Mathematics > QUESTIONS & ANSWERS > Questions and Answers > Colorado Technical University MATH 451-1404B-Decision Making Under Risk (All)

Questions and Answers > Colorado Technical University MATH 451-1404B-Decision Making Under Risk

Document Content and Description Below

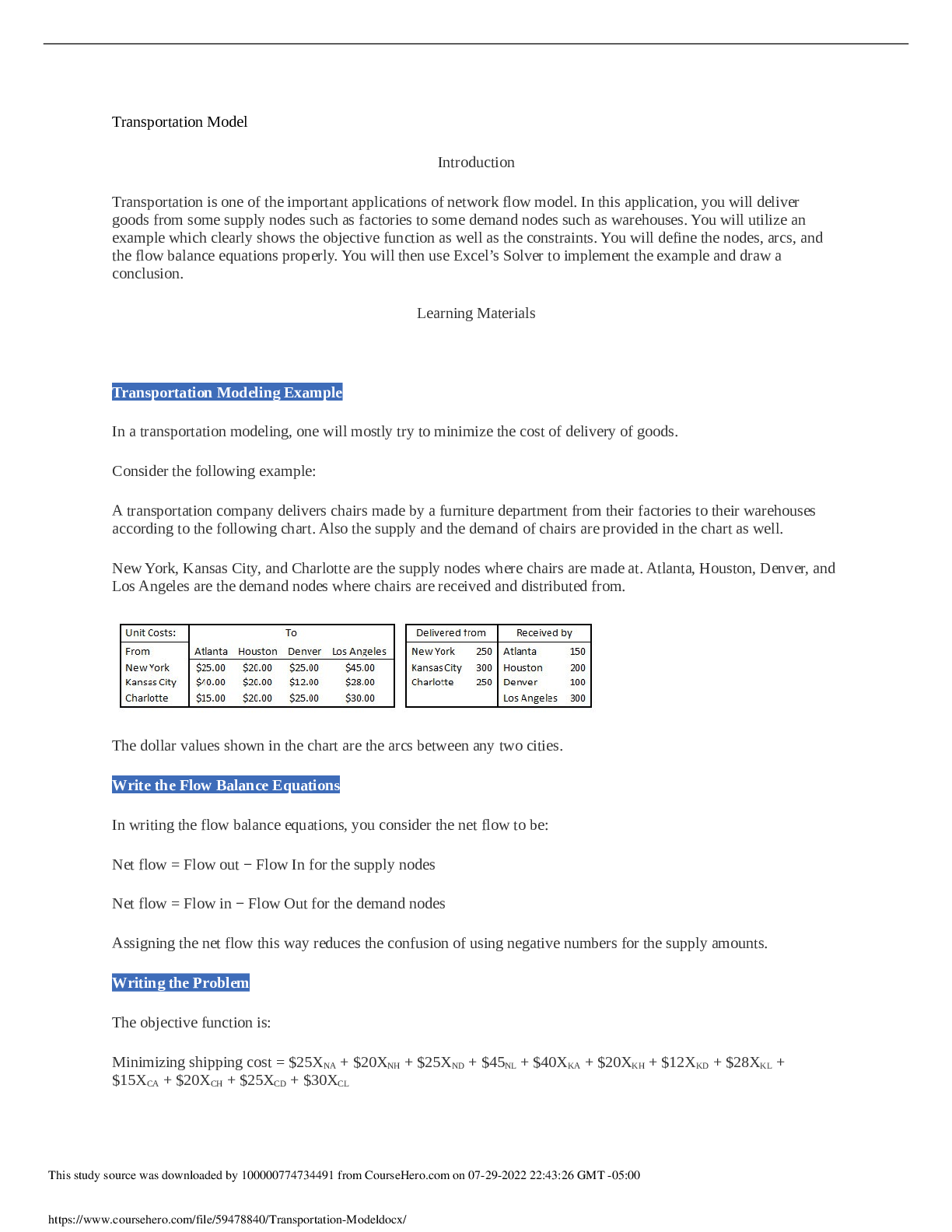

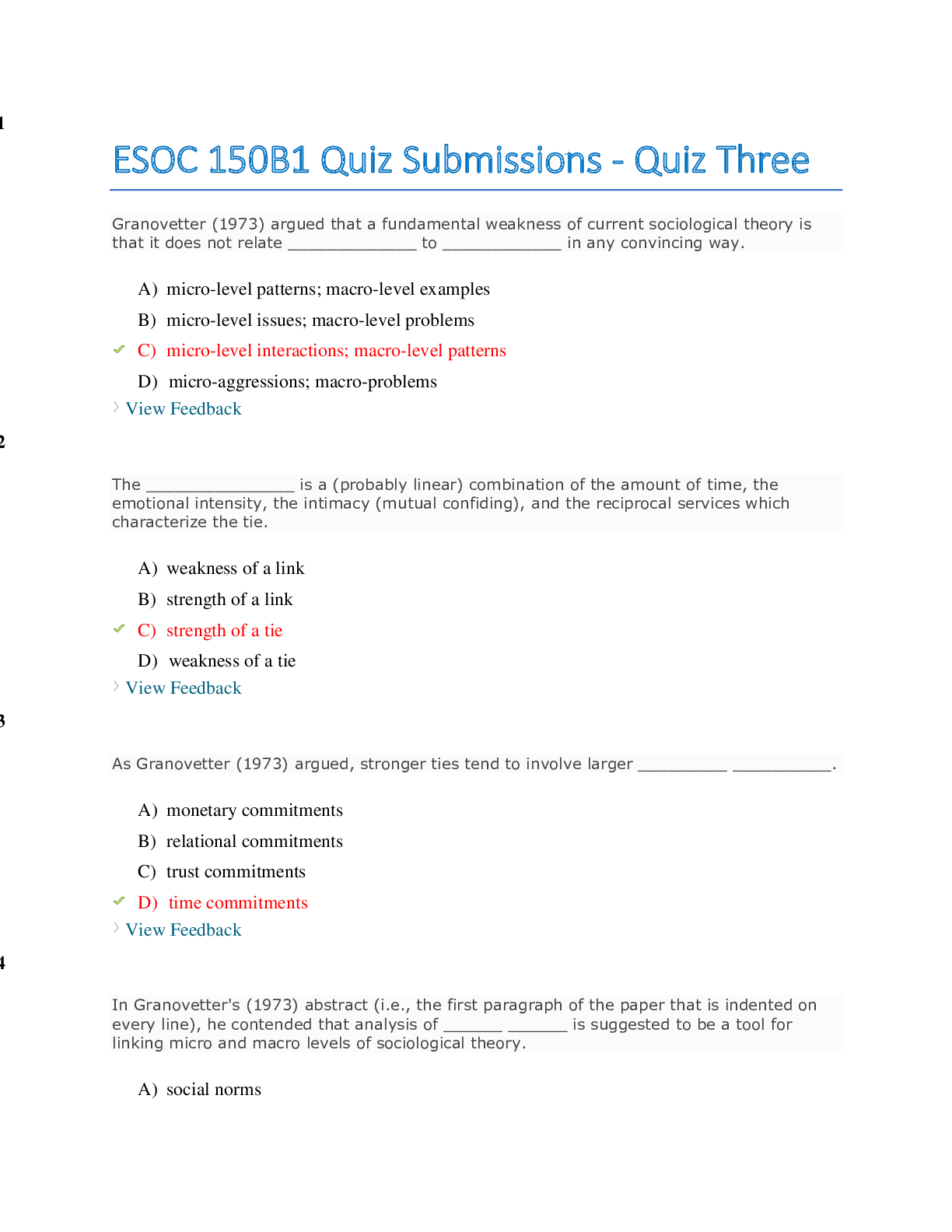

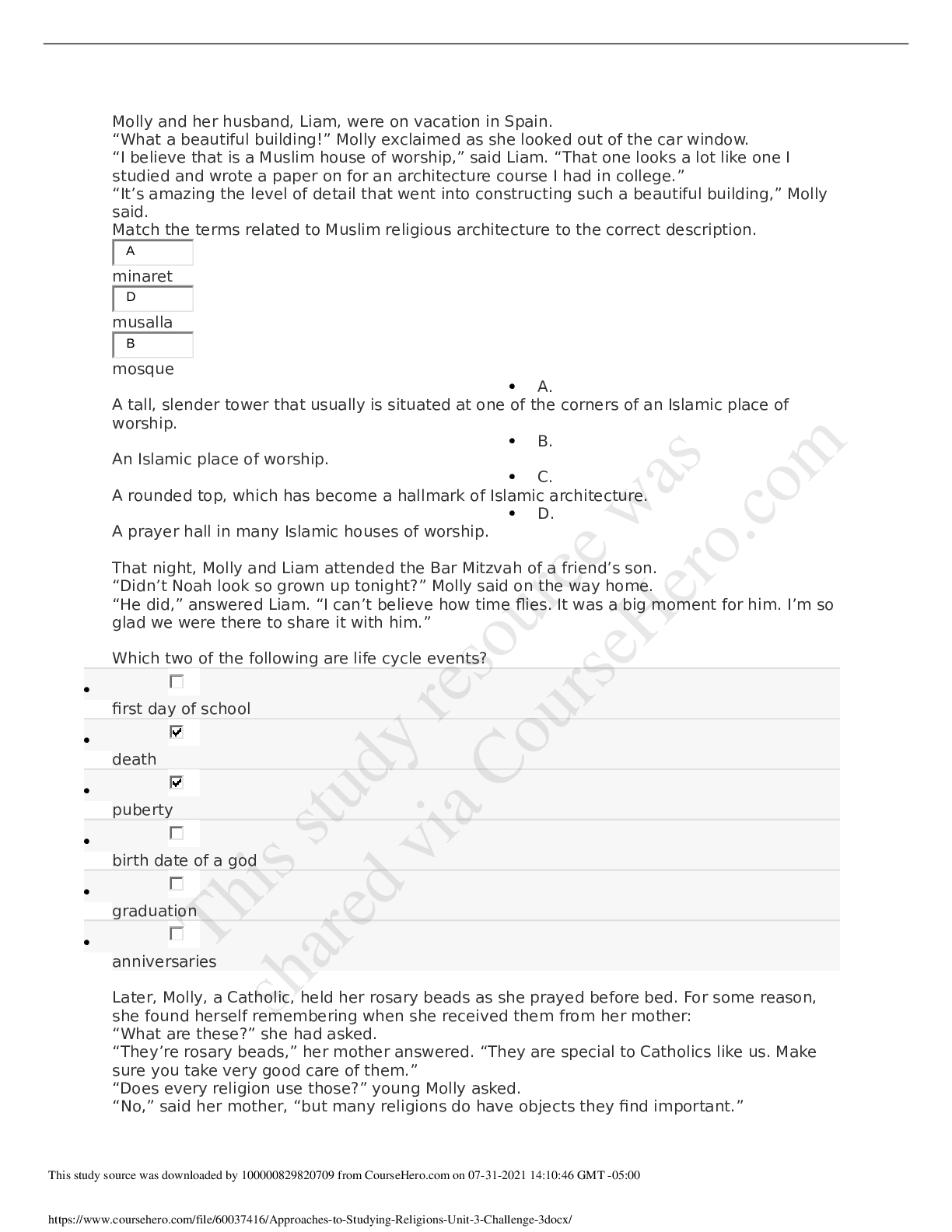

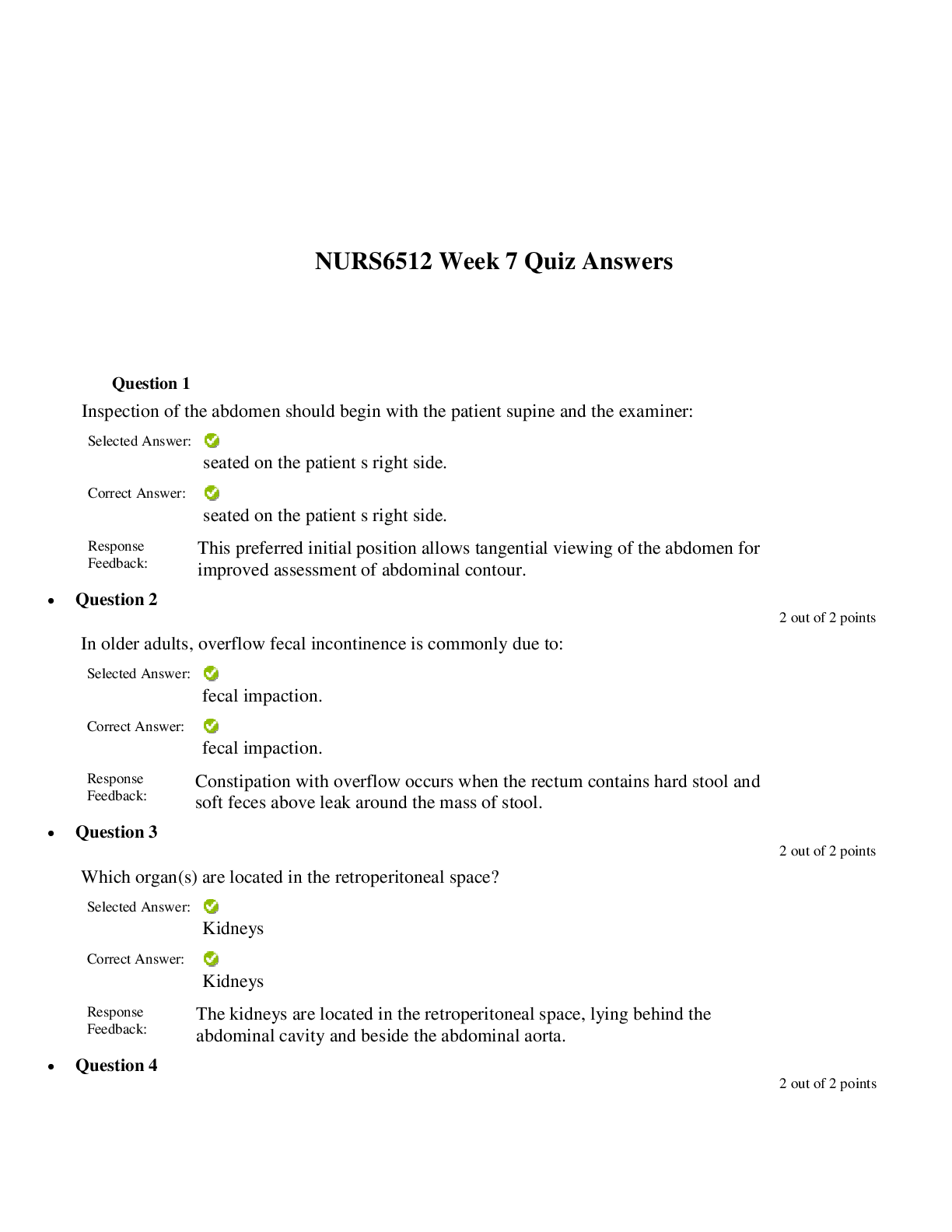

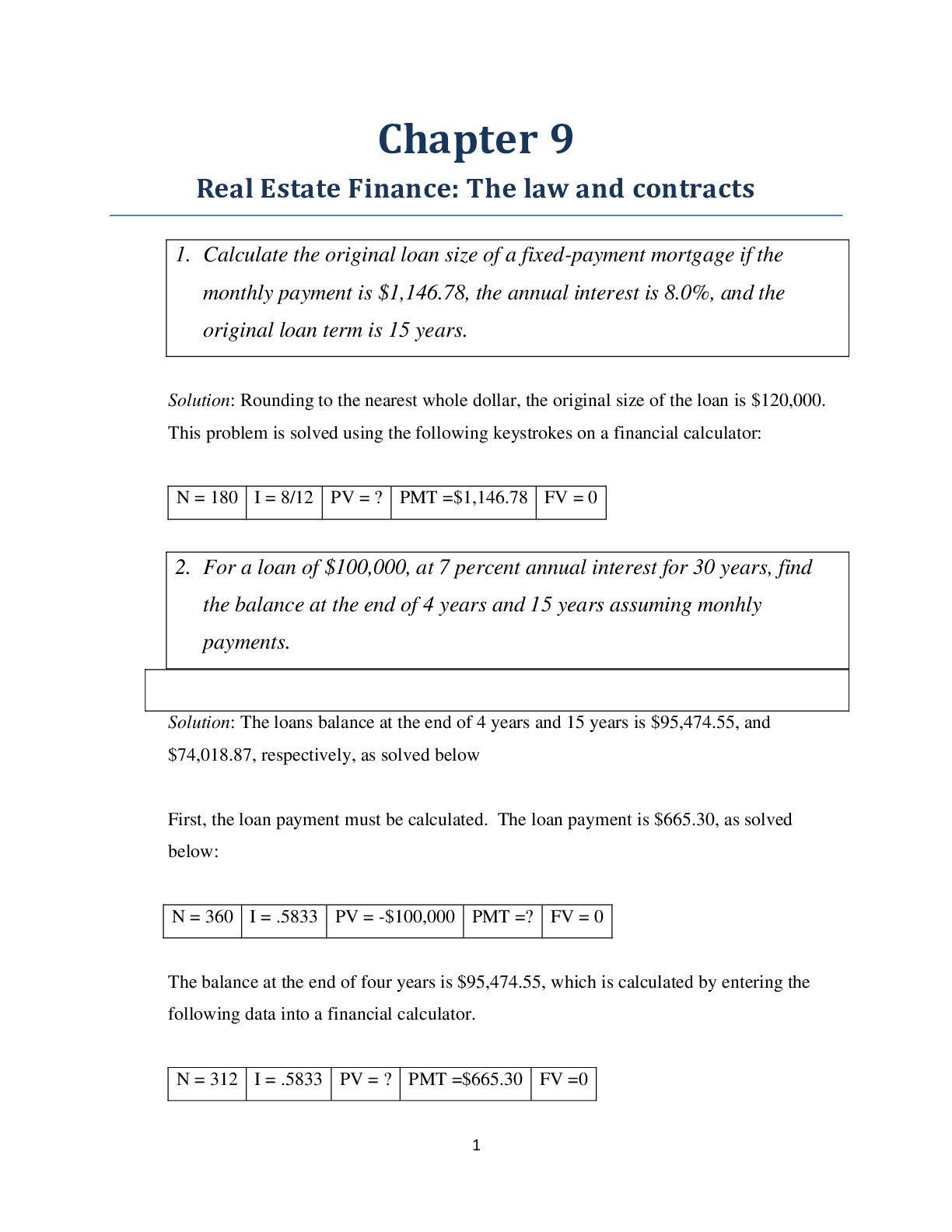

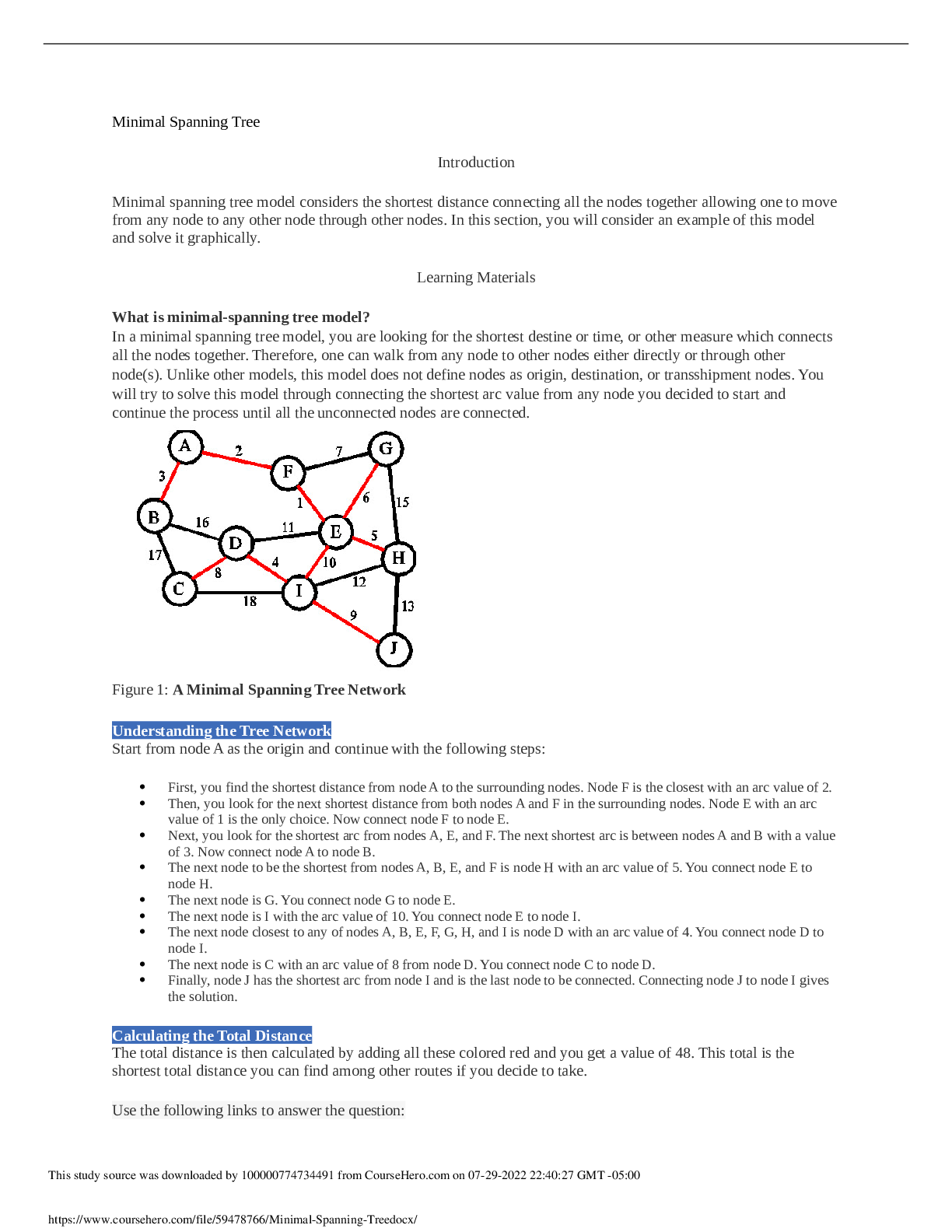

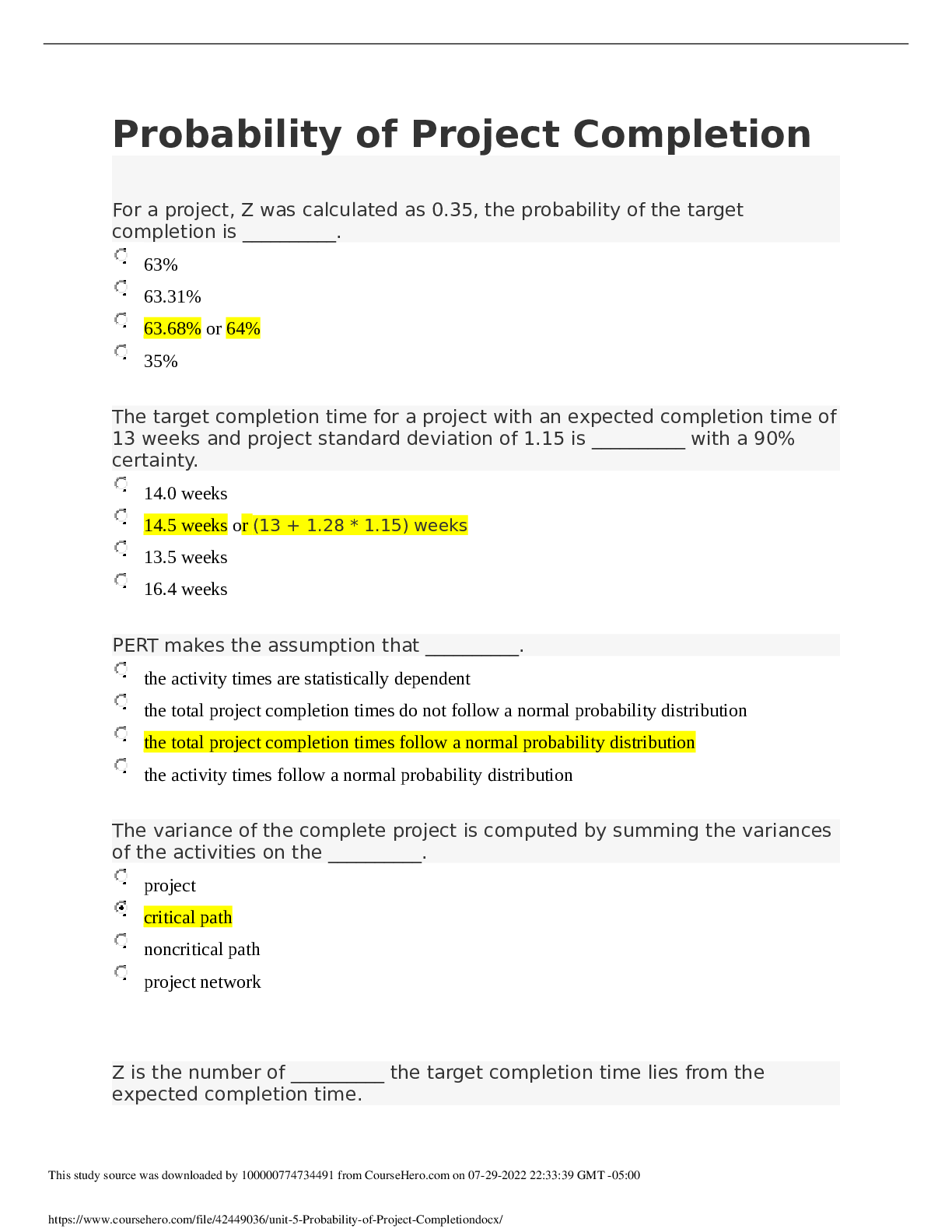

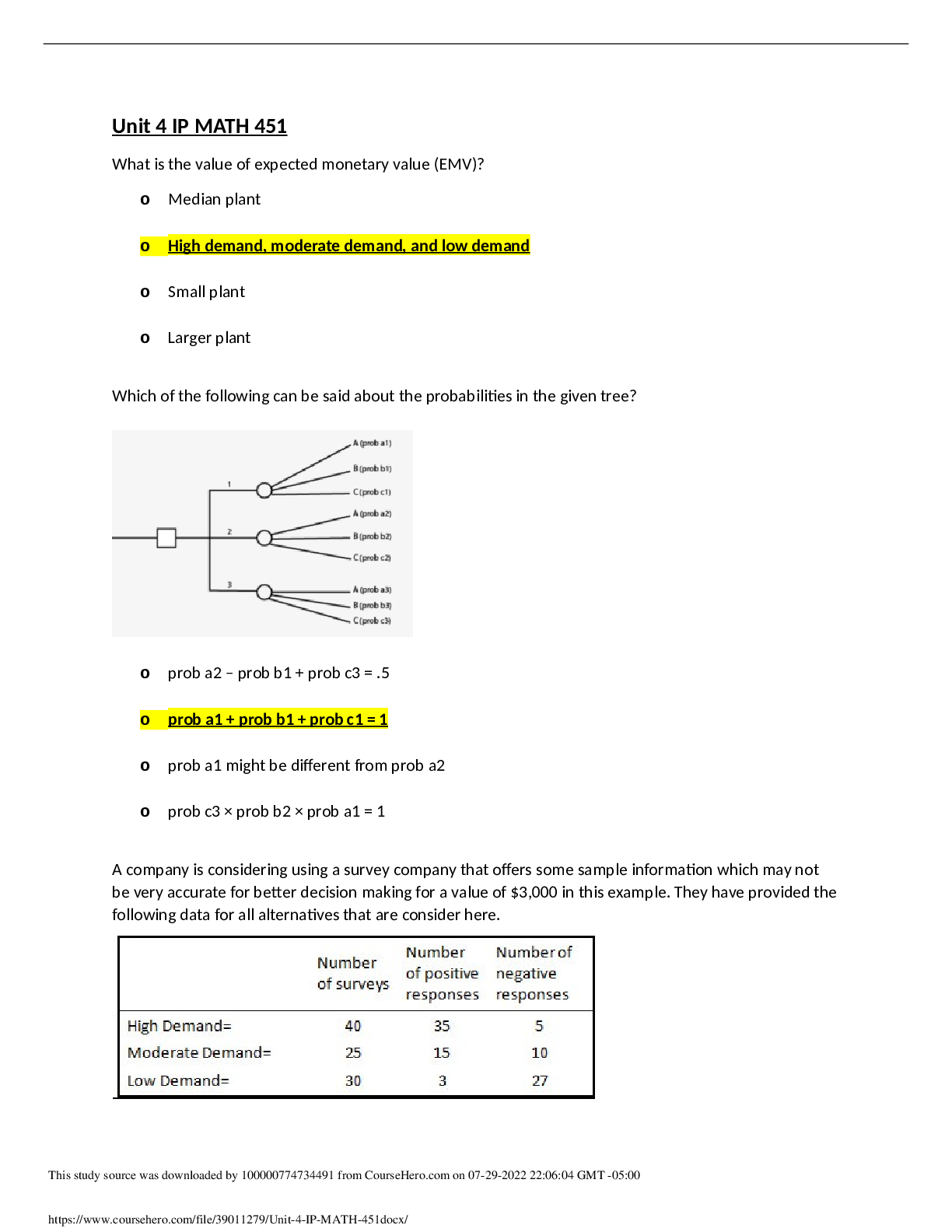

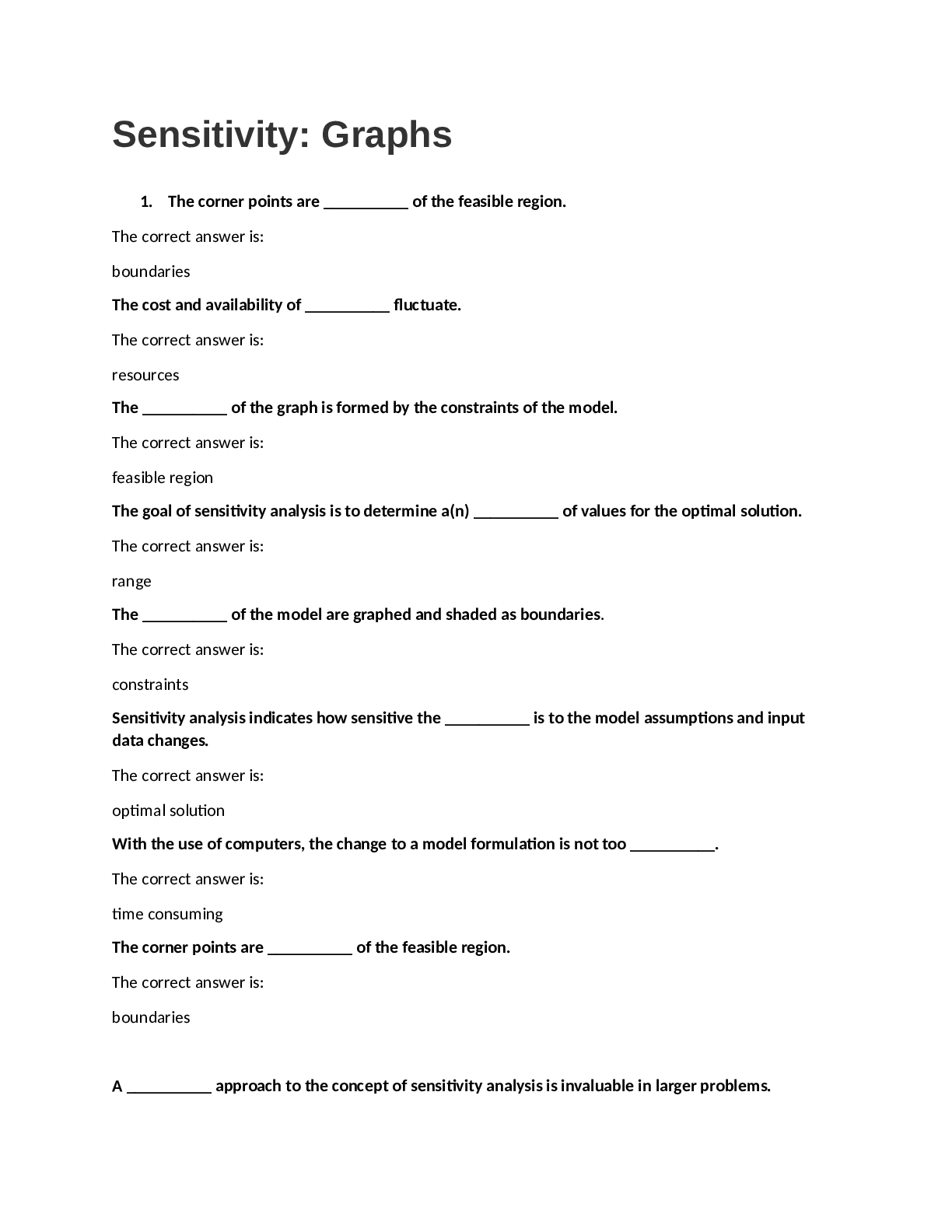

Colorado Technical University MATH 451-1404B- Decision Making Under Risk Learning Materials Probability of Occurrence The probability of occurrence of each outcome can be obtained from: surv... ey exports personal feelings Decision Making Under Risk The problem environmental is called decision making under risk. Consider the alternative with the highest expected monetary value (EMV). Calculate the expected opportunity loss (EOL) and expected value of perfect information. The EMV is calculated by the weighted average of all possible payoffs for that alternative as: EMV for an alternative = Payoff (of first outcome) * P(of first outcome) + Payoff (of the second outcome) * P(of the second outcome) + … Expected Monetary Value and Expected Opportunity Loss Expected monetary value (EMV) represents the long-run average payoff. Expected opportunity loss (EOL), also called regret, is considered to be the difference between