Business > EXAM > BPL 5100 - Globus Quiz 2 Part 2; Latest 2022/2023 Complete Solution, Already Graded A (All)

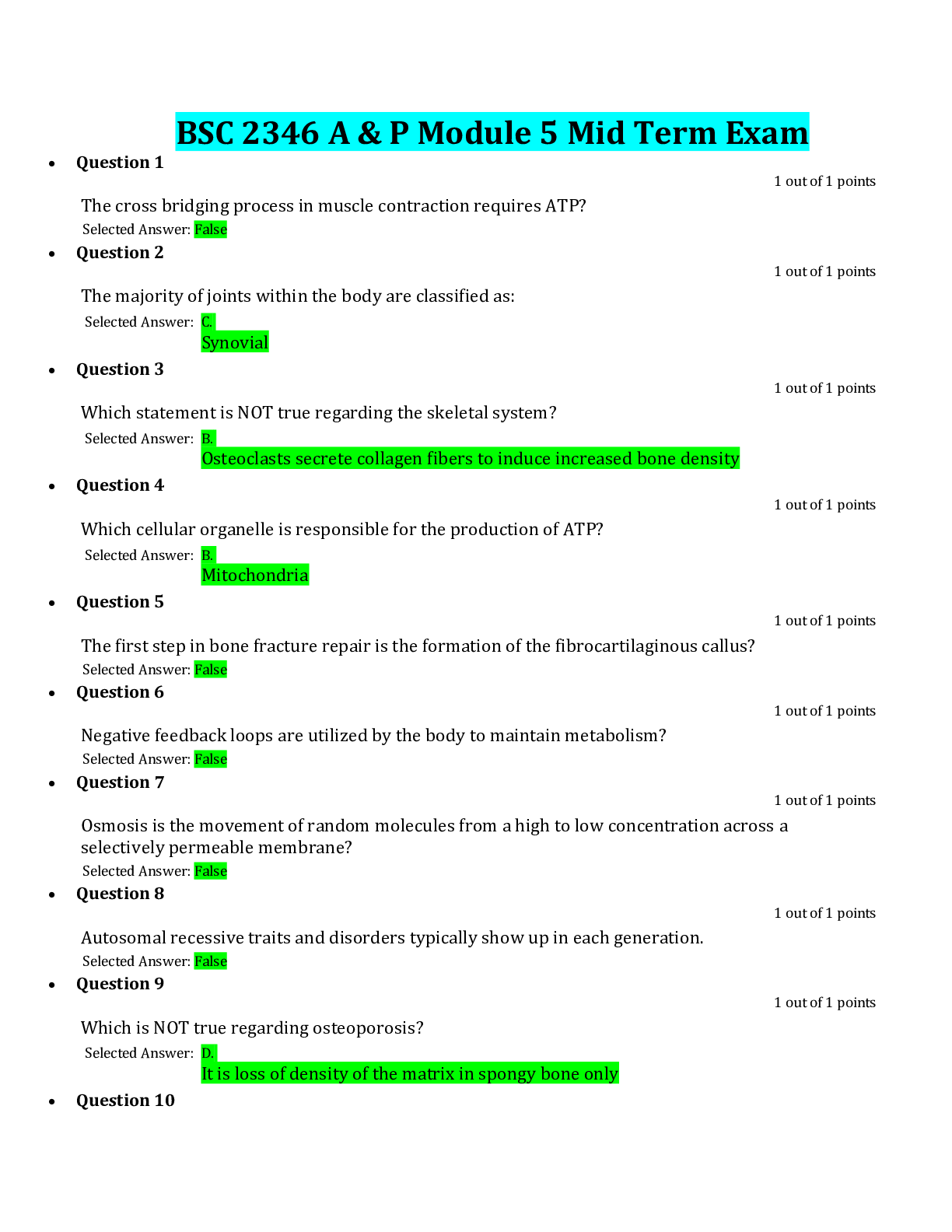

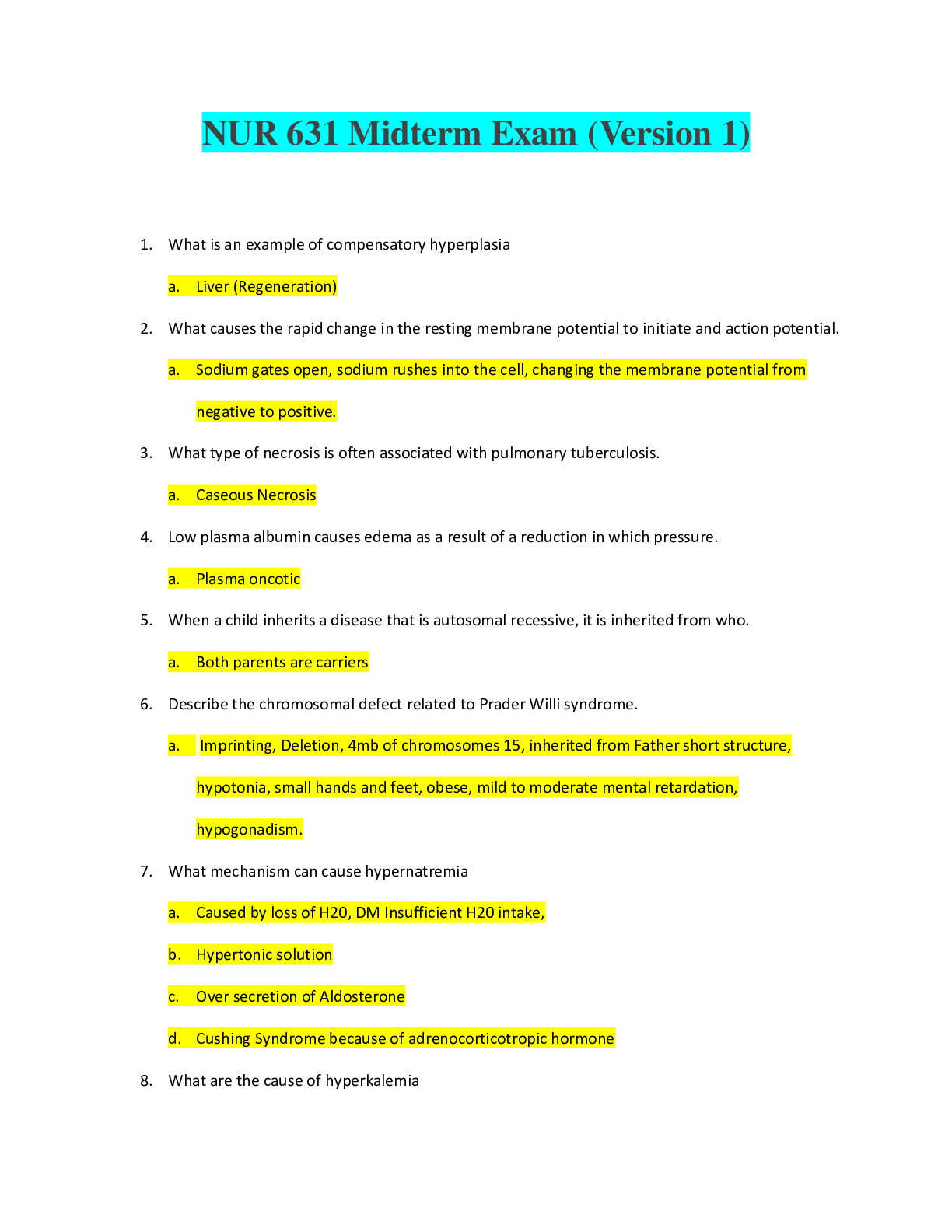

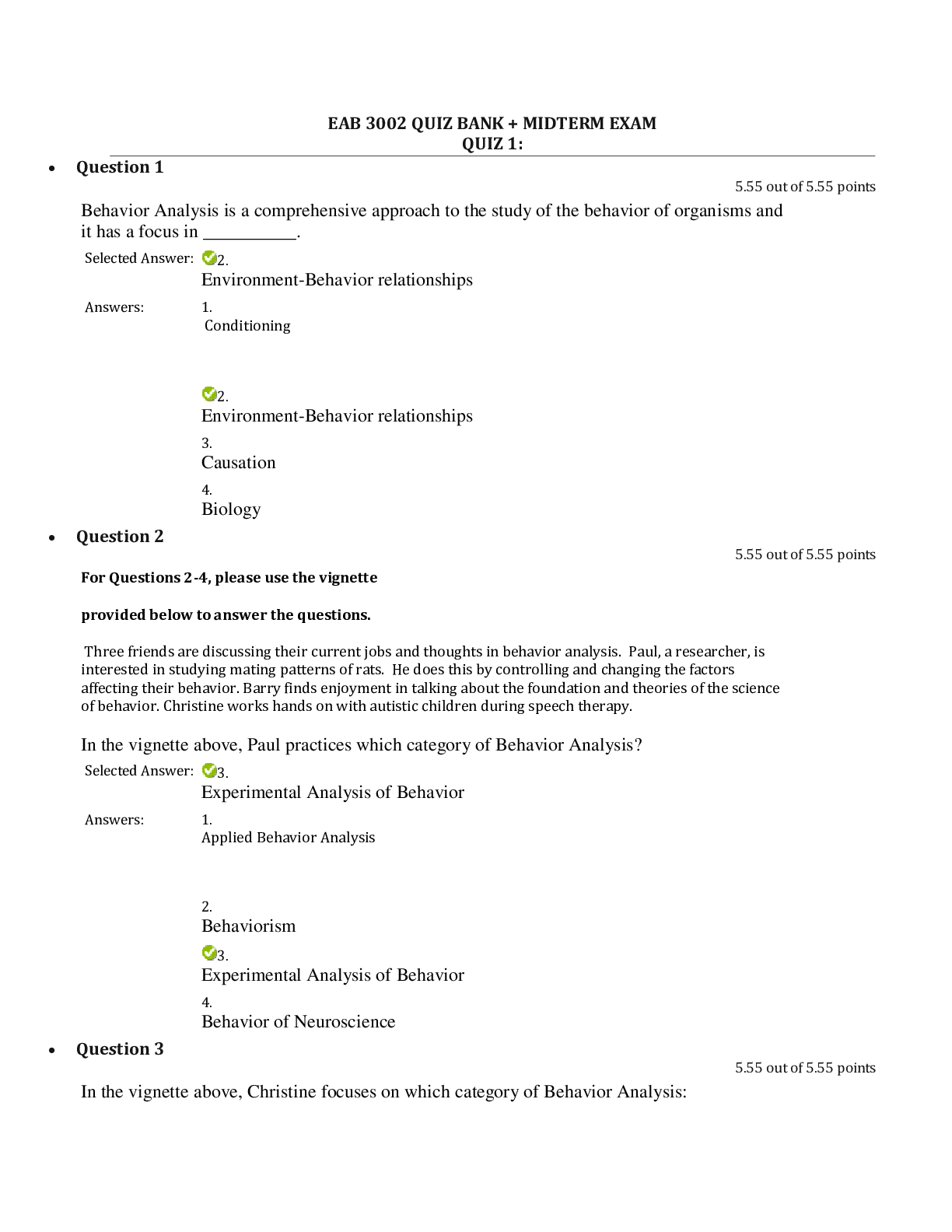

