Financial Accounting > EXAM > Questions and Answers > University of California, IrvineEXAM 2Exam 2 Prep Questions-1 (All)

Questions and Answers > University of California, IrvineEXAM 2Exam 2 Prep Questions-1

Document Content and Description Below

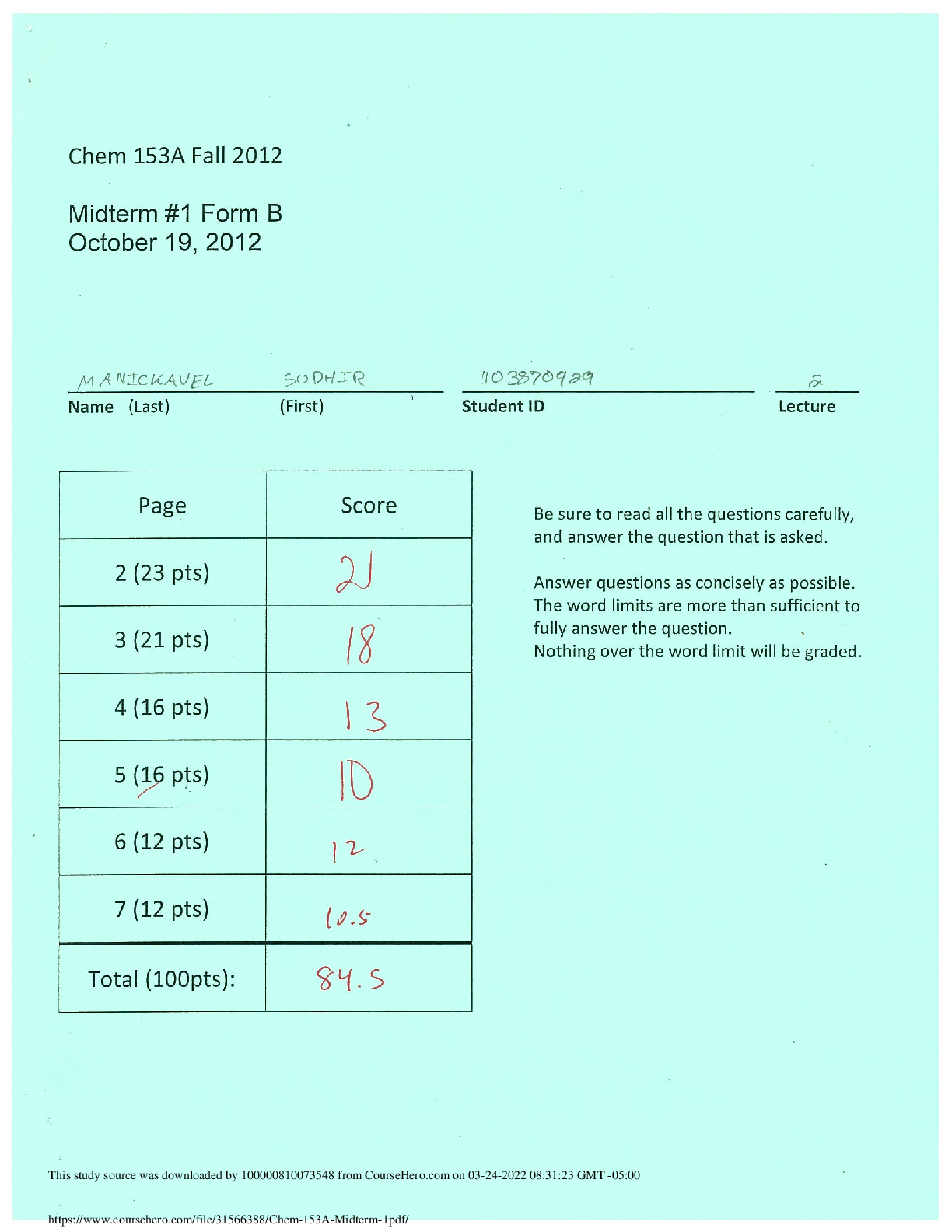

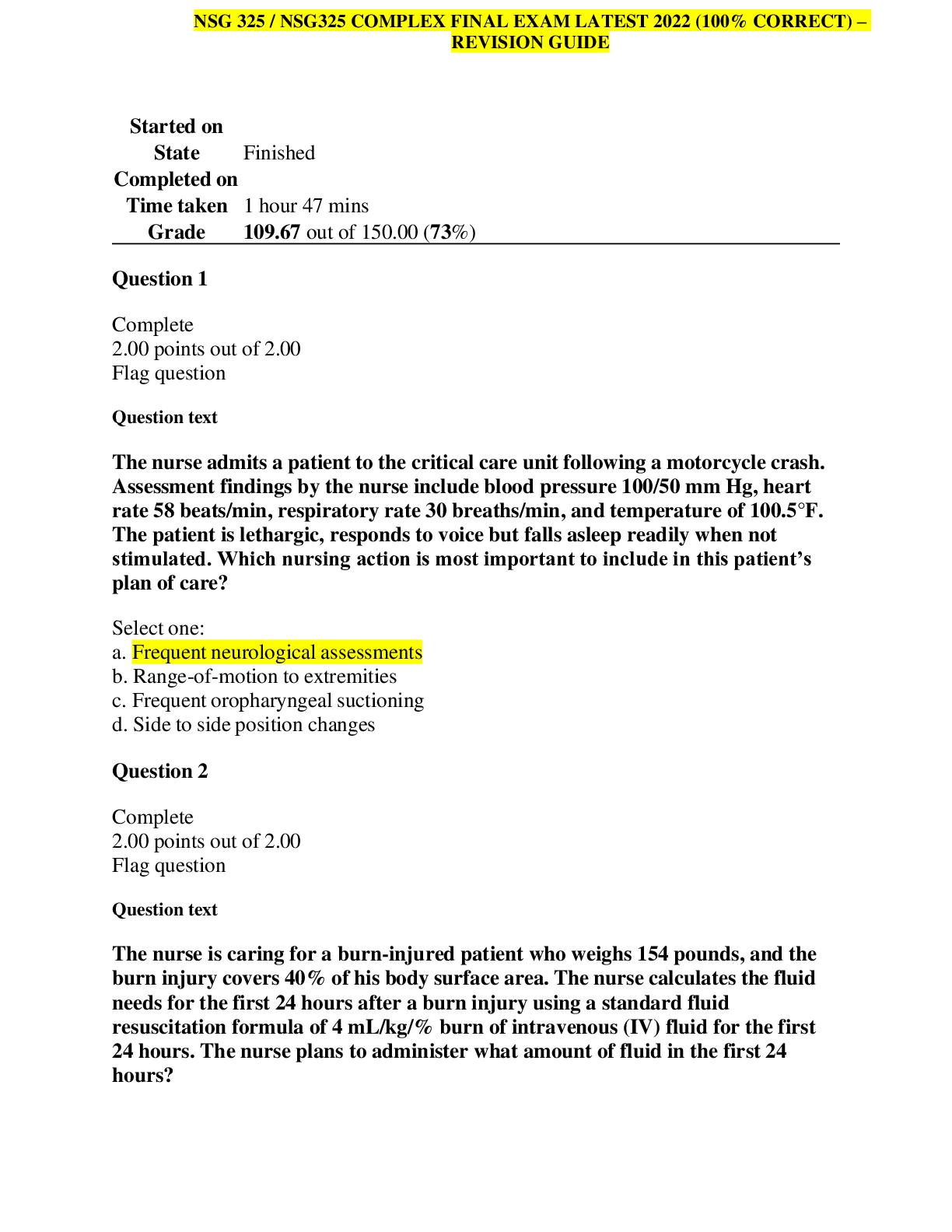

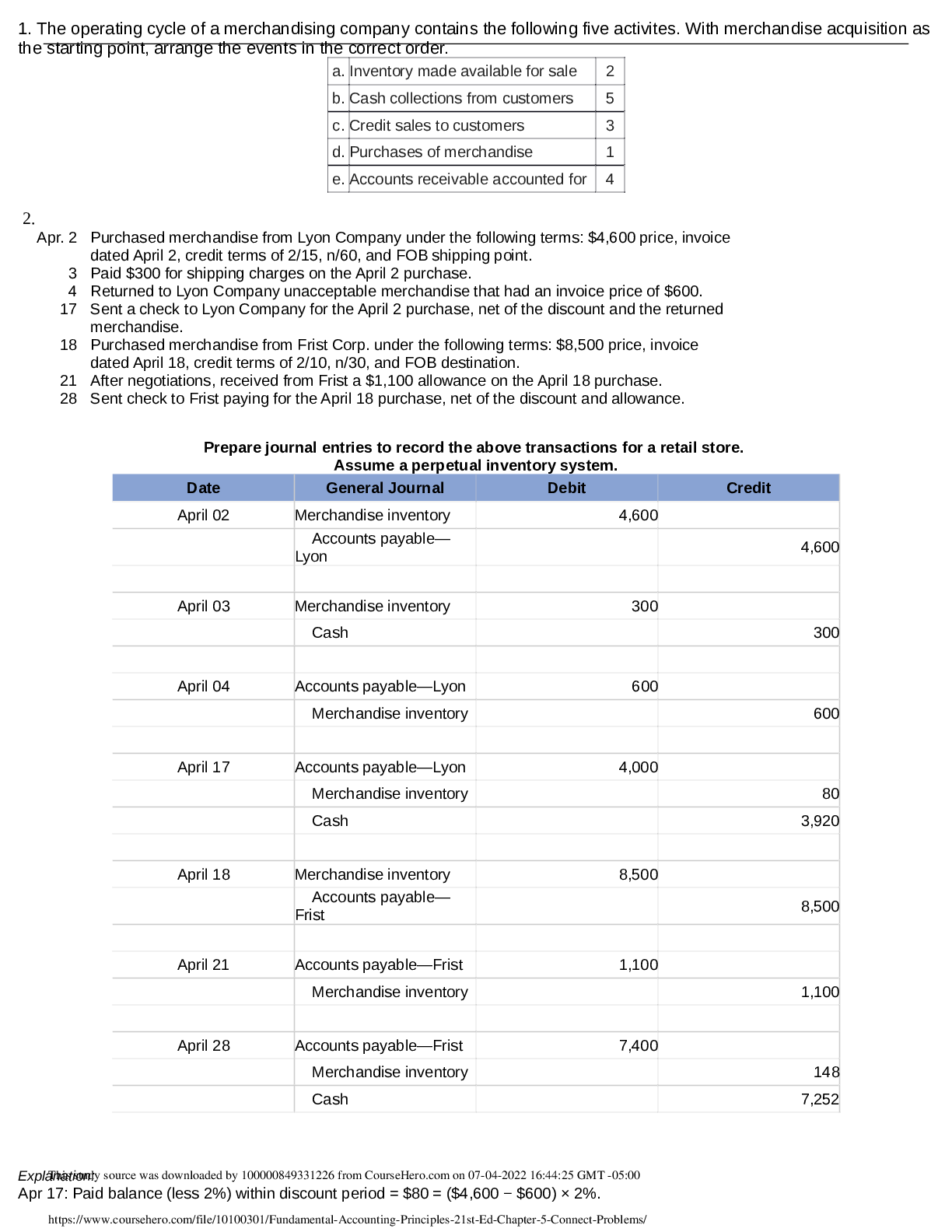

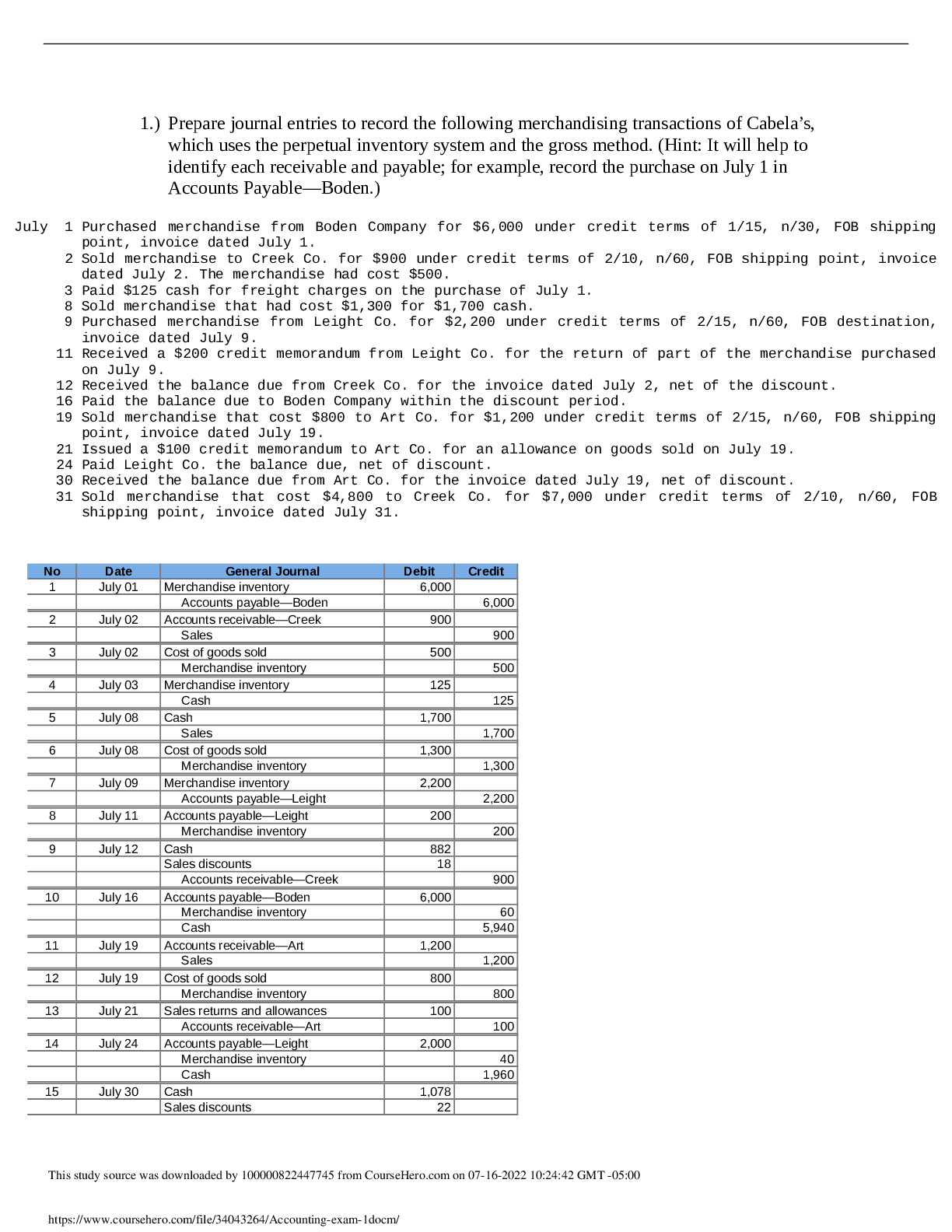

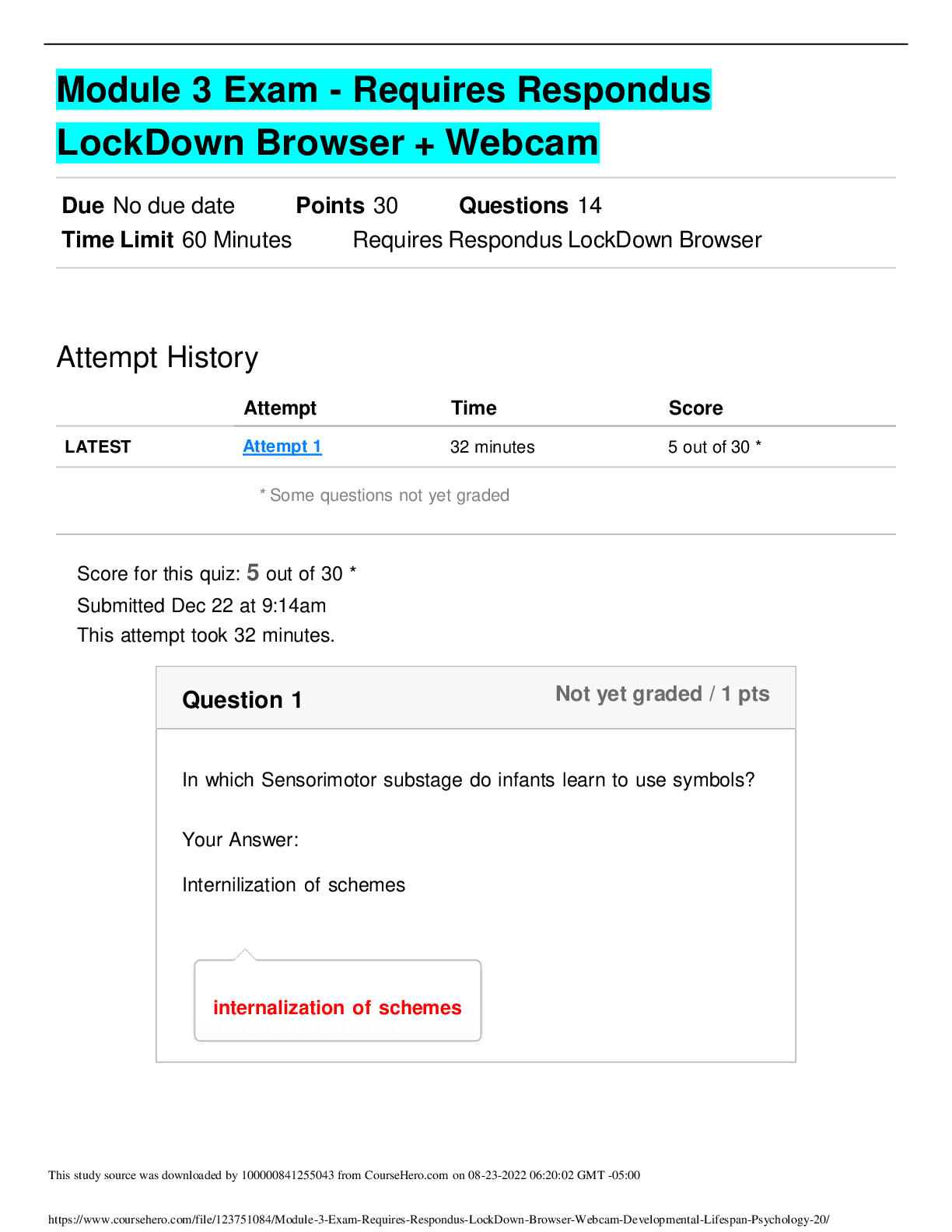

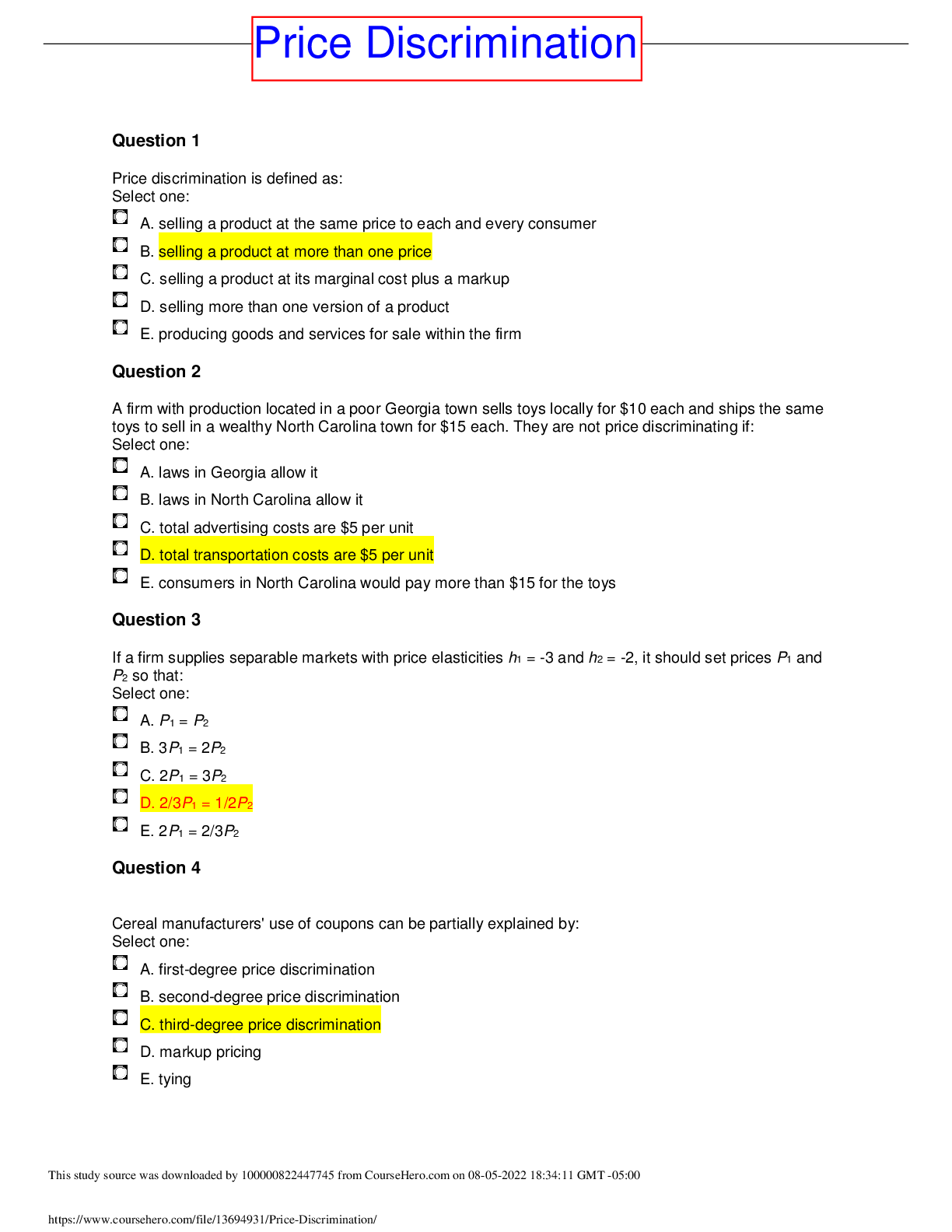

University of California, Irvine EXAM 2 Exam 2 Prep Questions-1 Laker Company reported the following January purchases and sales data for its only product. Date | $840 Units Acquired at Cost 140 ... units @ $6.00 = | Activities | Units sold at Retail Jan. 1 Beginning inventory Jan. 10 Sales | 100 units @ $15.00 = $1,500 Jan. 20 Purchase | 300 60 units @ $5.00 = Jan. 25 Sales | 80 units @ $15.00 = $1,200 Jan. 30 Purchase | 810 180 units @ $4.50 = 380 units | $1,950 | 180 units | $2,700Laker uses a perpetual inventory system. Complete comparative income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $1,250, and that the applicable income tax rate is 40%. For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory. Specific identification. For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory. Weighted average Perpetual FIFO Perpetual LIFO 1. Which method yields the highest net income? 2. Does net income using weighted average fall between that using FIFO and LIFO? 3. If costs were rising instead of falling, which method would yield the highest net income? Palmona Co. uses the perpetual system in accounting for merchandise inventory. Prepare the journal entries on January 8, to both reimburse the fund and increas the fund to $450. Date | Debit | Credit Jan. 8 | 74 29 16 43 162 Date | Debit | Credit Jan. 8 | 250 Cash | 250Palmona Co. establishes a $200 petty cash fund on January 1. On January 8, the fund shows $38 in cash along with receipts for the following expenditures: Wright Company deposits all cash receipts on the day when they are received and it makes all