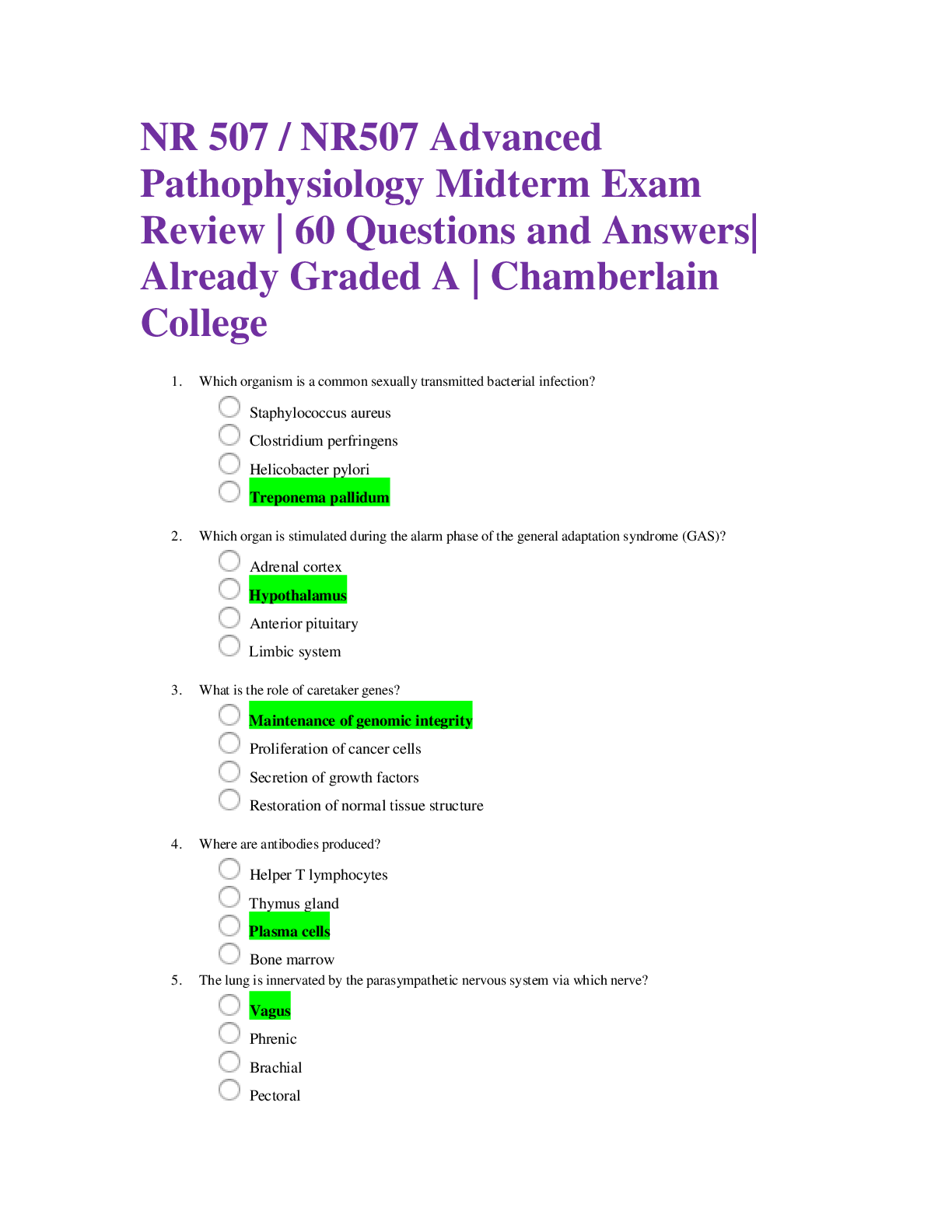

Financial Accounting > EXAM > University of Texas, Dallas ACCOUNTING 6344 Midterm 2A. 60 Questions and Answers plus Rationale. (All)

University of Texas, Dallas ACCOUNTING 6344 Midterm 2A. 60 Questions and Answers plus Rationale.

