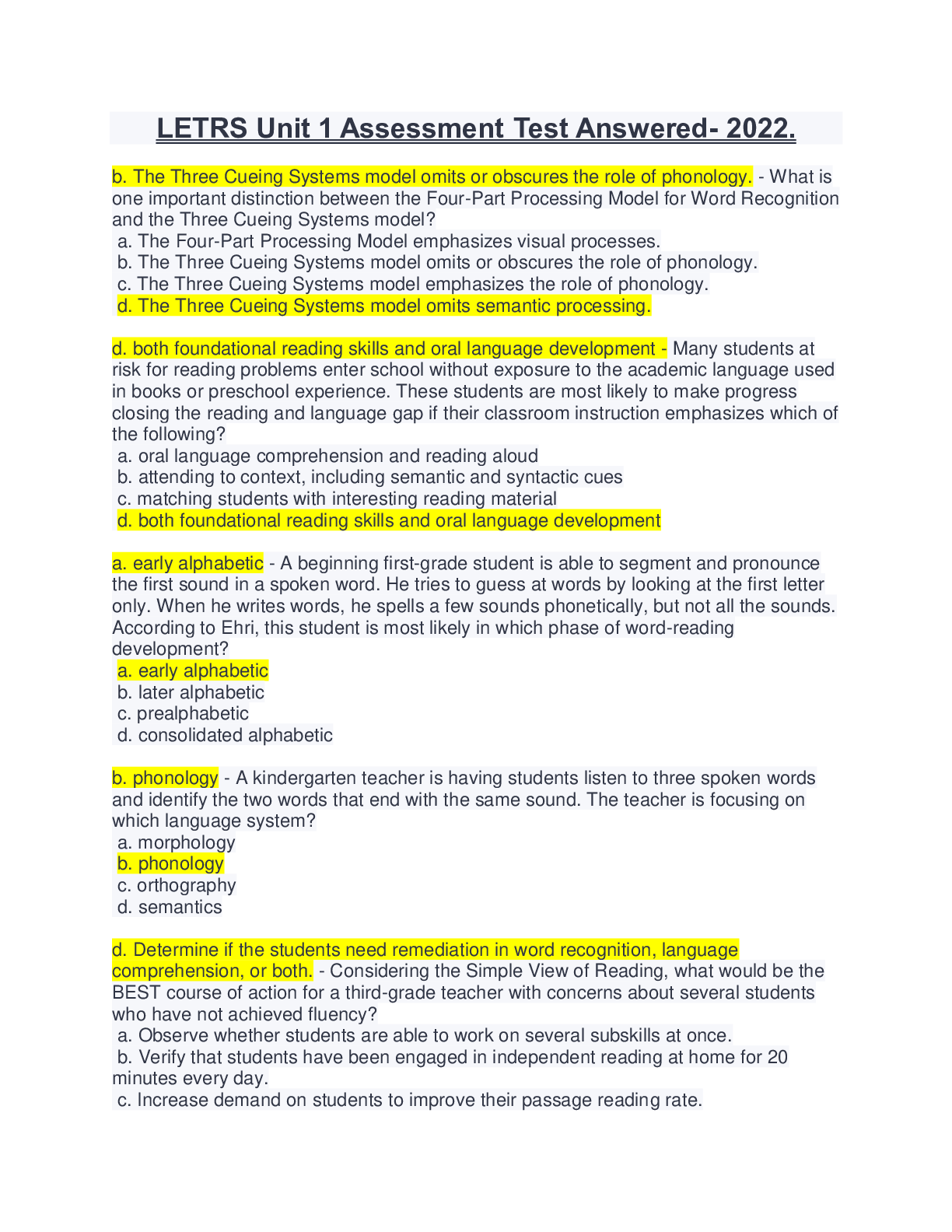

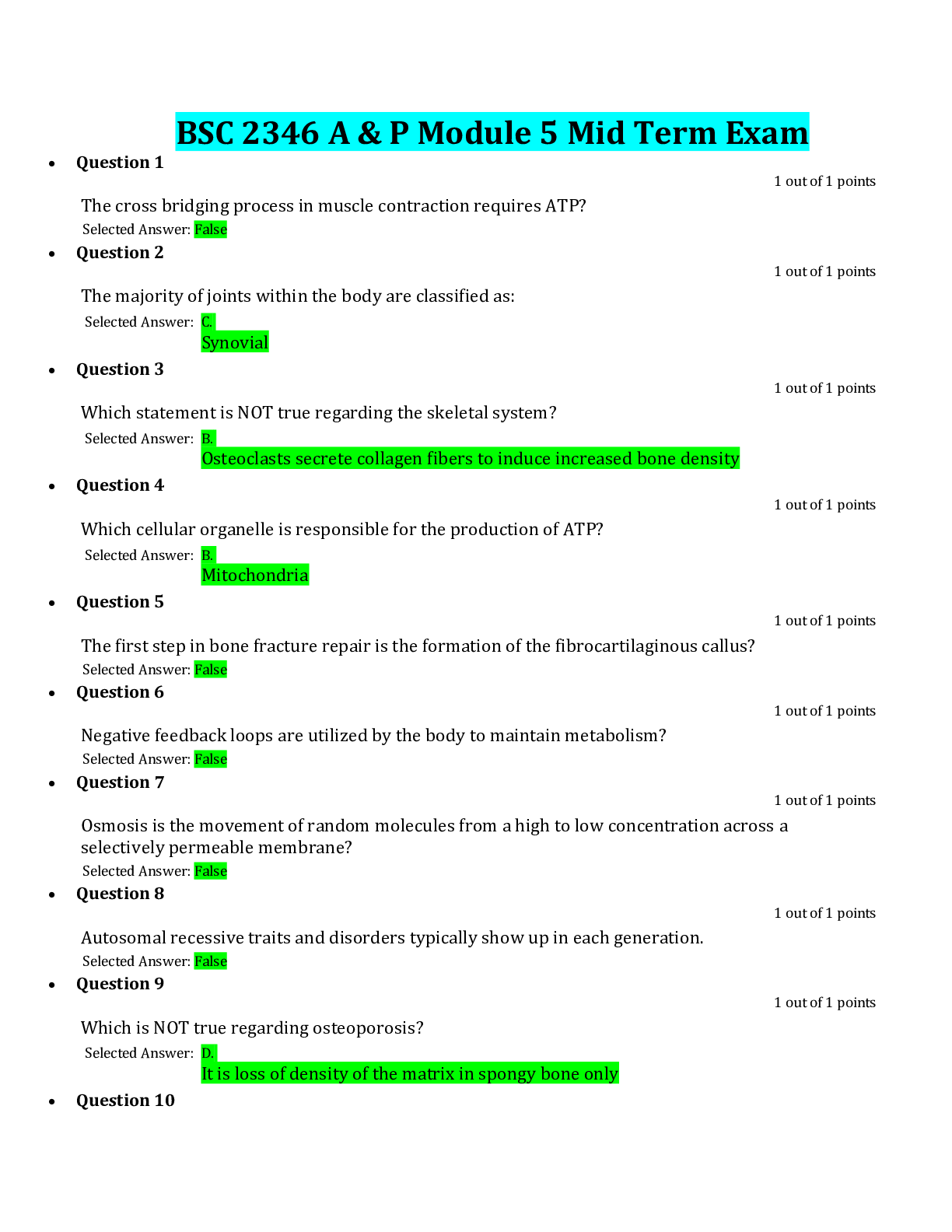

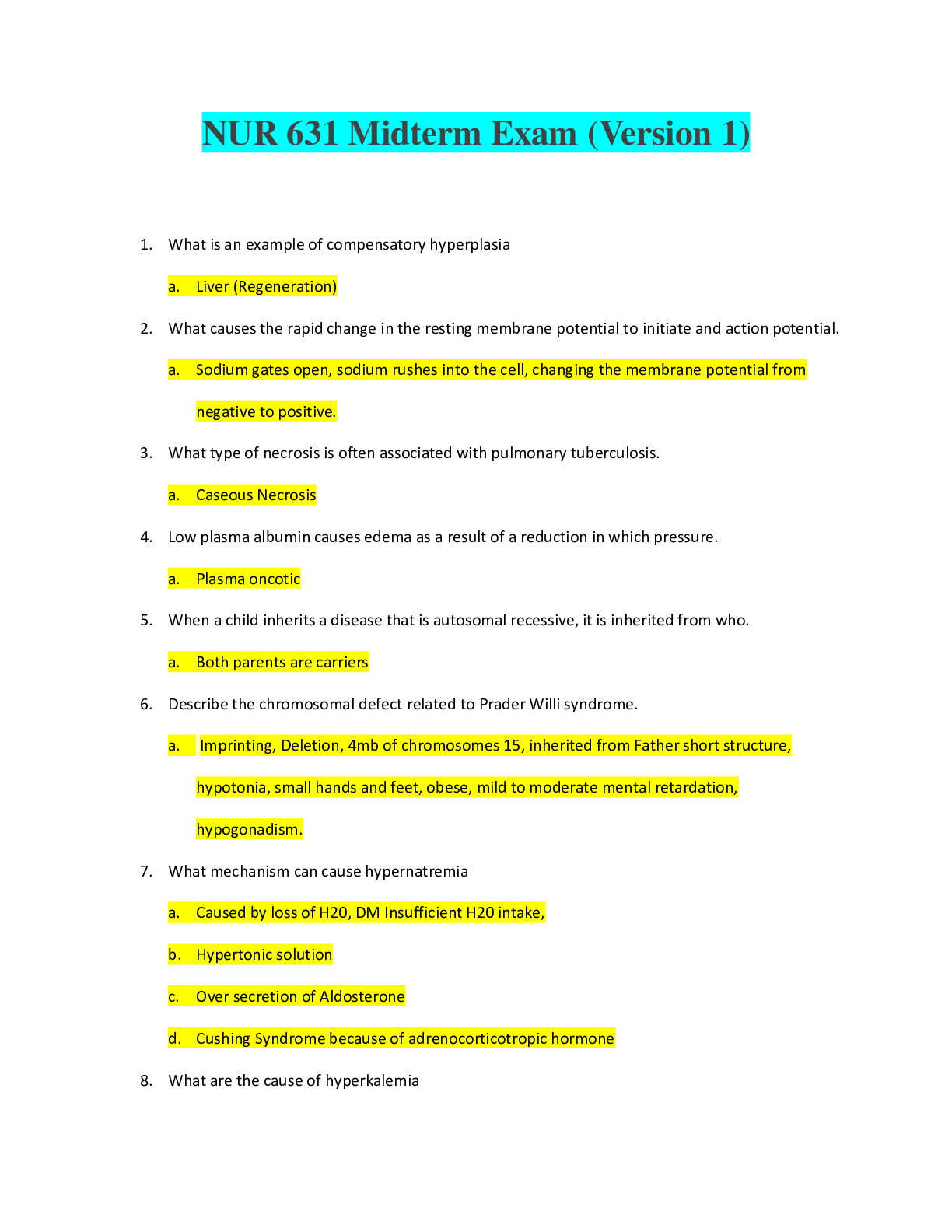

