Finance > Class Notes > MBA-FPX5010_FletcherTimothy_Assessment2-2,100% CORRECT (All)

MBA-FPX5010_FletcherTimothy_Assessment2-2,100% CORRECT

Document Content and Description Below

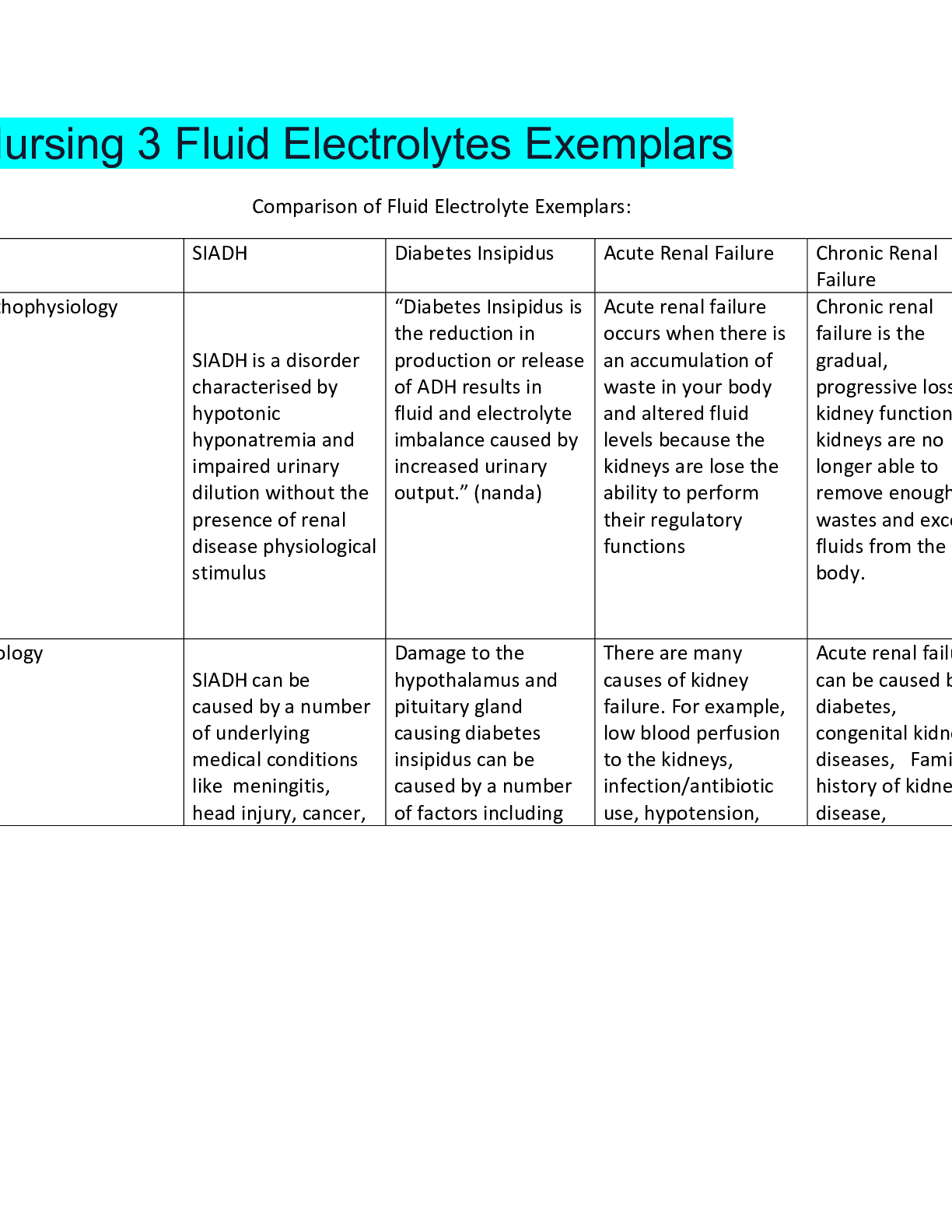

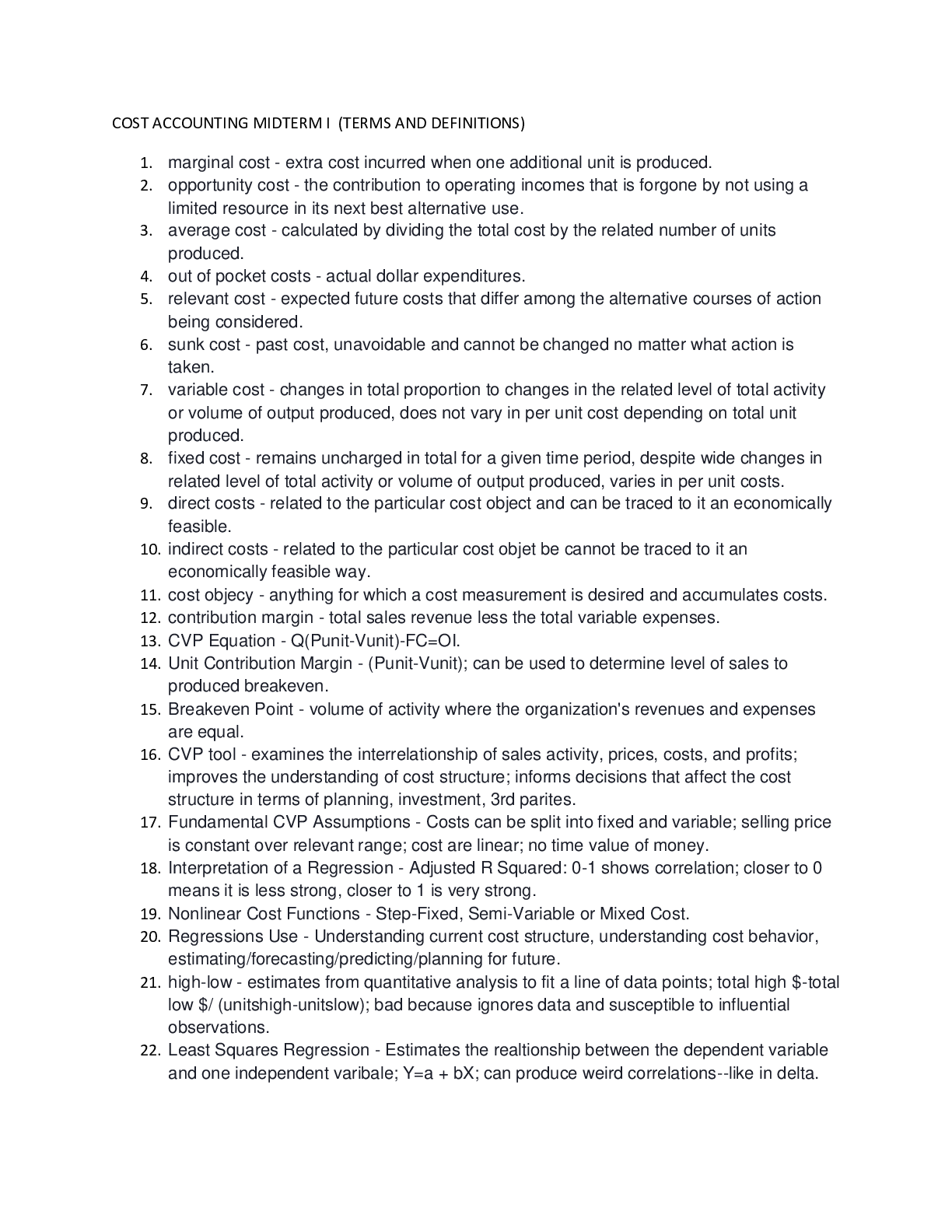

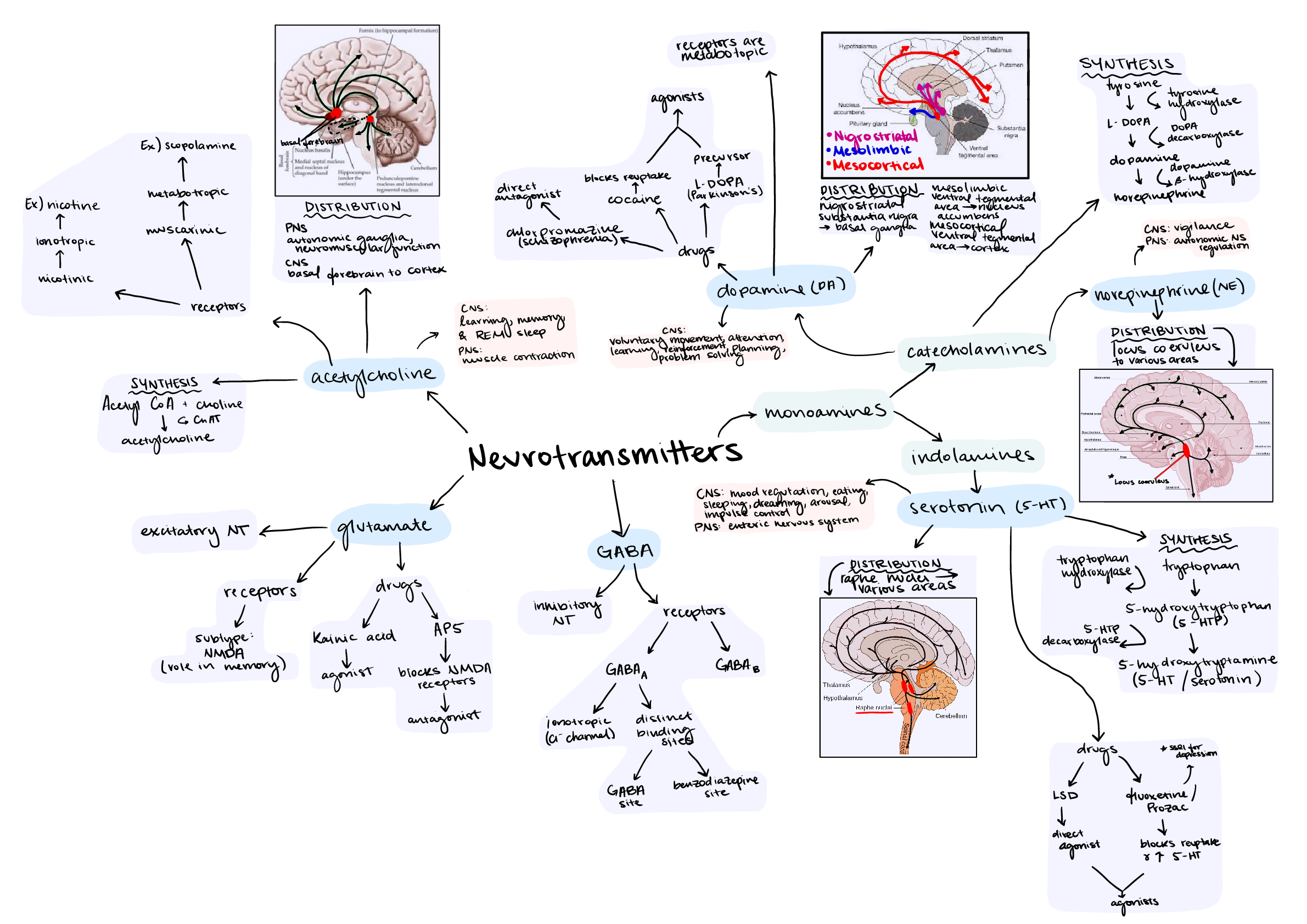

Cost Analysis Introduction The ACME Pickle Company produces a variety of pickles which are sold in cases in and around the Florida area. Super Deals which is a company located in Wisconsin has off... ered ACME a deal to purchase 2000 cases to sell in their 20 store supermarket chain. At first glance by ACME management the deal doesn't look appetizing, but internally the company will run a cost report to either support the claim that this is not a good deal or reverse its initial thoughts after the cost analysis has been completed. Current Production Currently, the ACME Pickle Company produces 9000 cases of pickles and sells them to a developed market. The current production costs show that the company is enjoying an impressive fifty percent markup on the 9000 cases produced. The current state of revenue is at $180,000 with a net profit of $90,000. The company feels it can increase production output to 12,000 cases without adding additional equipment or machinery. Current cost is well established and the company currently basis its sale price off of a ten dollar per case cost of production. See chart below for a current cost break down. Super Deals Proposal Super Deals is a company located in Wisconsin which operates twenty stores. The owner of the company has proposed to buy 2000 cases of pickles from ACME at a reduced price of $9.50 per case. The proposed deal would add $19,000 of revenue to ACME's bottom line and potentially help the company establish a new customer and potentially a new market area. One of the at first sight downfalls from this proposal is Super Deals offering price which is below the company's established cost structure which brings hesitation to the deal. ACME will need to understand all of the costs involved to drop their established selling price of $20 per case to a $9.50 