Accounting > Class Notes > Introduction to the annual income tax framework (All)

Introduction to the annual income tax framework

Document Content and Description Below

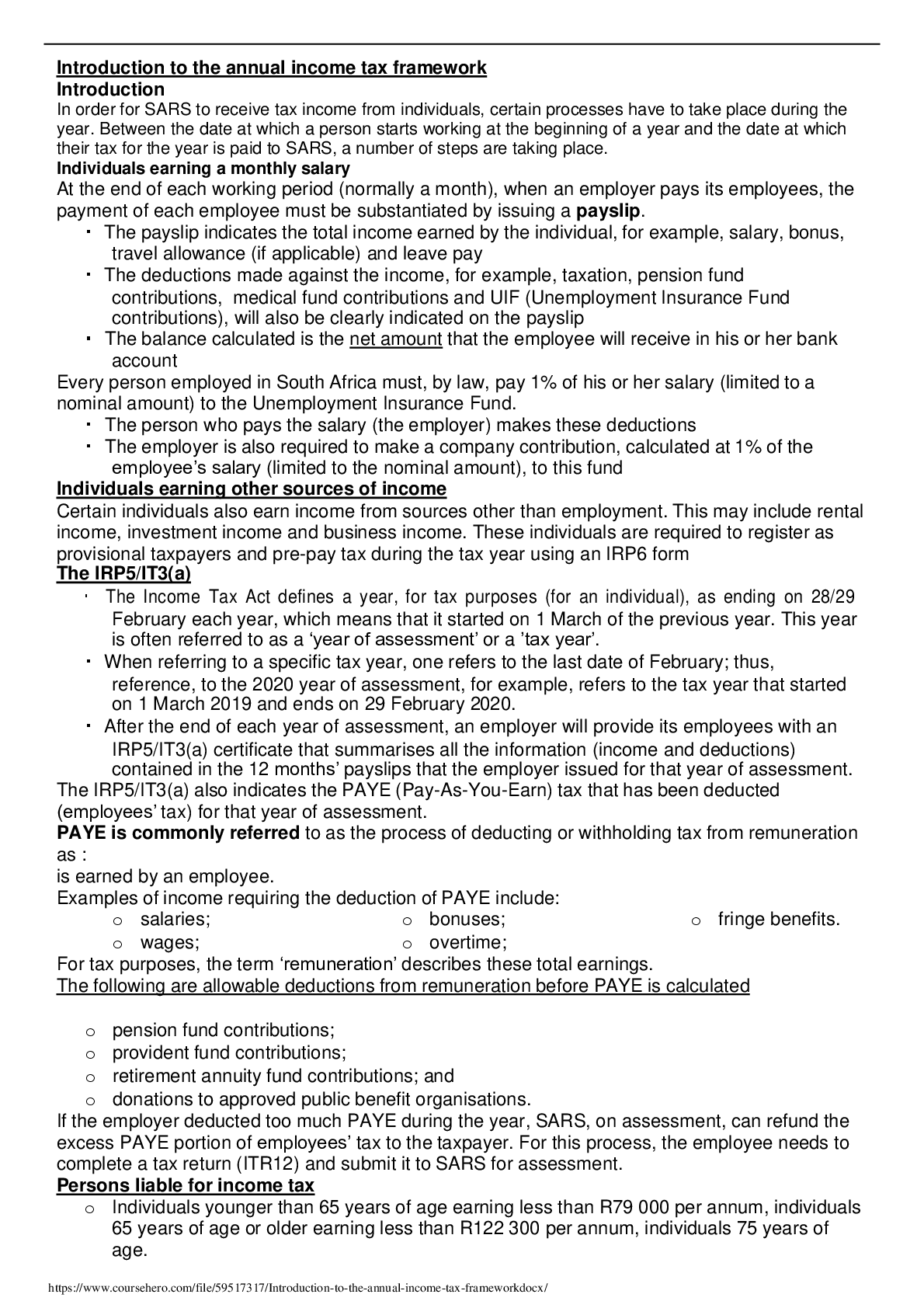

In order for SARS to receive tax income from individuals, certain processes have to take place during the year. Between the date at which a person starts working at the beginning of a year and the dat... e at which their tax for the year is paid to SARS, a number of steps are taking place. Individuals earning a monthly salary At the end of each working period (normally a month), when an employer pays its employees, the payment of each employee must be substantiated by issuing a payslip. The payslip indicates the total income earned by the individual, for example, salary, bonus, travel allowance (if applicable) and leave pay The deductions made against the income, for example, taxation, pension fund contributions, medical fund contributions and UIF (Unemployment Insurance Fund contributions), will also be clearly indicated on the payslip The balance calculated is the net amount that the employee will receive in his or her bank account Every person employed in South Africa must, by law, pay 1% of his or her salary (limited to a nominal amount) to the Unemployment Insurance Fund. The person who pays the salary (the employer) makes these deductions The employer is also required to make a company contribution, calculated at 1% of the employee’s salary (limited to the nominal amount), to this fund Individuals earning other sources of income Certain individuals also earn income from sources other than employment. This may include rental income, investment income and business income. These individuals are required to register as provisional taxpayers and pre-pay tax during the tax year using an IRP6 form The IRP5/IT3(a) The Income Tax Act defines a year, for tax purposes (for an individual), as ending on 28/29 February each year, which means that it started on 1 March of the previous year. This year is often referred to as a ‘year of assessment’ or a ’tax year’. When referring to a specific tax year, one refers to the last date of February; thus, reference, to the 2020 year of assessment, for example, refers to the tax year that started on 1 March 2019 and ends on 29 February 2020. After the end of each year of assessment, an employer will provide its employees with an IRP5/IT3(a) certificate that summarises all the information (income and deductions) contained in the 12 months’ payslips that the employer issued for that year of assessment. The IRP5/IT3(a) also indicates the PAYE (Pay-As-You-Earn) tax that has been deducted (employees’ tax) for that year of assessment. PAYE is commonly referred to as the process of deducting or withholding tax from remuneration as : is earned by an employee. Examples of income requiring the deduction of PAYE include: o salaries; o wages; o bonuses; o overtime; ..............................................................................CONTINUED................................................. [Show More]

Last updated: 1 year ago

Preview 1 out of 9 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 07, 2021

Number of pages

9

Written in

Additional information

This document has been written for:

Uploaded

Oct 07, 2021

Downloads

0

Views

56