Financial Accounting > EXAM > ACCT 212 Final Exam > 2019 > DeVry University, Arlington > Already Graded A+ (All)

ACCT 212 Final Exam > 2019 > DeVry University, Arlington > Already Graded A+

Document Content and Description Below

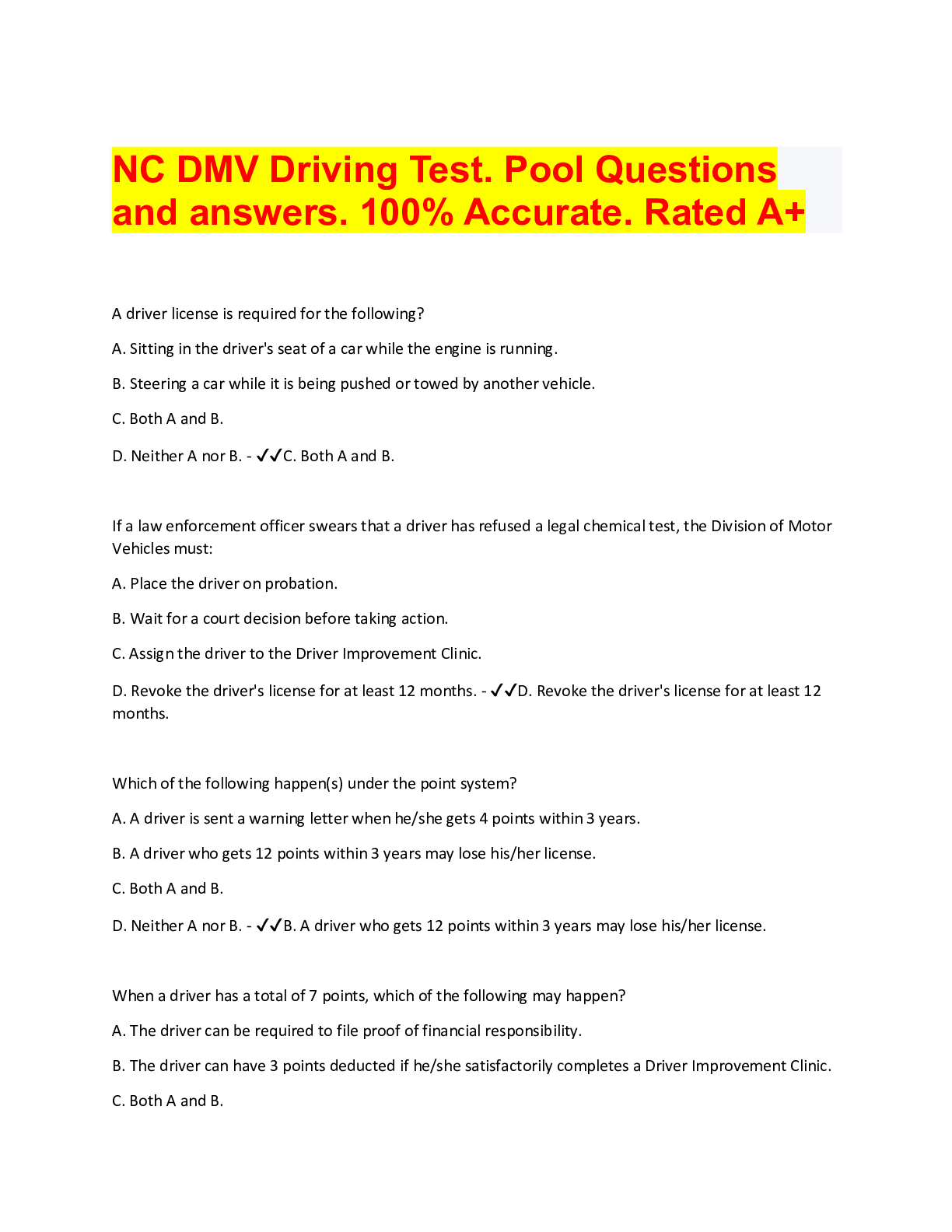

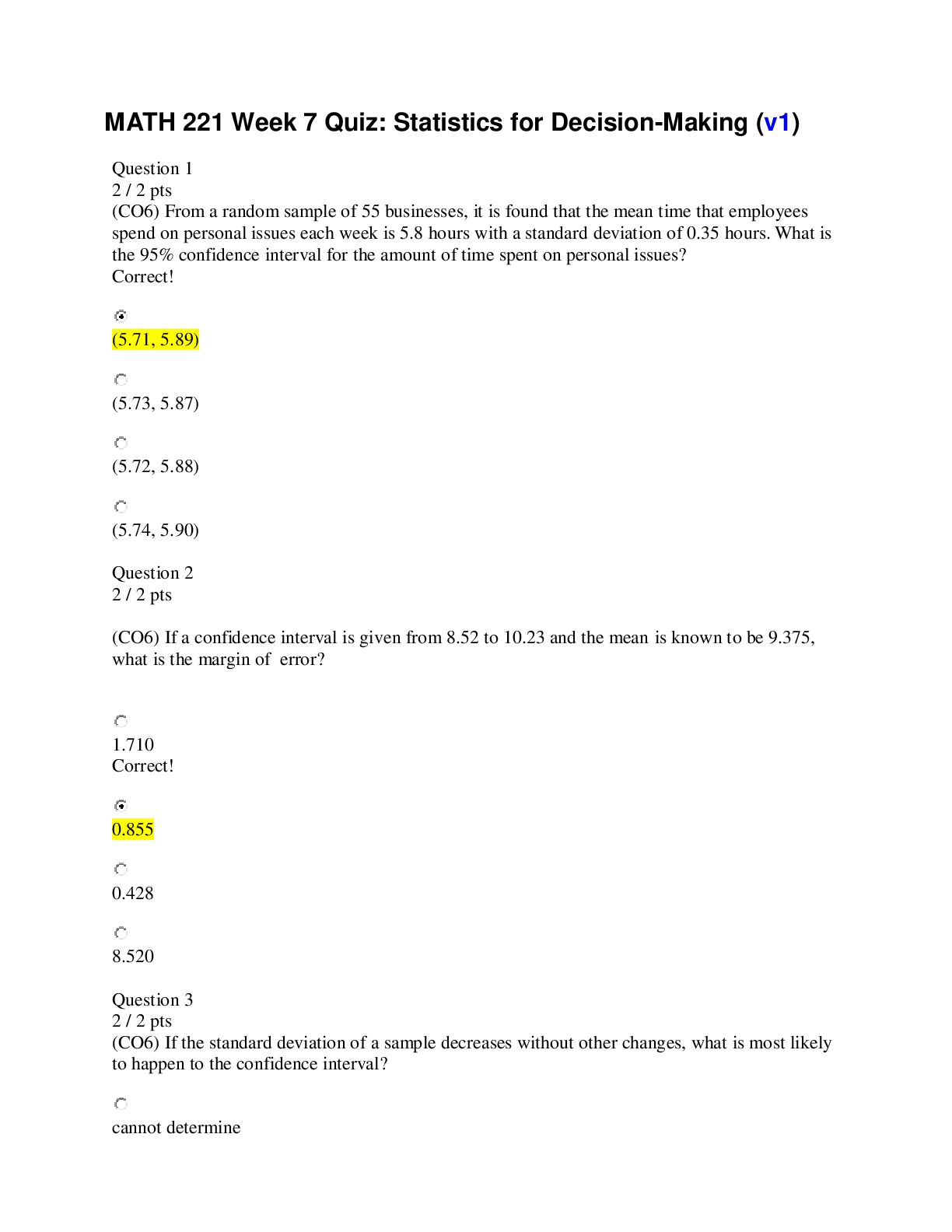

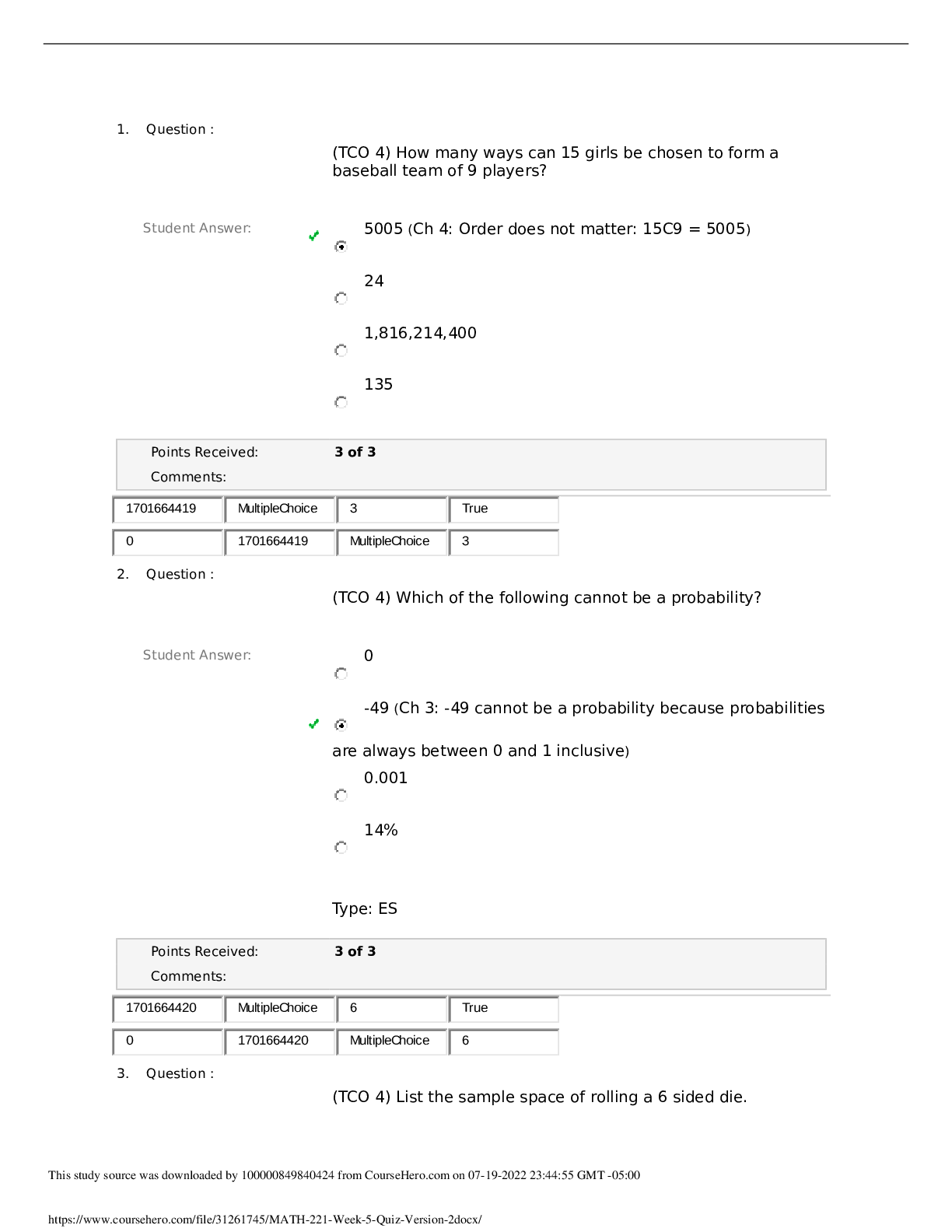

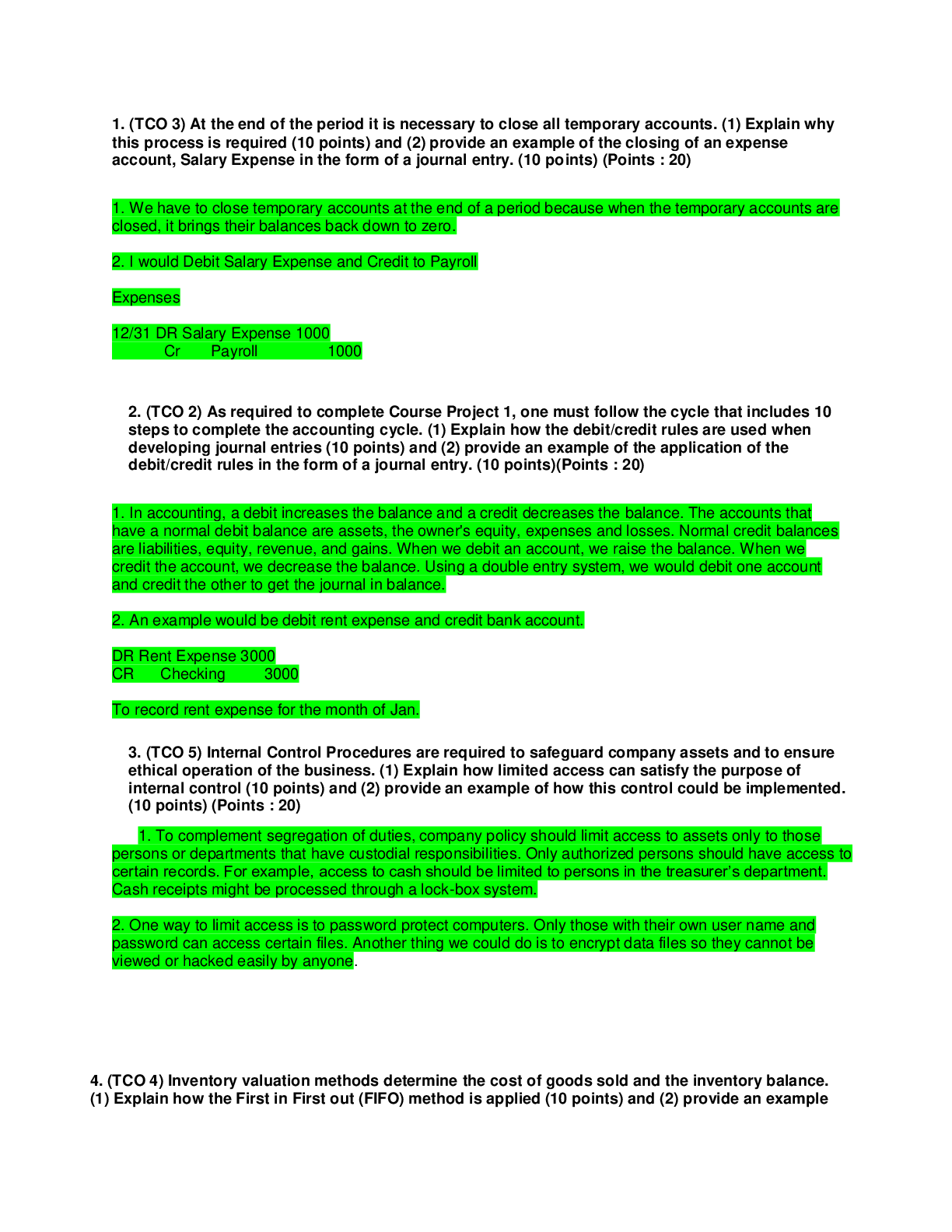

1. (TCO 3) At the end of the period it is necessary to close all temporary accounts. (1) Explain why this process is required (10 points) and (2) provide an example of the closing of an expense accoun... t, Salary Expense in the form of a journal entry. (10 points) (Points : 20) 2. (TCO 2) As required to complete Course Project 1, one must follow the cycle that includes 10 steps to complete the accounting cycle. (1) Explain how the debit/credit rules are used when developing journal entries (10 points) and (2) provide an example of the application of the debit/credit rules in the form of a journal entry. (10 points)(Points : 20) 3. (TCO 5) Internal Control Procedures are required to safeguard company assets and to ensure ethical operation of the business. (1) Explain how limited access can satisfy the purpose of internal control (10 points) and (2) provide an example of how this control could be implemented. (10 points) (Points : 20) 4. (TCO 4) Inventory valuation methods determine the cost of goods sold and the inventory balance. (1) Explain how the First in First out (FIFO) method is applied (10 points) and (2) provide an example of the impact that this method of inventory valuation will have on Gross