*NURSING > STUDY GUIDE > Sophia Finance Milestone 4_Complete Questions and Answers (Latest 2020/2021) (All)

Sophia Finance Milestone 4_Complete Questions and Answers (Latest 2020/2021)

Document Content and Description Below

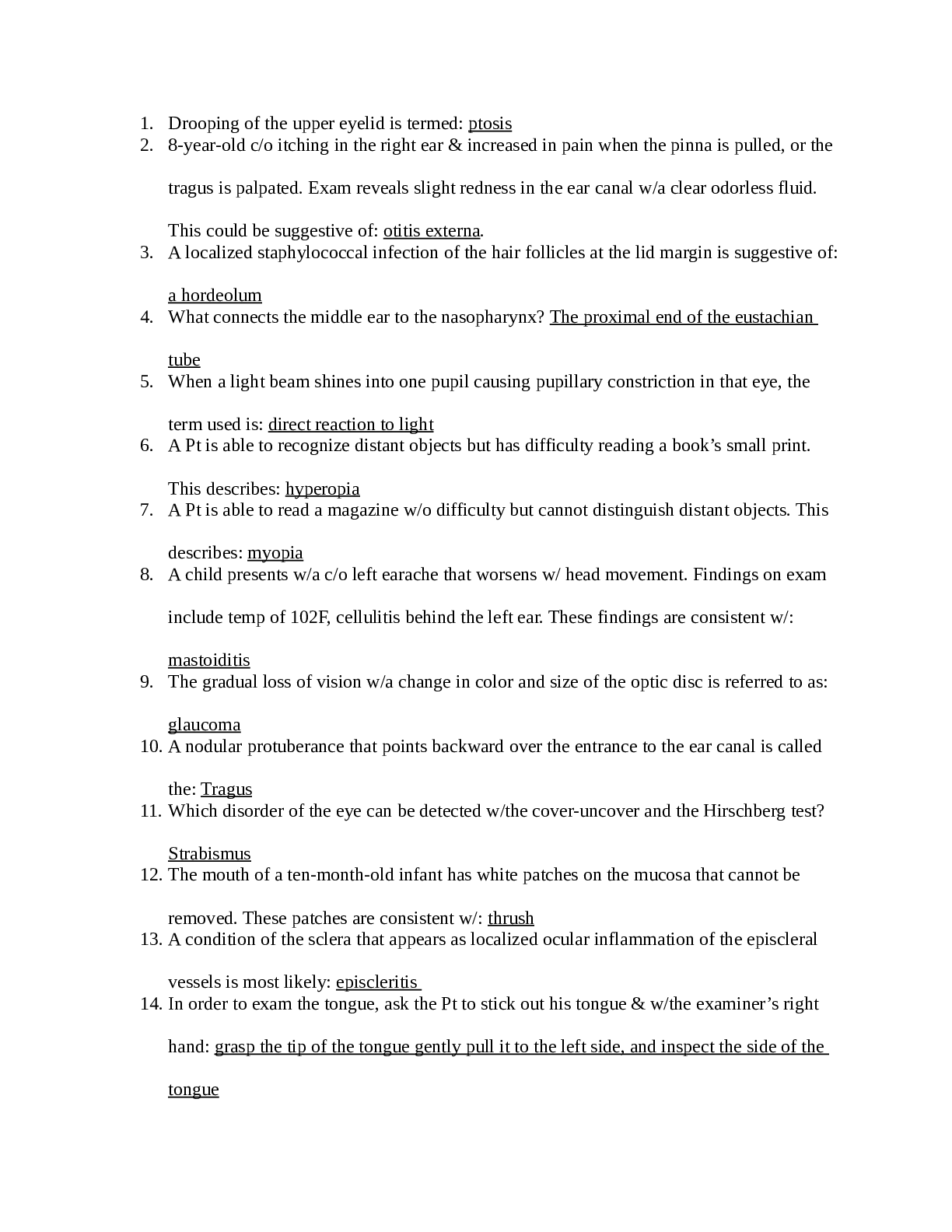

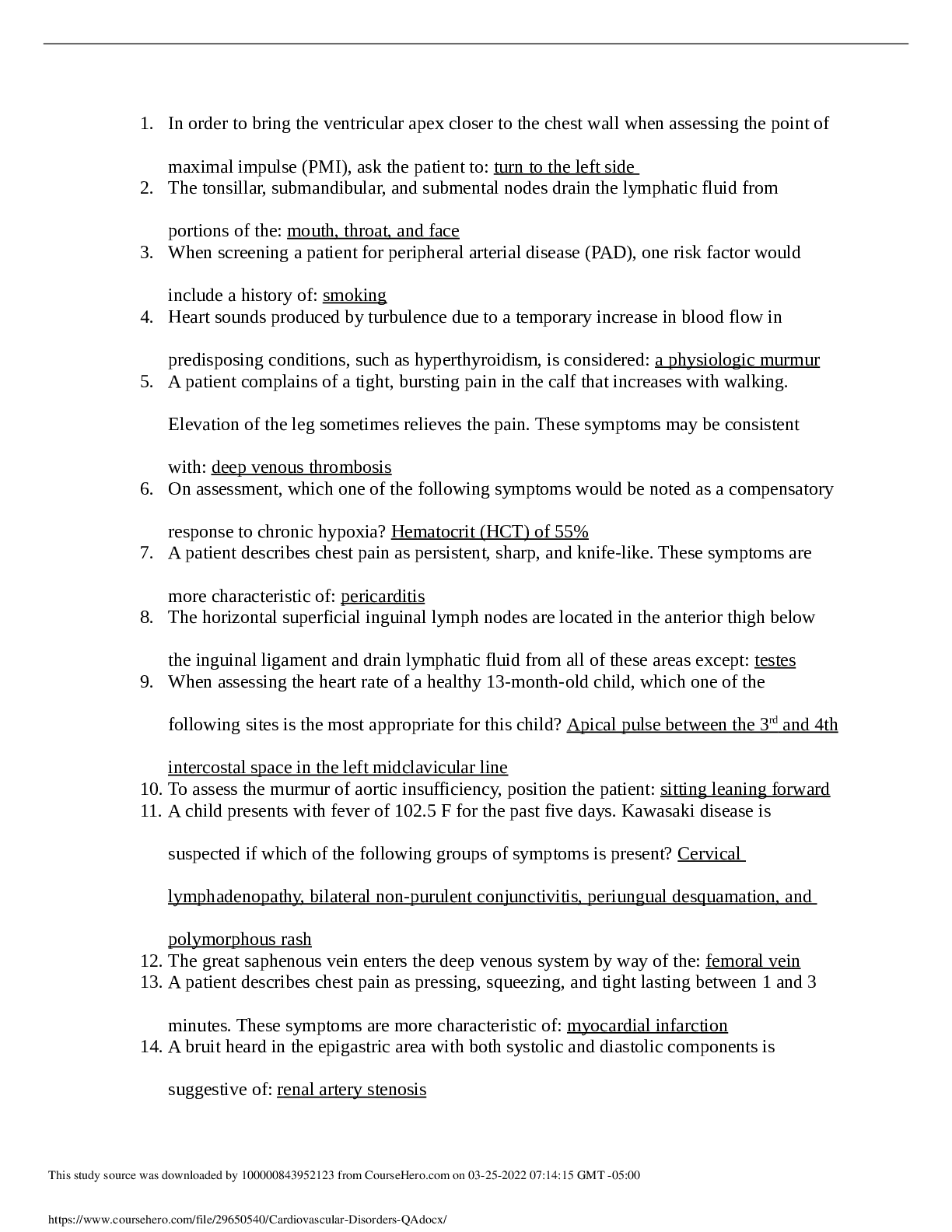

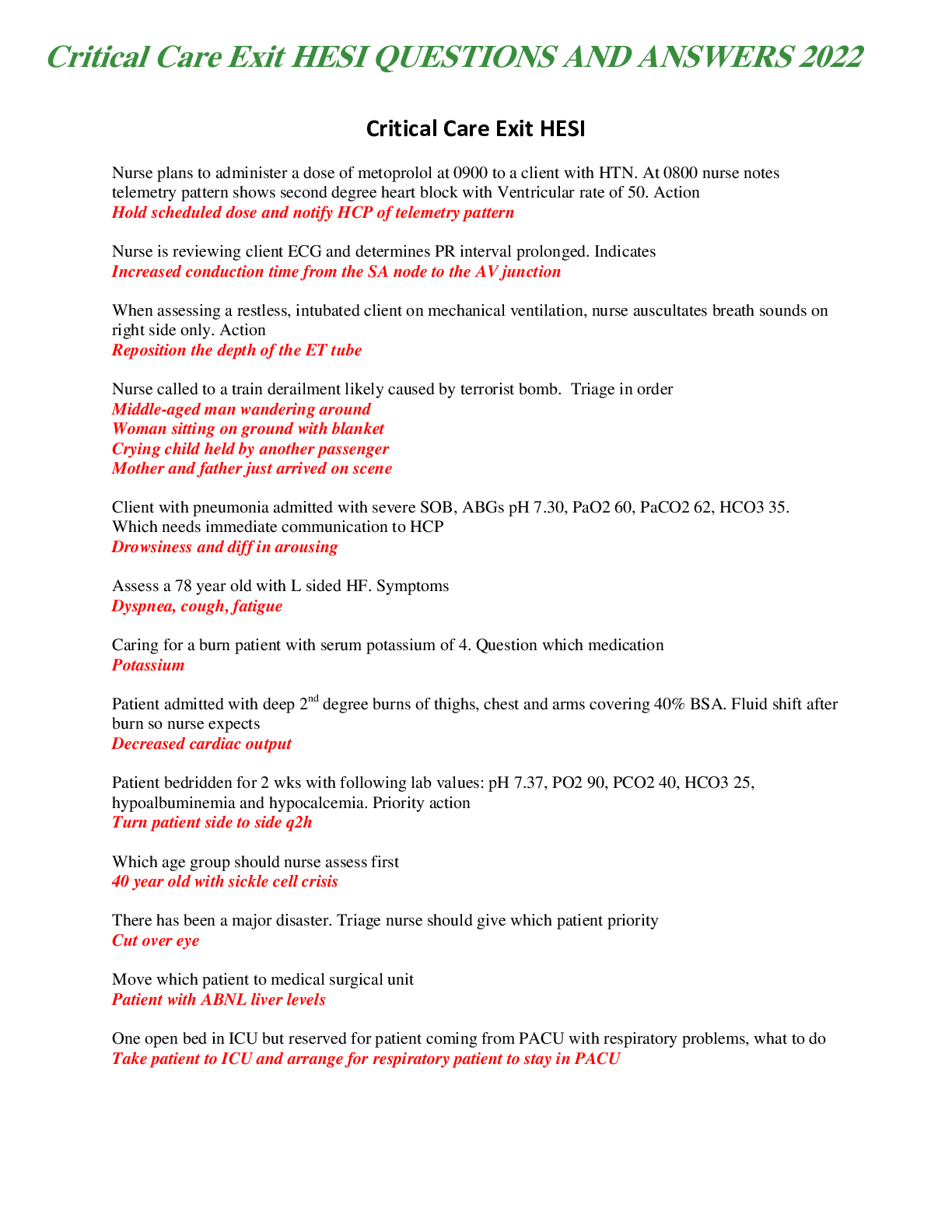

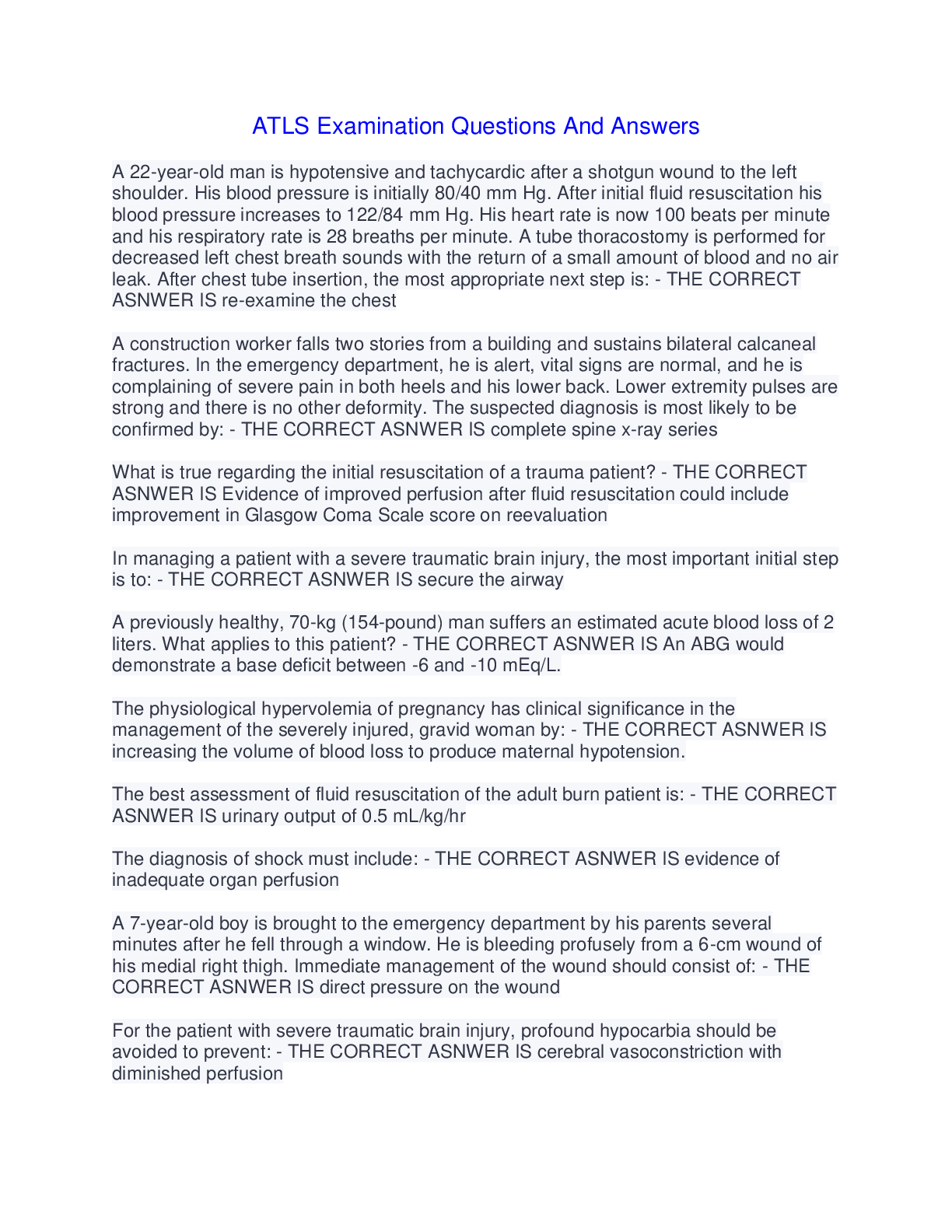

Sophia Finance Milestone 4 1 Which of the following is an example of an operational risk for a company that manufactures automobiles? Rising interest rates that affect the terms of car loans, t... hereby decreasing demand Damage to completed cars held on a storage lot A state tax increase that makes buying and registering a car more expensive A national car rental agency backing out of a contract to buy a certain volume of new cars CONCEPT Risk and Capital Budgeting 2 Which of the following is a goal of working capital management? To ensure liquidity and increase cash holding costs To balance adequate cash flow against maximal returns To lengthen the span of time between payment of accounts payable and collection of accounts receivable To minimize free working capital and maximize opportunity costs CONCEPT Working Capital Financing 3 Seed money is a type of financing appropriate for a company in what stage of development? Growth Introduction Maturity Decline CONCEPT Types of Financing 4 Kiran needs additional short-term financing for his robotics company, so he asks his suppliers if they could issue a discount if he pays his bills early. What type of financing resource is Kiran using? Trade credit Barter Peer-to-peer lending Factoring CONCEPT Short-Term Financing 5 What can a business that has too little working capital do to increase it? Decrease inventory Increase short-term liabilities Reduce current assets