Management > EXAM > Summer MGT 6203 FINAL EXAM PART1 – THEORY Questions And Answers all verified 2021 (All)

Summer MGT 6203 FINAL EXAM PART1 – THEORY Questions And Answers all verified 2021

Document Content and Description Below

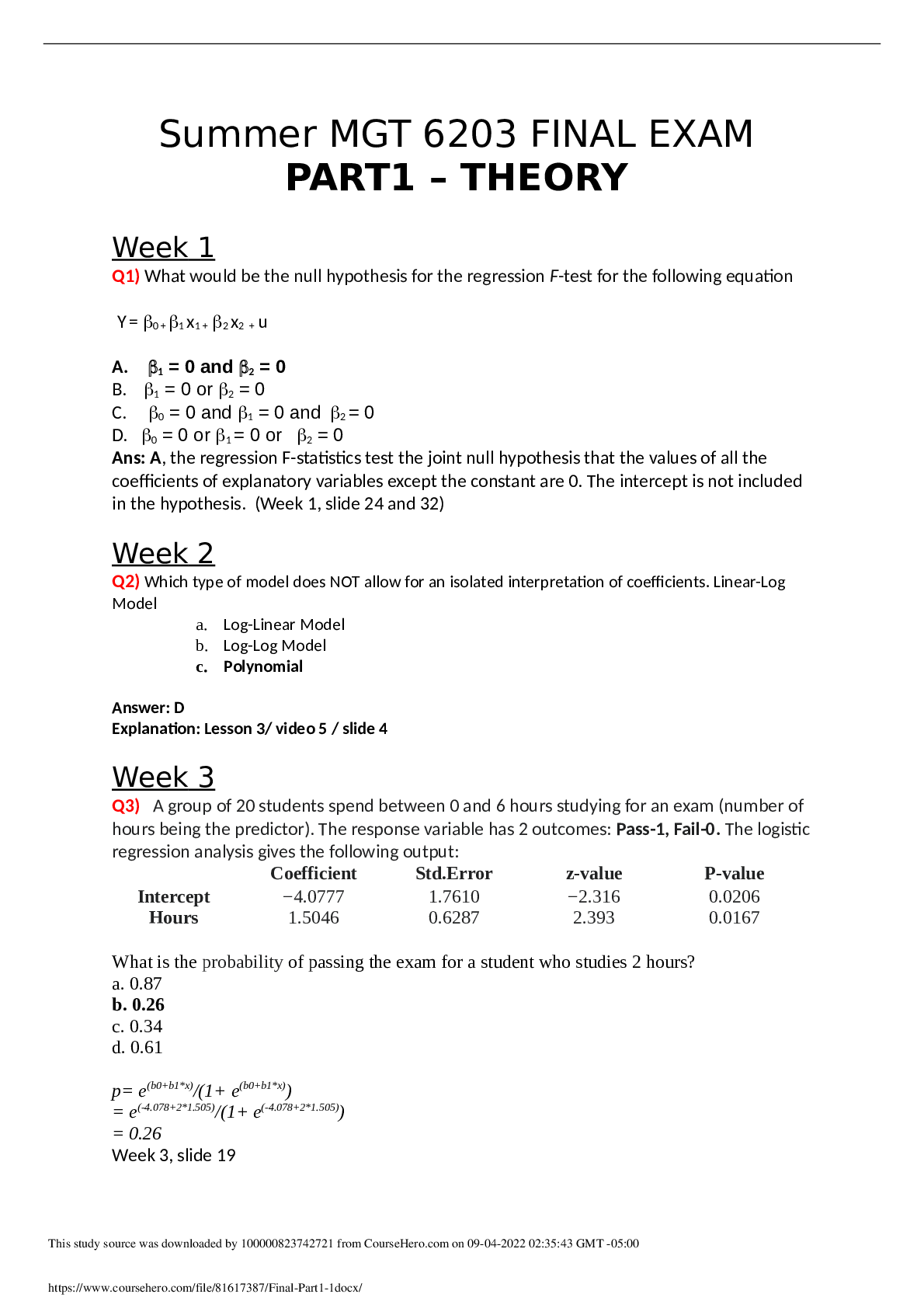

Week 1 Q1) What would be the null hypothesis for the regression F-test for the following equation Y = b0 + b1 x1 + b2 x2 + u A. b1 = 0 and b2 = 0 B. b1 = 0 or b2 = 0 C. b0 = 0 and b1 = 0 and b2 ... = 0 D. b0 = 0 or b1 = 0 or b2 = 0 Ans: A, the regression F-statistics test the joint null hypothesis that the values of all the coefficients of explanatory variables except the constant are 0. The intercept is not included in the hypothesis. (Week 1, slide 24 and 32) Week 2 Q2) Which type of model does NOT allow for an isolated interpretation of coefficients. Linear-Log Model a. Log-Linear Model b. Log-Log Model c. Polynomial Answer: D Explanation: Lesson 3/ video 5 / slide 4 Week 3 Q3) A group of 20 students spend between 0 and 6 hours studying for an exam (number of hours being the predictor). The response variable has 2 outcomes: Pass-1, Fail-0. The logistic regression analysis gives the following output: Coefficient Std.Error z-value P-value Intercept −4.0777 1.7610 −2.316 0.0206 Hours 1.5046 0.6287 2.393 0.0167 What is the probability of passing the exam for a student who studies 2 hours? a. 0.87 b. 0.26 c. 0.34 d. 0.61 p= e(b0+b1*x)/(1+ e(b0+b1*x)) = e(-4.078+2*1.505)/(1+ e(-4.078+2*1.505)) = 0.26 Week 3, slide 19 Week 4 Q4 ) Which statement is FALSE about the difference estimator in a linear regression? Selection bias can negatively impact a difference estimator a. A difference estimator measures the difference of means between two groups b. Randomized controlled experiments can have a negative impact on a difference estimator c. Self-Selection has a negative impact on a difference estimator Explanation: Week 4, Lesson 2, Slide 5 Q5) Given a simple linear equation (Y = a + bX + e) which uses OLS to estimate model parameters, which of the following statements is TRUE? A) When X and e are correlated it is difficult to estimate model parameters B) “Orthogonality Assumption” assumes Cov(Y,X) = 0 C) Difference-In-Difference estimator can be estimated with the model parameter ‘b ‘ D) Difference estimator can be estimated with the model parameter ‘a’ Explanation: Week 4, Lesson 2, Slide 3 & 5 Week 5 Q6) Using the stock monthly return in the chart below – calculate the Compounded return. You may use the standalone built-in calculator app on your computer, but advanced statistical tools like excel, python, r are prohibited and will trigger a violation. Date Price Dividend Stock Split Return Jan 45 Feb 45.35 0.6 2.1% March 47.2 4.1% April 48.3 3 for 2 53.5% May 40.6 -15.9% A. 37% B. 121% C. 46% D. 61% Answer: A. 37%. Lesson 6, slides 6-7. [Show More]

Last updated: 1 year ago

Preview 1 out of 9 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$9.00

Document information

Connected school, study & course

About the document

Uploaded On

Aug 03, 2021

Number of pages

9

Written in

Additional information

This document has been written for:

Uploaded

Aug 03, 2021

Downloads

0

Views

25