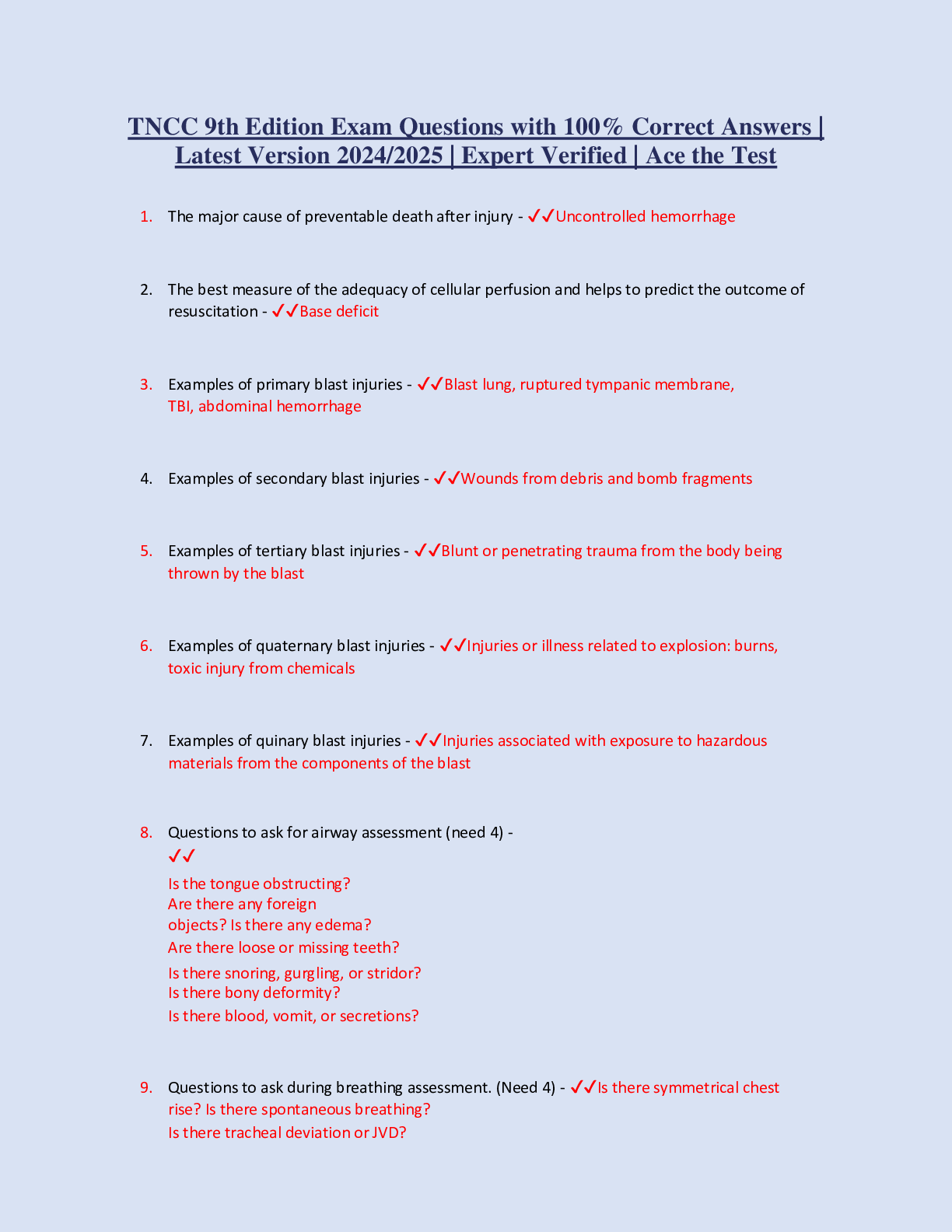

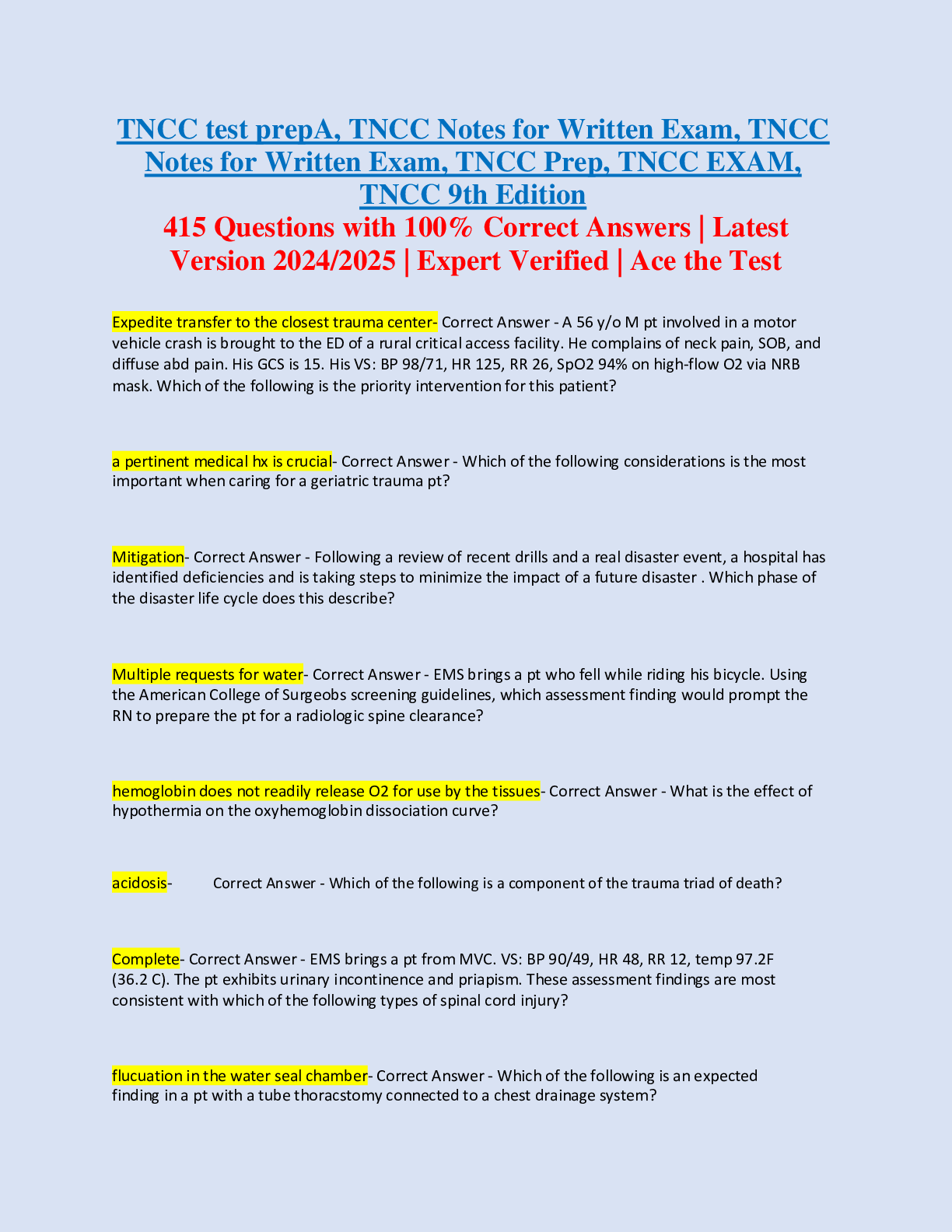

