Finance > LECTURE NOTES > LPC Notes Corporate Finance Revision Notes (Distinction level) 2023{211581} (All)

LPC Notes Corporate Finance Revision Notes (Distinction level) 2023{211581}

Document Content and Description Below

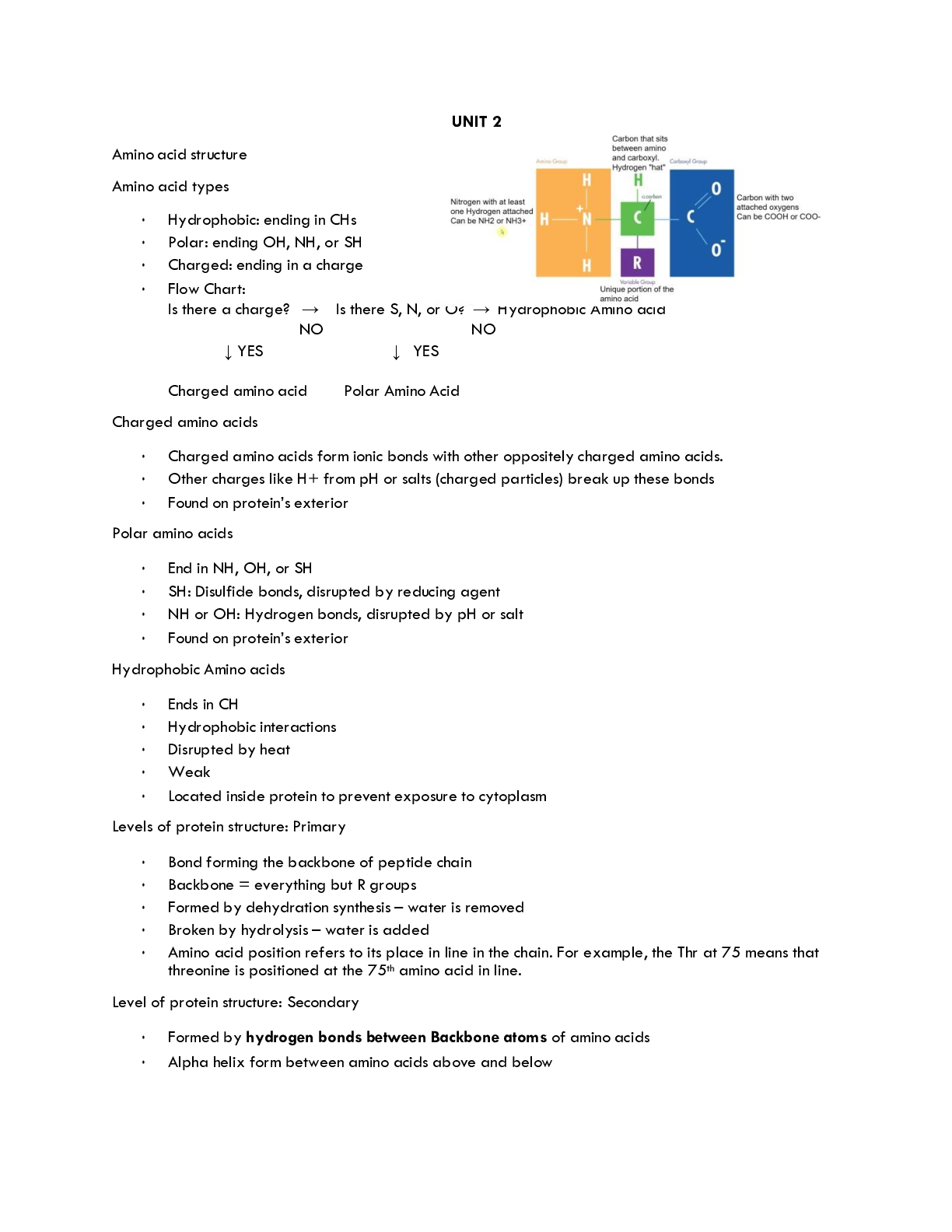

Is there a clever way to finance firm that increase firm value? - -MM capital structure irrelevance theorem states that it is only the expected CFs and risk of the project that determine firm value - ... capital structure is irrelevant -MM Proposition I assumption - -Firm's CFs are unaffected by D-E choice -MM Proposition II states - -The expected return on equity is positively related to leverage because the risk to equity holders increases with leverage. When D/E-ratio increases, the expected return on equity increases (due to higher risk on equity in a company with debt). -What MM misses - -Takes CF as given, and misses how they are formed. D and E often matter because they often affect firm's investment strategies, and therefore also CFs. -Why differences in leverage across industries? - -1) Risk of CFs - if an industry has very volatile CF it may not be able to handle its debt, which affects the cost of debt. For example oil and gas industry. [Show More]

Last updated: 1 year ago

Preview 1 out of 11 pages

Also available in bundle (2)

LPC Notes Corporate Finance Revision Notes (Distinction A+) 2023

The liability of sole proprietors is limited to the amount of their investment in the company. - -FALSE - The liability of sole proprietors is unlimited -General partners have limited personal liab...

By Detutor 11 months ago

$41

5

LPC Notes Corporate Finance Revision Notes (Distinction A+) 2023

The liability of sole proprietors is limited to the amount of their investment in the company. - -FALSE - The liability of sole proprietors is unlimited -General partners have limited personal liab...

By Detutor 11 months ago

$57.5

8

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 15, 2023

Number of pages

11

Written in

Additional information

This document has been written for:

Uploaded

Mar 15, 2023

Downloads

0

Views

50

.png)