Financial Accounting > EXAM REVIEW > ACCOUNTING 221 Exam Review Graded A...with answers (All)

ACCOUNTING 221 Exam Review Graded A...with answers

Document Content and Description Below

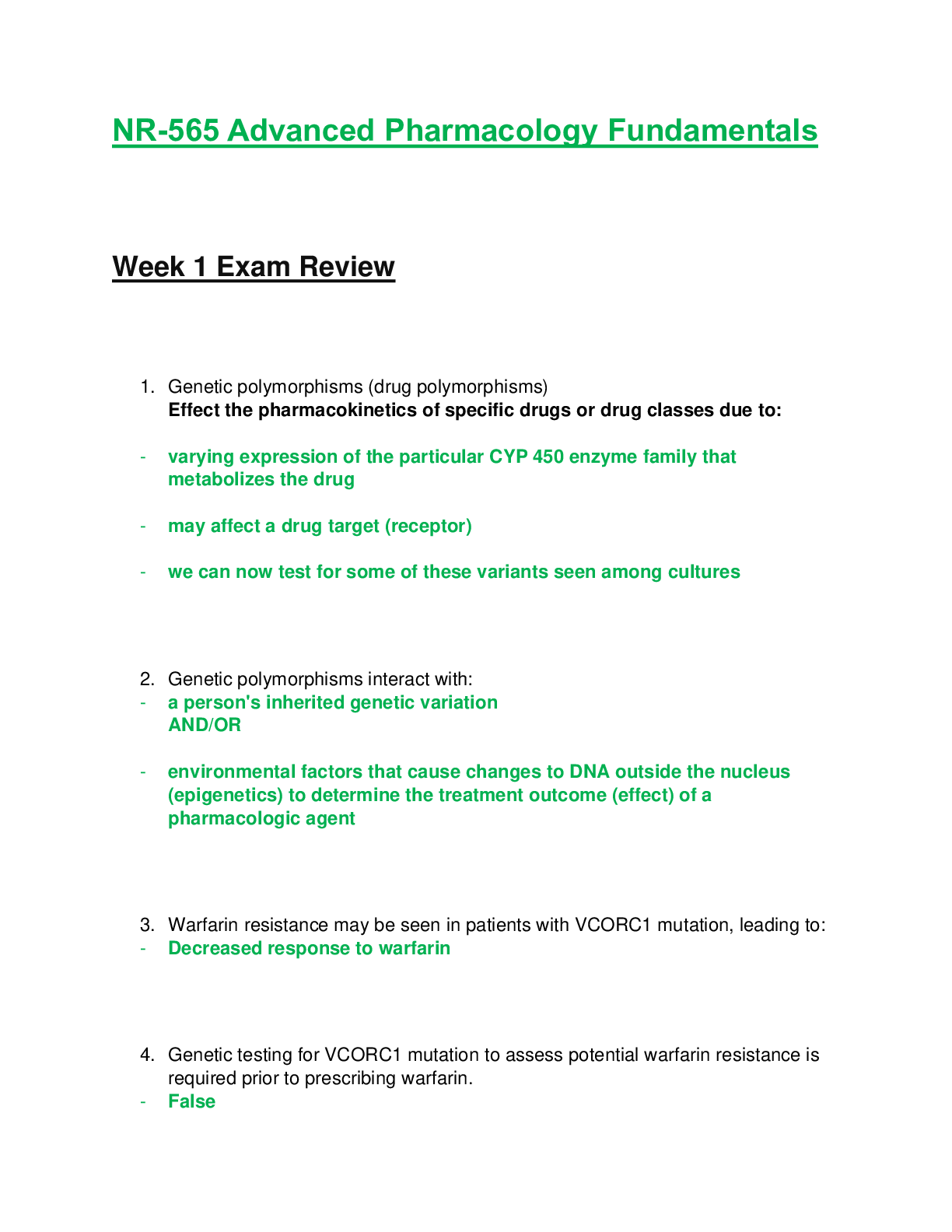

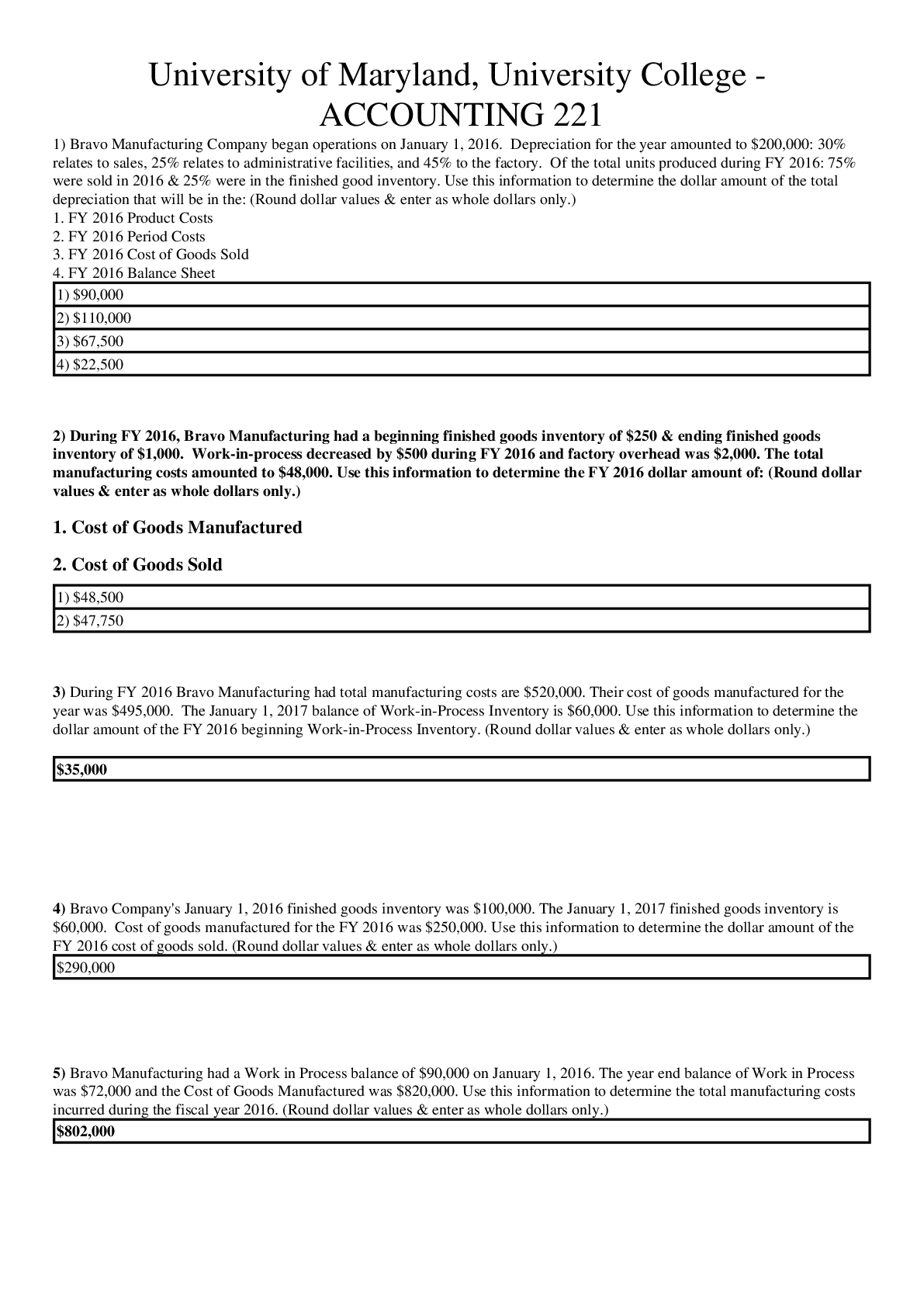

ACCOUNTING 221 1) Bravo Manufacturing Company began operations on January 1, 2016. Depreciation for the year amounted to $200,000: 30% relates to sales, 25% relates to administrative facilities, and... 45% to the factory. Of the total units produced during FY 2016: 75% were sold in 2016 & 25% were in the finished good inventory. Use this information to determine the dollar amount of the total depreciation that will be in the: (Round dollar values & enter as whole dollars only.) 1. FY 2016 Product Costs 2. FY 2016 Period Costs 3. FY 2016 Cost of Goods Sold 4. FY 2016 Balance Sheet 2) During FY 2016, Bravo Manufacturing had a beginning finished goods inventory of $250 & ending finished goods inventory of $1,000. Work-in-process decreased by $500 during FY 2016 and factory overhead was $2,000. The total manufacturing costs amounted to $48,000. Use this information to determine the FY 2016 dollar amount of: (Round dollar values & enter as whole dollars only.) 1. Cost of Goods Manufactured 2. Cost of Goods Sold 3) During FY 2016 Bravo Manufacturing had total manufacturing costs are $520,000. Their cost of goods manufactured for the year was $495,000. The January 1, 2017 balance of Work-in-Process Inventory is $60,000. Use this information to determine the dollar amount of the FY 2016 beginning Work-in-Process Inventory. (Round dollar values & enter as whole dollars only.) 4) Bravo Company's January 1, 2016 finished goods inventory was $100,000. The January 1, 2017 finished goods inventory is $60,000. Cost of goods manufactured for the FY 2016 was $250,000. Use this information to determine the dollar amount of the FY 2016 cost of goods sold. (Round dollar values & enter as whole dollars only.) 5) Bravo Manufacturing had a Work in Process balance of $90,000 on January 1, 2016. The year end balance of Work in Process was $72,000 and the Cost of Goods Manufactured was $820,000. Use this information to determine the total manufacturing costs incurred during the fiscal year 2016. (Round dollar values & enter as whole dollars only.) 6) Bravo Company manufactures quality gentlemen's clothing. The following selected financial information for the fiscal year 2016 is provided: Item Amount Sales $100,000 Cost of Goods Manufactured 75,000 Direct