cash payments by check. Prepare a bank reconciliation for the company using the above information. Bank statement balance $28,400 Book balance $30,100 Add: Add: Deposit of May 31 7,500 Bank error 530 8,030 Deduct: Deduct: Outstanding checks 6,900 Bank service charge 230 NSF check 340 6,900 570 Adjusted bank balance $29,530 Adjusted book balance $29,530 36,430 Wright Company Bank Reconciliation May 31, 2013d. In reviewing the bank statement, a $530 check written by Smith Company was mistakenly drawn against Wright’s account. e. A debit memorandum for $340 refers to a $340 NSF check from a customer; the company has not yet At the close of business on May 31, 2013, its Cash account shows a $30,100 debit balance. The company’s May 31 bank statement shows $28,400 on deposit in the bank. a. The May 31 bank statement included a $230 debit memorandum for bank services; the company has not yet recorded the cost of these services. b. Outstanding checks as of May 31 total $6,900. c. May 31 cash receipts of $7,500 were placed in the bank’s night depository after banking hours and were not recorded on the May 31 bank statement. recorded this NSF check. Exercise 6-‐9 Algorithm 5-9 Date Debit Credit Dec. 31 4,875 4,875 Feb. 01 580 580 Jun. 05 580 580 Jun. 05 580 580 Prepare the journal entries of Chan to record these transactions and events of December 31, February 1, and June 5. Apex Fitness Club uses straight-line depreciation for a machine costing $30,000, with an estimated four year life and a $2,000 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining life, after which it will have an estimated $1,300 salvage value. Compute (1) the machine’s book value at the end of its second year and (2) the amount of depreciation for each of the final three years given the revised estimates. [Show More]

Last updated: 1 year ago

Preview 1 out of 13 pages

.png)

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jul 05, 2022

Number of pages

13

Written in

Additional information

This document has been written for:

Uploaded

Jul 05, 2022

Downloads

0

Views

103

.png)

.png)