Financial Accounting > EXAM > Comprehensive Final Exam Module 1 - Part I the income tax school all done exam solution pdf (All)

Comprehensive Final Exam Module 1 - Part I the income tax school all done exam solution pdf

Document Content and Description Below

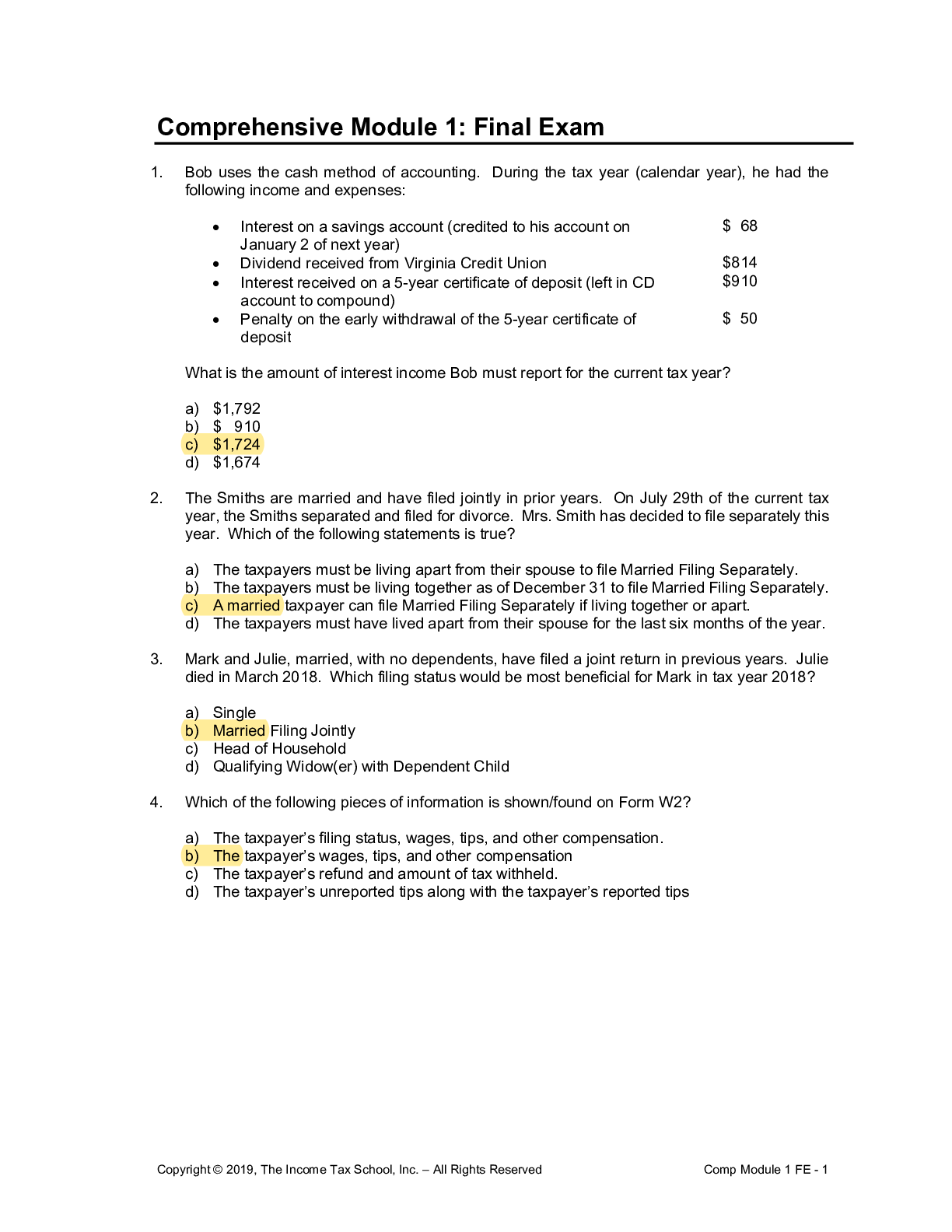

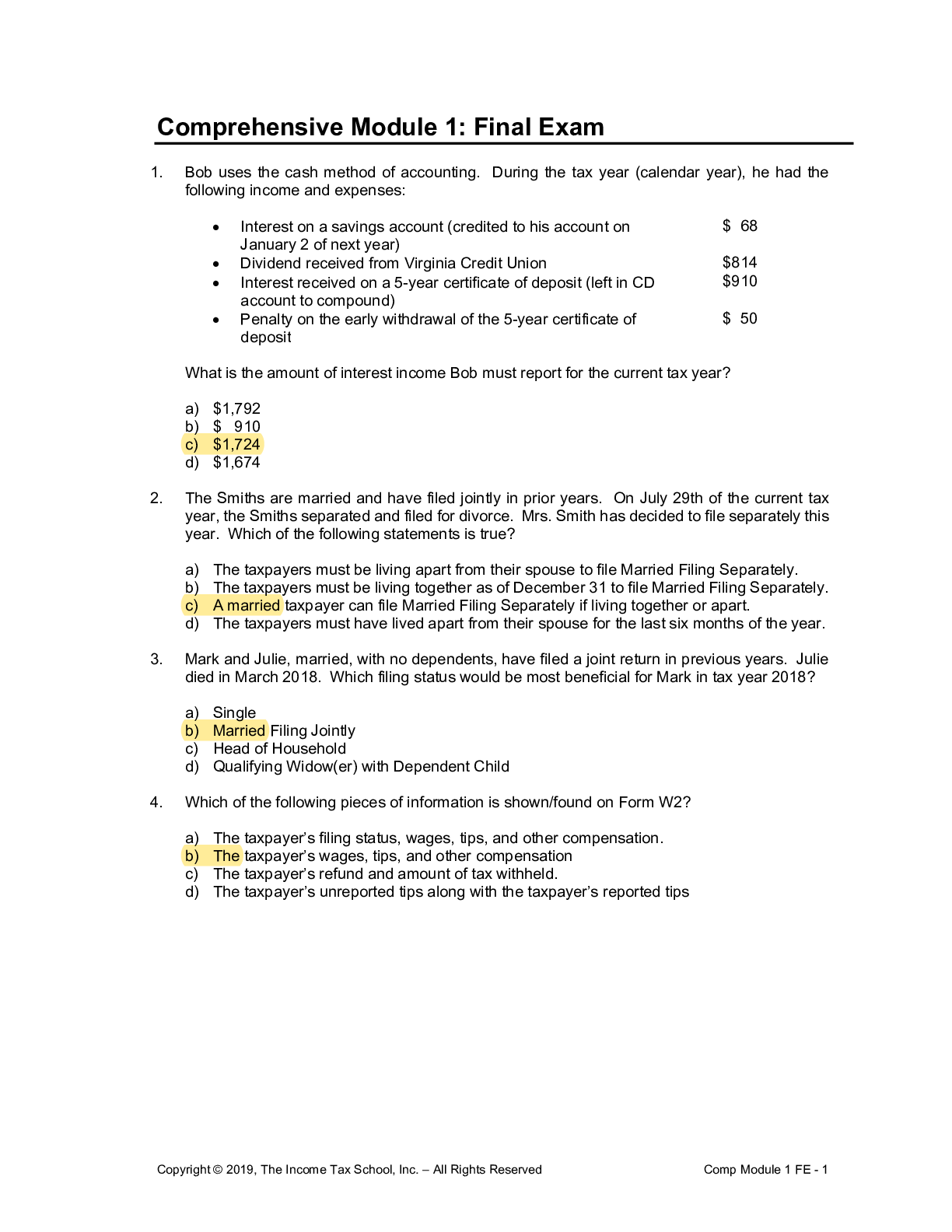

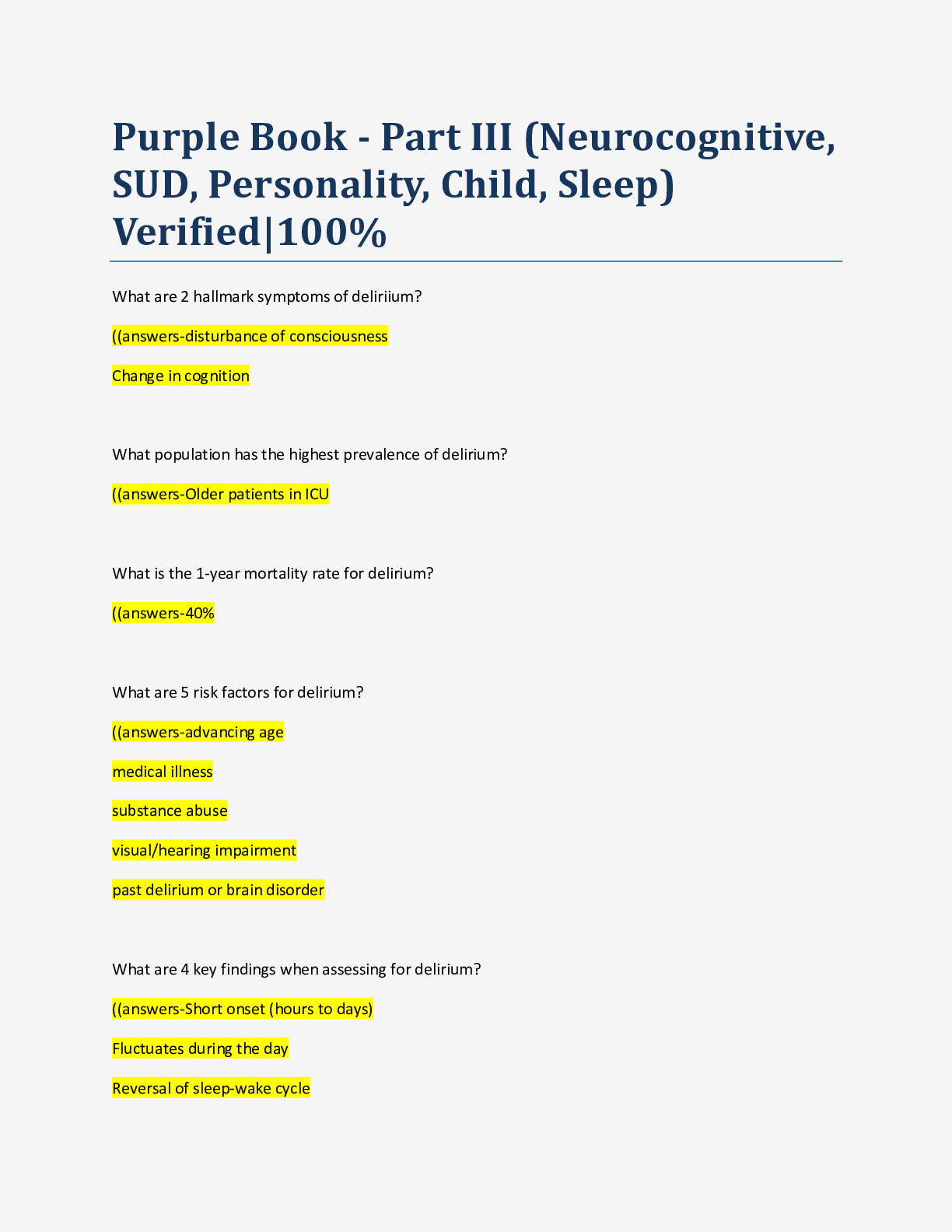

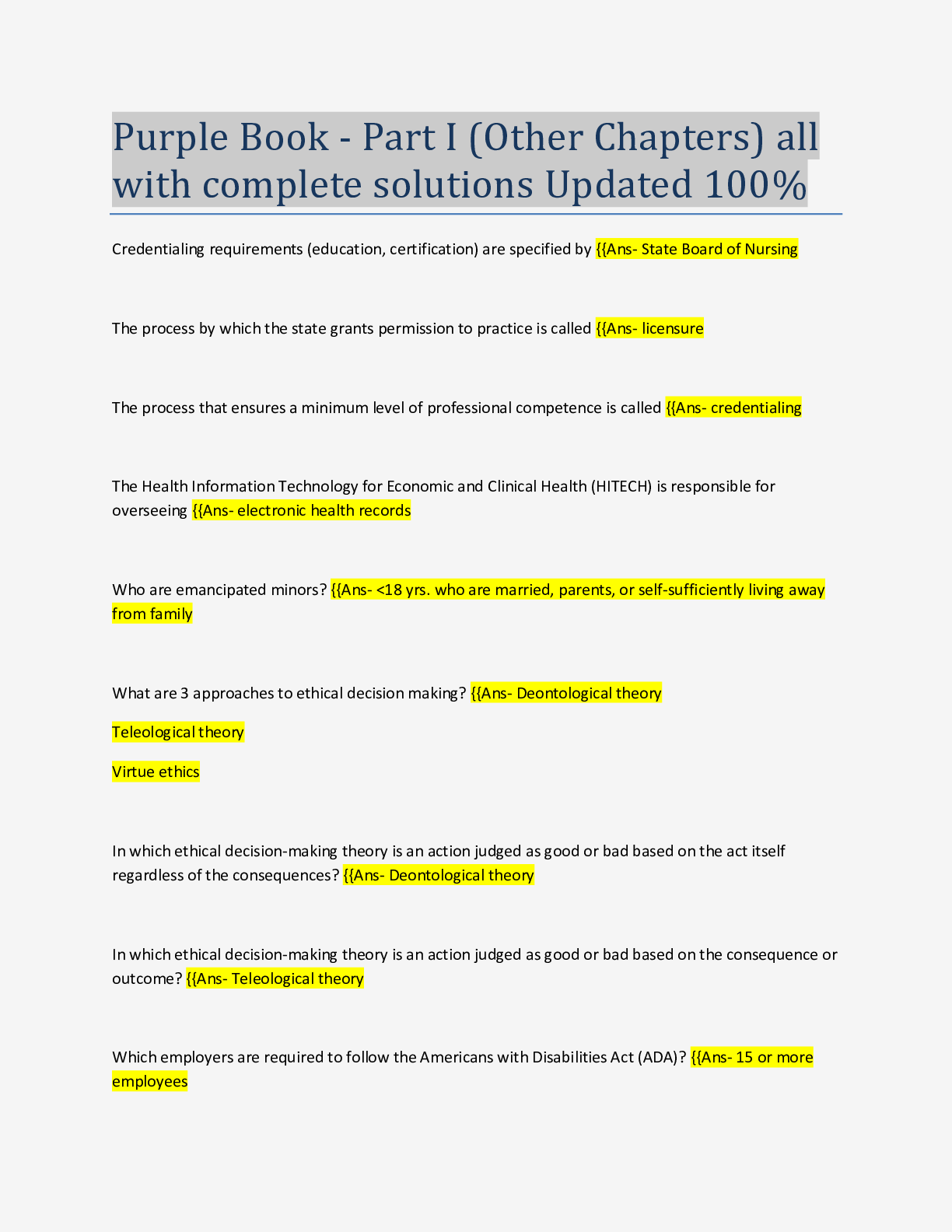

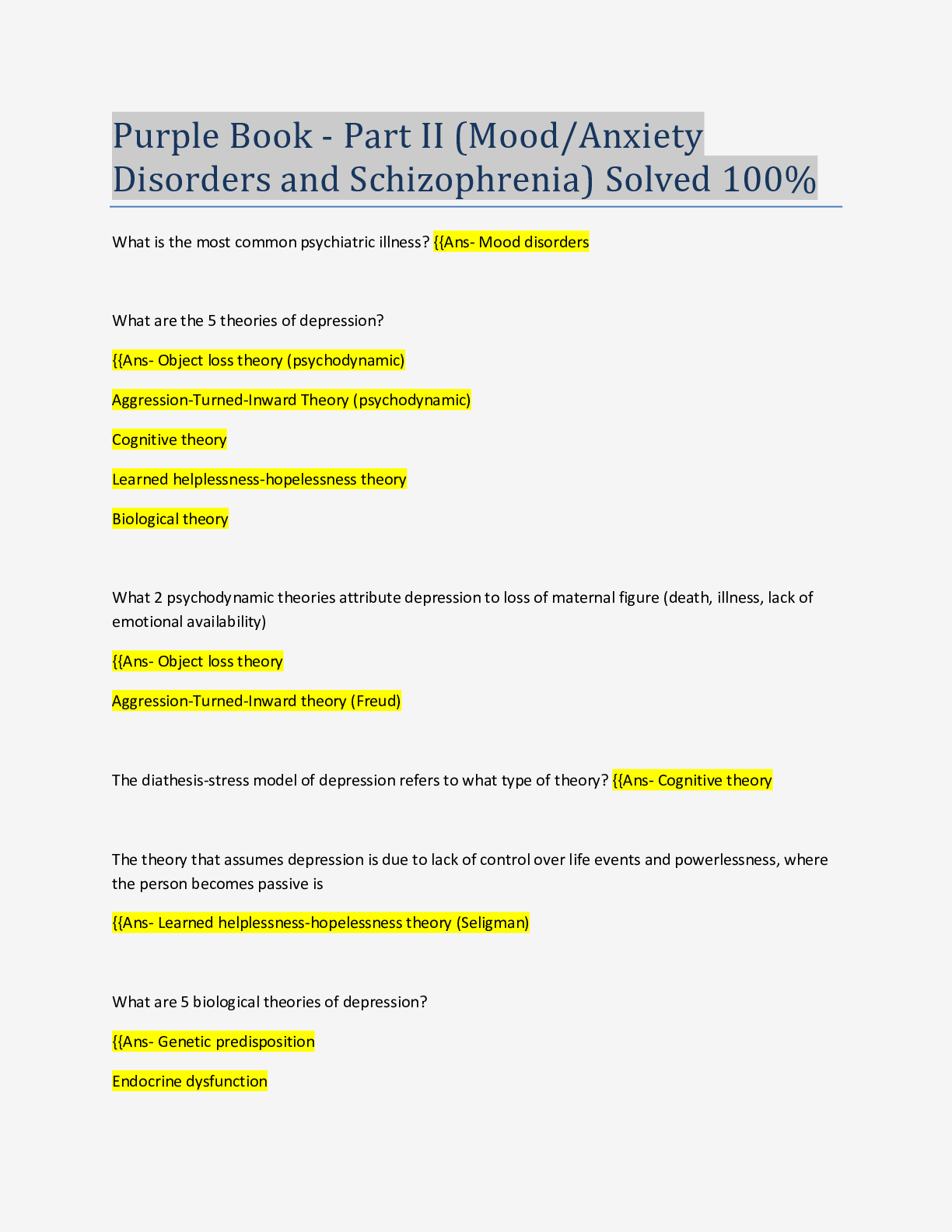

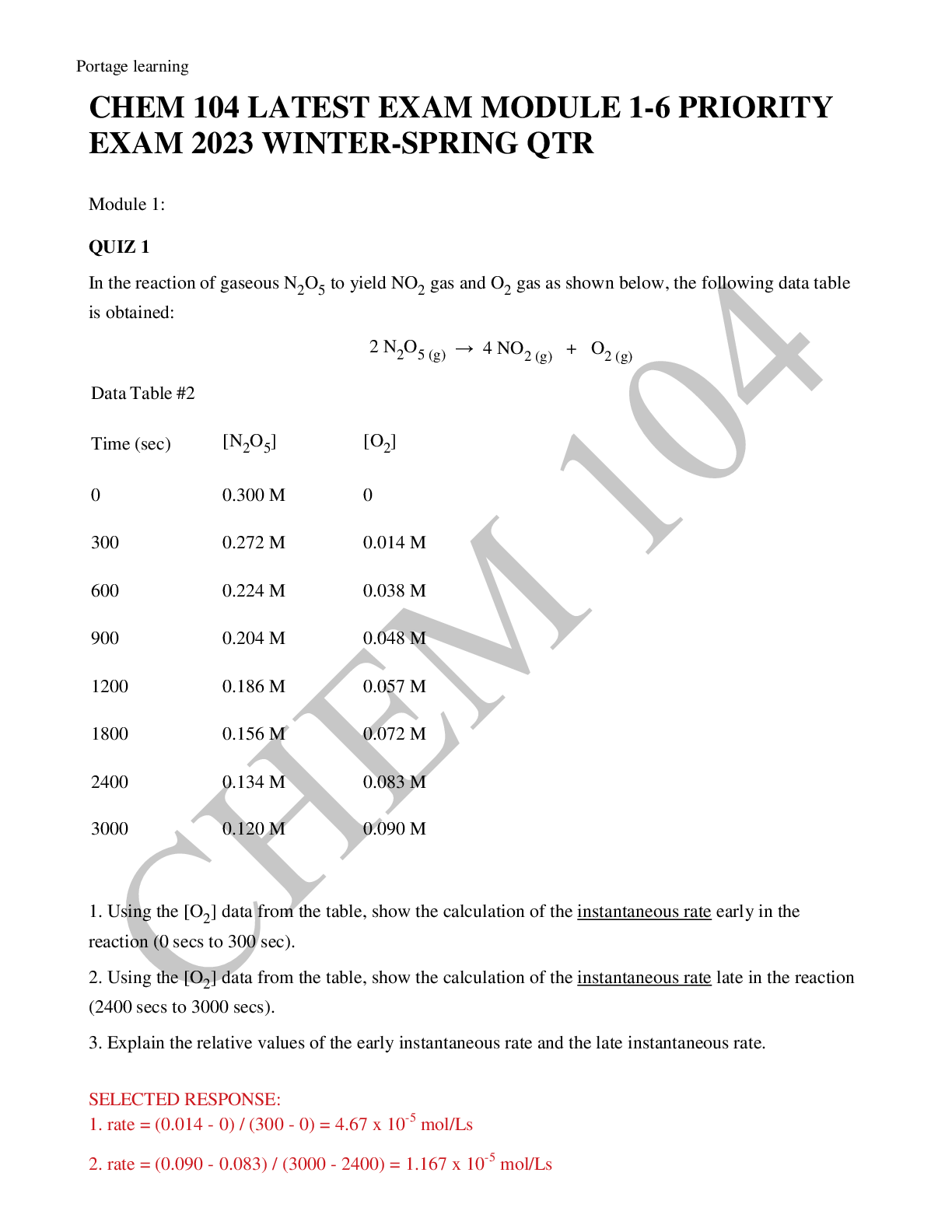

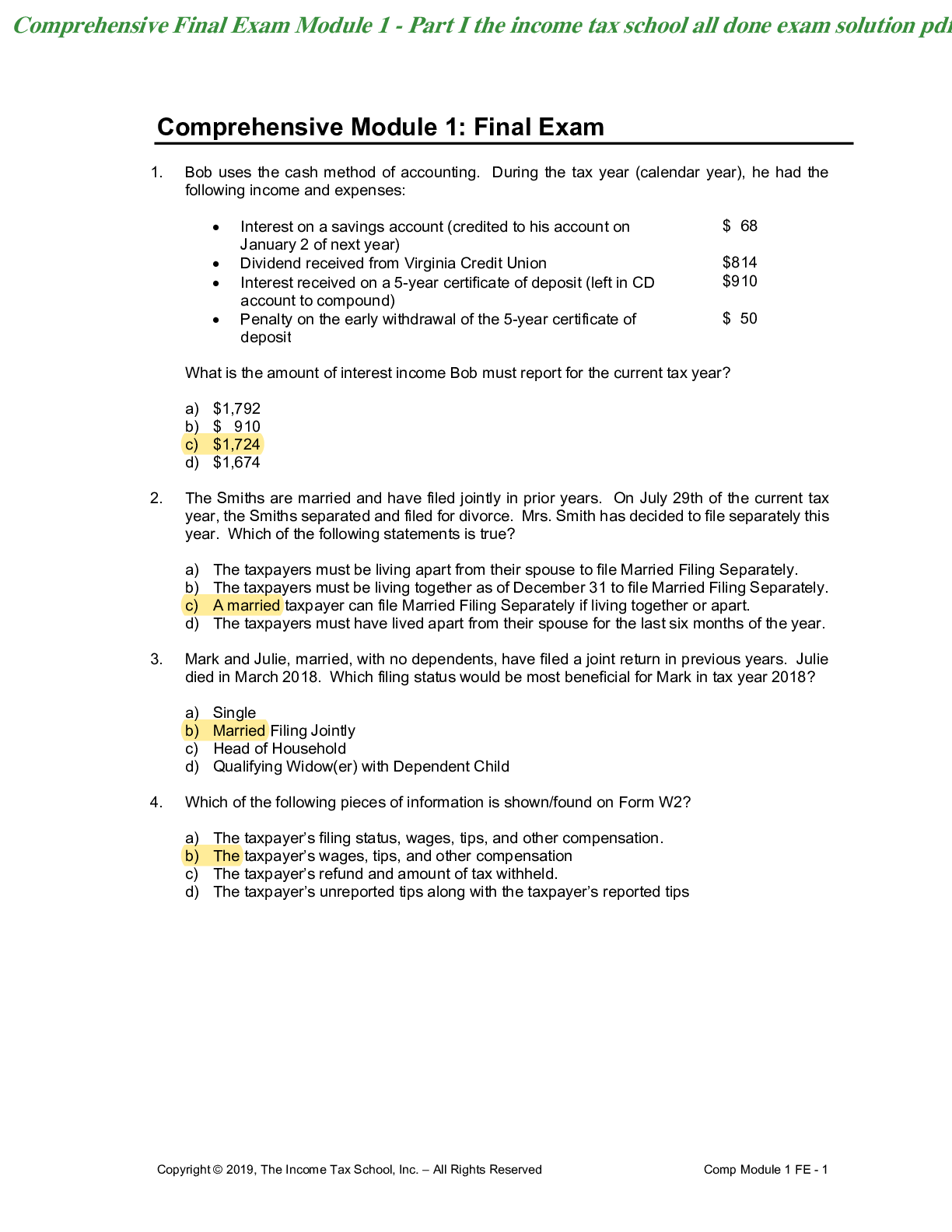

