Economics > EXAM > N.C. Claims Adjuster Exam: N.C. Claims Adjuster License Exam: Latest Updated A+ Guide Solution (All)

N.C. Claims Adjuster Exam: N.C. Claims Adjuster License Exam: Latest Updated A+ Guide Solution

Document Content and Description Below

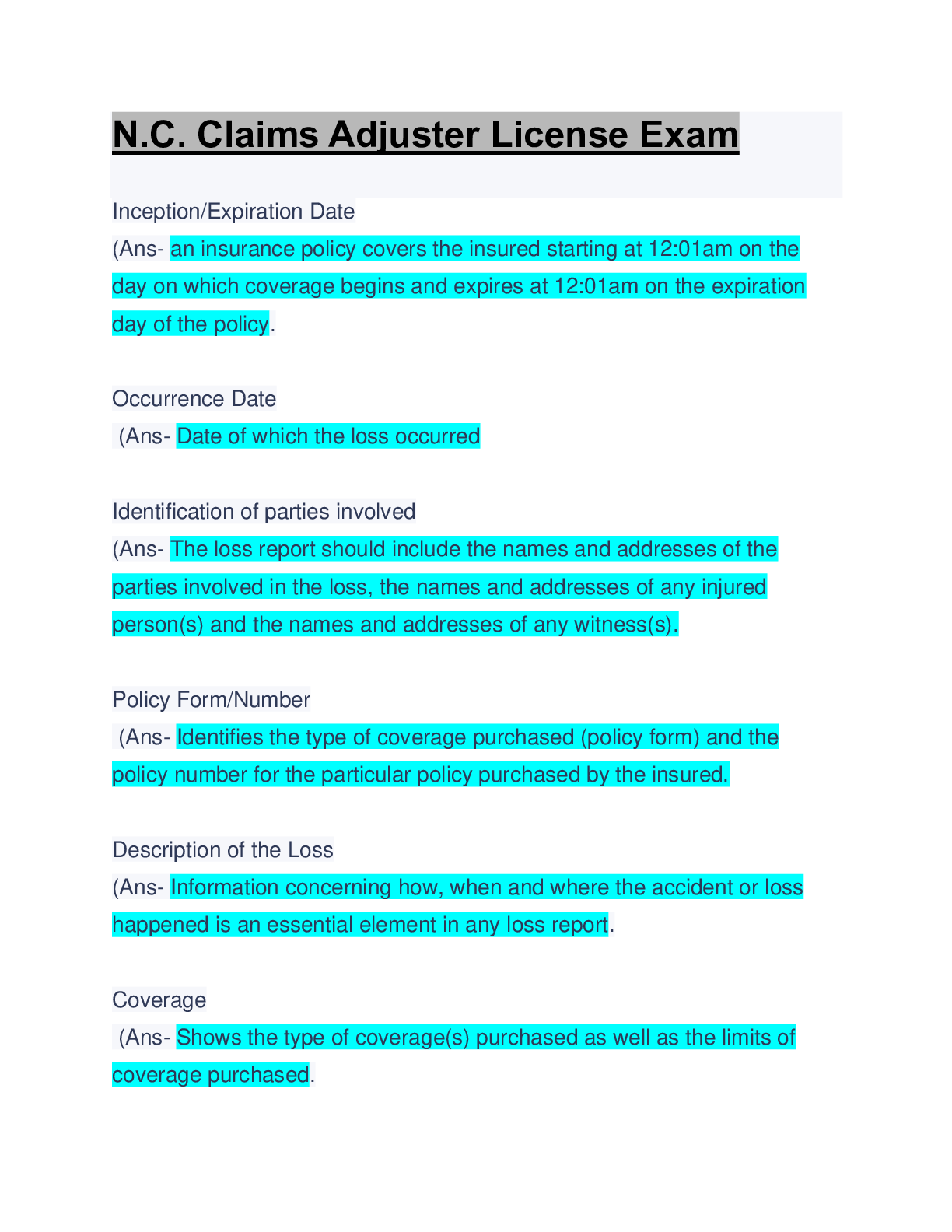

Inception/Expiration Date (Ans- an insurance policy covers the insured starting at 12:01am on the day on which coverage begins and expires at 12:01am on the expiration day of the policy. Occurrence Da... te (Ans- Date of which the loss occurred Identification of parties involved (Ans- The loss report should include the names and addresses of the parties involved in the loss, the names and addresses of any injured person(s) and the names and addresses of any witness(s). Policy Form/Number (Ans- Identifies the type of coverage purchased (policy form) and the policy number for the particular policy purchased by the insured. Description of the Loss (Ans- Information concerning how, when and where the accident or loss happened is an essential element in any loss report. Coverage (Ans- Shows the type of coverage(s) purchased as well as the limits of coverage purchased. Damages - Special Compensatory damages (Ans- Are amounts paid to compensate the plaintiff for direct expenses such as medical treatment, lost wages (both past and future), funeral expenses and rehabilitation expenses required because of bodily injury. Special damages are paid for losses that can be determined and documented. They are often referred to as "out-of-pocket" expenses. Damages - General Compensatory Damages (Ans- Are paid for losses that cannot be specifically measured and itemized in order to compensate the plaintiff for things such as pain and suffering, loss of the use of an arm or leg, loss of vision, physical disfigurement and/or loss of consortium. Damages - Punitive Damages (Ans- Are typically awarded to the plaintiff in addition to compensatory damages when the defendants conduct has been especially malicious. Punitive damages are awarded to punish the defendant and to deter others from engaging in similar actions. Unfair Claims Settlement Practices (Ans- 1. Knowingly misrepresenting relevant facts or policy provisions relating to the coverage at issue. 2. Failing to acknowledge with reasonable promptness communications pertaining to claims. 3. Failing to adopt and implement reasonable standards for the prompt investigation of claims. 4. Arbitrary and unreasonable refusal to pay claims. 5. Failing to affirm or deny coverage of claims within a reasonable time after proof of loss has been completed. 6. Not attempting in good faith to make prompt, fair and equitable claims settlement when the insurer's liability has become reasonably clear. 7. Compelling insureds to institute suits to recover amounts due under a policy by offering substantially less to settle immediately. 8. Attempting to settle claims for less than the amount for which a reasonable person would believe one was entitled based on written or printed advertising material accompanying or made a part of an application. I. Attempting settlement of claims on the basis of applications that were altered without notice to knowledge of or consent of insureds. Total Losses on Motor Vehicles/Miscellaneous Provisions (Ans- 1. If the insurer and the claimant are unable to reach an agreement as to the value of the vehicle, the insurer shall base any further settlement offer not only on the published regional average value of similar vehicles, but also on the value of the vehicle in the local market. 