Profit. (10 points) (Points : 20) 5. (TCO 1) To evaluate the financial operation and health of a business ratio analysis is used. (1) Provide the formula for the Current Ratio and explain how it is computed (10 points) and (2) provide an example of how this ratio can be used in decision-making in business. (10 points) (Points : 20) 1. (TCO 6) BagODonuts Company bought a used delivery truck on January 1, 2010, for $19,200. The van was expected to remain in service 4 years (30,000 miles). BagODonuts’ accountant estimated that the truck’s residual value would be $2,400 at the end of its useful life. The truck traveled 8,000 miles the first year, 8,500 miles the second year, 5,500 miles the third year, and 8,000 miles in the fourth year. 2. Which method best tracks the wear and tear on the van? 3. Which method would BagODonuts prefer to use for income tax purposes? Explain in detail why BagODonuts prefers this method. 2. (TCO 7) ABC Inc. was incorporated on 1/15/12. Their corporate charter authorized the following capital stock: Preferred Stock: 7%, par value $100 per share, 100,000 shares. Common Stock: $1 par value, 500,000 shares. The following transactions occurred during the year: 1/19/12 – Issued 100,000 shares of common stock for $17 cash per share. 1/31/12 – Issued 3,000 shares of preferred stock for $115 cash per share. 11/1/12 – Repurchased 30,000 shares of common stock for $22 cash per share. 12/1/12 – Declared and paid a total dividend of $95,000. Required: 1. Prepare the journal entry for each transaction listed above. 