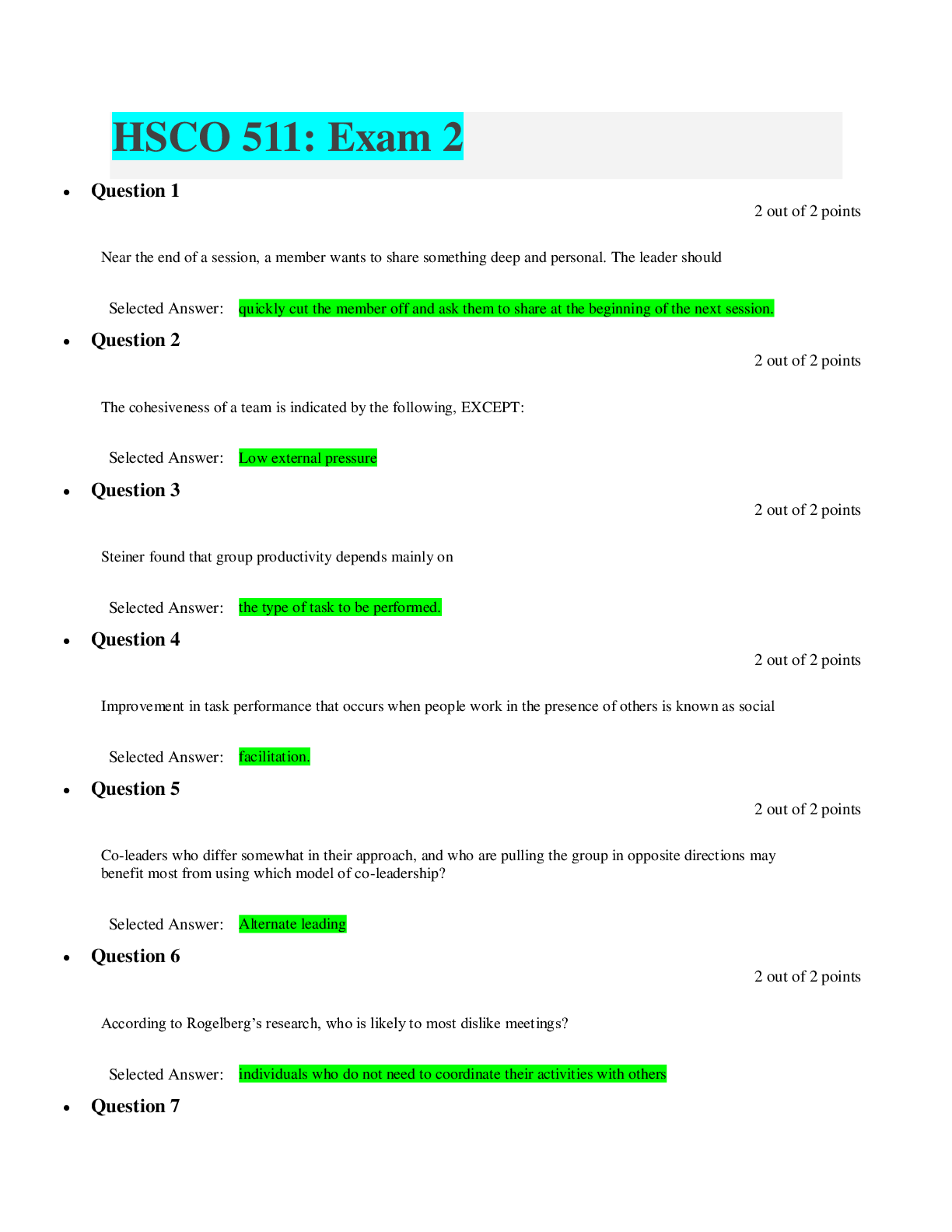

BPL 5100 - Globus Quiz 2 Part 2; Latest 2022/2023 Complete Solution, Already Graded A