2. Local market value shall be determined by using either the local price of a comparable vehicle or if no comparable vehicle can be found, quotations from at least two qualified dealers within the local market area. Additionally, if the claimant represents that the vehicle was in better than average condition, the insurer shall give due consideration to the condition of the claimant's vehicle prior to the accident. 3. When a motor vehicle is damaged in an amount which equals or exceeds 75 percent of the preaccident actual cash value, an insurer shall "total loss" the vehicle by paying the claimant the preaccident value and in return, receiving possession of the legal title for salvage purposes. 4. The insurer will be responsible for all reasonable towing and storage charges until three days after the owner and the storage facility are notified in writing that the insurer will no longer reimburse the owner or storage facility for storage charges. 5. Loss and claims payments shall be mailed or otherwise delivered within 10 business days after the claim is settled. After Market Parts (Ans- An after market part is any part made by a non original manufacturer. Speculative Risk (Ans- When there is a chance of gain as well as a chance of loss. Insurance is not intended to protect against this type of risk. Pure Risk (Ans- When there is a chance of loss only. Insurable Risk (Ans- One that an insurance company is willing to accept. Characteristics of Insurable Risk (Ans- 1. Low probability of loss occurring, 2. Less than catastrophic results, 3. The loss must be measurable, 4. The loss must be significant, 5. The loss must be accidental and unintended. Probability (Ans- Measures the chance of an event occurring, it is the measure of uncertainty (risk). Law of Large Numbers (Law of Averages) (Ans- Mathematical principle that makes it possible to predict future losses based upon prior experience. Spread of Risk (Geographic Dispersion) (Ans- Also used to decrease loss probability. This process involves spreading the company's policies (exposures) over a broad geographical area in order to avoid large losses in the vent of a catastrophic event. An example is a hurricane. Adverse Selection (Ans- Adverse selection occurs when insureds with a high risk of loss attempt to purchase insurance and are successful in obtaining insurance. Perils (Ans- Are the actual cause of loss such as a fire, theft, wind, hail, etc. Hazards (Ans- Increase the probability of a peril occurring. Bald tires on an automobile increase the chance of a wreck happening. The tires are the hazard, the wreck is the peril. Property Insurance (Ans- Indemnified (repays) a person or business with an interest in the physical integrity of tangible property for its loss or the loss of income produced by that property. Casualty Insurance (Ans- Provides protection to meet the unexpected costs imposed by law due to acts that have caused bodily injury or property damage to another individual. Included isn't he field of casualty (liability) insurance are automobile, crime and surety bonds. Private or Voluntary Insurance (Ans- Portion of the insurance industry where individuals seek coverage to meet recognized needs. These coverages are neither required nor made available by government. An example would be collision insurance in a personal automobile insurance policy. Social Insurance (Ans- Programs either required or made available by government. [Show More]

Last updated: 1 year ago

Preview 1 out of 76 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 05, 2023

Number of pages

76

Written in

Additional information

This document has been written for:

Uploaded

May 05, 2023

Downloads

0

Views

54