Increase cash on hand CONCEPT Working Capital 6 An electronics company is preparing a capital budget and considering four long-term investments. The payback period of each project is as follows: Project A: 4 years Project B: 5.2 years Project C: 2.4 years Project D: 3 years In theory, which two projects should the company pursue? Projects C and D Projects A and C Projects B and D Projects A and B CONCEPT Introduction to Capital Budgeting 7 What is one potential advantage of being a privately-held company? A private company has access to less expensive sources of capital than a public company. Risk is spread among a larger pool of investors in a private company. If managers also own the company, they are strongly incentivized to succeed. If a company is private, it is better positioned to pursue acquisitions. CONCEPT Comparing Public and Private Financing 8 What does the residual dividend model mean for a company? It prioritizes the company's growth over shareholder dividends. It allows a company to maintain a consistent dividend yield. It helps a company attract investors who seek a high dividend payout ratio. It helps a company attract investors who seek a low dividend payout ratio. CONCEPT Setting the Dividend 9 When performing capital budgeting, cash flow analysis can help a company determine when to execute __________. depreciation taxes replacement projects sunk costs CONCEPT Cash Flow Analysis and Other Factors 10 Aneeka owns 40 shares of stock in Company A that are valued at $15/share. After Company A repurchases 5% of its outstanding shares on the open market, what does Aneeka own? 40 shares valued at a higher price/share 38 shares of stock valued at a higher price/share 38 shares of stock valued at a lower price/share 40 shares valued at a lower price/share CONCEPT Cash Dividend Alternatives 