads

0

Views

115

(1).png)

.png)

.png)

.png)