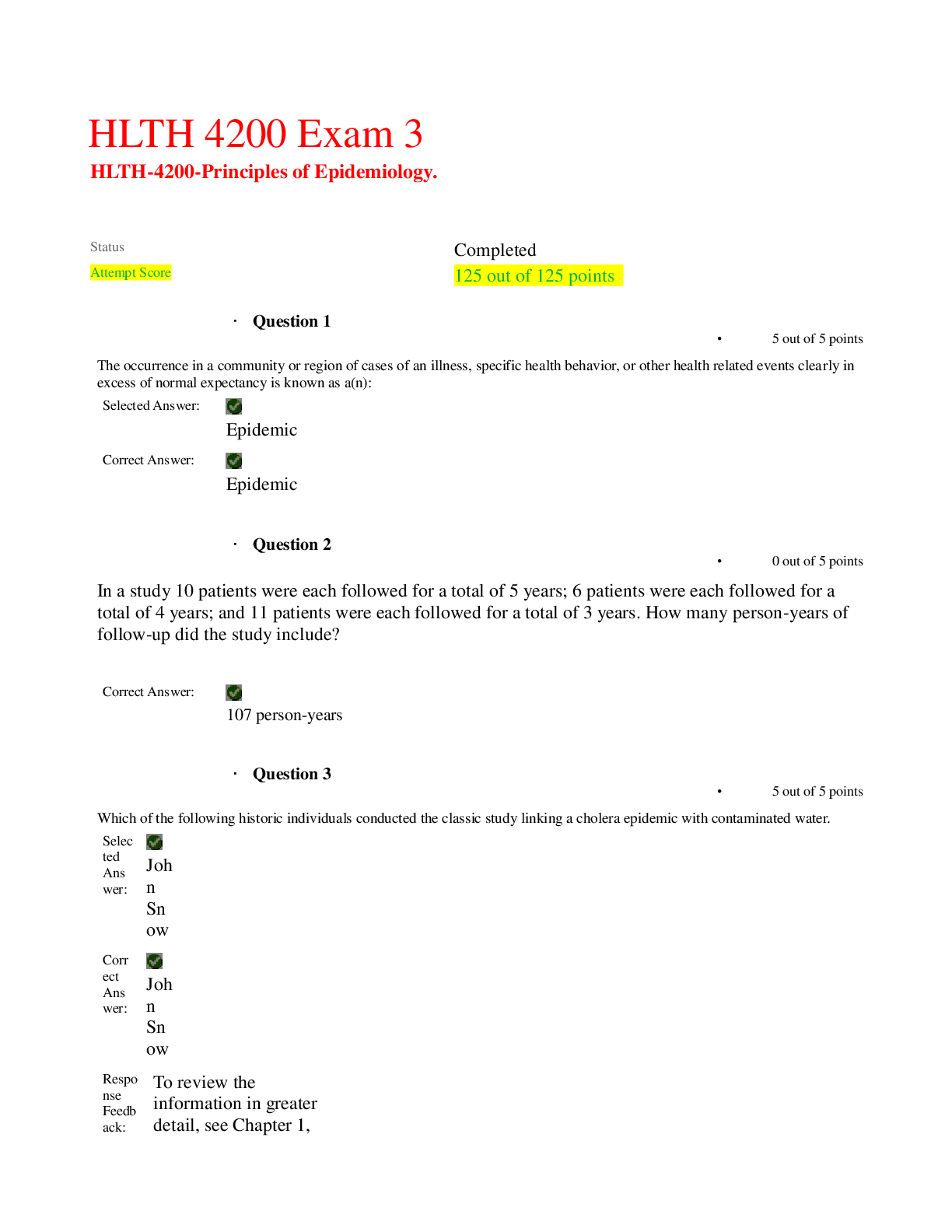

FIN 540 Final Exam 3 - Question and Answers GradeAplus

Document Content and Description Below

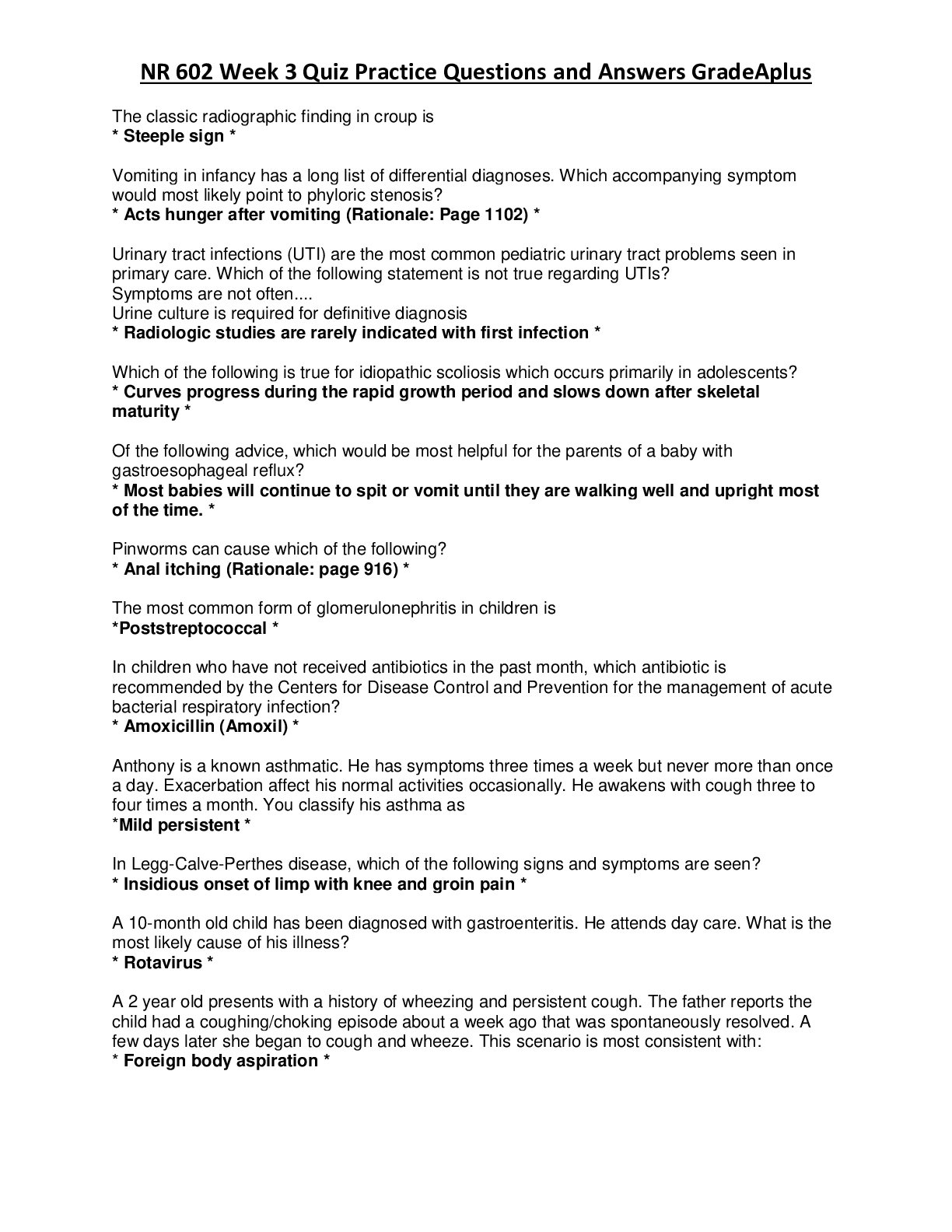

1. A swap is a method used to reduce financial risk. Which of the following statements about swaps, if any, is NOT CORRECT? 2. A firm’s credit policy consists of which of the following items? ... 3. You have the following data on three stocks: As a risk minimizer, you would choose Stock if it is to be held in isolation and Stock if it is to be held as part of a well-diversified portfolio. 4. Which of the following statements about pension plans if any, is incorrect? 5. Which of the following statements is most CORRECT? 6. Which of the following are the factors for the Fama-French model? 7. Which of the following are NOT ways risk management can be used to increase the value of a firm? 8. In a portfolio of three different stocks, which of the following could NOT be true? 9. Which of the following statements about defined contribution plans is incorrect? 10. Which of the following is not correct? 11. Which one of the following is an example of a “flexibility” option? 12. Which of the following is true of the EOQ model? Note that the optimal order quantity, Q, will be called EOQ. 13. Which of the following would cause average inventory holdings to decrease, other things held constant? 14. Which of the following statements concerning the MM extension with growth is NOT CORRECT? 15. Which of the following statements is CORRECT? 16. Which of the following statements is CORRECT? 17. Stock A’s beta is 1.5 and Stock B’s beta is 0.5. Which of the following statements must be true about these securities? (Assume market equilibrium.) 18. Which of the following statements about pension plan portfolio performance is incorrect? 19. For markets to be in equilibrium (that is, for there to be no strong pressure for prices to depart from their current levels), 20. Which of the following statements about project risk analysis in not-for-profit firms is incorrect? 21. Which of the following is NOT a real option? 22. Which of the following statements concerning the MM extension with growth is NOT CORRECT? 23. Which of the following statements concerning the MM extension with growth is NOT CORRECT? 24. Which of the following statements is CORRECT? 25. Which of the following is NOT a potential problem with beta and its estimation? 