Document Content and Description Below

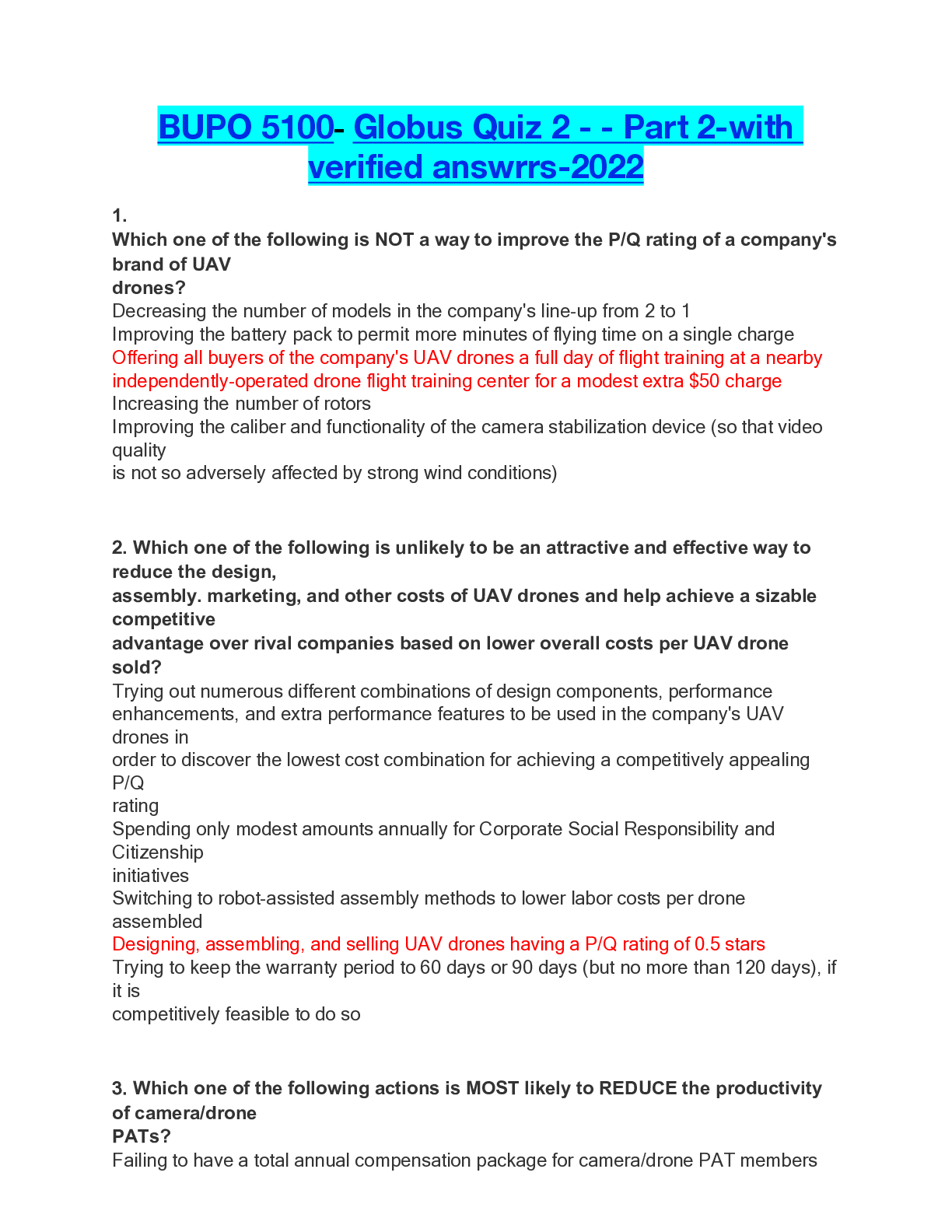

Globus- Quiz 2 - Part 2 / Globus Quiz 2 Part 2 Quiz 2 - Answers - Part 2 1. Which one of the following is NOT a way to improve the P/Q rating of a company's brand of UAV drones? 2. Which... one of the following is unlikely to be an attractive and effective way to reduce the design, assembly. marketing, and other costs of UAV drones and help achieve a sizable competitive advantage over rival companies based on lower overall costs per UAV drone sold? 3. Which one of the following actions is MOST likely to REDUCE the productivity of camera/drone PATs? 4. 11Which of the following is an action that merits serious consideration in trying to improve a company's credit rating? In answering this question, you may wish to consult the Help section for page 5 of the Camera & Drone Journal and read the discussion pertaining to The Credit Rating Measures." 5. As a general rule, it is important for company managers to be aware of the regions where the company's UAV drone business was most profitable and least profitable in the just-completed decision round (so they can pursue corrective actions in the underperforming regions in the upcoming decision round); the best information, then the best place(s) to look for this information is 6. A company's managers should almost always give serious consideration to making significant adjustments in its camera/drone strategies and competitive approaches when 7. The makers of action-capture cameras have good reason to sell their camera models to camera retailers in Europe-Africa at lower average wholesale prices than the average wholesale prices charged to camera retailers in Latin America because 8. Which of the following actions does NOT help improve a company's image rating/brand reputation? 9. If a company adds 40 new workstations at a cost of $75,000 each and also spends $14 million for addition space in its camera/drone assembly facilities to accommodate more workstations, then its annual depreciation costs will rise by 10. Which of the following actions are most likely to catch the eye of action camera shoppers, generate the biggest boost in overall buyer appeal for a company's camera models versus rival brands. and cause the biggest number of additional camera shoppers to purchase its brand instead of rival brands? 11. Which of the following results from the latest decision round are LEAST important in providing guidance to company managers in making their strategic moves and decisions to improve their company's competitiveness and rank among the top-performing companies in the upcoming decision round? 