Material Purchased 40,000 Factory Overhead 10,000 Work in Process - January 1 30,000 Work in Process - December 31 15,000 Direct Material - December 31 10,000 Finished Goods Inventory - December 31 65,000 Net Income 15,000 Direct Materials used 30,000 Cost of Goods Sold 55,000 Use this information to determine the dollar amount of Bravo's Finished Goods Inventory for January 1, 2016. (Round dollar values & enter as whole dollars only.) 7) Bravo Company manufactures quality gentlemen's clothing. The following selected financial information for the fiscal year 2016 is provided: Item Amount Sales $100,000 Cost of Goods Manufactured 75,000 Direct Material Purchased 40,000 Factory Overhead 10,000 Work in Process - January 1 30,000 Work in Process - December 31 15,000 Direct Material - December 31 10,000 Finished Goods Inventory - December 31 60,000 Net Income 15,000 Direct Materials used 30,000 Cost of Goods Sold 65,000 Use this information to determine the dollar amount of Bravo's Gross Profit for the fiscal year 2016. (Round dollar values & enter as whole dollars only.) 8) Bravo Company manufactures quality gentlemen's clothing. The following selected financial information for the fiscal year 2016 is provided: Item Amount Sales $100,000 Cost of Goods Manufactured 75,000 Direct Material Purchased 40,000 Factory Overhead 10,000 Work in Process - January 1 30,000 Work in Process - December 31 15,000 Direct Material - December 31 10,000 Finished Goods Inventory - December 31 60,000 Net Income 15,000 Direct Materials used 30,000 Cost of Goods Sold 65,000 Use this information to determine the dollar amount of Bravo's Operating Expenses for the fiscal year 2016. (Round dollar values & enter as whole dollars only.) 9) Bravo Company manufactures quality gentlemen's clothing. The following selected financial information for the fiscal year 2016 is provided: Item Amount Sales $100,000 Cost of Goods Manufactured 65,000 Direct Material Purchased 40,000 Factory Overhead 10,000 Work in Process - January 1 30,000 Work in Process - December 31 15,000 Direct Material - December 31 10,000 Finished Goods Inventory - December 31 60,000 Net Income 15,000 Direct Materials used 30,000 Cost of Goods Sold 55,000 Use this information to determine the dollar amount of Bravo's Direct Labor Costs for the fiscal year 2016. (Round dollar values & enter as whole dollars only.) 10) Bravo Company manufactures quality gentlemen's clothing. The following selected financial information for the fiscal year 2016 is provided: Item Amount Sales $100,000 Cost of Goods Manufactured 75,000 Direct Material Purchased 25,000 Factory Overhead 10,000 Work in Process - January 1 30,000 Work in Process - December 31 15,000 Direct Material - December 31 10,000 Finished Goods Inventory - December 31 60,000 Net Income 15,000 Direct Materials used 30,000 Cost of Goods Sold 55,000 Use this information to determine the dollar amount of Bravo's Direct Material Inventory for January 1, 2016. (Round dollar values & enter as whole dollars only.) 11) Alpha Company publishes & sells a calendar for $6.50 each. The variable cost per calendar is $4.00 with the current annual sales volume of 200,000 calendars. This volume is currently Alpha's breaking even point. Use this information to determine the dollar amount of Alpha's fixed costs. (Round any total dollar value to the nearest whole dollar & enter as whole dollars only. Round any unit dollar value to the nearest penny & enter with both dollar(s) & cents. Round any unit non-dollar decimal numbers to the next higher whole number and enter as a whole number.) 12) Bravo Company sells Widgets at $7 a unit. In FY 2016, fixed costs are expected to be $200,000 and variable costs are estimated to increase from $3 per unit to $4 a unit. Bravo wants to have a FY 2016 operating income of $40,000. Use this information to determine the number of units of Widgets that Bravo must sell in FY 2016 to meet this goal. (Round any total dollar value to the nearest whole dollar & enter as whole dollars only. Round any unit dollar value to the nearest penny & enter with both dollar(s) & cents. Round any unit non-dollar decimal numbers to the next higher whole number and enter as a whole number.) 13) During FY 2016, Bravo Company plans to sell Widgets for $5.00 a unit. Current variable costs are $2.50 a unit and fixed costs are expected to increase to a total of $110,000. Use this information to determine: 1. the number of units of Widgets for Bravo to breakeven 2. the total dollar value of sales that Bravo must achieve in FY 2016 to breakeven (Round any total dollar value to the nearest whole dollar & enter as whole dollars only. Round any unit dollar value to the nearest penny & enter with both dollar(s) & cents. Round any unit non-dollar decimal numbers to the next higher whole number and enter as a whole number.) 