the optimal payoff and the actual payoff received. In all decision-making application under risk, the minimum EOL will always is equal to the decision alternative as the maximum EMV. Perfect Information Having the right kind of information at the time of decision making is very critical. Therefore, perfect information can seriously help a company to make proper and correct decision and, therefore, it has a value so-called expected value of perfect information. Consider the following two types of perfect information: Expected value with perfect information (EVwPI) Expected value of perfect information (EVPI) Expected Value with Perfect Information The first one is the expected value with perfect information (EVwPI) which defines the expected payoff if you have perfect information before a decision has to be made. It is calculated as: EVwPI = (Best payoff of first outcome) * P(of the first outcome) + (Best payoff of the second outcome) * P(of the second outcome) + … Expected Value of Perfect Information The second perfect information is called expected value of perfect information (EVPI) which is the difference of EVwPI and the expected value without information which means maximum EMV. The value of the best minimum expected opportunity loss (EOL) choice is always __________. less than the expected value of perfect information (EVPI) greater than the expected value of perfect information (EVPI) the opposite of the expected value of perfect information (EVPI) equal to the expected value of perfect information (EVPI) Which of the following best calculates expected value of perfect information (EVPI)? The average of expected value with perfect information (EVwPI) and maximum of expected monetary value (EMV) Expected value with perfect information (EVwPI) + maximum of expected monetary value (EMV) Expected value with perfect information (EVwPI) + the expected value without information Expected value with perfect information (EVwPI) - the expected value without information Decision making under risk involves considering various choices and several possible outcomes. The learning materials provide an example of this using the choice of factory size and whether there is high, moderate, or low demand. The payoffs are shown in the following table: Payoffs Outcome O1 O2 O3 O4 O5 Choice C1 17 233 -131 231 107 C2 -137 155 248 29 -146 C3 311 61 -150 24 360 C4 185 298 86 297 12 C5 -119 330 85 353 -107 Probability 0.265 0.137 0.095 0.195 0.308 Each outcome admits a choice with no regret. Which of the following choices corresponds to no regret for each outcome? 3, 5, 2, 5, 3, which means choice 3 for outcome 1, choice 5 for outcome 2, and so on. 4, 5, 5, 4, 4, which means choice 4 for outcome 1, choice 5 for outcome 2, and so on. 4, 1, 1, 1, 1, which means choice 4 for outcome 1, choice 1 for outcome 2, and so on. 5, 3, 1, 5, 5, which means choice 5 for outcome 1, choice 3 for outcome 2, and so on. Decision making under risk involves considering various choices and several possible outcomes. The learning materials provide an example of this using the choice of factory size and whether there is high, moderate, or low