Financial Accounting > EXAM REVIEW > ACC 100 Final Milestone with Verified Answers (All)

ACC 100 Final Milestone with Verified Answers

Document Content and Description Below

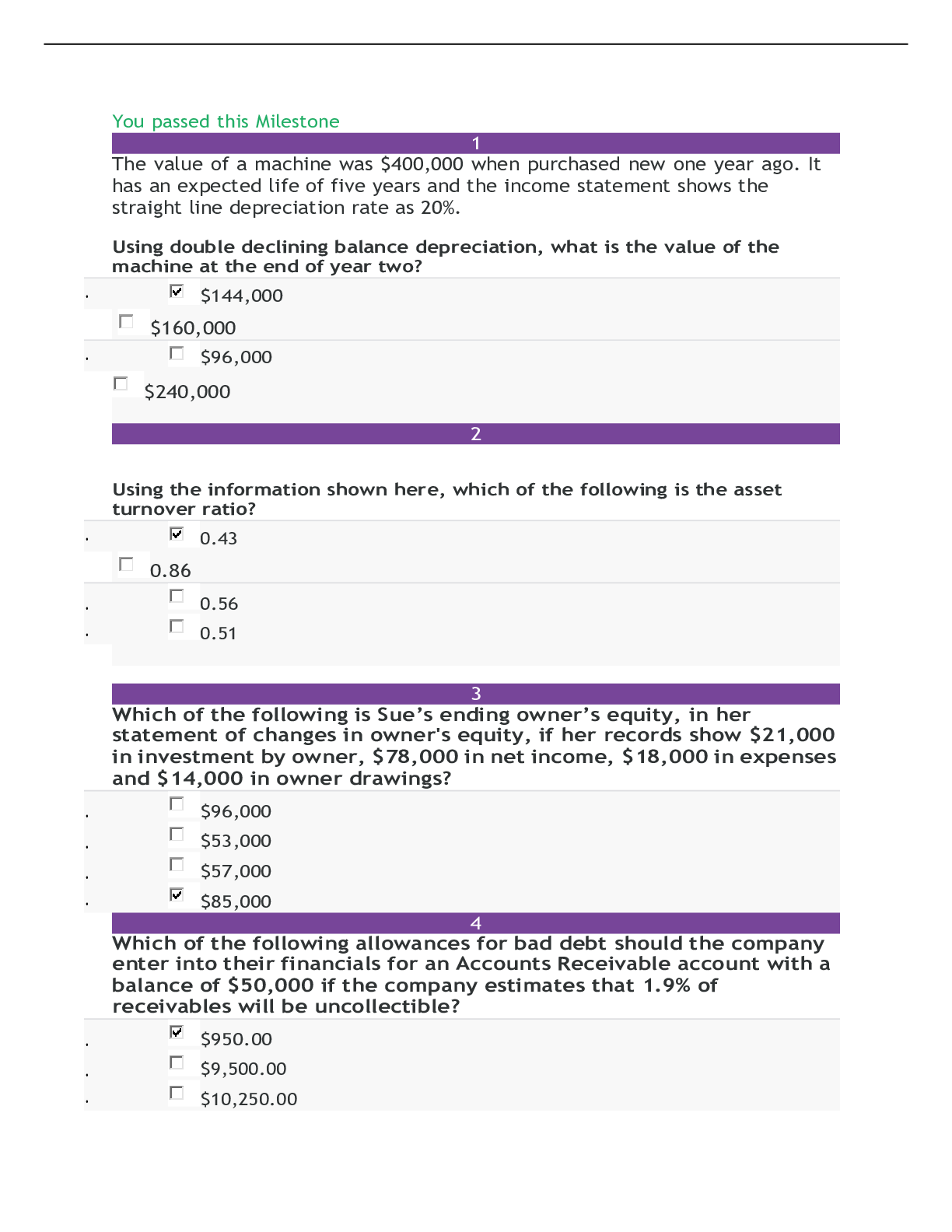

You passed this Milestone 1 The value of a machine was $400,000 when purchased new one year ago. It has an expected life of five years and the income statement shows the straight line depreciation rat... e as 20%. Using double declining balance depreciation, what is the value of the machine at the end of year two? $144,000 $160,000 $96,000 $240,000 2 Using the information shown here, which of the following is the asset turnover ratio? 0.43 0.86 0.56 0.51 3 Which of the following is Sue’s ending owner’s equity, in her statement of changes in owner's equity, if her records show $21,000 in investment by owner, $78,000 in net income, $18,000 in expenses and $14,000 in owner drawings? $96,000 $53,000 $57,000 $85,000 4 Which of the following allowances for bad debt should the company enter into their financials for an Accounts Receivable account with a balance of $50,000 if the company estimates that 1.9% of receivables will be uncollectible? $950.00 $9,500.00 $10,250 [Show More]

Last updated: 1 year ago

Preview 1 out of 7 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Feb 18, 2021

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

Feb 18, 2021

Downloads

0

Views

153