Economics > EXAM > Questions and Answers > ECN MANAGERIAL MAIN 1 OF 3 Assessment Review - Corporate Finance Institute F (All)

Questions and Answers > ECN MANAGERIAL MAIN 1 OF 3 Assessment Review - Corporate Finance Institute FMVA Practice Exam

Document Content and Description Below

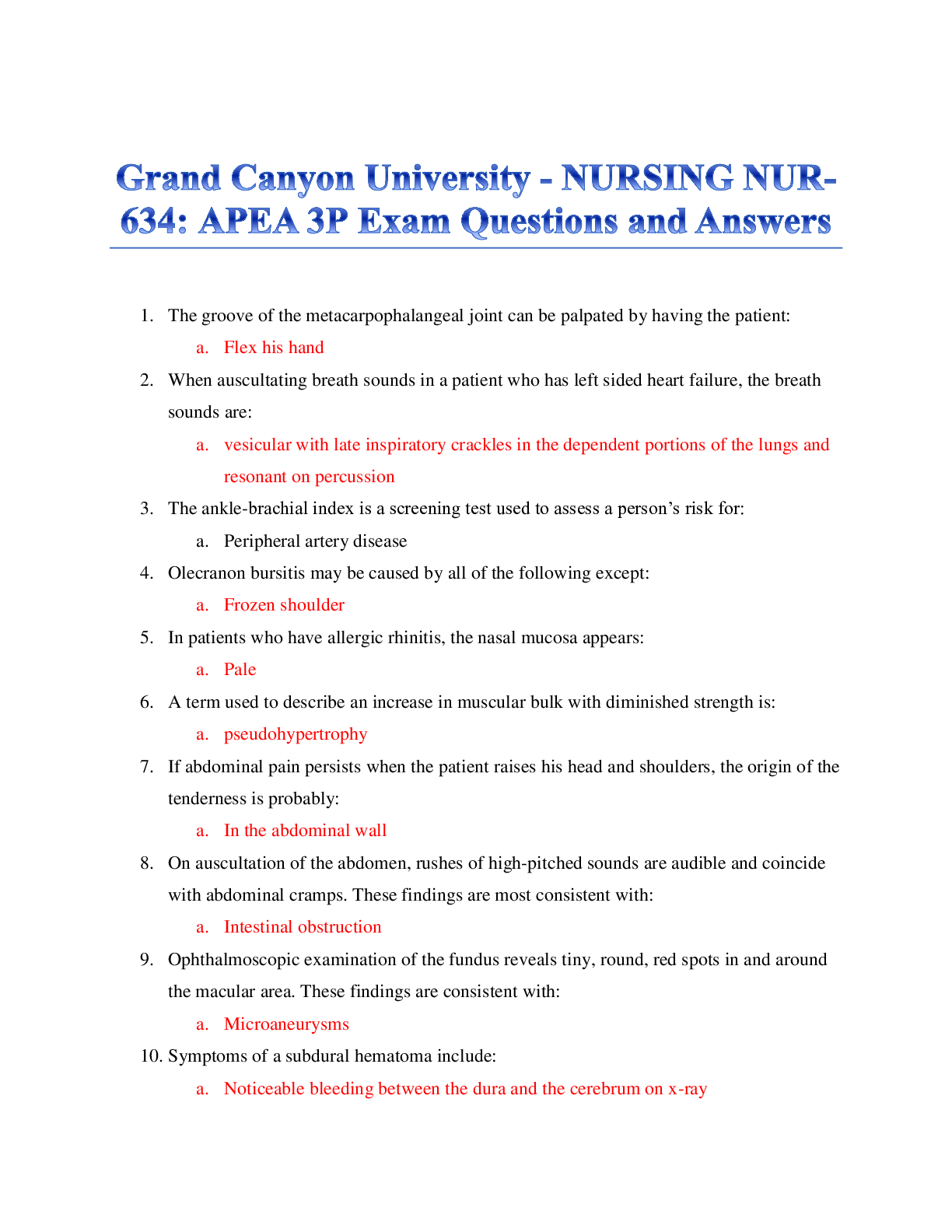

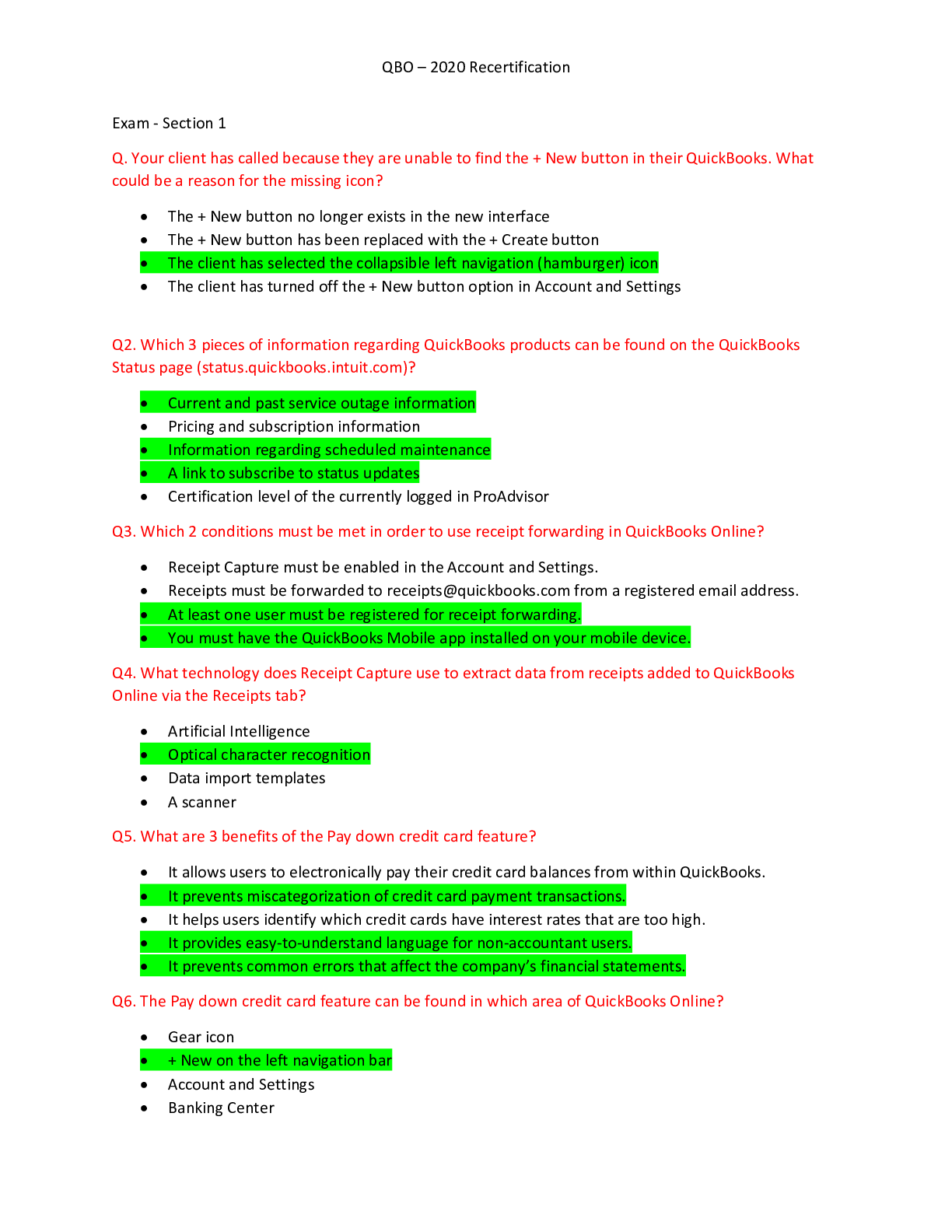

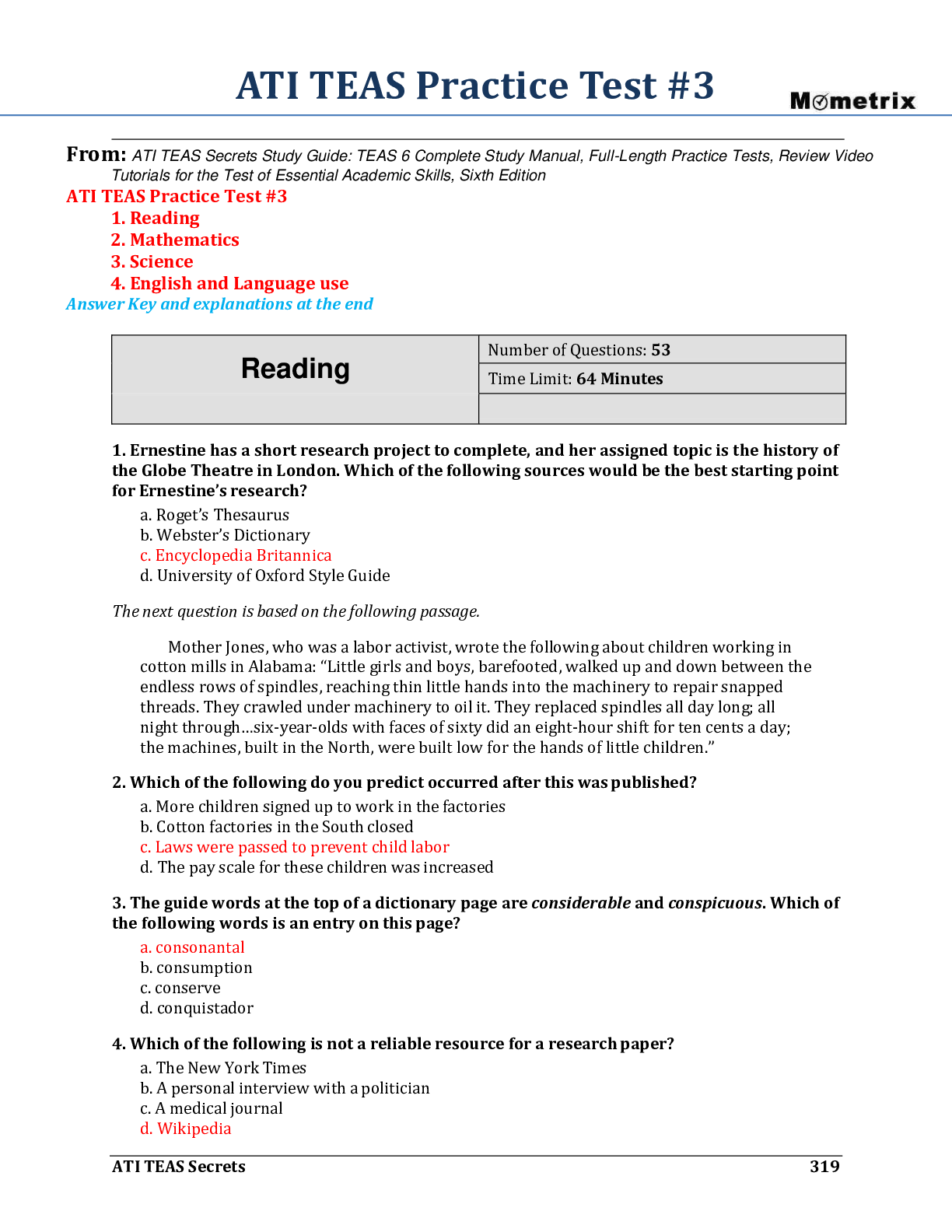

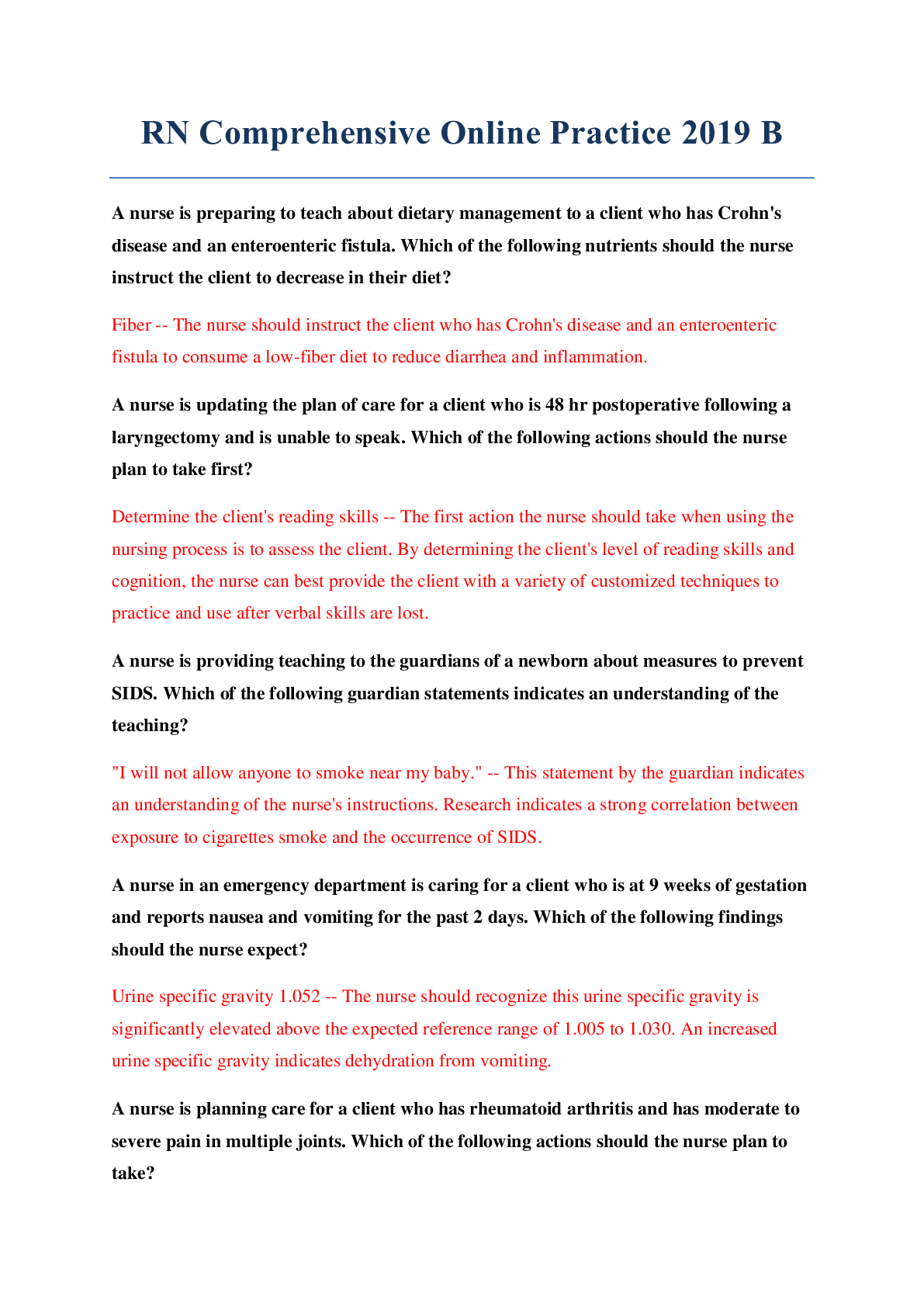

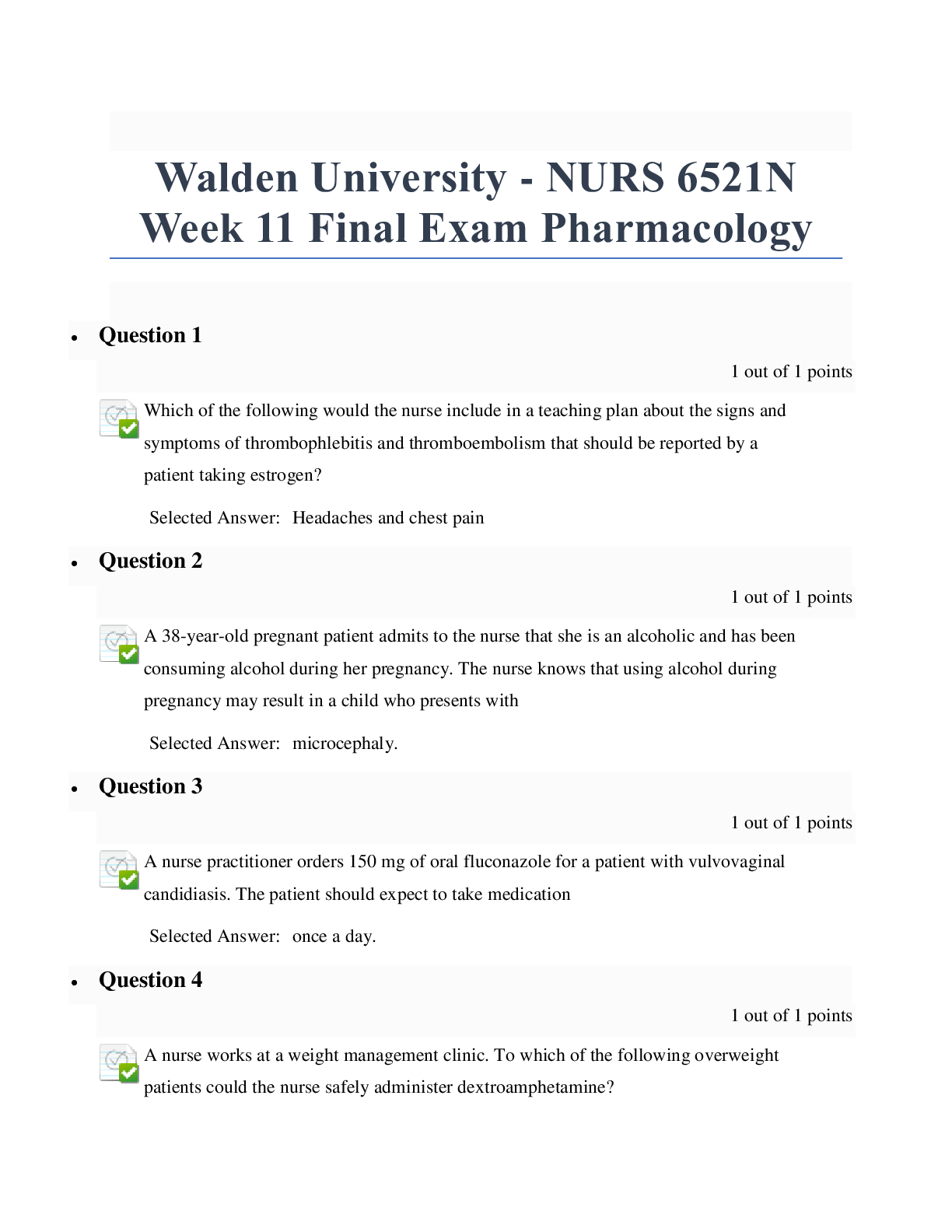

ECN MANAGERIAL MAIN 1 OF 3 Assessment Review - Corporate Finance Institute FMVA Practice Exam Assessment Review - Corporate Finance Institute Below is a scored review of your assessment. All ques... tions are shown. 