demand. The payoffs are shown in the following table: Payoffs Outcome O1 O2 O3 O4 O5 Choice C1 17 233 -131 231 107 C2 -137 155 248 29 -146 C3 311 61 -150 24 360 C4 185 298 86 297 12 C5 -119 330 85 353 -107 Probability 0.265 0.137 0.095 0.195 0.308 What is the expected value with perfect information (EVwPI)? Round your answer off to the nearest tenth. 330.7 316.0 312.9 330.9 A company has outcomes for four different decision-making options they have. The following table shows the payoff of each alternative. What is the value of expected opportunity loss (EOL) for the median plant? $30,000 $28,000 $78,000 $104,000 The best minimum expected opportunity loss (EOL) choice is always __________. equal to the minimum expected monetary value (EMV) greater than the maximum expected monetary value (EMV) equal to the best maximum expected monetary value (EMV) less than the maximum expected monetary value (EMV) When the probability of occurrence of each outcome can be accessed, the problem environment is called __________. decision making under uncertainty decision making with no risk decision making under risk decision making with certainty Decision making under risk involves considering various choices and several possible outcomes. The learning materials provide an example of this using the choice of factory size and whether there is high, moderate, or low demand. The payoffs are shown in the following table: Payoffs Outcome O1 O2 O3 O4 O5 Choice C1 17 233 -131 231 107 C2 -137 155 248 29 -146 C3 311 61 -150 24 360 C4 185 298 86 297 12 C5 -119 330 85 353 -107 Probability 0.265 0.137 0.095 0.195 0.308 What is the expected value with perfect information (EVwPI)? Round your answer off to the nearest tenth. 