per case price which is below the current known costs. Breaking Down the Numbers When breaking down the numbers, the company can look at two different methods of accounting to understand what the numbers mean for the company and the Super Deals deal. Understanding the numbers is critical to deciding whether or not the deal makes sense for the company. The first method is financial accounting which primarily used for reporting finances to outside entities. This method uses income statements and balance sheets to report performance. Financial accounting doesn't normally allow for good decision making as this method is shared externally and allows for outside criticism. Unlike managerial accounting which allows for the numbers to be examined internally and decisions based off of raw numbers. For the company to make the appropriate decision it is recommended that the company base their decision on internal raw numbers versus numbers that are on a balance sheet or income statement. Managerial accounting will allow the company to base their decision on raw data which will give the company the best base line decision against the numbers. In the chart below the costs are broken out Variable Costs and Fixed Costs If ACME takes on the Super Deals deal the variable costs will increase due to the amount of raw materials needed to produce the additional cases. The variable costs are cucumbers, spices and vinegar, jars and lids, direct labor. The more you produce the more labor you will pay along with buying more goods to make the products out of. The fixed costs remain the same for example if ACME takes on the additional 2000 cases the insurance on the factory doesn’t go up it remains the same. The fixed costs are line supervisors, on salary, depreciation on factory, property taxes, and insurance. Variable costs increase at a sustained rate like the price of cucumbers will be the same if the company buys 1 or 10. The labor will increase as more hours will be needed to produce the additional goods. Fixed costs don’t change, so in essence ACME can bank on profiting on the fixed costs amount in their overall costing