26. Which one of the following aspects of banks is considered most relevant to businesses when choosing a bank? 27. Which of the following will NOT increase the value of a real option? 28. The major contribution of the Miller model is that it demonstrates that 29. Which of the following statements concerning capital structure theory is NOT CORRECT? 30. Which is the best measure of risk for an asset held in isolation, and which is the best measure for an asset held in a diversified portfolio? 31. Diplomat.com is considering a project that has an up-front cost of $3 million and is expected to produce a cash flow of $500,000 at the end of each of the next 5 years. The project’s cost of capital is 10%. 32. Wentworth Greenery harvests its crops four times annually and receives payment for its crop 90 days after it is picked and shipped. However, the firm must plant, irrigate, and harvest on a near continual schedule. The firm uses 90-day bank notes to finance its operations. The firm arranges an 11 percent discount interest loan with a 20 percent compensating balance four times annually. What is the effective annual interest rate of these discount loans? 33. XYZ Company needs to borrow $200,000 from its bank. The bank has offered the company a 12-month installment loan (monthly payments) with 9 percent add-on interest. What is the effective annual rate (EAR) of this loan? 34. Calculate the required rate of return for Mercury, Inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) Mercury has a beta of 1.00, and (5) its realized rate of return has averaged 15.0% over the last 5 years. 35. Oklahoma Instruments (OI) is considering a project called F-200 that has an up-front cost of $250,000. The project’s subsequent cash flows are critically dependent on whether another of its products, F-100, becomes an industry standard. There is a 50% chance that the F-100 will become the industry standard, in which case the F-200’s expected cash flows will be $110,000 at the end of each of the next 5 years. There is a 50% chance that the F-100 will not become the industry standard, in which case the F-200’s expected cash flows will be $25,000 at the end of each of the next 5 years. Assume that the cost of capital is 12%. [Show More]

Last updated: 1 year ago

Preview 1 out of 15 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 05, 2020

Number of pages

15

Written in

Additional information

This document has been written for:

Uploaded

Apr 05, 2020

Downloads

0

Views

42