11 Which of the following is a disadvantage of venture capital? Venture capital investors may place restrictions on company operations, such as setting salary caps. Receiving venture capital can send a message to other investors that your company is unlikely to succeed. Venture capitalists only receive a return on their investment if the company is eventually purchased for a large sum. Companies that receive venture capital are prohibited from issuing an IPO once they become successful. CONCEPT Venture Capital 12 Which inventory technique is most useful when a business has inventory that varies greatly in value? LIFO Average cost FIFO ABC CONCEPT Inventory Management 13 Determine whether the following description is true of a capital lease, an operating lease, neither or both. "A way for a company to acquire equipment for a relatively short-term period, after which the equipment returns to the owner" Capital lease Operating lease Both Neither CONCEPT Leasing 14 Which of the following describes derivatives, rather than debt securities or equity securities? They are a fixed-term security. They are often used to offset external risks like changes in commodity pricing. They are considered a liquid investment. They are the least risky of the three. CONCEPT Securities Management 15 What is one disadvantage of NPV as a capital budget method? It can be very difficult to calculate, even if inputs like cash flows are quite clear. It can only be used to evaluate bonds. It cannot be used to compare mutually exclusive investments. Although the weighted average cost of capital is commonly used as the discount rate, it is not a perfect input. CONCEPT Net Present Value 16 A company with a 120-day operating cycle determines its cash conversion cycle using the following data: Receivable days: 35 Inventory days: 95 Payable days: 45 What is the company's cash conversion cycle? 