Comprehensive Final Exam Module 1 - Part I the income tax school all done exam solution Comp Module 1 FE - 1 Comprehensive Final Exam Module 1 - Part I the income tax school all done exam solut... ion Comp Module 1 FE - 2 Comprehensive Module 1: Final Exam 1. Bob uses the cash method of accounting. During the tax year (calendar year), he had the following income and expenses: Interest on a savings account (credited to his account on January 2 of next year) $ 68 Dividend received from Virginia Credit Union $814 Interest received on a 5-year certificate of deposit (left in CD account to compound) Penalty on the early withdrawal of the 5-year certificate of deposit $910 $ 50 What is the amount of interest income Bob must report for the current tax year? a) $1,792 b) $ 910 d) $1,674 2. The Smiths are married and have filed jointly in prior years. On July 29th of the current tax year, the Smiths separated and filed for divorce. Mrs. Smith has decided to file separately this year. Which of the following statements is true? a) The taxpayers must be living apart from their spouse to file Married Filing Separately. b) The taxpayers must be living together as of December 31 to file Married Filing Separately. c) A married taxpayer can file Married Filing Separately if living together or apart. d) The taxpayers must have lived apart from their spouse for the last six months of the year. 3. Mark and Julie, married, with no dependents, have filed a joint return in previous years. Julie died in March 2018. Which filing status would be most beneficial for Mark in tax year 2018? a) Single b) Married Filing Jointly c) Head of Household d) Qualifying Widow(er) with Dependent Child c) $1,724 Comp Module 1 FE - 3 4. Which of the