231.2 316.0 330.9 312.9 A company has outcomes for four different decision-making options they have. The following table shows the payoff of each alternative. What is the value of expected value of perfect information (EVPI)? $20,000 $104,000 $30,000 $0 Decision making under risk involves considering various choices and several possible outcomes. The learning materials provide an example of this using the choice of factory size and whether there is high, moderate, or low demand. The payoffs are shown in the following table: Payoffs Outcome O1 O2 O3 O4 O5 Choice C1 17 233 -131 231 107 C2 -137 155 248 29 -146 C3 311 61 -150 24 360 C4 185 298 86 297 12 C5 -119 330 85 353 -107 Probability 0.265 0.137 0.095 0.195 0.308 What is the expected opportunity loss (EOL) for choice 1? Round your answer off to the nearest tenth. 322.1 228.9 382.1 344.7 Decision making under risk involves considering various choices and several possible outcomes. The learning materials provide an example of this using the choice of factory size and whether there is high, moderate, or low demand. Let be the ith choice, be the jth outcome, be the payoff for the ith choice with the jth outcome, and lastly, let be the probability of the jth outcome. Sometimes, the letters get changed around. Consider the following expressions: a. b. c. d. Which of the following is the correct expression for the expected monetary value? Only d for choice r Only a for choice s Only a for choice r Only c for choice s Decision making under risk involves considering various choices and several possible outcomes. The learning materials provide an example of this using the choice of factory size and whether there is high, moderate, or low demand. The payoffs are shown in the following table: Payoffs Outcome O1 O2 O3 O4 O5 Choice C1 154 -75 285 182 94 C2 -15 169 -27 -65 -18 C3 55 144 193 208 240 C4 263 223 305 91 345 C5 305 318 374 225 -125 Probability 0.055 0.373 0.298 -0.313 0.755 Which of the following choices has the highest EMV, and what is its value when rounded off to the nearest integer? C4, 380 C4, 371 C3, 448 There is no meaningful answer because the probabilities do not add to 1. Decision making under risk involves considering various choices and several possible outcomes. The learning materials provide an example of this using the choice of factory size and whether there is high, moderate, or low demand. The payoffs are shown in the following table: Payoffs Outcome O1 O2 O3 O4 O5 Choice C1 17 233 -131 231 107 C2 -137 155 248 29 -146 C3 311 61 -150 24 360 C4 185 298 86 297 12 C5 -119 330 85 353 -107 Probability 0.265 0.137 0.095 0.195 0.308 Which of the following is the choice that has the best expected monetary value? C3 C2 C1 C5 Decision making under risk involves considering various choices and several possible outcomes. The learning materials provide an example of this using the choice of factory size and whether there is high, moderate, or low demand. Let be the ith choice, be the jth outcome, be the payoff