105 165 25 75 CONCEPT Cash Conversion Cycle 17 A company invests $40,000 in a project with the following net cash flows: Year 1: $3,000 Year 2: $8,000 Year 3: $14,000 Year 4: $19,000 Year 5: $22,000 Year 6: $28,000 In what year does payback occur? Year 6 Year 3 Year 4 Year 5 CONCEPT The Payback Method 18 Select one disadvantage of IRR as a capital budget method. It can be difficult to interpret and understand. It fails to account for the time value of money. It is not useful for comparing projects with different lifespans. It can only be used with projects that have positive cash flows. CONCEPT Internal Rate of Return 19 When managing its cash, a company should make use of float to __________. make payments before they come due decrease the length of time for a payment to clear the bank increase the length of the disbursement cycle set aside cash for future payments CONCEPT Cash Management 20 What is the benefit to a company from a securities underwriter? They generate demand for a company's securities by giving them a strong credit rating. They help companies to receive a premium on the sale of their securities. They study the market and advise companies on where to set their IPO share price. They help companies to reduce the risk associated with an IPO. CONCEPT The Role of Investment Banks in Financing 21 Place the following steps for developing a credit policy in the correct order of process: A: The company decides that it wants to minimize opportunity costs by having as much cash on hand as possible. B: The company decides that it will send out two notices of late payments to customers before pursuing other collection methods. C: The company decides that its payment terms will be Net 15. A, B, C A, C, B C, B, A C, A, B CONCEPT Accounts