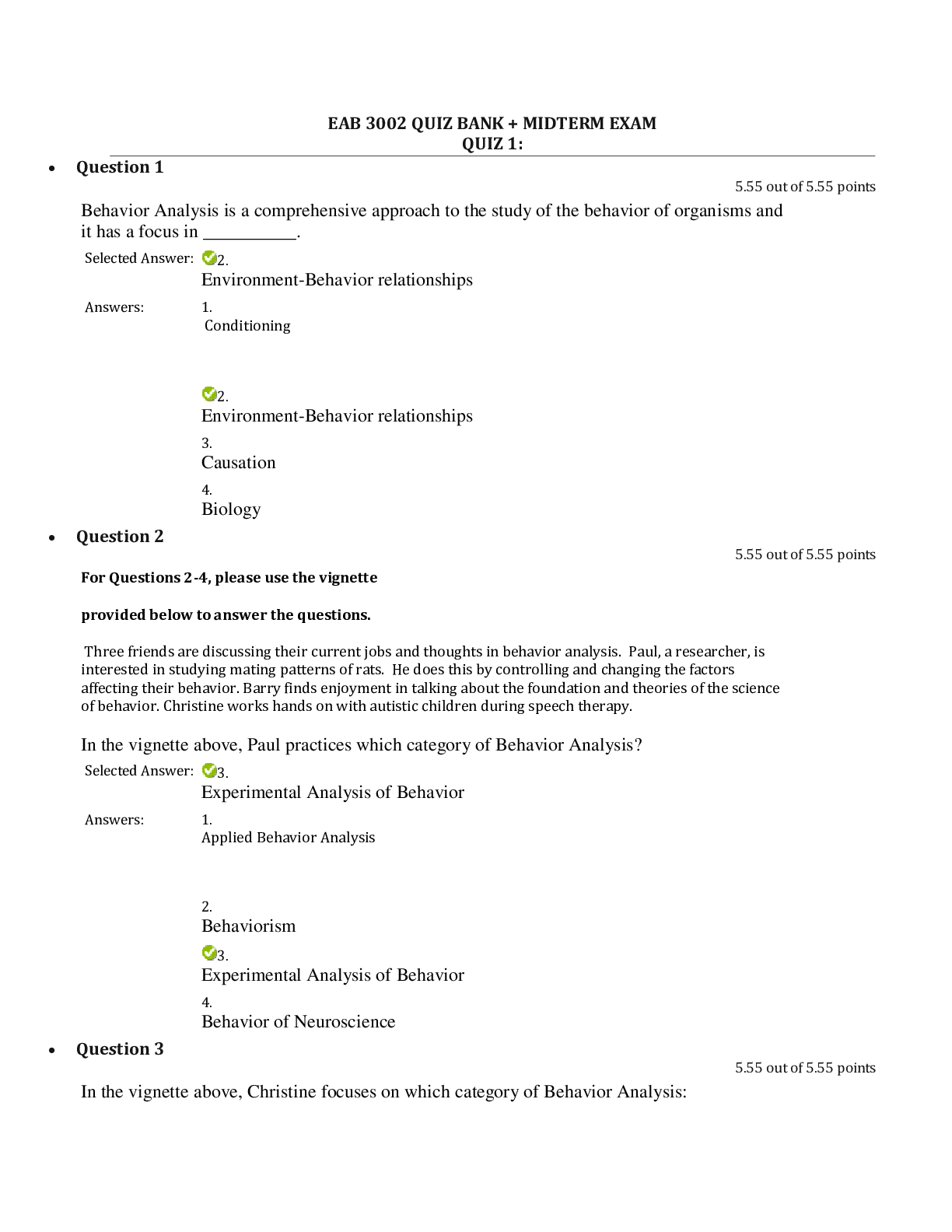

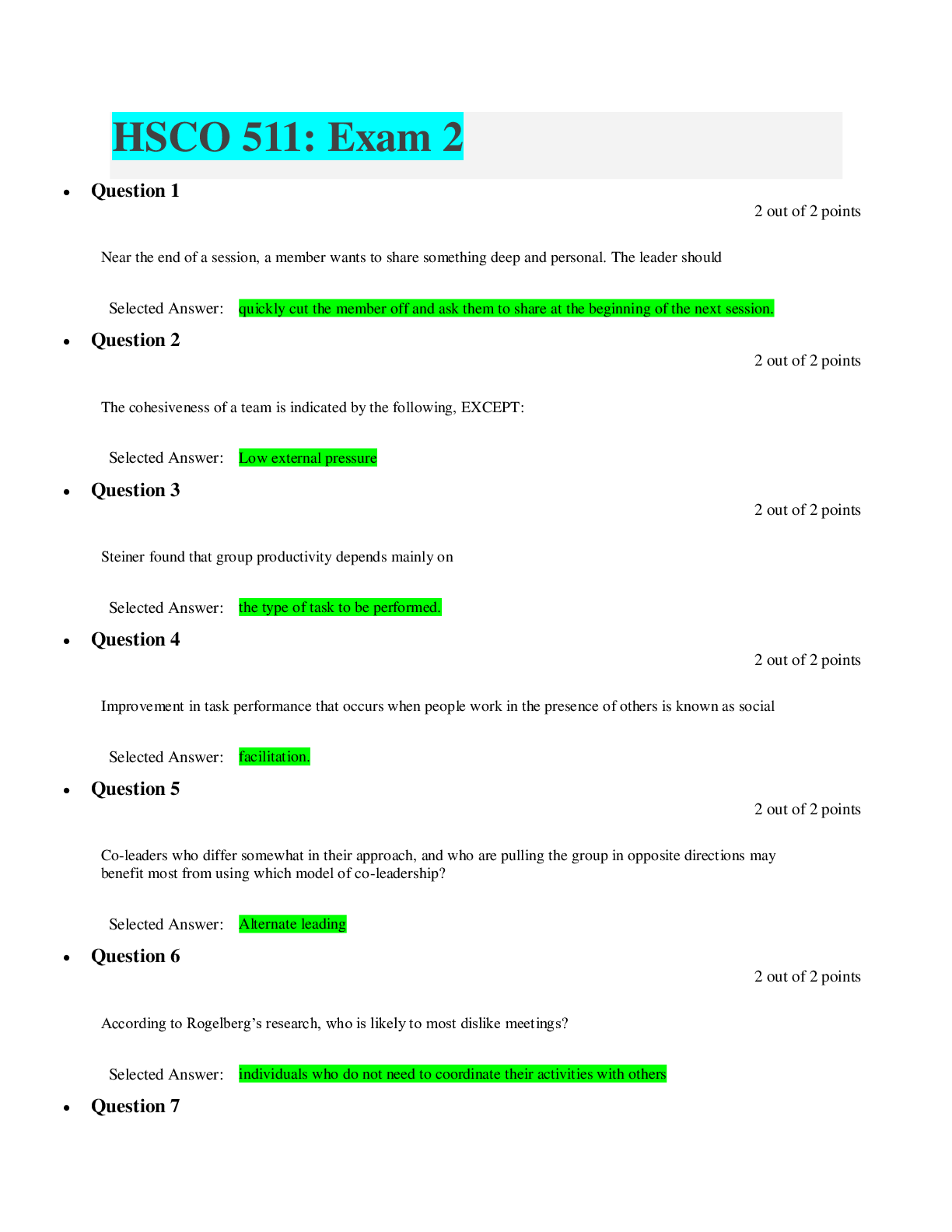

Finance > EXAM > Strayer University, Washington FIN 534 Midterm Exam Complete Solution (2019/20) Attempt Score 42 out (All)

Strayer University, Washington FIN 534 Midterm Exam Complete Solution (2019/20) Attempt Score 42 out of 50.