1 What is Gross Profit in 2028E using the assumptions listed above and on the Control Panel? 2 What is EBITDA in 2022E using the assumptions listed above and on the Control Panel? 3 What is Cash Generated From Operating Activities in 2025E using the assumptions listed above and on the Control Panel? 4 What is the PP&E balance in 2030E using the assumptions listed above and on the Control Panel? 5 What is the cash ratio in 2025E using the assumptions listed above and on the Control Panel? 6 What is the margin impact ratio in 2026E using the assumptions listed above and on the Control Panel? 7 What is the cash turnover ratio in 2029E using the assumptions listed above and on the Control Panel? Is it higher or lower than the same ratio in 2020? 8 What is the risk-free rate? 9 Based on a discounted cash flow analysis and using the WACC as the discount rate, what is the implied equity value of Company XYZ on January 1, 2021? 10 What is the implied equity value at the transaction date (June 15, 2024) based on a discounted cash flow analysis using the WACC as the discount rate, and assuming $50 million of cash and zero debt? 12/22 11 Assuming an investment is made on June 15, 2024 in an amount equal to 1.5x the equity value at that date, what is the investor IRR? 12 Assuming an investment is made on June 15, 2024 in an amount equal to 1.5x the equity value at that date, what is the equity IRR if the investment is funded with 