2. In your own words, explain the main differences between common and preferred stock. (Points : 25) 3. (TCO 5) Fraud is an intentional misrepresentation of facts, made for the purpose of persuading another party to act in a way that causes injury or damage to that party. In our readings and discussions we have seen several examples of fraud in business. Using that experience (1) provide an example of a common fraudulent practice in business with an explanation of how the practice works and (2) name and describe each of the elements of the Fraud Triangle. 4. (TCO 5) Internal Control Procedures are in place to protect the assets of every business as mentioned in the textbook and our discussions. Of the seven internal control procedures, list five of these controls and describe how each procedure is implemented (Points : 25) 5. (TCO2) Below are the accounts of Super Pool Service, Inc. The accounts have normal balances on June 30, 2012. The accounts are listed in no particular order. Account Balance Common stock $5,100 Accounts payable $4,400 Service revenue $17,100 Land $28,800 Note payable $9,500 Cash $5,200 Dividends $6,100 Utilities expense $2,100 Accounts receivable $10,600 Delivery expense $700 Retained earnings $25,600 Salary expense $8,200 Prepare the company’s trial balance as of June 30, 2012, listing accounts in proper sequence, as illustrated in the chapter. For example, Accounts Receivable comes before Land. List the expense with the largest balance first, the expense with the next largest balance second, and so on. (Points : 25) 6. (TCO4) Linda’s Lampshades started business on Jan. 1, 2001. They had the following inventory transactions: Journals - Jan. 2001 