for the cases of pickles. Best Decision Cost accounting allows a company to dig deep into the numbers and understand if producing and selling certain products is truly feasible for a company. Within the ACME Pickles Company, the financial success of its brands has led the company to enjoy a nice profit margin of 50% which creates a very healthy bottom line. The company does realize that there is excess capacity remaining within its current production means without expansion or adding staff. Super Deals has proposed to give ACME some additional cases which will chew up some of the excess capacity which exists. Unfortunately, for ACME the decision to take on the new cases lies strictly within the numbers, and the company will need to understand the numbers thoroughly to make the decision. The company based on the numbers of raw data should take on the additional cases from Super Deals for several reasons. First, the deal would add additional cash flow to the company which the company can use to expand its market if growth is what the company is seeking. The next reason for taking on the deal would be for the opportunity of entering a new market which in itself could bring excellent growth opportunities. Another reason for taking on the deal would be because the number pan out to be profitable even if the company produces the additional 2000 cases at a loss. Producing products at a loss doesn't always mean a company loses money. In this case, ACME can produce the additional cases at a loss and still increase profits and revenues. Based off of the current production numbers and costs the company can reduce the overall costs of production simply by adding in the new cases which will increase production by 22%. The increase in production with the same fixed costs is where the additional profit dollars are for the company. Simply put the more ACME produces, the cheaper all of the cases become. The variable raw material and labor costs rise but are offset by the fixed costs which allow for more profit dollars to be reeled on the original 9000 cases. Further explanation of the accounting involved proves that