Document Content and Description Below

True/False 1. Next year, Dow Chemical Corporation plans to build a laboratory dedicated to a special project. The company will not use the laboratory after the project is finished. Under GAAP, this... laboratory should be expensed. 2. Revenues from discontinued operations of a company are reported separately from revenues from continuing operations in the income statement. 3. Accounts payable are a short-term source of non-interest-bearing financing. 4. Accrued liabilities are obligations for which there is no external transaction. 5. If accrued liabilities are overestimated in the current period, the reported income in a following period will be lower than it should be.. 6. Contingent liabilities that are ‘probable’ and can be reasonably estimated are recorded on the balance sheet as a liability and as an expense in the income statement. 2 7. The principal and interest that will be paid on long-term debt within the next operating cycle are reported on the balance sheet as “current portion of long-term debt.” 8. All gains and losses on bond repurchases are reported as extraordinary items. Answer: False 9. For an item to be classified as extraordinary, it needs to be both unusual and infrequent. However, there is an exception for material items – for one-time items that are extremely large, firms have the option of classify these items as extraordinary to provide better information to investors. Answer: False 10. Income tax expense is not recorded at the amount owing to the tax authorities even if this is the most objectively measured amount. Answer: True 11. In order to report accounts receivable, net, companies estimate the amount they do not expect to collect from their credit customers. Answer: True 12. Overestimating the allowance for uncollectible accounts receivable can shift income from the current period into one or more future periods. Answer: True 3 13. The financial statement effects for uncollectible accounts occur when the company writes off the account because that is when all the uncertainty is resolved. Answer: False 14. The three components of manufacturing costs are direct materials, direct labor, and manufacturing overhead. Answer: True 15. LIFO inventory costing yields more accurate reporting of the inventory balance on the balance sheet. Answer: False 16. Companies using LIFO are required to disclose the amount at which inventory would have been reported had it used FIFO. Similarly, companies using FIFO are required to disclose what their inventory would have been if the company had used LIFO. Answer: False 17. In general, in a period of falling prices, LIFO produces higher gross profits than FIFO. 4 18. Impairment of long-term assets is determined by comparing the sum of the present value of the asset’s expected future cash flows to the asset’s net book value. 19. The gain or loss on the sale of the asset is computed by: Gain/(Loss) on sale = Market value of asset – Net book value of asset 20. For self-constructed assets, a firm may capitalize any expenses required to place the asset in service. This includes any interest expense on loans during the construction period. Multiple Choice 21. Boston Consulting Group (BCG) is a management consulting, technology services and outsourcing organization. Which of the following actions should managers take when there is evidence that a fixed-rate contract is over budget and will generate a loss for the firm? A) Use the percentage of completion method to recognize the loss over the remaining term of the engagement. B) Recognize the loss in the current period rather than over the remaining term of the engagement. C) Restate the financial statements and recognize the loss in the earliest period of the engagement. D) Use the percentage of completion method and pro rate the loss over the entire term of the engagement. E) None of the above is an appropriate action. 22. On December 31, 2012, Tri-State Construction Inc. signs a contract with the state of Texas Department of Transportation to manufacture a bridge over the Rio Grande. Tri-State anticipates the construction will take three years. The company’s accountants provide the following contract details relating to the project: 5 Contract price Estimated construction costs Estimated total profit During the three-year construction period, Tri-State incurred costs as follows: 2013 2014 $180 million 2015 $ 90 million Tri-State uses the percentage of completion method to recognize revenue. Which of the following represent the revenue recognized in 2013, 2014, and 2015? [Show More]

Last updated: 1 year ago

Preview 1 out of 20 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 30, 2022

Number of pages

20

Written in

Additional information

This document has been written for:

Uploaded

Apr 30, 2022

Downloads

0

Views

67

(1).png)