following pieces of information is shown/found on Form W2? a) The taxpayer’s filing status, wages, tips, and other compensation. b) The taxpayer’s wages, tips, and other compensation c) The taxpayer’s refund and amount of tax withheld. d) The taxpayer’s unreported tips along with the taxpayer’s reported tips Powered by qwivy(www.qwivy.org) Comprehensive Final Exam Module 1 - Part I the income tax school ... Comprehensive Final Exam Module 1 Part I the income tax school ... IMG_0245.jpg - Comprehensive Module 1: Final Exam ... Module 1 Final Exam - Part I the income tax school.pdf 2021 comprehensive module 2 final exam part 1 pdf 1 Basic Income Tax Course Final Exam - TaxOsphere USC LEVENTHAL SCHOOL OF ACCOUNTING - USC Search USC LEVENTHAL SCHOOL OF ACCOUNTING - USC Search Wiley CPAexcel Exam Review 2015 Study Guide (January): ... I keep getting the message Cannot Get Mail. - Cafe Andrea ... The Income Tax School Final Exam - Faq-Courses.Com Review Package - The Income Tax School 20 Tips for Success in Law School - Chapman University acca learning. the authorized ACCA exam center in Dubai ... Cs 1332 final exam John's University. 1 1962-1965 ... Tax Preparer Final Exam Review Flashcards | Quizlet 200-301 CCNA - Cisco Cpa pep reddit unit 1 exams. EXTERNAL EXAMS TIMETABLE 2022 Exam ... Online training - WHO | World Health Organization [Show More]

Last updated: 1 year ago

Preview 1 out of 22 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$13.00

Document information

Connected school, study & course

About the document

Uploaded On

Sep 10, 2022

Number of pages

22

Written in

Additional information

This document has been written for:

Uploaded

Sep 10, 2022

Downloads

0

Views

109

.png)