for the decision to be made the company would need to understand that 50% profit margin on the original 9000 cases would rise to 52.5% and the additional 2000 cases would essentially be produced and sold at cost. Even though these cases are sold at cost, the company benefits off of its original production. Looking at the 2000 additional cases from a different perspective also can help clarify the numbers. If ACME looks at the 11000 cases as a whole, accepting a per case reduction in margin from $10 to $8.59 spread across all cases reduces margin from 50% to 47.5%. The increase in overall profits and revenue for the company are the deciding factors based off of managerial accounting. If the company had to base the decision solely off of the income statement and balance sheet the decision may be swayed the opposite way. Accounting and Profit Accounting methods are a critical aspect of measuring a company's overall success or failure, but sometimes within raw accounting numbers compared with profits and how they are achieved can be easily explained out in income statements and balance sheets. If a company doesn't understand the numbers or how they work, they can miss opportunities just like this opportunity with Super Deals. If ACME had decided to not produce the extra 2000 case the company would have lost $4,482 in additional profit and an additional $19,000 in revenue. Other losses like new market development and potential for a new customer could have been lost. Profit is always a determining factor as long as the profit is earned honestly, and in this case, it is earned honesty so reporting out financials should be no problem for the ACME Pickles Company. If the company can sell the additional 1000 cases that remain in available production the company can lower their costs per case even further and draw in additional revenue and profits. [Show More]

Last updated: 1 year ago

Preview 1 out of 4 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jan 31, 2021

Number of pages

4

Written in

Additional information

This document has been written for:

Uploaded

Jan 31, 2021

Downloads

0

Views

112