12. If your company earns $3.00 per share of common stock (in a year when the investor-expected EPS target is $3.60), if another company has an industry-leading EPS of S5.00, and if EPS has a scoring weight of 20 points, then your company's EPS score on the Best-in-Industry scoring standard will be 13. The industry-low. industry-average. and industry-high benchmarks on pp. 6-7 of each issue of the Camera & Drone Journal 14. Which of the following is an action company co-managers can take that will help the company meet or beat the investor-expected ROE targets in upcoming years? 15. Which one of the following is NEITHER an advantage or disadvantage of shifting to roboticsassisted camera assembly methods? Installing robots at each camera workstation enables the size of PATs to be cut by one member. 16. As explained in the Help section for the Workforce Compensation, Training, and Product Assembly decision screen, if (1) a company pays a drone PAT member an annual base wage of $25.000, an $800 year-end bonus for perfect attendance, and provides a company-paid annual fringe benefits package worth $3,600 and (2) a PAT is paid a $4 assembly quality incentive per UAV drone assembled that is equally divided among 4 PAT members, then if a drone PAT's 17. One of the benefits of pursuing a strategy of social responsibility and corporate citizenship that involves spending sizable sums of money for social responsibility initiatives and good corporate citizenship over a multi-year period is 18. If a company earns net income of S55 million in Year 8, has 10 million shares of common stock outstanding, pays a dividend of $1.50 per share, and has annual interest costs of $15 million, then 19. If company co-managers wish :o pursue efforts aimed specifically at helping the company meet or beat the investor-expected stock price appreciation targets in upcoming years, then comanagers should consider issuing new shares of common stock to help fund needed capital investment expenditures in those decision rounds when internal cash flows are insufficient to cover all the expenditures 20. A company's EPS can most always be bolstered by managerial actions to [Show More]

Last updated: 1 year ago

Preview 1 out of 9 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 28, 2019

Number of pages

9

Written in

Additional information

This document has been written for:

Uploaded

Dec 28, 2019

Downloads

0

Views

295