for the ith choice with the jth outcome, and lastly, let be the probability of the jth outcome. Expected value with perfect information (EVwPI) is the expected payoff if you have perfect information before making the decision. Which of the following formulas is correct for E? Decision making under risk involves considering various choices and several possible outcomes. The learning materials provide an example of this using the choice of factory size and whether there is high, moderate, or low demand. Let be the ith choice, be the jth outcome, be the payoff for the ith choice with the jth outcome, and lastly, let be the probability of the jth outcome. Regret, or expected opportunity loss (EOL), is the difference between the best payoff and the actual payoff. Consider the following descriptions: a. The difference between the results you got and the best results you could have gotten with a different choice b. The difference between the results you got and the best results you could have gotten with a different outcome Consider the following formulas for regret: 1. 2. 3. 4. Which of the following pairs is the correct representation of regret? a, 1 a, 4 b, 4 b, 3 A company has outcomes for four different decision-making options they have. The following table shows the payoff of each alternative. What is the value of expected opportunity loss (EOL) for the no plant option? $35,000 $104,000 $0 $78,000 A company has outcomes for four different decision-making options they have. The following table shows the payoff of each alternative. What is the value of expected value with perfect information (EVwPI)? $30,000 $104,000 $74,000 $0 Decision making under risk involves considering various choices and several possible outcomes. The learning materials provide an example of this using the choice of factory size and whether there is high, moderate, or low demand. Let be the ith choice, be the jth outcome, be the payoff for the ith choice with the jth outcome, and lastly, let be the probability of the jth outcome. The expected value with perfect information is the weighted average of the best results for each possible outcome. It is the results that you can obtain if you had perfect information before making your choice. Which of the following is the formula that expresses this? What is the expected monetary value (EMV)? the sum of all possible payoffs for that alternative with their probabilities of the different outcomes the weighted average of all possible payoffs for that alternative with their probabilities of the different outcomes the average of all possible payoffs for that alternative with their equal probabilities of the different outcomes the difference of all possible payoffs for that alternative with their probabilities of the different outcomes [Show More]

Last updated: 1 year ago

Preview 1 out of 9 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

$7.00

Document information

Connected school, study & course

About the document

Uploaded On

Aug 02, 2022

Number of pages

9

Written in

Additional information

This document has been written for:

Uploaded

Aug 02, 2022

Downloads

0

Views

56