Document Content and Description Below

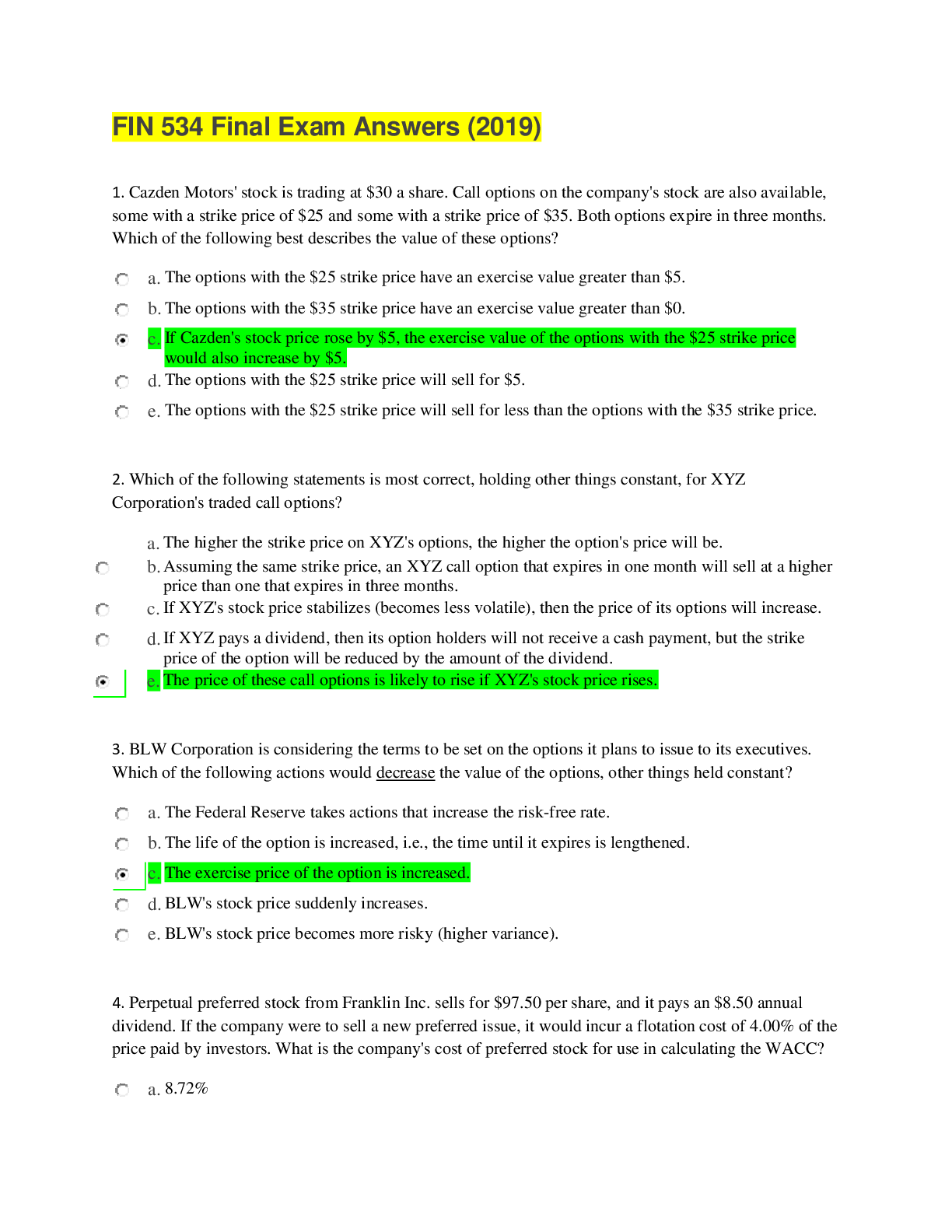

• Question 1 A U.S. Treasury bond will pay a lump sum of $1,000 exactly 3 years from today. The nominal interest rate is 6%, semiannual compounding. Which of the following statements is CORRE... CT? • Question 2 Which of the following statements is CORRECT? • Question 3 A $150,000 loan is to be amortized over 6 years, with annual end-of-year payments. Which of these statements is CORRECT? • Question 4 You plan to analyze the value of a potential investment by calculating the sum of the present values of its expected cash flows. Which of the following would increase the calculated value of the investment? • Question 5 A U.S. Treasury bond will pay a lump sum of $1,000 exactly 3 years from today. The nominal interest rate is 6%, semiannual compounding. Which of the following statements is CORRECT? Which of the following statements regarding a 20-year monthly payment amortized mortgage with a nominal interest rate of 10% is CORRECT? • Question 7 A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is NOT CORRECT? • Question 8 A 15-year bond has an annual coupon rate of 8%. The coupon rate will remain fixed until the bond matures. The bond has a yield to maturity of 6%. Which of the following statements is CORRECT? • Question 9 Which of the following statements is CORRECT? • Question 10 Which of the following statements is CORRECT? • Question 11 Which of the following statements is CORRECT? • Question 12 Which of the following statements is CORRECT? • Question 13 Bonds A and B are 15-year, $1,000 face value bonds. Bond A has a 7% annual coupon, while Bond B has a 9% annual coupon. Both bonds have a yield to maturity of 8%, which is expected to remain constant for the next 15 years. Which of