14) Bravo Air Conditioning & Heating Company performs air conditioner repair service. During July, its busiest month, Bravo had repair labor hours of 60,000 and total costs of $840,000. During November, its slowest month, Bravo had labor hours of 15,000 and total costs or $480,000. Bravo planned for 42,000 labor hours in August. Use this information to determine how many dollars Bravo should be budgeted for total costs in August. (Round any total dollar value to the nearest whole dollar & enter as whole dollars only. Round any unit dollar value to the nearest penny & enter with both dollar(s) & cents. Round any unit non-dollar decimal numbers to the next higher whole number and enter as a whole number.) 15) For FY 2016 Bravo Company's CVP format Income Statement is as follows: Bravo Company Income Statement (CVP format) For the Year Ended 12/31/16 Sales (100 units) $10,000 Variable Costs: Direct Labor $1,500 Direct Materials 1,400 Factory Overhead (variable) 2,000 Selling Expenses (variable) 600 Administrative Expenses (variable) 500 Total Variable Expenses 6,000 Contribution Margin $4,000 Fixed Costs: Factory Overhead (fixed) $400 Selling Expenses (fixed) 1,000 Administrative Expenses (fixed) 1,000 Total Fixed Expenses 2,400 Net Income (aka Operating Income) $1,600 Bravo utilizes a JIT production system and there are no Raw Materials, Work-in-Process of Finished Goods inventories. Bravo Company expects that all costs will remain the same for FY 2017 with the exception of fixed factory overhead which is budgeted to increase by $1,700. Use this information to determine: 1. FY 2016 Cost of Goods Sold 2. FY 2016 breakeven point in units (Round any total dollar value to the nearest whole dollar & enter as whole dollars only. Round any unit dollar value to the nearest penny & enter with both dollar(s) & cents. Round any unit non-dollar decimal numbers to the next higher whole number and enter as a whole number.) 16) During FY 2016, Bravo Company sold 16,000 units for $96,000. Bravo had $2.75 variable costs per unit sold. Bravo also reported $28,000 of fixed costs. Use this information to determine FY 2016: 1. Contribution Margin per unit 2. Breakeven in Units 3. Breakeven in Total Sales (Round any total dollar value to the nearest whole dollar & enter as whole dollars only. Round any unit dollar value to the nearest penny & enter with both dollar(s) & cents. Round any unit non-dollar decimal numbers to the next higher whole number and enter as a whole number.) [Show More]

Last updated: 1 year ago

Preview 1 out of 6 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 13, 2021

Number of pages

6

Written in

Additional information

This document has been written for:

Uploaded

Mar 13, 2021

Downloads

0

Views

49