Accounting > EXAM PROCTORED > 2021 Tax Comprehensive Module 2: Final Exam (All)

2021 Tax Comprehensive Module 2: Final Exam

Document Content and Description Below

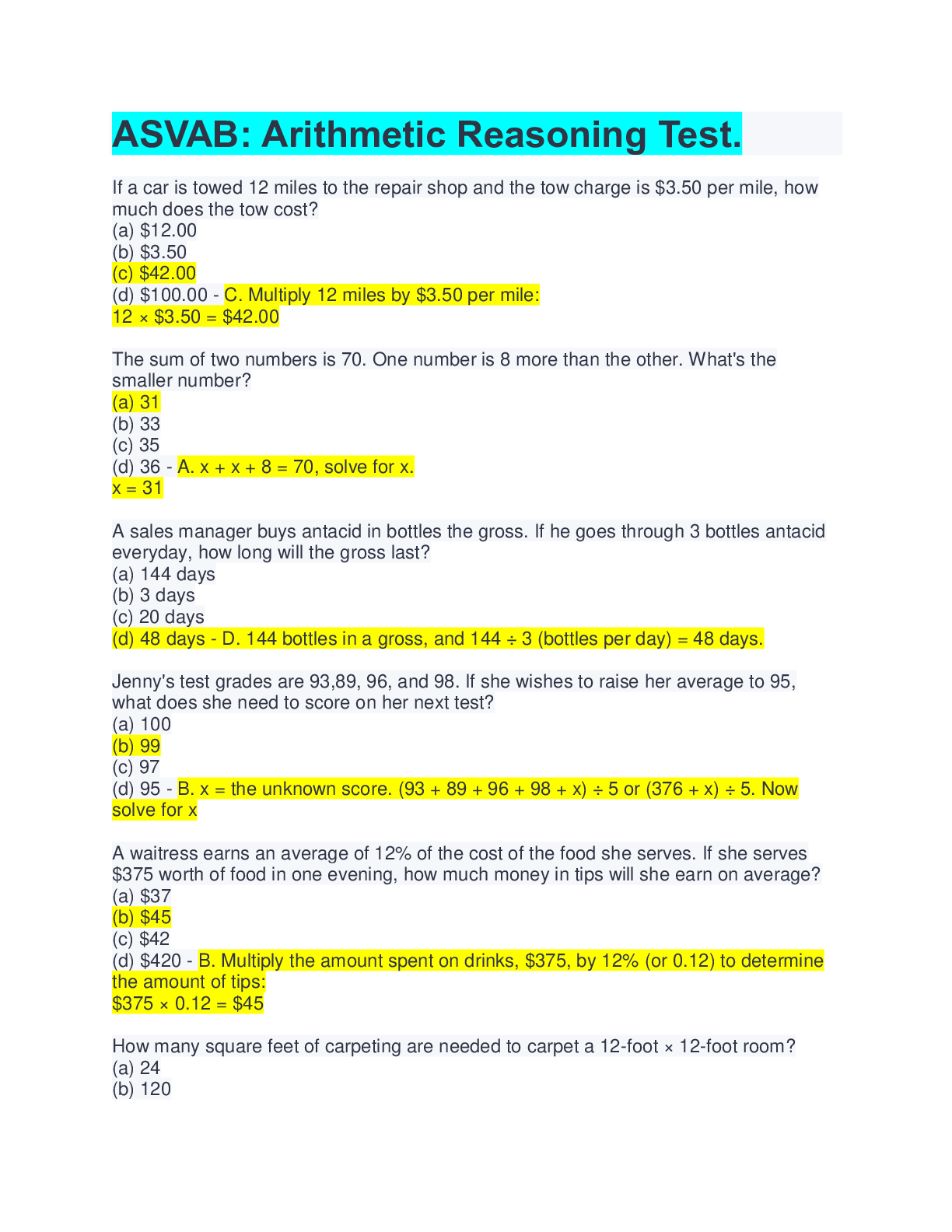

1. Don is a single parent. His son is 19 (not a student), and his daughter is 17 (still a student). Don claimed EIC on his tax return for both children. He later received a letter from the Internal Re... venue Service which disallowed EIC for his son. The letter also stated that Don’s claim was an error due to reckless or intentional disregard of the EIC rules. For how many years will Don be denied EIC? a) 10 years b) 5 years c) 2 years d) 1 year 2. Last year Rick fraudulently claimed his cousin’s children as dependents on his return to receive earned income credit. The IRS discovered this when Rick’s cousin also claimed the children. Rick’s cousin was able to prove he had the right to claim his children, and the EIC was denied on Rick’s return. How long will EIC be prohibited if a taxpayer is denied EIC due to fraud? a) 10 years b) 5 years c) 2 years d) 1 year 3. Walt was a tax preparer who neglected to complete Form 8867 or record information needed for the return Rick fraudulently claimed the children for EIC purposes. After the IRS proved Rick had committed fraud, it was shown that Walt failed to exercise due diligence. What penalty will a tax preparer face if it is determined that he failed to exercise due diligence? a) $540 per return b) $540 per failure to comply c) $540 per year d) $540 per taxpayer and per return 4. In which of the following scenarios does the taxpayer fail to meet the residency test for EIC purposes? a) A taxpayer whose child lived with him for 5 months and 28 days b) A taxpayer whose eligible foster child lived with him all year c) A taxpayer whose child lived with him all year. He and his spouse separated on May 29. d) A taxpayer who is 64 years old and lived in the United States for more than half of the year 5. Trudy lives with her two children (ages 16 and 12), and her filing status is Head of Household. Trudy’s earned income and AGI was $31,000. Is Trudy eligible for EIC? a) Yes b) No, the taxpayer’s earned income is not within the range to receive EIC. c) No, the taxpayer’s children do not meet the age test to be a qualifying child. d) No, the taxpayer is not eligible due to her filing status. [Show More]

Last updated: 1 year ago

Preview 1 out of 16 pages

Instant download

Instant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 17, 2022

Number of pages

16

Written in

Additional information

This document has been written for:

Uploaded

Mar 17, 2022

Downloads

0

Views

78

.png)