Receivable 22 Which of the following investors would likely prefer a cash dividend over a stock dividend? Enrique subscribes to the "bird in the hand" theory when it comes to dividends. Kylie is a high-income earner and prefers to avoid additional taxes this year. Layton prefers when companies let him decide how to benefit from his dividends. Harriett is more focused on long-term outcomes than short-term ones when it comes to investing. CONCEPT Dividend Policy 23 Rose is concerned about a stock in her portfolio because in recent periods, the dividend she has received for each share has gotten smaller while the share price has remained relatively constant. What financial metric is Rose analyzing? Dividend yield Dividend cover Payout ratio Dividend per share CONCEPT Introduction to Dividends [Show More]

Last updated: 1 year ago

Preview 1 out of 18 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 06, 2020

Number of pages

18

Written in

Additional information

This document has been written for:

Uploaded

Oct 06, 2020

Downloads

0

Views

30

.png)

.png)

, Correct, Download to Score A.png)

, Correct, Download to Score A.png)

, Correct, Download to Score A.png)

, All Correct, Download to Score A.png)

, All Correct, Download to Score A.png)

, All Correct, Download to Score A.png)

, All Correct, Download to Score A.png)

, Correct, Download to Score A.png)

, All Correct, Download to Score A.png)

Questions and Answers (latest Update), All Correct, Download to Score A.png)

Questions and Answers (latest Update), All Correct, Download to Score A.png)

, All Correct, Download to Score A.png)

Questions and Answers (latest Update), Correct, Download to Score A.png)

Questions and Answers with Explanations (STUDY MODE) Questions and Answers (latest Update), Correct, Download to Score A.png)