Business > EXAM > BUSI 320 exam 4 Liberty University answers complete solutions, Latest 2019/20. Attempt Score 100/100 (All)

BUSI 320 exam 4 Liberty University answers complete solutions, Latest 2019/20. Attempt Score 100/100 Points.

Document Content and Description Below

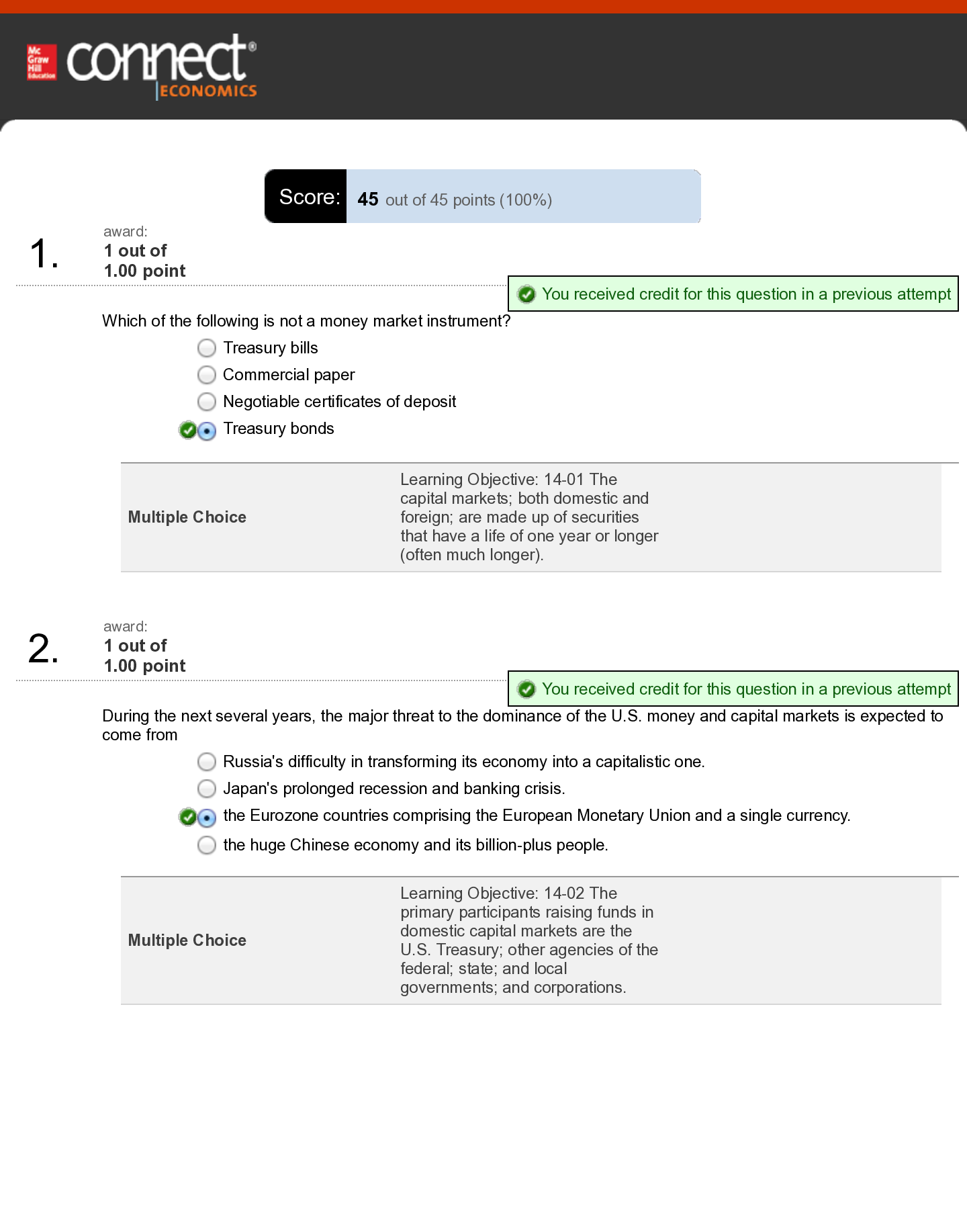

BUSI 320 exam 4 Liberty University answers complete solutions Question Which of the following is not a money market instrument? Question Security markets provide liquidity Question Of the foll... owing efficient market hypotheses, researchers have stated that markets are somewhat efficient in the ____________ sense. Question Which of the following is not an example of indirect investment by a household? Question During the next several years, the major threat to the dominance of the U.S. money and capital markets is expected to come from Question The Pioneer Petroleum Corporation has a bond outstanding with an $70 annual interest payment, a market price of $860, and a maturity date in four years. Assume the par value of the bond is $1,000. Find the following: (Use the approximation formula to compute the approximate yield to maturity and use the calculator method to compute the exact yield to maturity. Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Question Harold Reese must choose between two bonds: Bond X pays $70 annual interest and has a market value of $845. It has 10 years to maturity. Bond Z pays $60 annual interest and has a market value of $870. It has five years to maturity. Assume the par value of the bonds is $1,000. a. Compute the current yield on both bonds. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) b. Which bond should he select based on your answers to part a? c. A drawback of current yield is that it does not consider the total life of the bond. For example, the approximate yield to maturity on Bond X is 9.43 percent. What is the approximate yield to maturity on Bond Z? The exact yield to maturity? (Use the approximation formula to compute the approximate yield to maturity and use the calculator method to compute the exact yield to maturity. Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) d. Has your answer changed between parts b and c of this question? Question Cox Media Corporation pays a coupon rate of 8 percent on debentures that are due in 15 years. The current yield to maturity on bonds of similar risk is 6 percent. The bonds are currently callable at $1,080. The theoretical value of the bonds will be equal to the present value of the expected cash flow from the bonds. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. Find the market value of the bonds using semiannual analysis. (Ignore the call price in your answer. Do not round intermediate calculations and round your answer to 2 decimal places.) Question The investment banking firm of Einstein & Co. will use a dividend valuation model to appraise the shares of the Modern Physics Corporation. Dividends (D1) at the end of the current year will be $1.50. The growth rate (g) is 6 percent and the discount rate (Ke) is 10 percent. a. What should be the price of the stock to the public? (Do not round intermediate calculations and round your answer to 2 decimal places.) b. If there is a 5 percent total underwriting spread on the stock, how much will the issuing corporation receive? (Do not round intermediate calculations and round your answer to 2 decimal places.) [Show More]

Last updated: 1 year ago

Preview 1 out of 34 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 17, 2019

Number of pages

34

Written in

Additional information

This document has been written for:

Uploaded

Dec 17, 2019

Downloads

0

Views

64