70% debt? 13 If Beta Limited has opening PP&E balance of 150, a depreciation expense of 75, and a closing PP&E balance of 170, what is Beta's net capital expenditure (or CAPEX)? 15/22 14 Which is the best description of authorized shares? 16/22 15 Given the above screenshot, which of the following is the resulting value in cell G2? 17/22 16 | Cost of Equity | 5% | Cost of debt | 7% | % Debt | 60% | % Equity | 40% Given the data in the above table, what is the weighted average cost of capital of this company? 18/22 17 | Free Cash Flow | 100 | Growth rate | 2% | Tax Rate | 1% | Cost of Capital | 5% | Debt-to-total value | 50% Given the data in the above table, what is the terminal value of the business (using the growing perpetuity formula)? 19/22 18 Covariance is best described as: Covariance is a measure of how much two sets of numbers change together. 20/22 19 What actions could a company take to reduce its working capital funding gap? 21/22 20 The debt to tangible net worth ratio is calculated as follows: 22/22 Software by Version 10.2 Privacy Policy. Assessment content is copyright 2021, Corporate Finance Institute. Summary Next Page Go to Dashboard [Show More]

Last updated: 1 year ago

Preview 1 out of 22 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 08, 2022

Number of pages

22

Written in

Additional information

This document has been written for:

Uploaded

Aug 08, 2022

Downloads

0

Views

277