Purchases Supplier Date Received Quantity Unit Cost Amount Donna 01/10/01 110 12.00 1320.00 Thomas 01/15/01 160 14.00 2240.00 Cindy 01/18/01 150 15.00 2250.00 Sales Customer Date shipped Quantity Sel. Price Amount Norilene 01/16/01 200 25.00 5000.00 1. Calculate the ending inventory, using the perpetual inventory method: A. Using FIFO B. Using LIFO C. Using Average Cost 2. Prepare the following statement Using FIFO LIFO Average Cost Sales Cost of Sales Gross Profit (Points : 25) Depreciation is a process to allocate the cost of long-life assets to each period's income statement and adjusts the value of the asset on the balance sheet. (1) Explain how the Units-of-Production method is computed (10 points) and (2) provide an example of how this method could be used on a new delivery truck purchased for $25,000 to be used for 100,000 miles with a salvage value of $5,000 for year one only (25,000 miles driven in year one) (1) The units of production method is computed by determining the approximate units that will be produced during a given year. When production is high and more units are produced, the depreciation will be higher that year. If the units produced from the machine are low for any given year, the amount of depreciation will be a lot less than in productive years. (2) provide an example of how this method could be used on a new delivery truck purchased for $25,000 to be used for 100,000 miles with a salvage value of $5,000 for year one only (25,000 miles driven in year one) (TCO 2) As required to complete Course Project 1, one must follow the cycle that includes 10 steps to complete the