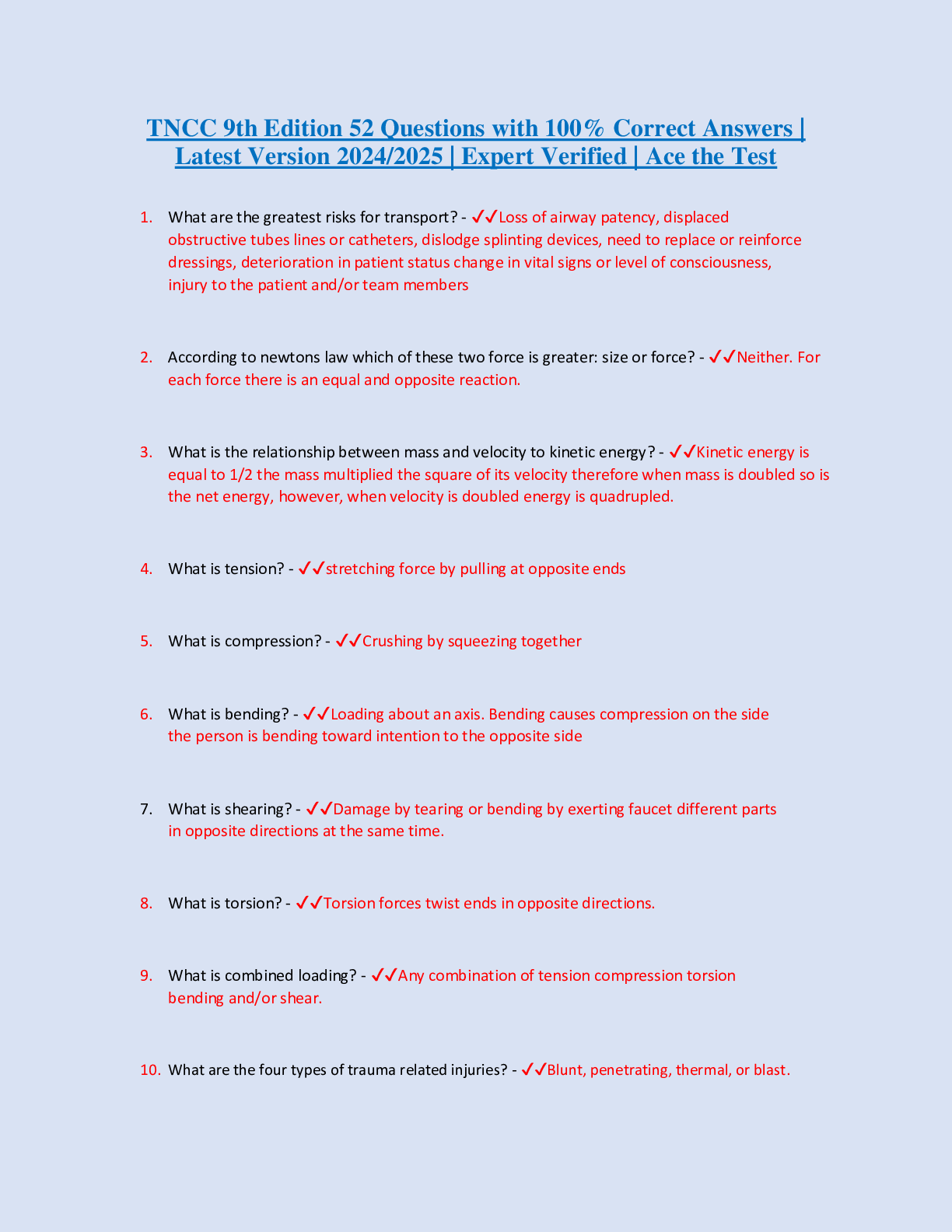

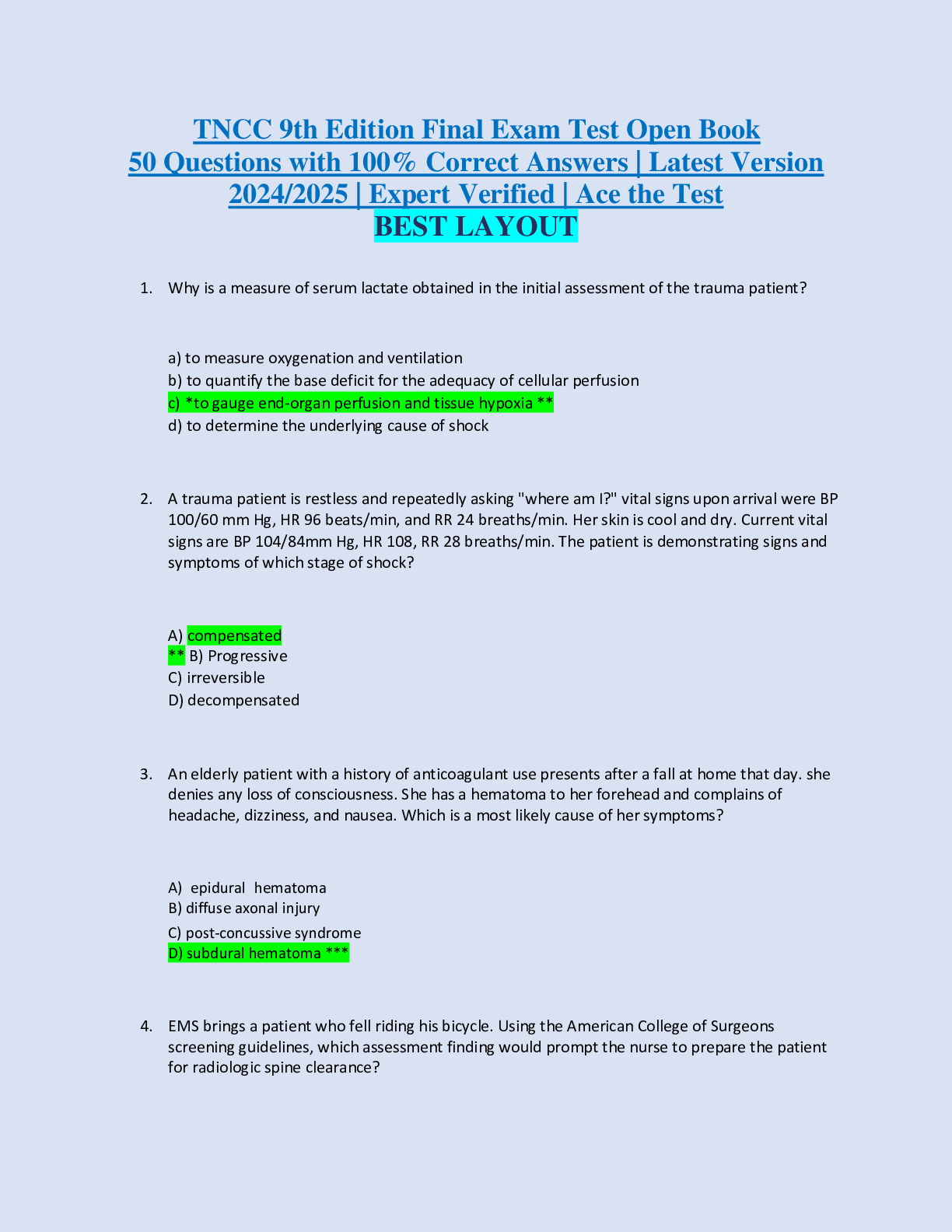

Financial Accounting > EXAM > San Jacinto Community CollegeACCOUNTING 2301Accounting exam 1. (All)

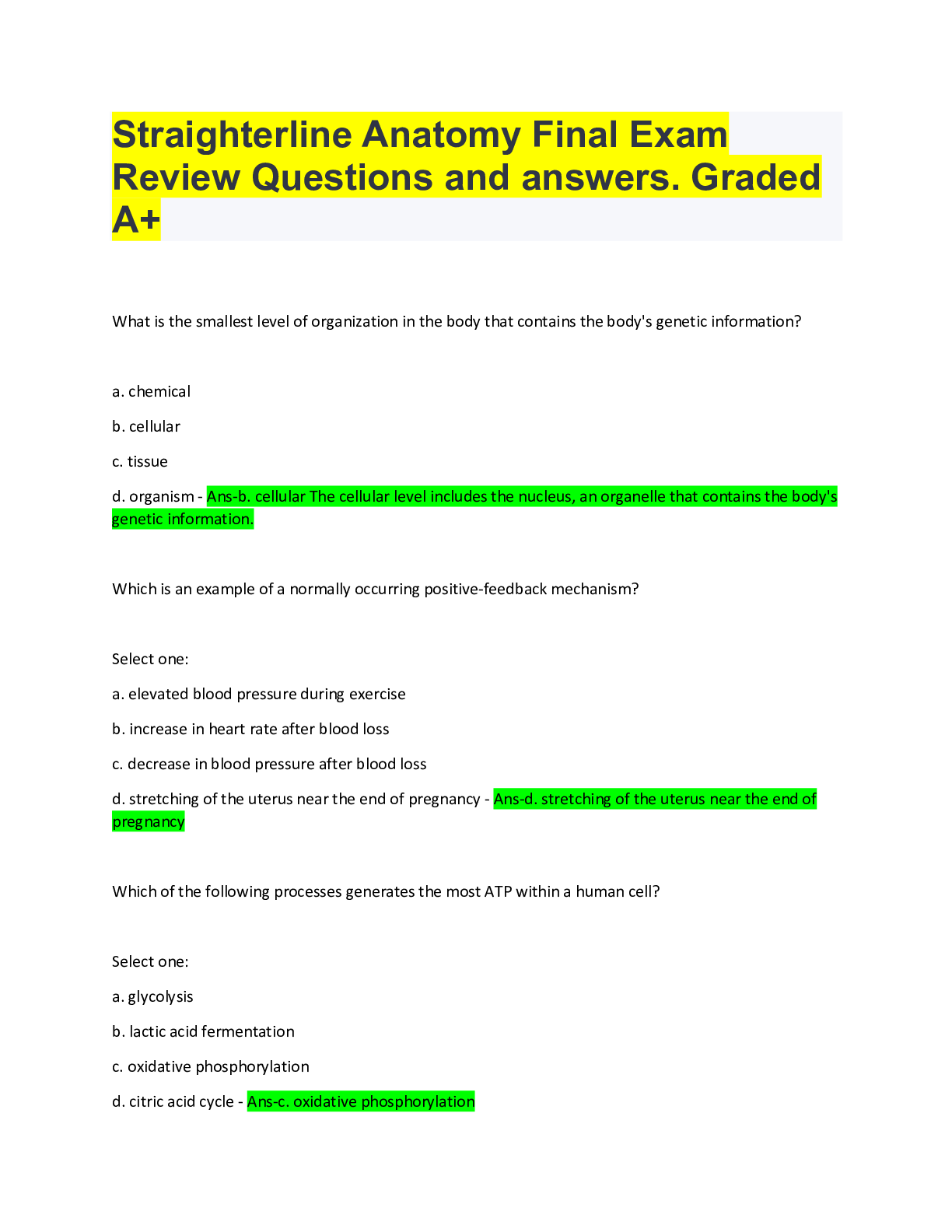

San Jacinto Community CollegeACCOUNTING 2301Accounting exam 1.

