Business > QUESTIONS & ANSWERS > University of WaterlooMATBUS 470HullOFOD9eSolutionsCh25 (All)

University of WaterlooMATBUS 470HullOFOD9eSolutionsCh25

Document Content and Description Below

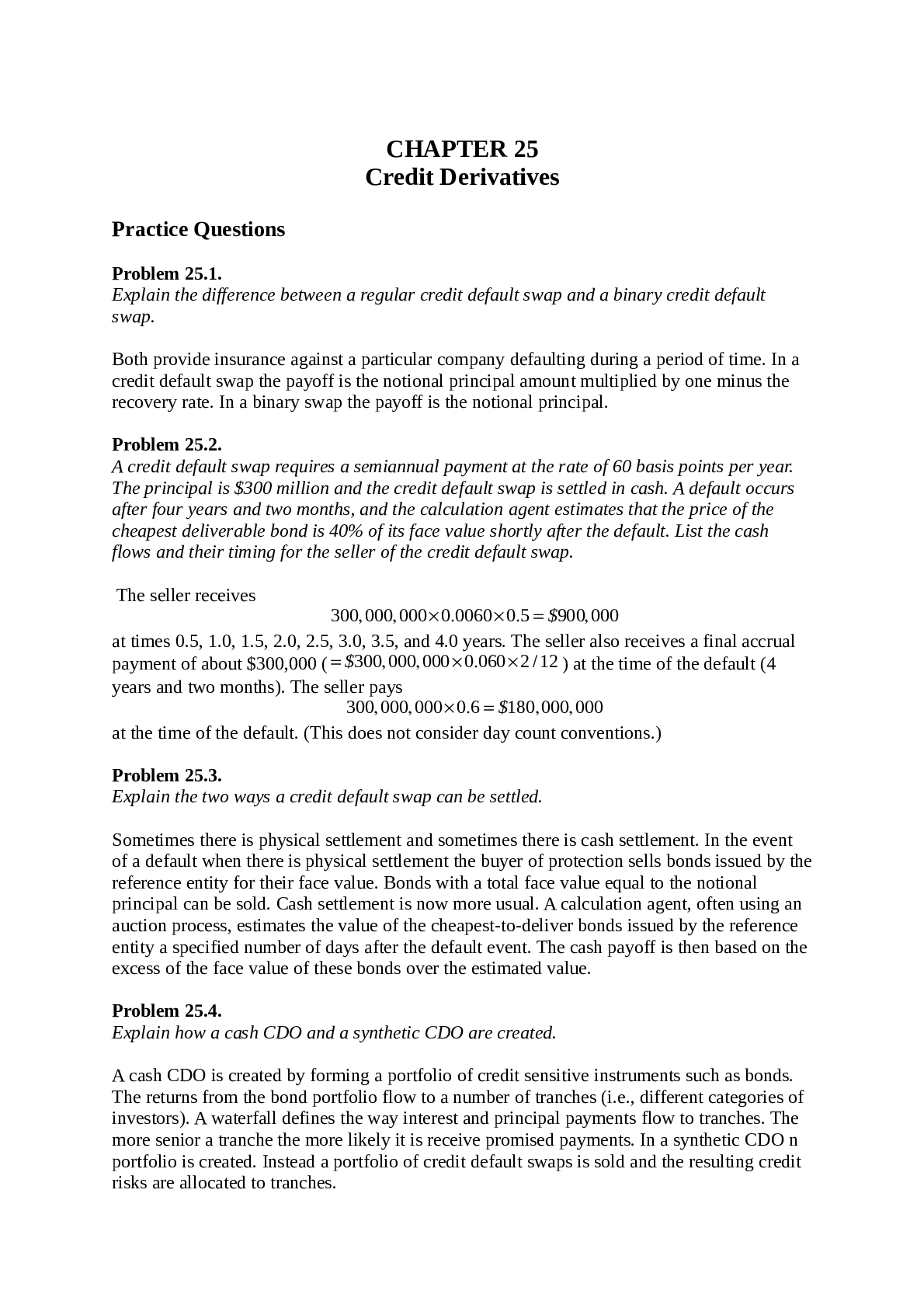

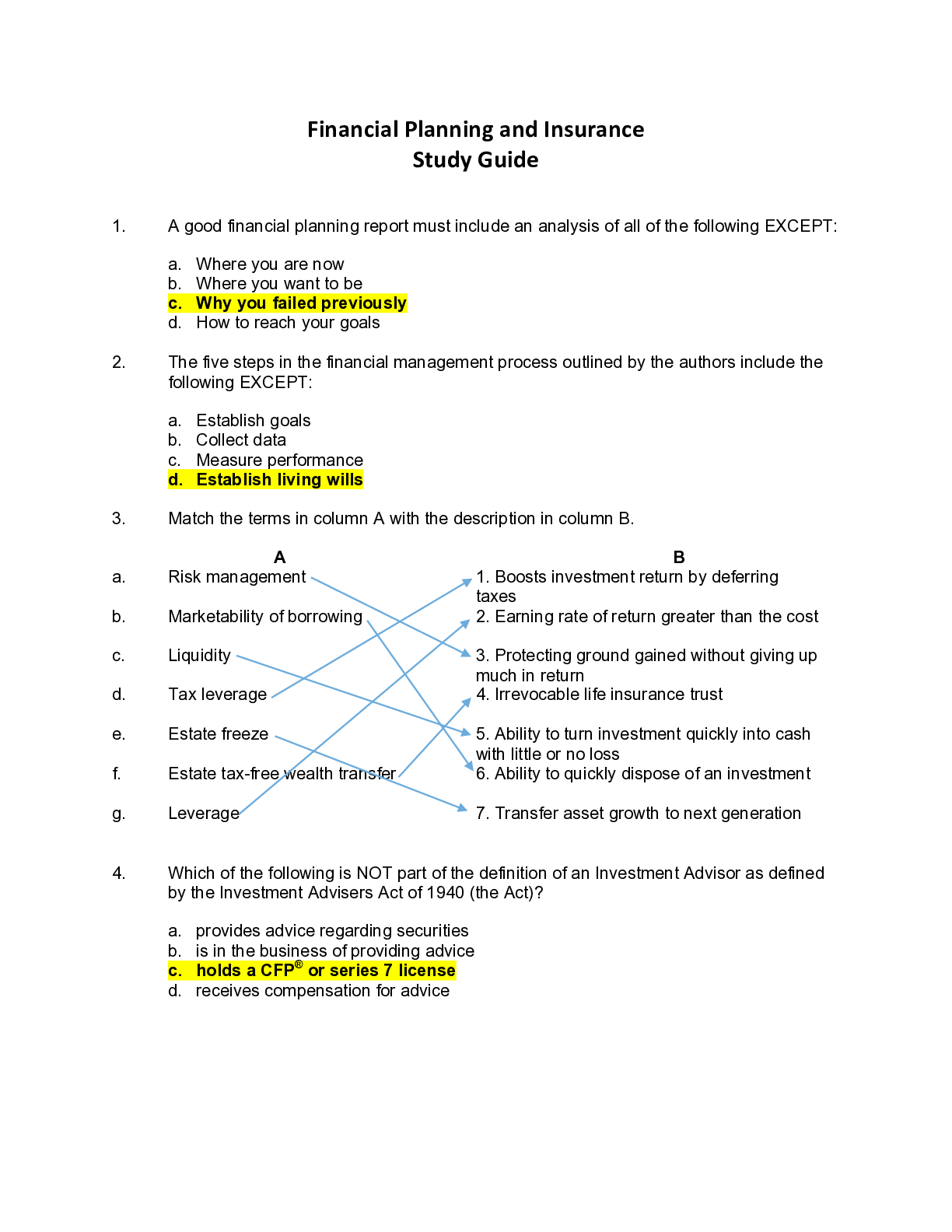

CHAPTER 25 Credit Derivatives Practice Questions Problem 25.1. Explain the difference between a regular credit default swap and a binary credit default swap. Both provide insurance against a par... ticular company defaulting during a period of time. In a credit default swap the payoff is the notional principal amount multiplied by one minus the recovery rate. In a binary swap the payoff is the notional principal. Problem 25.2. A credit default swap requires a semiannual payment at the rate of 60 basis points per year. The principal is $300 million and the credit default swap is settled in cash. A default occurs after four years and two months, and the calculation agent estimates that the price of the cheapest deliverable bond is 40% of its face value shortly after the default. List the cash flows and their timing for the seller of the credit default swap. The seller receives 300 000 000 0 0060 0 5 900 000 $ at times 0.5, 1.0, 1.5, 2.0, 2.5, 3.0, 3.5, and 4.0 years. The seller also receives a final accrual payment of about $300,000 ( $300 000 000 0 060 2 12 ) at the time of the default (4 years and two months). The seller pays 300 000 000 0 6 180 000 000 $ at the time of the default. (This does not consider day count conventions.) Problem 25.3. Explain the two ways a credit default swap can be settled. Sometimes there is physical settlement and sometimes there is cash settlement. In the event of a default when there is physical settlement the buyer of protection sells bonds issued by the reference entity for their face value. Bonds with a total face value equal to the notional principal can be sold. Cash settlement is now more usual. A calculation agent, often using an auction process, estimates the value of the cheapest-to-deliver bonds issued by the reference entity a specified number of days after the default event. The cash payoff is then based on the excess of the face value of these bonds over the estimated value. Problem 25.4. Explain how a cash CDO and a synthetic CDO are created. A cash CDO is created by forming a portfolio of credit sensitive instruments such as bonds. The returns from the bond portfolio flow to a number of tranches (i.e., different categories of investors). A waterfall defines the way interest and principal payments flow to tranches. The more senior a tranche the more likely it is receive promised payments. In a synthetic CDO n portfolio is created. Instead a portfolio of credit default swaps is sold and the resulting credit risks are allocated to tranches. [Show More]

Last updated: 1 year ago

Preview 1 out of 10 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 25, 2021

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Apr 25, 2021

Downloads

0

Views

44

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)