accounting cycle. (1) Explain how information from the journal entries get into the ledger accounts (15 points) and (2) provide an example of information that would be transferred. (10 points) In accounting, ledger refers to a book consisting of all accounts used by the company. While the journal is referred to as (books of original entry) the ledger is known as a book of final entry. The next step of accounting cycle is posting journal entries to ledger accounts. The journal records that were recorded during the previous step of the cycle provide all the information about which accounts are to be debited and which ones to be credited. So we post the information from the journal entries into the ledger account. An example would be debit rent expense and credit bank account. Debit Rent Expense 3000 Credit Checking 3000 To record rent expense for the month of Jan. (TCO 5) Internal Control Procedures are required to safeguard company assets and to ensure ethical operation of the business. (1) Explain how separation of duties can satisfy the purpose of internal control (10 points) and (2) provide an example of how this control could be implemented. (10 points) (Points : 20) 1) To complement segregation of duties, company policy should limit access to assets only to those persons or departments that have custodial responsibilities. Only authorized persons should have access to certain records. Each person in the information chain is important. The chain should start with hiring. Background checks should be conducted on job applicants. Proper training and supervision, as well as paying competitive salaries, helps ensure that all employees are sufficiently competent for their jobs. Employee responsibilities should be clearly laid out in position descriptions. 2) Warehouse personnel should be in charge of storing and keeping track of inventory. 3) In the case of EPIC Products, separation of the duties of cash handling from record keeping for customer accounts receivable would have removed Erica Price’s incentive to engage in fraud, because it would have made it impossible for her to have lapped accounts receivable if another employee had been keeping the books. (TCO 1) To evaluate the financial operation and health of a business ratio analysis is used. (1) Provide the formula for the Debt Ratio and explain how it is computed (10 points) and (2) provide an example of how this ratio can be used in decision-making in business. (10 points) (Points : 20) 1) The formula for the debt ratio is total liabilities divided by total assets. The debt ratio is a financial leverage ratio used along with other financial leverage ratios to measure a company's ability to handle its obligations. 2) An example of the debt ratio formula would be a company who has total assets of $3 million and total liabilities of $2.5 million. The total liabilities of $2.5 million would be divided by the total assets of $3 million which gives a debt ratio of .8333. [Show More]

Last updated: 1 year ago

Preview 1 out of 8 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 02, 2019

Number of pages

8

Written in

Additional information

This document has been written for:

Uploaded

Oct 02, 2019

Downloads

0

Views

49

.png)

.png)