the following statements is CORRECT? • Question 14 Which of the following is most likely to be true for a portfolio of 40 randomly selected stocks? • Question 15 Which of the following statements is CORRECT? • Question 16 Which of the following statements is CORRECT? • Question 17 Which of the following statements is CORRECT? (Assume that the risk-free rate is a constant.) • Question 18 Assume that the risk-free rate is 6% and the market risk premium is 5%. Given this information, which of the following statements is CORRECT? • Question 19 If you randomly select stocks and add them to your portfolio, which of the following statements best describes what you should expect? • Question 20 Stocks X and Y have the following data. Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT? X Y Price $25 $25 Expected dividend yield 5% 3% Required return 12% 10% • Question 21 A share of Lash Inc.'s common stock just paid a dividend of $1.00. If the expected long-run growth rate for this stock is 5.4%, and if investors' required rate of return is 11.4%, what is the stock price? • Question 22 Which of the following statements is CORRECT? • Question 23 Which of the following statements is NOT CORRECT? • Question 24 Franklin Corporation is expected to pay a dividend of $1.25 per share at the end of the year (D1 = $1.25). The stock sells for $32.50 per share, and its required rate of return is 10.5%. The dividend is expected to grow at some constant rate, g, forever. What is the equilibrium expected growth rate? • Question 25 Which of the following statements is CORRECT? [Show More]

Last updated: 1 year ago

Preview 1 out of 10 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 27, 2019

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Dec 27, 2019

Downloads

0

Views

47

.png)