Document Content and Description Below

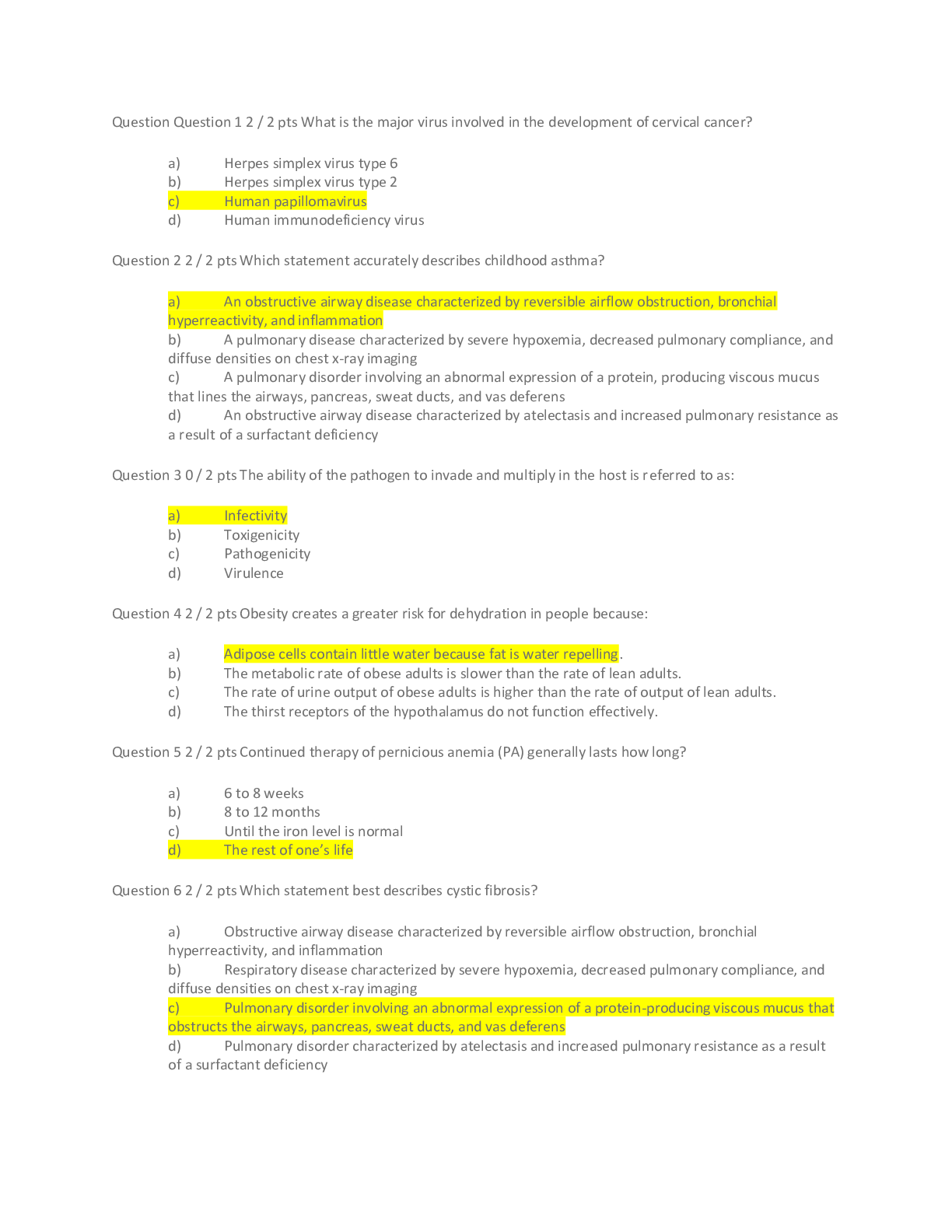

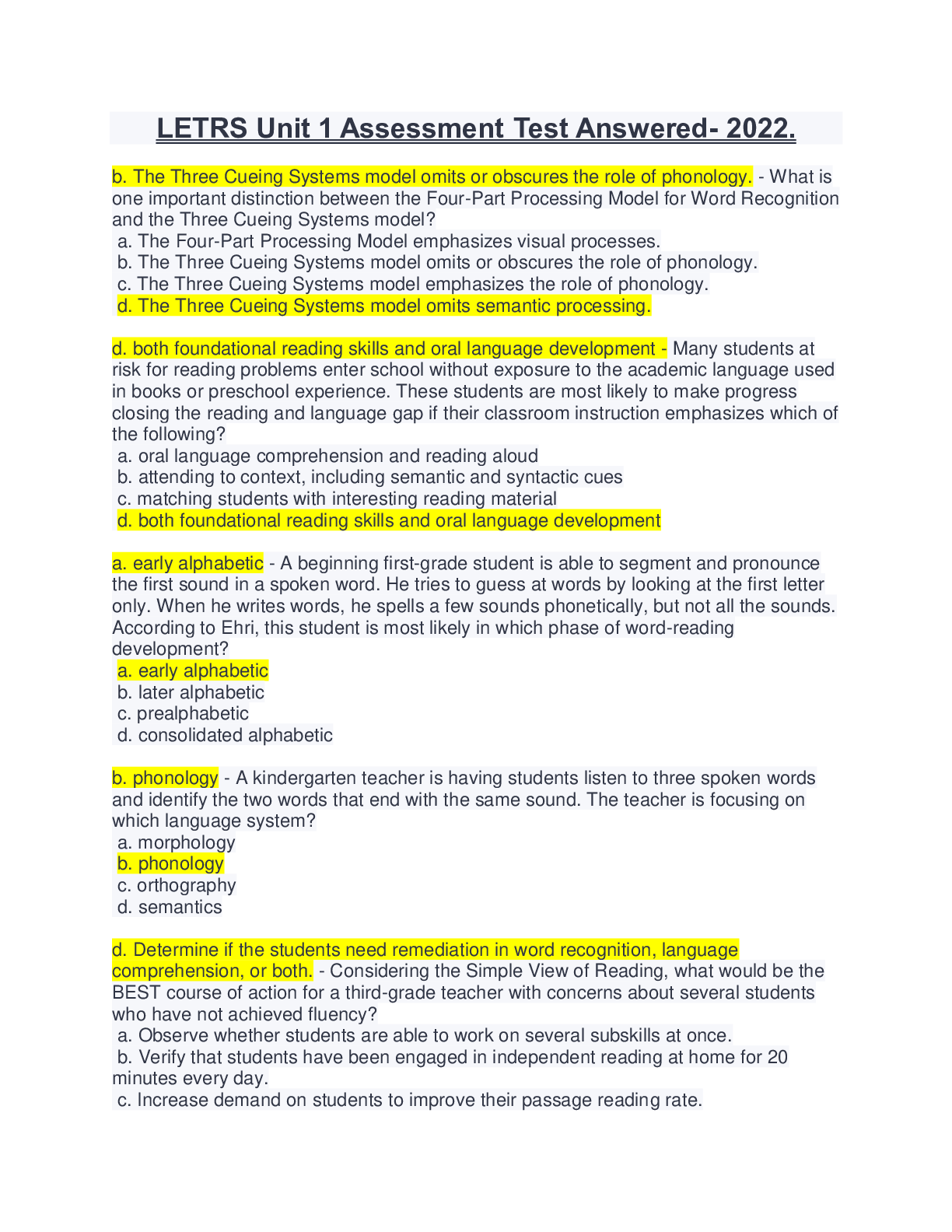

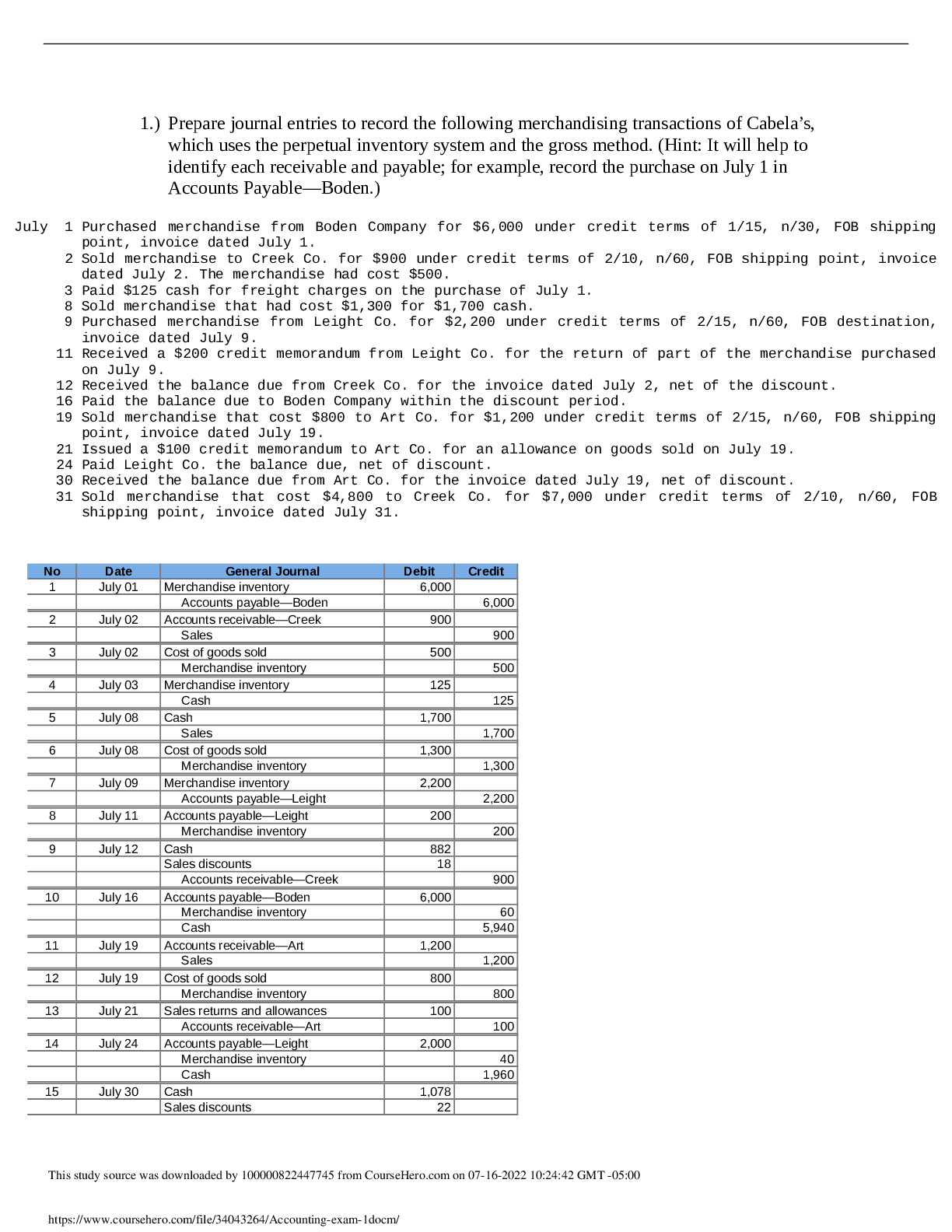

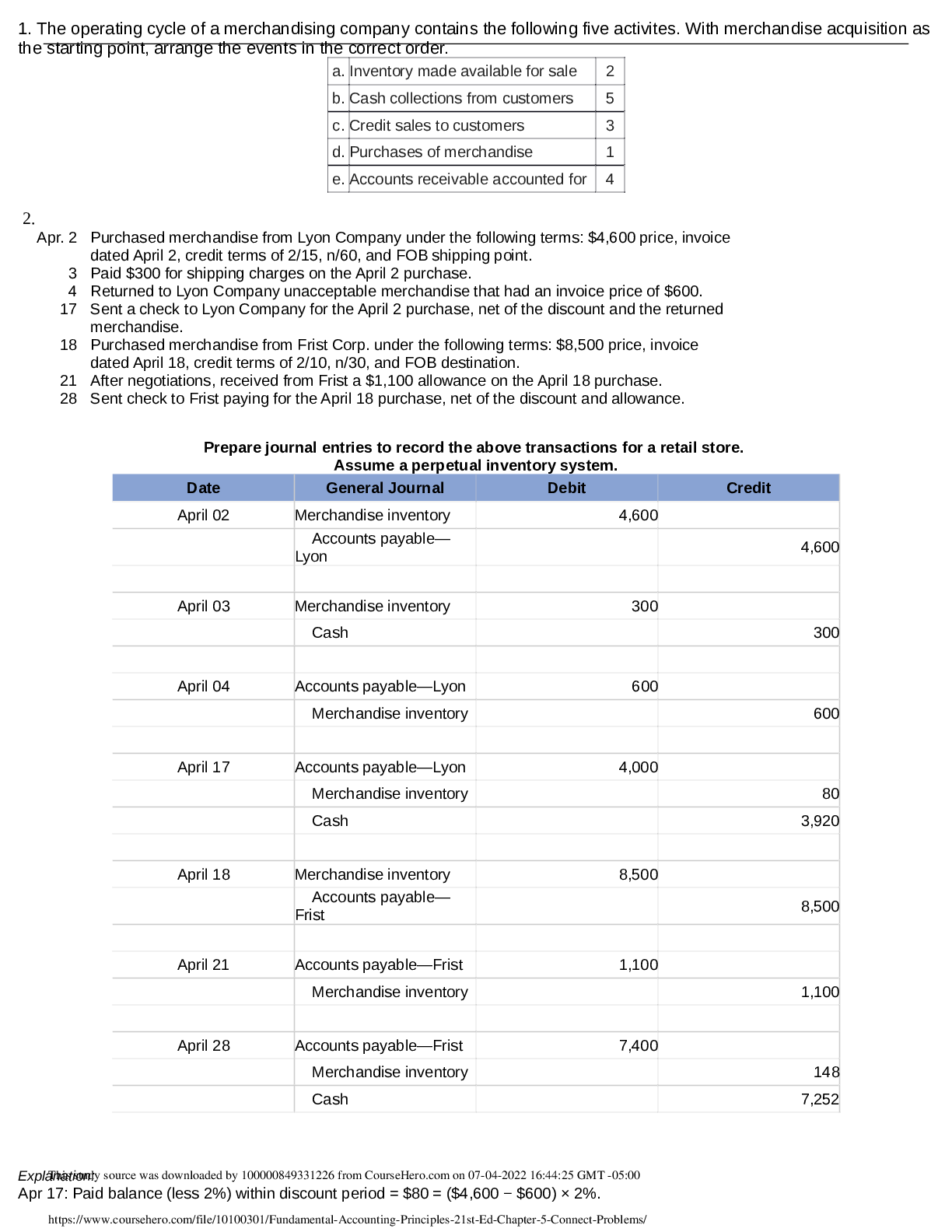

San Jacinto Community College ACCOUNTING 2301 Accounting exam 1. 1.) Prepare journal entries to record the following merchandising transactions of Cabela’s, which uses the perpetual inventory sys... tem and the gross method. (Hint: It will help to identify each receivable and payable; for example, record the purchase on July 1 in Accounts Payable—Boden.) July 1 Purchased merchandise from Boden Company for $6,000 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1. 2 Sold merchandise to Creek Co. for $900 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $500. 3 Paid $125 cash for freight charges on the purchase of July 1. 8 Sold merchandise that had cost $1,300 for $1,700 cash. 9 Purchased merchandise from Leight Co. for $2,200 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9. 11 Received a $200 credit memorandum from Leight Co. for the return of part of the merchandise purchased on July 9. 12 Received the balance due from Creek Co. for the invoice dated July 2, net of the discount. 16 Paid the balance due to Boden Company within the discount period. 19 Sold merchandise that cost $800 to Art Co. for $1,200 under credit terms of 2/15, n/60, FOB shipping point, invoice dated July 19. 21 Issued a $100 credit memorandum to Art Co. for an allowance on goods sold on July 19. 24 Paid Leight Co. the balance due, net of discount. 30 Received the balance due from Art Co. for the invoice dated July 19, net of discount. 31 Sold merchandise that cost $4,800 to Creek Co. for $7,000 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 31. 2.) L'Oréal reports the following income statement accounts for the year ended December 31, 2014 (euros in millions). 3.) Chico Company allows its customers to return merchandise within 30 days of purchase. At December 31, 2017, the end of its first year of operations, Chico estimates future-period merchandise returns of $67,000 (cost of $26,000) related to its 2017 sales. On January 3, 2018, a customer returns merchandise with a selling price of $2,350 for a cash refund; the returned merchandise cost $820 and is returned to inventory as it is not defective. a. Prepare the December 31, 2017, year-end adjusting journal entry for estimated future sales returns and allowances (revenue side). b. Prepare the December 31, 2017, year-end adjusting journal entry for estimated future inventory returns and allowances (cost side). c. Prepare the January 3, 2018, journal entry(ies) to record the merchandise returned. 4.) Med Labs has the following December 31, 2017, year-end unadjusted balances: Allowance for Sales Discounts, $0; and Accounts Receivable, $5,800. Of the $5,800 of receivables, $1,400 are within a 3% discount period, meaning that it expects buyers to take $42 in future-period discounts arising from this period's sales. a. Prepare the December 31, 2017, year-end adjusting journal entry for future sales discounts. b. Assume the same facts above and that there is a $8 year-end unadjusted credit balance in the Allowance for Sales Discounts. Prepare the December 31, 2017, year-end adjusting journal entry for future sales discounts. 5.) [The following information applies to the questions displayed below.] The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. Rent expense and salaries expense are equally divided between selling activities and general and administrative activities. Nelson Company uses a perpetual inventory system. Additional Information: a. Store supplies still available at fiscal year-end amount to $1,750. b. Expired insurance, an administrative expense, for the fiscal year is $1,400. c. Depreciation expense on store equipment, a selling expense, is $1,525 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $10,900 of inventory is still available at fiscal year-end. [The following information applies to the questions displayed below.] The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. Rent expense and salaries expense are equally divided between selling activities and general and administrative activities. Nelson Company uses a perpetual inventory system. Additional Information: a. Store supplies still available at fiscal year-end amount to $1,750. b. Expired insurance, an administrative expense, for the fiscal year is $1,400. c. Depreciation expense on store equipment, a selling expense, is $1,525 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $10,900 of inventory is still available at fiscal year-end. [Show More]

Last updated: 1 year ago

Preview 1 out of 6 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jul 05, 2022

Number of pages

6

Written in

Additional information

This document has been written for:

Uploaded

Jul 05, 2022

Downloads

0

Views

93

.png)

.png)